NON-QM Jumbo Loans Mortgage Options For Borrowers

In this article, we will cover and discuss qualifying for non-QM jumbo loans and the lending requirements. Jumbo mortgages are becoming more and more popular in certain parts of the country. Many places such as Chicago, Denver, Los Angeles, Portland, Dallas, San Francisco, and many others are in the midst of a real estate boom. This is driving up the cost of the average home. In areas such as these, it is very difficult to find a home below $700,000. In many areas, this will put home buyers into a jumbo mortgage.

The Qualified Regulation Z regulations introduced by Consumer Finance Protection Bureau introduced the creation of Non-QM lending and all programs which doesn’t qualify as a QM loan. Non-QM loans, also known as portfolio loans, are those that do not fulfill the stringent criteria defined by QM. Common sense underwriting and a borrower’s creditworthiness to assess their willingness and capacity to pay are used in non-QM loans.

In this article (Skip to…)

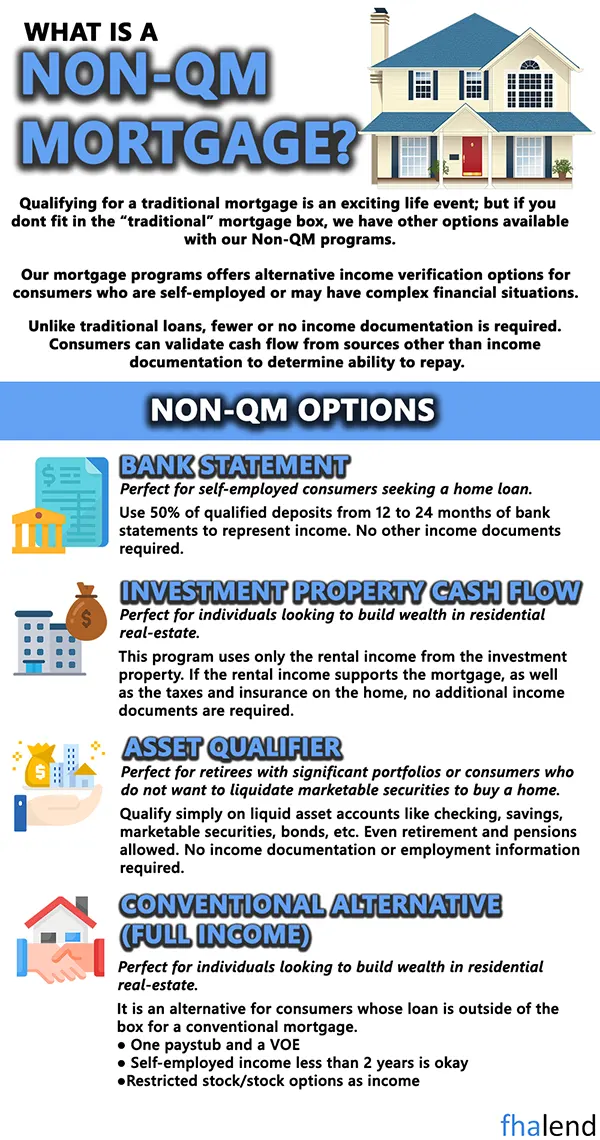

What are Non-QM Loans?

A non-qualified mortgage, or a non-qualified loan, is a kind of mortgage financing that allows you to qualify based on different criteria rather than the traditional income verification standards. Bank statements and using your assets as income are examples of common non-QM loans. Non-QM loans allow more people to invest in real estate because they are more flexible in terms of certification requirements.

The CFPB has established a set of rules for QM loans to ensure more predictable borrowing requirements. These are intended to safeguard borrowers from taking on unsustainable debt obligations. In 2014, in order to address the Great Recession that stretched from 2007 to 2009, when many borrowers defaulted on their subprime loans and were forced into foreclosure, stricter rules were implemented. This had a significant long-term impact on the economy and harmed numerous individuals’ credit.

NON-QM Jumbo Loan Requirements in 2022

| NON-QM Requirements | ||

|---|---|---|

| Loan Amount | $3,000,000 | |

| Type Of Properties | Primary, second home, and investment properties (Single family, townhomes, warrantable and non-warrantable condos) | |

| foreclosure, short sale, bankruptcy or deed-in-lieu | Four years out of | |

| Tax Returns | One-year tax return program available | |

| Loan Programs | Purchase, cash-out, and rate-term refinance | |

Please scroll down to see all NON-QM options which we have available right now for 2022.

We are licensed in 48 states and specializing in NON-QM Loans (75% of our clients are NON-QM loan borrowers)

Loans are granted based on each borrower’s individual circumstances and creditworthiness. Each case is unique, and each loan is judged independently. That’s why FHA Lend works with 170+ lenders to have all available mortgage programs possible for you. Every lender will accept a loan if he or she has a reasonable belief that the borrower can pay it back. So we have our top list of lenders which closes files on time and with fewer hiccups than others.

A jumbo mortgage in the year 2022 is any loan amount above $647,200 (in NON-high-cost areas). The Federal Housing Finance Agency raised the conforming loan limits to $647,200 in 2022. Home buyers can review the announcement of the increase right on FHFA’s Website. Depending on the area, loan limits on high-cost counties have increased as well. In this article, we will cover and discuss qualifying and getting approved for NON-QM Jumbo Home Loans.

Conforming Versus Non-Conforming Loans

Each year The Housing and Economic Recovery Act (HERA) establishes a new baseline conforming loan limit. Typically announced around December 1st each year. The conforming loan limit is adjusted each year for Fannie Mae and Freddie Mac to offset the changes in the average home price in the United States. From quarter 3 2020 to quarter 3 2021, FHFA saw the average house price increase by 9.8%, which is now reflected in the conforming loan limit of $647,200.

What Is The Definition Of High-Cost Areas

What is a high-cost area? According to FHFA, areas in which 115% of the local median home value exceeds the baseline conforming loan limit (from the paragraph above) that area will be “high-cost”. Meaning the conforming loan limits in these areas are higher than $647,200. There is a ceiling put on high-cost areas of 150% of the baseline loan limit. High-balance FHA and Conforming loans in high-cost areas, the maximum loan limit on single-family homes is set at $970,800.

So, what happens when you’re trying to buy a house outside of a high-cost area with a loan amount higher than $647,200? You then enter the Jumbo mortgage or NON-CONFORMING loan category unless it is FHA Jumbo loans and/or high-balance conforming loans.

Lending Guidelines On NON-QM Jumbo Loans

Seems simple right? Well, it’s not simple. Non-conforming Jumbo mortgages (also referred to as NON-QM Jumbo Home Loans) are a gray area of the mortgage industry. They are not like Fannie Mae or Freddie Mac with very black and white mortgage guidelines.

To obtain jumbo financing, typically borrowers need a credit score of 720 or above. Lenders also require a very clean payment schedule on a credit report. Bankruptcies, foreclosures, deed in lieu, and even short sales will affect borrowers from qualifying for traditional Jumbo Loans. This is where FHA Lend Mortgage can really help you out.

Qualifying For NON-QM Jumbo Loans Versus Traditional Jumbo Mortgages

For many potential home buyers, the thought of getting their credit score to 720 seems impossible. Depending on consumer credit profile it may take borrowers years to get their score back where it was. This is why we have a full line of NON-QM Jumbo Home Loans and NON-QM mortgages.

We are able to help borrowers with credit scores down to 500 FICO obtain Jumbo mortgages. NON-QM opens the door to homeownership to thousands of Americans who do not fit in the everyday mortgage lending guidelines. We are able to provide jumbo mortgages with as little as a 10% down payment.

See our 90% LTV Jumbo Mortgage blog for more details on that program.

Credit Scores Versus Down Payment On NON-QM Jumbo Loans

For many borrowers down payment is not the issue. Credit score or credit issues are usually what hold someone back from obtaining a jumbo mortgage.

See our credit score matrix below:

- CREDIT SCORES LOAN TO VALUE MAXIMUM LOAN AMOUNT

- 500 to 539 75% $1,000,000

- 540 to 599 80% $1,000,000

- 600 to 610 85% $1,500,000

- 620 and higher 80% $2,000,000

- 660 and higher 90% $2,000,000

- 700 and higher 90% $3,000,000

- 720 and higher 95% $1,500,000

All of the programs above allow one 30-day late payment within the past 24 months with zero effect on interest rate:

- Borrowers can be one day out of foreclosure and still obtain a jumbo mortgage with a NON-QM loan

- Even one day out of foreclosure, with a 600 credit score, you can get a jumbo loan with a 20% down payment of up to $1,000,000

- As you can see we offer mortgage products that most lenders do not

- FHA Lend Mortgage go above and beyond with no lender overlays on FHA, VA, USDA, or conventional loans

- We offer a full slate of NON-QM loan products that help everyday Americans buy their dream homes

Types Of NON-QM Jumbo Loans

A jumbo loan, also known as a non-conforming loan, is a mortgage loan that exceeds the maximum loan limit for conforming loans. Jumbo loans are not backed by government-sponsored entities like Fannie Mae or Freddie Mac, and they typically come with higher interest rates and stricter underwriting standards than conforming loans.

With jumbo loans you can:

- You can finance expensive properties: The maximum loan limit for conforming loans is $970,800 in most counties, but you can get a jumbo loan for a property that costs more than this.

- Jumbo loans often come with lower interest rates than conforming loans. This is because jumbo loans are less risky for lenders.

- Jumbo loans are more difficult to qualify for. You’ll need a higher credit score, a lower debt-to-income ratio, and a larger down payment to qualify than for FHA Loan

- Jumbo loans typically come with higher interest rates than conforming loans. This is because they’re considered riskier for lenders.

- You may have to pay private mortgage insurance (PMI) if you put less than 20% down on your home like with FHA Loan.

Bank statement loans:

Bank statement loans are designed for self-employed borrowers who may have difficulty documenting their income. Rather than requiring tax returns, these loans use the borrower’s bank statements to determine their ability to repay the loan. 12-month bank statement loans can be a convenient option for self-employed borrowers or those with irregular incomes. Just make sure you do your homework before applying, so you can get the best terms and rates.

ITIN loan

is a type of loan that’s available to immigrants who have an Individual Taxpayer Identification Number (ITIN). ITIN loans can be used for a variety of purposes, including home ownership, business expenses, and education costs.

- Verification of employment (VOE) is acceptable.

- Bank Statement Program Available Fo Non-Citizens

- DTI < 55%

- 12-month (1-year) income qualification required

- If no credit score, then extra credit tradelines or paperwork like bills and utilities can be used

- Properties like PUD, condos, single units or multifamily unit

Fresh Start

The Fresh Start Mortgage Program is a government-backed initiative that provides support to homeowners who are struggling to make their mortgage payments. The program offers a number of different options for assistance, including loan modification, refinancing, and forbearance. If you’re struggling to make your mortgage payments, the Fresh Start Mortgage Program may be able to help you get back on track.

For individuals who recently filed for bankruptcy, lost their house in foreclosure, had a deed-in-lieu of foreclosure or short sale, or otherwise did not meet qualifying mortgage requirements, we offer fresh start home financing if they cannot qualify for an FHA loan after bankruptcy. This loan program is intended for people who are unable to complete the customary mortgage waiting periods.

- There is no waiting period and no seasoning required after a bankruptcy, foreclosure, deed-in-lieu-of-foreclosure, or short sale.

- It’s possible to get a mortgage with poor credit if your FICO score is 500.

- Single-family houses, condominiums, co-ops, two to four-unit properties, or homes in a PUD are all eligible.

- Fixed/ARMS options.

- The homebuyer may make a low down payment.

Jumbo Loan With 10% Down

If you’re looking to buy a home but don’t have 20% down, you may still be able to get a mortgage. Jumbo loans with 10% down are available, and they can make homeownership more accessible.

Here are 3 things to know about jumbo loans with 10% down

- You’ll need strong credit and income to qualify.

- You may pay a higher interest rate than with a conventional loan.

- You’ll need to purchase private mortgage insurance (PMI).

If you’re thinking of applying for a jumbo loan with 10% down, keep these three things in mind before you start the application process.

Credit & Income

Higher Interest

Interest rates on jumbo loans are usually higher than rates on conventional loans because they’re considered riskier by lenders. But if you have strong credit and income, you may be able to get a competitive interest rate on your jumbo loan.

Credit & Income

Private Mortgage Insurance

DSCR (DSR) Program

A DSCR program is a debt service coverage ratio program. It’s used to help business owners and real estate investors finance their projects. It allows business owners and real estate investors to finance their projects without having to put up any collateral. It helps them get access to capital that they would not otherwise have access to.

The DSCR program gives them a fixed interest rate for the life of the loan and it offers them flexibility in how they use the funds from the loan. The interest rates on these loans can be higher than traditional loans. There is sometimes a prepayment penalty associated with these loans, which can make it difficult to pay off the loan early. The terms of the loan need to be clearly explained to the borrower by one of our loan officers.

The program works like this:

- Business owner or real estate investor finds a project they want to finance.

- They apply for a loan through the DSCR program.

- If they are approved, they will receive funding for their project.

- Once the project is completed, they will make payments on the loan according to their debt service coverage ratio.

This mortgage loan program is intended for a novice or experienced real estate investor who is buying or refinancing investment properties.

- You can cash out up to 80% of the loan amount to value (LTV).

- LTV as high as 85% for purchase

- Downpayment of 15% or more

- DTI (debt-to-income ratio) Calculation

- A borrower is qualified if the subject property has a cash flow that meets the standards for qualification, regardless of the number of properties owned.

- FICO as low as 600 (or 660 for I/O)

- Maximum loan amount up to $2,500,000

- No income, no employment verification, no tax returns, no 4506C

The team at FHA Lend Mortgage has closed many NON-QM Jumbo Loans. We are experts in originating and closing traditional and non-QM jumbo loans. If you have questions on your exact scenario, please reach out to us at FHA Lend Mortgage and start your loan process today. The team at FHA Lend Mortgage is available 7 days a week and can answer your questions. A jumbo mortgage is not impossible to obtain, even with blemishes on your credit profile. Please reach out to The Experts.

Comments: 2

Great article! I have an interview today for a company that focuses on Non-QM. This article really helped me understand the difference between traditional home loans and Non-QM. Thanks for the help!

Enjoy Marcus!