FHA Manual Underwriting Guidelines

Many mortgage borrowers hear the term “manual underwriting” and instantly panic. In this blog, we want to change that status quo. We will detail the steps to apply for a mortgage that requires manual underwriting, a few tips and tricks to pass manual underwriting, and explain which situations require manual underwriting. Our team specializes in manual underwriting. So, even if you have recently been turned down for a loan, our team is here for you.

FHA Manual Underwriting Guidelines do allow late payments in the past 24 months on FHA loans. However, there are two different types of mortgage guidelines on FHA loans. All lenders need to meet the agency guidelines set by the U.S. Department of Housing and Urban Development (HUD). However, mortgage companies are allowed to have their own lending requirements that are above and beyond the minimum FHA Mortgage Guidelines called lender overlays on FHA loans.

What is FHA Manual Underwriting?

First, we must understand what the manual underwriting process means. When you put apply for a mortgage loan, your mortgage team will need to collect numerous data points in order to qualify you and your family. There are three main pillars for mortgage qualifications, and they are income, assets, and credit. Based on these three criteria, your fire will be put through an algorithm called “automated underwriting system” or AUS for short. This algorithm will take every data point from your credit report, your debt to income ratio, and your total assets available to calculate your overall risk for mortgage lending.

Many times you will receive an automated approval which is great news. In the event that you do not receive an automatic ineligible, you may have the ability to participate in manual underwriting. Manual underwriting is only available for FHA and VA mortgage loans. While you may see information from Fannie Mae and Freddie Mac on manual underwriting for conventional mortgage loans, we have yet to see an investor who will allow these transactions. So, this blog is geared specifically for FHA and VA mortgage lending.

Approve/Eligible

The automated underwriting system will produce one of three results. The ideal result you are looking for is called approve/eligible. This means you have received automated approval. An automated approval will require less documentation to get your loan to the finish line.

Refer/Ineligible

The least favorable result from the automated underwriting system is referred/ ineligible. This means you have received an automated no go and at the time, you need to work on your qualifying criteria in order to move forward with a mortgage loan. Make sure you are working with a trusted loan officer as you may receive an automated “ineligible” if the information is not entered into the system correctly.

Refer/Eligible

The third and final result from the automated underwriting system is called Refer/Eligible. This means your file did not receive an automated approval but may still qualify for manual underwriting requirements. Many banks and lending institutions do not participate in manual underwriting due to lender overlays. Additionally, many lenders do not participate in manual underwriting with chapter 13 bankruptcy as part of the equation. If you are currently in an active Chapter 13 mortgage plan or less than two years from your discharge result, your loan will require a manual underwrite 100% of the time. Our team is experts with FHA manual underwriting surrounding all chapter 13 requirements. Click here so we can answer all your questions related to manual underwriting.

FHA Manual Underwriting Guidelines on Bad Credit

Even though HUD, the parent of FHA, does allow a few limited late payments in the past 24 months, most lenders will still require timely payments in the past 24 months as part of their lender overlays. We just go off the minimum agency lending guidelines. FHA Lend Mortgage only goes off the automated findings of the automated underwriting system (AUS). FHA Lend Mortgage has zero lender overlays. Borrowers can have one or two late payments in the past 12 and 24 months which we will detail in this article.

Mortgage Underwriting Discretion on Manual Underwriting

Mortgage underwriters have a lot of underwriter discretion on manual underwrites. If the borrower has strong compensating factors but one or two late payments in the past 24 months, they may be eligible to qualify for manual underwriting on FHA loans at FHA Lend Mortgage Group.

2022 FHA Manual Underwriting Guidelines

You can have prior bad credit, bankruptcy, foreclosure, deed in lieu of foreclosure, short sale, and can qualify for a mortgage with timely payments and re-established credit after the period of bad credit. Lenders understand periods of bad credit can happen due to extenuating circumstances such as unemployment, loss of business, health, divorce, or other reasons where regular income was disrupted. With the disruption of income and no reserves, most consumers fall behind on their monthly debts.

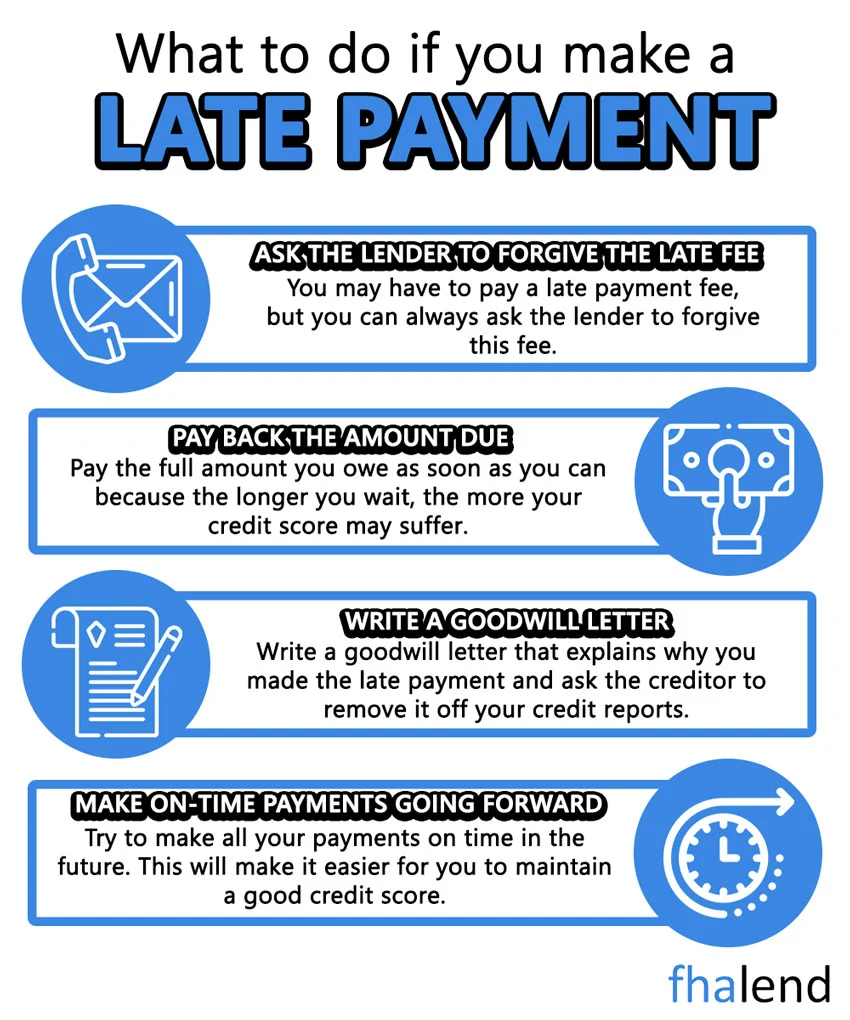

Late Payments on Credit Reports

Creditors who do not get the minimum monthly payments will often report the consumer’s payment history on the three major credit bureaus. This often negatively reflects on consumers’ credit reports which will affect them in qualifying and obtaining a home mortgage. However, most lenders want to see borrowers have surpassed the negative period in their lives and have re-established themselves. They expect consumers have been timely for at least 12 months, preferably 24 months.

FHA Guidelines On Waiting Period After Bankruptcy and Foreclosure

There are mandatory waiting period requirements after bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale. Re-established and timely payments after bankruptcy, foreclosure, deed in lieu of foreclosure, a short sale is expected. Late payments after bankruptcy and/or foreclosure are frowned upon by lenders. However, one or two late payments after bankruptcy and/or a housing event are not a deal killer at FHA Lend Mortgage Group.

Manual Versus Automated Underwriting System Mortgage Process

The automated underwriting system is commonly referred to as the AUS. The AUS is a sophisticated intricate computerized system that will analyze a borrower’s credit, credit scores, payment history, public records, income, assets, liabilities, and other factors and will render a decision in a matter of seconds.

Automated Findings per AUS

The three automated findings the AUS will render are the following:

- Approve/eligible: This means the AUS renders an automated underwriting system approval and the borrower meets all the agency mortgage guidelines.

- Refer/eligible: This means the AUS cannot determine the borrower’s eligibility and needs a human mortgage underwriter to manually underwrite the file.

- Refer with caution: This means the borrower does not meet the eligibility requirements on the particular home mortgage program.

Difference Between Automated Underwriting System Versus Manual Underwriting

Manual underwriting is stricter than automated underwriting system approval. Mortgage underwriters will look for compensating factors for borrowers with recent late payments and high-risk levels. The ability to repay will be emphasized by mortgage underwriters. Not all lenders do manual underwriting. However, a large percentage of our business at FHA lend are manual underwriting files.

FHA Manual Underwriting Guidelines On Late Payments

In general, most lenders will require 24 months of timely payments on manual underwrites. However, FHA Lend Mortgage will allow certain types of late payments in the past 24 months on manual underwriting.

Here is how borrowers can have late payments in the past 24 months on manual underwriting:

- Borrowers are allowed up to 2×60 late payments in the past 12 months on revolving accounts.

- An example of revolving accounts is credit cards.

- Borrowers cannot have any 90-day late payments in the past 12 months on revolving accounts and any late payments in the past 12 months on housing and/or installment accounts to qualify for manual underwriting.

Borrowers can have 2×30 late payments in the past 24 months in housing and/or installment loans but not in the past 12 months on manual underwrites at FHA Lend Mortgage.

Do I Meet FHA Manual Underwriting Guidelines?

Manual Underwriting is available on FHA and VA Home Loans. It is not available on conforming loans. FHA Manual Underwriting is when Automated Underwriting System (AUS) cannot render an approve/eligible. If AUS renders a refer/eligible per AUS, the file can be manually underwritten. It needs to be manually underwritten by a human underwriter because Automated Underwriting System cannot render an approve/eligible with the data it was provided.

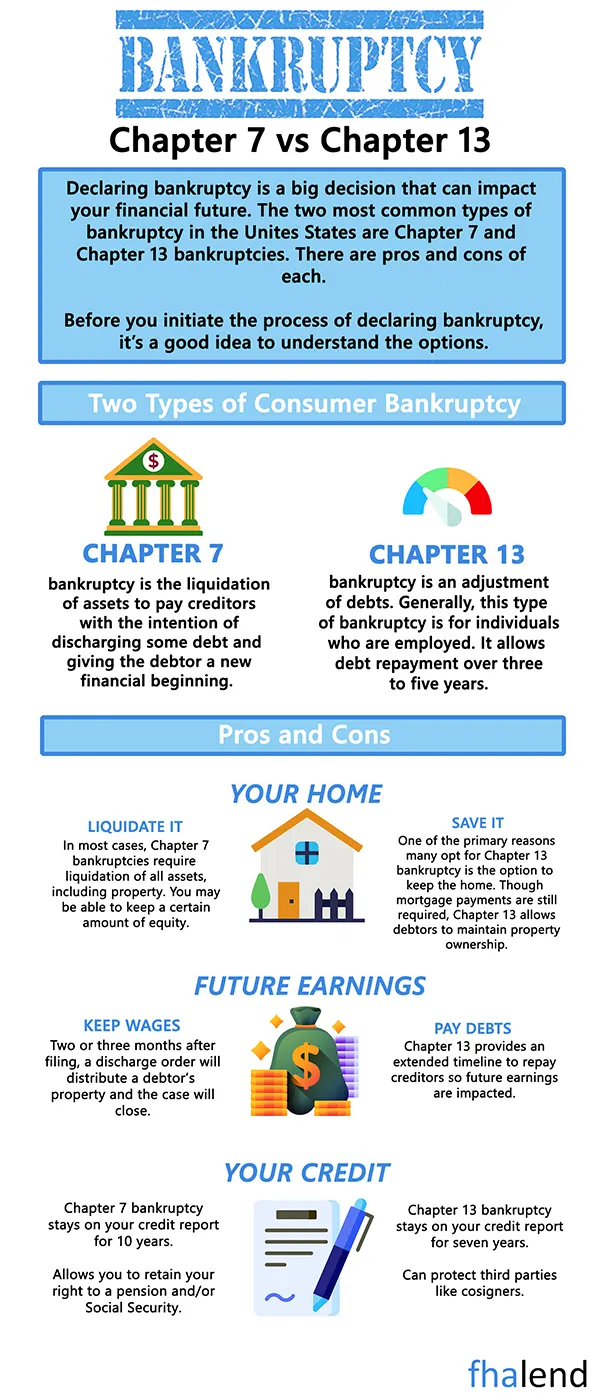

FHA Manual Underwriting Guidelines on Bankruptcies

All VA and FHA Home Loans during Chapter 13 Bankruptcy repayment plans need to be manually underwritten. Any VA and/or FHA borrowers who recently got a Chapter 13 Bankruptcy discharge that has not been seasoned for at least two years to need to be manually underwritten. HUD, the parent of FHA, has strict HUD Manual Underwriting Guidelines for FHA mortgage underwriters to follow.

FHA Manual Underwriting Guidelines On Credit History

FHA Manual Underwriting Guidelines on how mortgage underwriters should review borrowers’ credit history are as follows:

- Mortgage Underwriters need to analyze and review borrowers’ overall credit reports and payment history in the following order.

- Review prior housing expenses.

- Review and analyze not just housing expenses but also utilities.

- Review borrower’s monthly installment payments and debts.

- Revolving accounts.

Importance Of Timely Payments In The Past 12 Months

Borrowers need to be timely on all monthly payments, especially housing payments in the past 12 months. No late payments on revolving debt in the past 12 months. Borrowers cannot have any major derogatory payments on credit in the past 12 months. Per HUD Manual Underwriting Guidelines, major derogatory means any late payments that are one time 90 days late and/or no more than three times 60 days late reporting on the credit report.

No more than two times 30 days late payments in housing payments in the past 24 months (2 years). There cannot be any non-medical collections in the past 12 months. If the above checklist is not met, it can only be reviewed and signed off by a DE Mortgage Underwriter with documentation that the above checklist cannot be met is due to extenuating circumstances.

Credit Approval FHA Manual Underwriting Guidelines

Verification Of Rent is required per FHA Manual Underwriting Guidelines. A payment Shock of 5% or less is considered a great positive compensating factor. Verification Of Rent is only valid if borrowers can provide 12 months of canceled checks and/or 12 months of bank statements paid on time to the landlord.

FHA Manual Underwriting Guidelines For Borrowers Renting From Property Management Companies

If the renter has been renting from a registered property management company, then VOR Form completed, signed, and dated by the property manager can be used in lieu of 12 months of canceled checks and/or 12 months of bank statements. If borrowers were living rent-free with a family member and/or relative, need to provide a letter from the owner of the property where borrowers have been living rent-free.

Letter of Explanation Required By Mortgage Underwriters

The borrower can provide a letter of explanation that he or she was living rent-free in lieu of paying utilities and/or saving for the down payment on a home purchase. Borrowers with prior Loan Modification and a history of mortgage payments must utilize the time period in the modification to determine housing late payments.

How Underwriters View Collections And Charged Off Accounts

Outstanding collections and charged-off accounts do not have to be paid off to qualify for FHA loans. However, outstanding collections and charge-off accounts of any loans and/or debts in the name of borrowers need to be fully documented with a letter of explanation and supporting documentation. It needs to be consistent with the file for each credit tradeline.

FHA Manual Underwriting Guidelines on Credit Disputes

Credit Disputes on accounts that are in collections, charged-off accounts, or have late payments in the past 12 months also need to be documented with a letter of explanation and supporting documentation with the exception of medical collection accounts. Non-medical collection accounts with an aggregate total balance of $2,000 or greater, underwriters must take 5.0% of the outstanding balance and use it as a monthly debt of borrowers when calculating debt-to-income ratios. Charge-off accounts are excluded from the 5% rule.

Waiting Period After Housing Event And Bankruptcy

FHA Case Numbers cannot be assigned without the mandatory wait periods after housing events and/or bankruptcy. Three-year wait period after foreclosure, deed in lieu of foreclosure, short sale from the date the property has been transferred. Two-year wait period after the discharge date of Chapter 7 Bankruptcy. Borrowers in a current repayment plan under Chapter 13 Bankruptcy can qualify for FHA Loan after 12 months of timely payments to their creditors with Trustee Approval. There is no waiting period after the Chapter 13 Bankruptcy discharged date to qualify for FHA Loans. Chapter 13 Bankruptcy discharge that has not been seasoned for 24 months needs to be manually underwritten by DE Mortgage Underwriter.

Non‐Traditional Credit HUD Manual Underwriting Guidelines

Under HUD Manual Underwriting Guidelines, three credit tradelines need to be provided by borrowers to determine they are creditworthy.

Primary Non-Traditional Credit Tradelines include the following:

- 12 months of rental history

- Telephone

- Utilities

Secondary Non-Traditional Credit Tradelines include the following:

- Insurance

- Children’s care

- Tuition

- Store credit cards

- Rent to own creditors

- Medical bills and creditors

- Automotive Leases

- Personal Loan Payments

- Saving deposits made consistently for the past 12 months

FHA Manual Underwriting Guidelines on Employment And Work History

The mortgage loan application needs to reflect the following:

- Two years of employment history

- School history can be used in lieu of work history

- With employment gaps of six months or greater, the borrower needs to be in a current full-time job for at least six or more months and require a letter of explanation as to the reason for a gap in employment

- Need a two-year history of employment prior to job gap

Reserve Requirements And Guidelines

Reserves cannot be gifted. It needs to be the borrower’s own funds. One month’s reserves are required on manual underwriting which consists of one month of the following:

- Principal

- Interest

- Taxes

- Insurance

- HOA if applicable

- Flood Insurance if applicable

Reserves On Multiple Unit Properties:

- One to two-unit properties requires a minimum of one month’s PITI in reserves.

- Three to four-unit properties require a minimum of 3 months PITI in reserves.

FHA Manual Underwriting When a Job Change

If you have numerous job changes in the previous two years, low qualifying assets, a high debt to income ratio, low credit scores, being a first-time home buyer, no rental history, using gift funds, or any combination of the above may result in a manual underwriting situation.

FHA Manual Underwriting DTI

Borrowers will get an approved/eligible with 46/9% front end and 56.9% back end with the Automated Underwriting System.

Debt to income ratio requirements for FHA Manual Underwriting

- With No Scores, DTI may not exceed 31% front end and 43% DTI back end.

- 500‐579 credit scores ‐Debt To Income Ratios cannot exceed 31/43.

- 580 and above maximum debt to income ratios are 31% front end and 43% back end without compensating factors.

580 and above maximum DTI is 37/47 with one compensating factor:

- Verified and documented cash reserves.

- Verified and documented cash reserves.

- Less than 5% in payment shockMinimal increase in housing expense.

- or Residual income.

580 and above debt to income ratio is 40/40 with no discretionary debt:

- 580 and above maximum debt to income ratio is 40% front end and 50% back end with two compensating factors:

- Verified and documented cash reserves.

- Payment shock of less than 5% or Minimal increase in housing expense.

- Significant additional income such as part-time income borrower had one-year seasoning but not used as qualified and effective income.

- and/or borrowers having residual income.

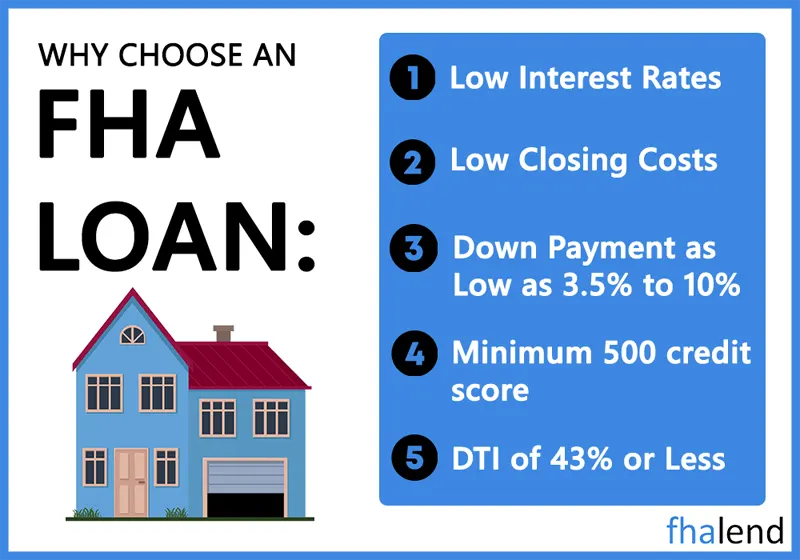

Down Payment Requirements On FHA Purchase Loans

If the home buyer has credit scores of 580 or higher, HUD requires a 3.5% down payment. If the buyer has credit scores under 580, FHA requires a 10% down payment. FHA Lend Mortgage has the most aggressive manual underwriting program on FHA and VA loans. To qualify for an FHA manual underwriting home mortgage with a national mortgage company licensed in multiple states with no lender overlays, please contact us at FHA Lend Mortgage at (888) 900-1020. The team at FHA Lend Mortgage Group is available 7 days a week, on evenings, weekends, and holidays.

January 24, 2022 - 10 min read