FHA Loan With a Bad Credit Score

Homebuyers do not need perfect credit when buying a new home with an FHA loan with a bad credit score. Buyers thinking about purchasing a first home and are ready to be a first-time home buyers, here are some tips prior to entering into a real estate purchase contract.

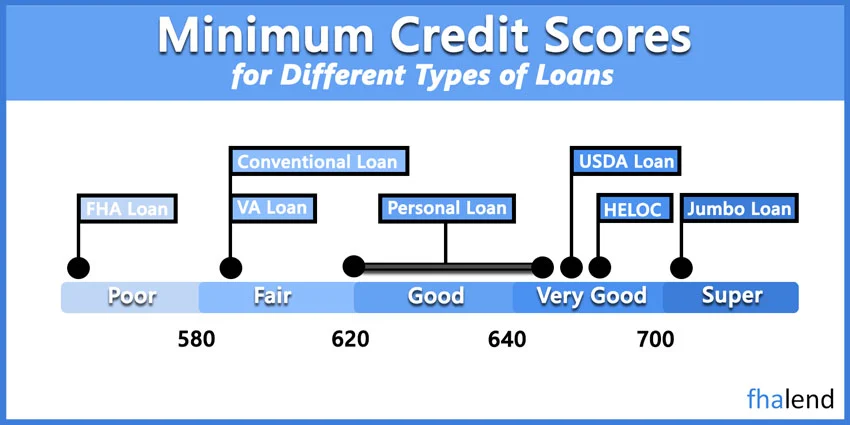

So what is an FHA loan with a bad credit score? The FHA mortgage loan it’s a Federal Housing Administration-insured loan that is provided for low credit score borrowers having less than perfect credit scores. In most cases, we are talking about bad credit loans when borrowers’ FICO score is lower than 640. Most banks like Chase, WellsFargo and others have mortgage lender overlays in place. They cannot qualify you and cannot lend you money until your credit score is near perfect. They work with 700and higher credit score borrowers and they have set of hard rules and requirements in place.

In most cases, borrowers are getting denied because of having 580 or 610 credit score. They are not aware that every bank has different FHA mortgage overlays and they are getting misled. Not many people know that HUD has own minimum requirements which are way lowered and way more forgiving than those provided by big banks. The reality is that you can still qualify for FHA loan with bad credit when your fico is at 500 or you have no credit score (credit tradelines needed)

In this article (Skip to…)

8 Steps to Get an FHA loan with a Bad Credit Score

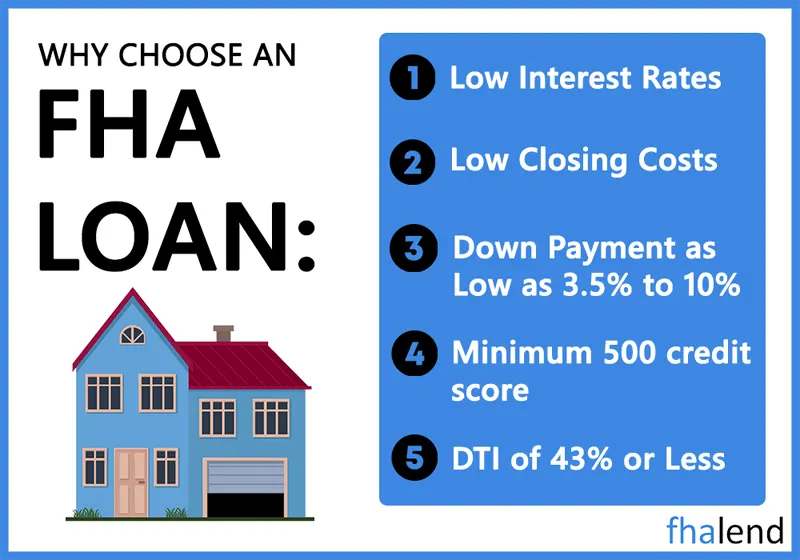

Bad credit can seem like a huge obstacle when it comes to getting a mortgage, but there are options available. The Federal Housing Administration (FHA) insures loans made by approved lenders, and they accept lower credit scores than conventional lenders.

If you’re looking for an FHA loan with bad credit, you’ll need to be honest about your credit history and work with a lender that’s willing to work with you. In this article, we’ll provide some tips on how to get an FHA loan with bad credit.

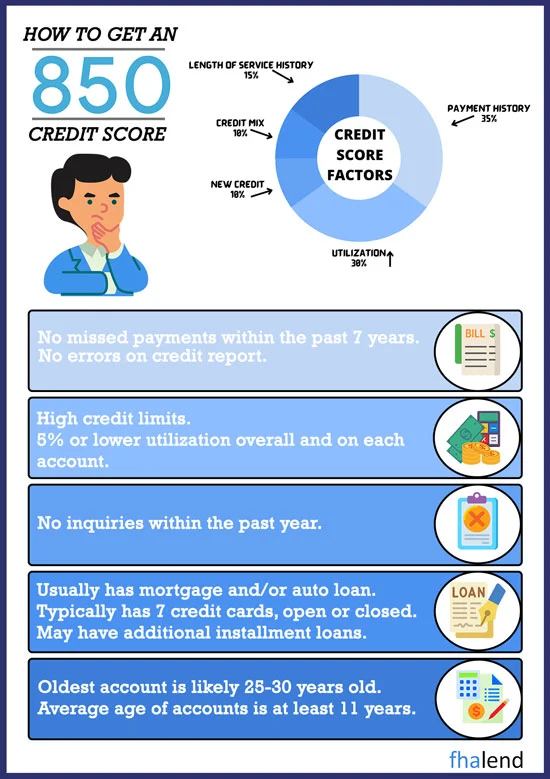

1. Know Your Credit Score

The first step is to know your credit score. This number is a representation of your creditworthiness and it’s important to know where you stand before you begin the mortgage process.There are a few ways to obtain your credit score. You can get a free credit report from each of the major credit reporting agencies once per year. You can also use a credit monitoring service like Credit Karma, myFICO, or a free credit online once per year.

2. Get Pre-Approved for an FHA Loan

Once you know your credit score, you’ll need to get pre-approved for an FHA loan. This involves submitting some basic information about your finances and employment history to a lender. The lender will then pull your credit report and give you a pre-approval letter.This letter will state the maximum loan amount that you’re eligible for, as well as any conditions that must be met before you can close on the loan.

3. Find a Property Within Your Budget

The next step is to find a property that’s within your budget. Keep in mind that you’ll need to factor in the cost of repairs if you apply for a 203k loan and renovations when determining how much you can afford to spend.

4. Work With a Lender That’s Willing to Work With You

Not all lenders are willing to work with borrowers who have bad credit. It’s important to shop around and find a lender that’s willing to give you a chance. Be sure to compare rates, terms, and conditions before making a decision.

5. Understand the Requirements of an FHA Loan

There are some specific requirements that you’ll need to meet in order to qualify for an FHA loan. These include a minimum credit score of 580, a down payment of 3.5%, and a debt-to-income ratio of no more than 43%.

6. Prepare for a Higher Interest Rate

When getting an FHA loan with a bad credit score, you can expect to pay a higher interest rate on your mortgage. This is because lenders perceive you as being a higher-risk borrower.

7. Improve Your Credit Score Before Applying

If you have time, it’s always best to work on improving your credit score before applying for a mortgage. This will give you the best chance at getting approved for a loan with favorable terms and conditions. There are a few ways to improve your credit score, including paying your bills on time, maintaining a good credit history, and using a credit monitoring service.

8. Consider an FHA Streamline Refinance

If you already have an FHA loan with a bad credit score, you may be eligible for a streamline refinance or a cash-out refinance. This is a great option if you’re looking to lower your monthly payment or interest rate. There are some specific requirements that you’ll need to meet in order to qualify, but it’s definitely worth considering if you’re interested in saving money on your mortgage.

FHA loan with a bad credit score credit doesn’t have to stand in the way of homeownership. If you’re willing to work with a lender and meet the requirements of an FHA loan, you can get the financing you need to purchase a home. Just be sure to shop around, compare rates and terms, and understand the requirements before making a decision.

You can get an FHA loan with bad credit if you’re willing to work with a lender and meet the requirements of an FHA loan. Keep in mind that you’ll need to pay a higher interest rate on your mortgage if you have bad credit. You can also consider an FHA streamline refinance if you already have an FHA loan. Just be sure to compare rates, terms, and conditions before making a decision.

Consult With Mortgage Lender With No Overlays

Buying New Home With Bad Credit requires a loan officer and lender that specializes in mortgages with bad credit. The loan officer will make sure that the borrower qualifies for a loan program with a credit and income profile. Loan Officer will determine what the maximum amount of loan borrowers qualify for.

FHA Loan With a Bad Credit Scores Mortgage Loan Application and Approval Process

Here is a basic typical mortgage process. The mortgage lender will need to take a preliminary mortgage application and will need to run credit. Loan Officer will analyze the following:

- Income

- Assets

- Debts

- Liabilities

- Credit

- Credit history

- Credit report

- Derogatory Credit Items

After analyzing and evaluating the above, the loan officer can determine what the maximum proposed housing budget will be and the maximum home loan amount. Property tax and insurance information will be estimated using comparable properties in the areas borrowers are interested in.

Down Payment And Closing Costs

The lender will approximately how much down payment is needed and what the tentative closing costs will be.

- The mortgage lender will then review the following:

- Two years of tax returns

- Two years W-2s

- 2 months’ bank statements

- Other documents

- Determine the maximum amount that borrowers qualify for

- The mortgage loan officer will then issue a pre-qualification letter

All pre-approvals issued by FHA Lend are full credit mortgage approvals that are fully underwritten and signed off by one of our mortgage underwriters. Loan Officers should not be allowed to sign off on a pre-approval letter.

FHA Lend Mortgage Has Reputation of Being Able to Do Loans Other Lenders Cannot Do

Over 75% of our borrowers are borrowers who either get a last-minute mortgage denial by other lenders or are stressing over their mortgage process because their pre-approval letters were not valid. All mortgage borrowers issued pre-approval letters at FHA Lend Mortgage can bank their loan will not just close but will close on time because their pre-approval letters are loan commitments.

Buying a New Home With FHA Loan With a Bad Credit Score

Borrowers with recent bad credit or other financial issues may not qualify for a mortgage loan. However, as long as they have income but had prior credit issues, the mortgage loan originator can help borrowers prepare for getting a mortgage in the near future. Most lenders require timely payments in the past 12 months.

Getting AUS Approval With Late Payments in the Past 12 Months

Borrowers can get an approve/eligible per Automated Underwriting System Findings with one or two late payments in the past 12 months. However, multiple late payments in the past 12 months may be a no go in getting AUS FINDINGS approval. The mortgage loan originator can either send borrowers to a credit consultant or many mortgage loan originators, like myself, help future borrowers with their credit so they can qualify for a mortgage.

How To Qualify For FHA Loan With a Bad Credit Score With Late Payments In The Past 12 Months

Borrowers with multiple recent late payments may need to wait six months to twelve months before qualifying for a mortgage loan. Most lenders want to see at least a 12-month payment history with no late payments. Borrowers with a credit score under 580 need a 10% down payment for FHA Loans per HUD Guidelines. To qualify for 3.5% down payment FHA Loans, borrowers need a 580 plus credit score. Raising the credit score can be done by paying down credit balances or adding secured credit cards

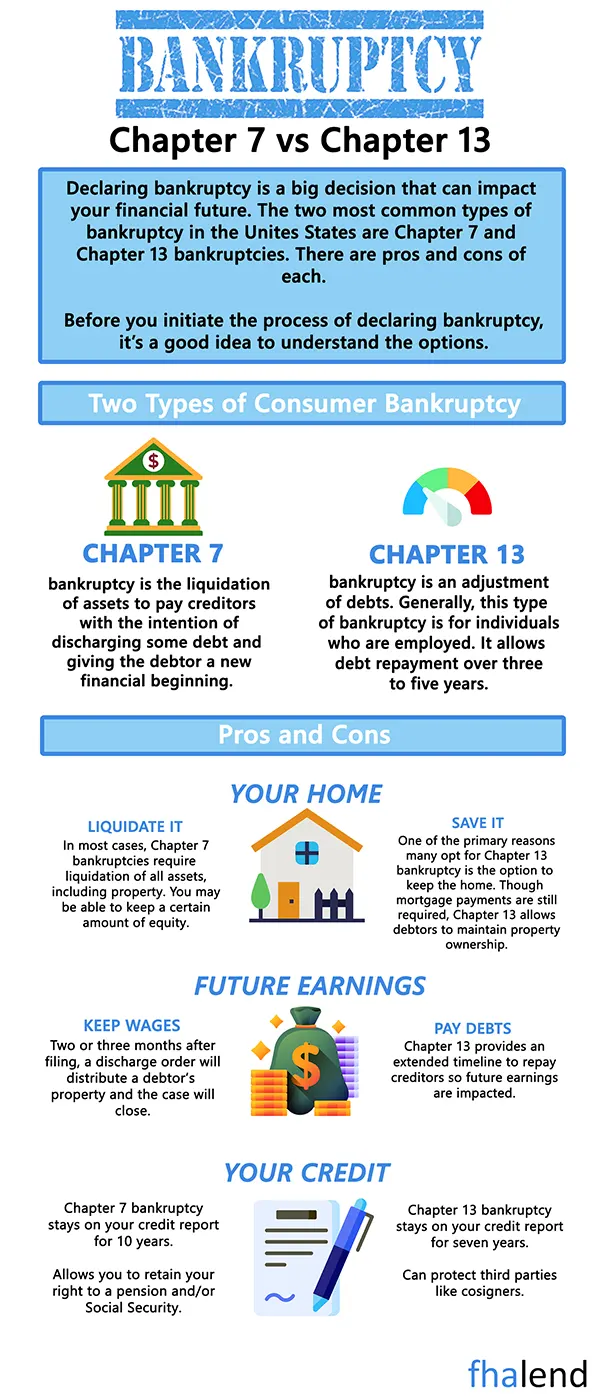

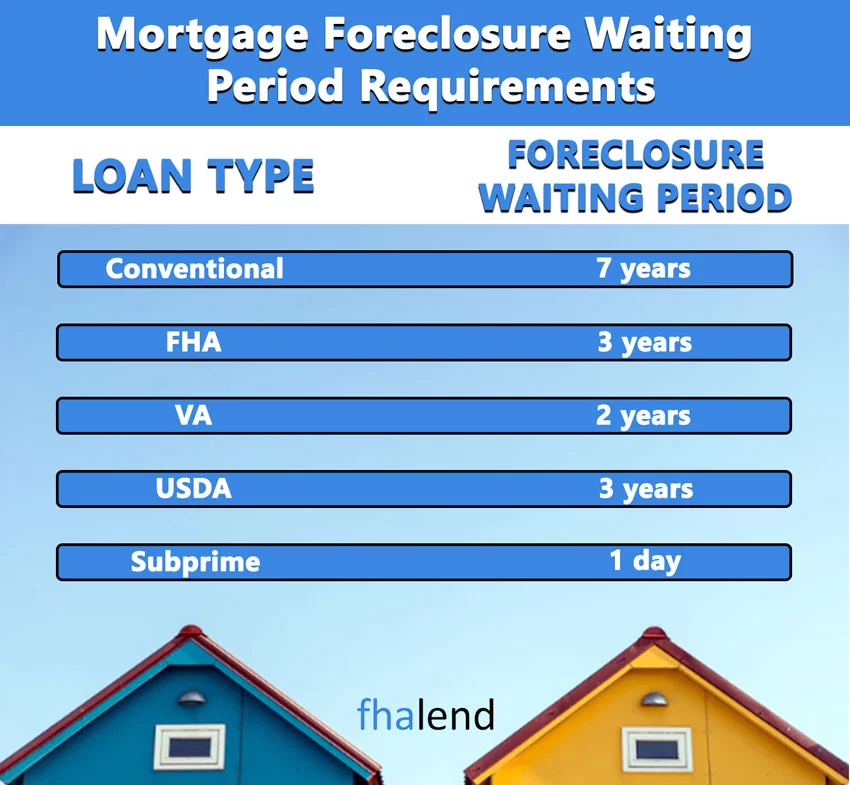

Mortgage After Bankruptcy And Foreclosure

Also, those who recently filed for bankruptcy or had a foreclosure can start prepping themselves up in getting qualified ready to be homeowners by re-establishing their credit as soon as possible. Borrowers need to realize that there are mandatory waiting periods to qualify for home loans after the following:

- Bankruptcy

- Foreclosure

- Deed in lieu of foreclosure

- Short sale

VA and FHA Loan With a Bad Credit Score

For FHA chapter bankruptcy 13 loan or VA Loan bankruptcy chapter 13, HUD requires a two-year waiting period from the discharge date. FHA requires three years waiting period after foreclosure, deed in lieu of foreclosure, and short sale. Department of Veteran Administration (VA) requires two years waiting period after foreclosure, deed in lieu of foreclosure, and short sale.

Reestablishing Credit After Bankruptcy and Foreclosure

Just passing the waiting period does not automatically qualify guarantee home loans. Lenders want to see established credit tradelines. Many lenders have overlays on tradelines where they require seasoned tradelines of 12 to 24 months. They do not want to see any late payments after a bankruptcy, foreclosure, deed in lieu of foreclosure, or short sale.

Importance of Verification of Rent with Bad Payment Shock

Rental verification is a must. The only way the mortgage lender will accept rental verification is by providing 12 months of canceled checks and/or bank statements. VOR form and/or letter from a registered property management company can be used in lieu of canceled checks and/or bank statements on verification of rent.

Choosing The Right Lender When Buying a New Home With Bad Credit

FHA and VA Home Loans do not require borrowers to pay off outstanding collections and charge-offs. However, most lenders have overlays on FHA and VA loans where they require borrowers to pay off outstanding unpaid collection accounts and charge off accounts. FHA Lend does not require borrowers to pay outstanding collections and/or charge off accounts. The reason is due to lender overlays.

FHA Loan With 500 Credit Score?

It’s possible to get FHA loan with a 500 or higher credit score but you can improve your credit with the below steps. For those folks who went through a financial meltdown, their credit scores also dropped. There is a fast-track way of Improving Credit Scores To Qualify For A Mortgage:

- A financial crisis can happen to any hardworking individual during the course of their lives

- A person who has had great credit can ruin their credit literally overnight if they lost their jobs, or they needed to shut their business down

- One late payment can drop a person’s credit score by 50 points or more

- Bankruptcy and foreclosure can drop a person’s credit score by more than 150 points

- Repairing credit and Improving Credit Scores To Qualify For A Mortgage go hand in hand

- But Improving Credit Scores To Qualify For A Mortgage is much more important than deleting old negative credit accounts via disputing with credit reporting agencies

FHA Loan With a Bad Credit Score After Bankruptcy And Foreclosure

Many people have given up on improving their credit scores or even trying to improve their credit after filing bankruptcy, going through a foreclosure, or having a judgment.They just figure that they can no longer get credit and purchase everything with cash and that improving their credit scores is nothing but a waste of time. Homebuyers can start Improving Credit Scores To Qualify For A Mortgage from the date of bankruptcy discharge date and from when the foreclosure/short sale has been finalized.

Improve Your FICO To Qualify for FHA Loan With a Bad Credit Score

Other folks who have had prior bankruptcy or bad credit spend thousands of dollars on credit repair. They hire expensive credit repair companies to delete negative items from their credit report. Some credit repair companies charge more than $100 for every negative item they remove. Some folks who filed for bankruptcy years ago spend thousands of dollars on credit repair companies trying to delete aged negative credit accounts that have been included in their bankruptcy petition. Credit repair is not necessary to qualify for a mortgage.

Should I hire a Credit Repair Company To Qualify For A Mortgage?

Sometimes people who want to get approved for an FHA loan with a bad credit score are struggling and they want to fix the issue fast. They find a credit repair company online and they think they will get everything resolved for $100 dollars or more to remove a negative old account is a total waste of your hard-earned money. Credit repair companies should tell you that. Negative accounts that are 2 years or older have little or no impact on your credit score. Lenders go by a person’s credit score in determining whether to grant them a loan.

Granted, if you are late with monthly debt payments, it will definitely drop your credit scores, and that late payment will be on your credit report for 7 years. However, your credit scores will go back up as time goes by. Two years from the late payment, that late payment will no longer have an impact on your credit scores anymore. It might not look good on your credit report but the thing that counts is your overall credit score. Credit repair may do more damage than good when it comes to qualifying for a mortgage.

Does Secured Credit Cards Will Increase My Credit Scores?

Improving credit score is done by establishing new credit as soon as possible.

- Get three secured credit cards

- Get an installment loan

- Be an authorized user of a family member’s credit card

We will be discussing improving your credit scores by establishing new credit on future blogs.

What Are Mortgage Lender Overlays on FHA Loan

Overlays are when a lender will have their own mortgage guidelines that have higher standards than those of FHA, VA, USDA, FANNIE MAE, FREDDIE MAC. When qualifying for an FHA loan with a bad credit score, borrowers who need a direct mortgage broker licensed in multiple states with no overlays, please apply here. If you would like to learn more or you’re looking for a mortgage and your credit is low.

March 23, 2022 - 10 min read