FHA Down Payment Requirements For First Time Homebuyers

In this article, we will discuss the FHA down payment requirements for homebuyers. FHA down payment requirements for home purchases requires that homebuyers put in a 3.5% down payment. However, to qualify for the 3.5% down payment home purchase FHA Loan, the home buyer needs to have a minimum credit score of 580 FICO. Homebuyers can qualify for FHA Loans with credit scores of under 580 FICO.

Anyone with under 580 FICO credit scores requires to put a 10% down payment on a home purchase FHA loan. FHA Down Payment Requirements allow for 100% of gifted funds for the down payment. The down payment can be gifted by a family member and/or relative but there are rules and regulations on how the gift funds can be used. Gift funds can be used for the down payment and closing cost but cannot be used for reserves. Reserves are one month’s P.I.T.I. ( principal, interest, taxes, insurance). Three-month reserves are normally required on mortgage loan borrowers with credit scores under 600 FICO as well as manual mortgage underwriting files.

In this article (Skip to…)

FHA Down Payment Requirements: Gift Funds For Down Payment

FHA allows 100% gift funds for the down payment on a home purchase. The gift fund donor needs to sign a gift letter stating that the gift funds for the down payment are not a loan and the gift funds will not get paid back from the home buyer.

The gift funds recipient needs to provide a copy of the check along with the deposit slip of the gift funds as well as an updated bank statement with the gift funds deposited. The donor of the gift funds needs to provide 30 days bank statements of their bank account. The bank statements need to show the funds have been seasoned and show that the gift funds left their bank account.

Automated Underwriting System Findings

Mortgage lenders and the Automated Underwriting System does not view gift funds favorably. There are many times where borrowers with credit scores under 620 FICO will get a referred/eligible per DU Findings and not get an approve/eligible per DU Findings due to having gift funds for their down payment. If you remove the gift funds for the down payment when the DU Findings are referred/eligible, the new findings may result in an approve/eligible just by not having gift funds and the home buyer having their own funds for the down payment.

FHA Down Payment Requirements: How To Avoid Gift Funds

A home buyer can get gift funds and use them as their own funds for the down payment on a home purchase. There are two ways of doing this. The first is by getting the gift funds deposited in the home buyer’s bank account and letting it season for sixty days. Mortgage lenders will require 60 days of bank statements. This holds true as long as the funds are already in the borrower’s bank account, it will be treated like it is the borrower’s own funds.

Tips On How To Come Up With Verified Assets

The second way of avoiding gift funds for a down payment is by adding the borrower’s name into the donor’s bank account as a joint bank account holder. Once the borrower’s name is added to the bank account of the gift donor, get sixty days of bank printouts and have the printout signed, dated, and stamped by the bank teller. Then get a letter from the main account holder stating that the joint bank account holder has full access and rights to the joint bank account.

Low Down Payment Home Purchase Programs And Guidelines

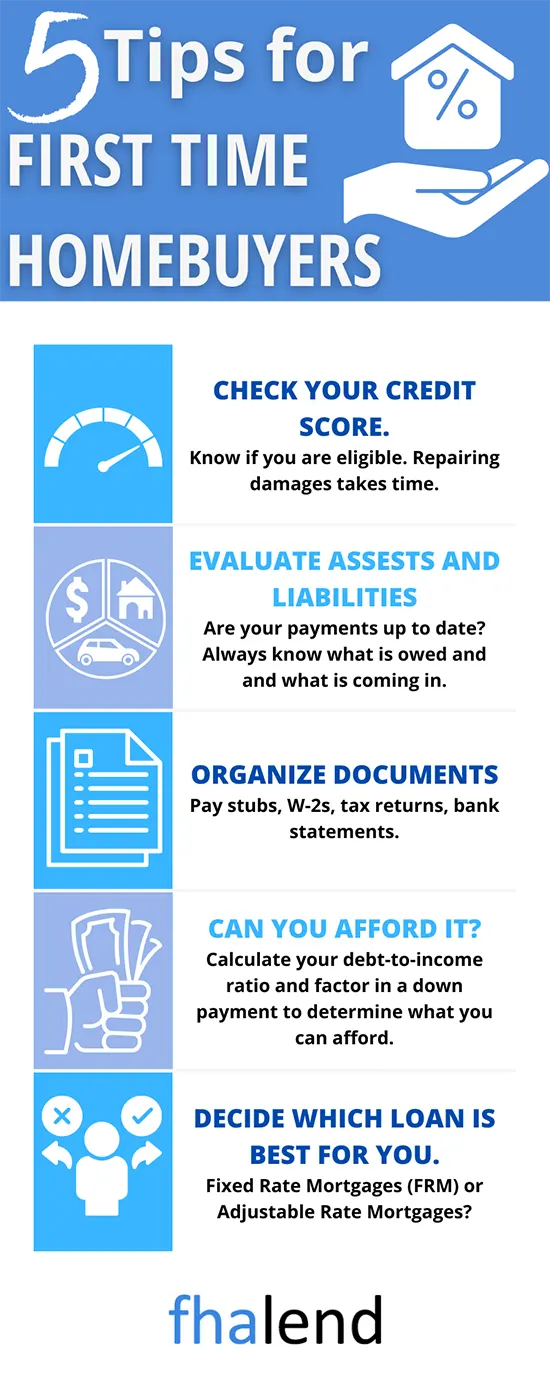

Down Payment is the biggest hurdle for first-time home buyers. Many home buyers often contact us to go over Down Payment Home Purchase Options. Many homebuyers can afford to make monthly mortgage payments and become homeowners. The single biggest hurdle they have is coming up with the down payment. All real estate transactions have closing costs. However, most closing costs can be covered with sellers’ concessions and/or lender credit. In this blog, we will go over Down Payment Home Purchase Options for home buyers.

Costs And Fees Involved With Home Purchase Transactions

With the exception of VA and USDA Loans, all loan programs have down payment requirements. All purchase and refinance transactions have closing costs. Most homebuyers do not need to worry about closing costs. Closing costs can be covered with sellers’ concessions. If they are short with sellers’ concessions, lenders can offer lender credit in lieu of a higher mortgage rate. However, during a booming hot housing market where sellers get multiple purchase offers, it may be difficult to get a seller concession.

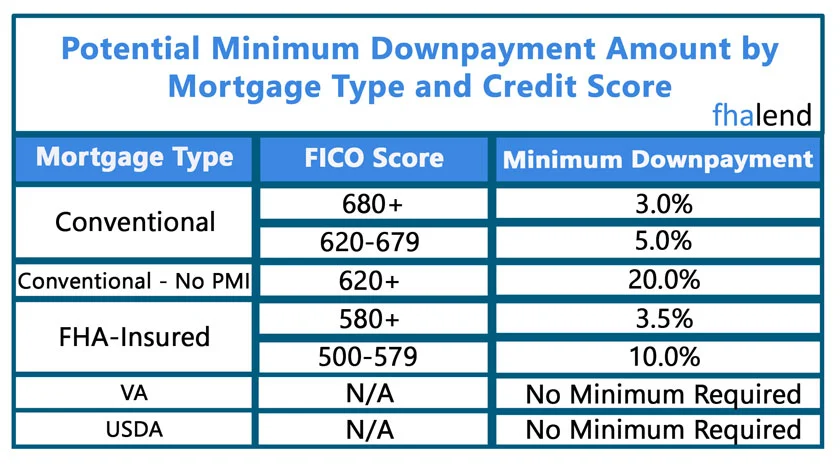

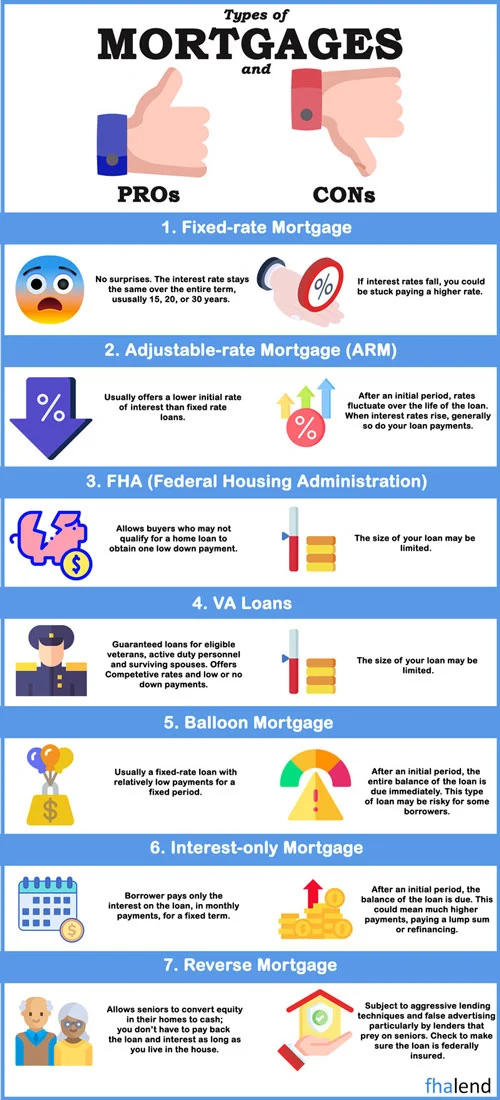

FHA Down Payment Requirements Versus Mortgage Loan Program

There are many down-payment mortgage options. VA and USDA Loans are government loan programs that do not require any down payments. Lenders can offer 100% financing on VA and USDA loans to qualified borrowers. HUD, the parent of FHA, requires a 3.5% down payment. Freddie Mac Home Possible mortgage program allows a 3% down payment. Fannie Mae Home Ready Mortgage Program requires a down payment of 3%. FHA Lend Mortgage offers national DPA programs. Our Down Payment Assistance Programs offer grants to first-time homebuyers needing down payment assistance.

How Property Tax Proration Credit Can Help With Down Payment

In certain states like Illinois, property taxes are paid in arrears. What this means is that home seller owe home buyers the previous year’s property taxes at closing. This is called property tax proration. Homebuyers in Illinois or other states where property taxes are paid in arrears get to use the tax prorations as part of their down payment and/or closing costs.

For example, if a home buyer is buying a home for $100,000, the home buyer needs to show a 3.5% down payment or $3,500. However, if they get a property tax proration credit of $3,000, then the buyer only needs to come up with $500 in closing. The property tax proration credit will be applied to the down payment. Buyers still need to show that they have $3,500 to the lender but do not need to use their own funds if they are getting property tax proration.

Can Sellers Concessions And Lender Credit Be Used For Down Payment

Sellers are allowed to give sellers concessions to home buyers. Sellers’ concessions can only be used for closing costs. It cannot be used for a down payment. The only credit that can be used for a down payment is property tax prorations. Lender credit can only be used for closing costs and NOT Down Payments on home purchases. Every mortgage program has its maximum sellers’ concession credits sellers can offer buyers.

Maximum Sellers Concessions Allowed

Here are the maximum seller concessions per loan program. FHA maximum sellers concessions are 6%. VA is 4% sellers concessions. USDA loans allow up to 6% seller concession. Conventional loans allow up to seller concession Up to 3% with 90% LTV or higher on owner-occupant and second homes. Up to 6% sellers concession on Loan To Values of 75% to 90% LTV on owner occupant and second homes.

Up to 9% sellers concessions with a loan to value than 75% on owner-occupant and second homes. Maximum 2% sellers concessions on investment home loans. Jumbo lenders allow sellers concessions but depend on the lender. NON-QM lenders allow sellers concessions of up to 6% but depend on the particular non-QM lender.

Qualifying For Mortgage With Little Down Payment

There are times when borrowers will get overages in sellers concessions:

- Any sellers concession overages need to go back to the home sellers

- Buyers cannot have sellers concession overages

- Borrowers cannot get a kickback from sellers on sellers concession overages

- It needs to go back to home sellers

- Most experienced loan officers will not waste sellers concessions

- Loan officers will find creative ways of using up all sellers concessions

The easiest way of using up sellers concession overages is to use it in buying down mortgage rates. Upfront FHA mortgage insurance premiums and VA Funding Fees can be paid with seller’s concessions and not rolled into the mortgage loans.

Sources For Down Payment

VA and USDA do not require down payments. Homebuyers can purchase homes with zero money out of pocket with VA and USDA Loans. Both agencies allow 100% financing. Closing costs are not needed because they can be covered with seller concessions and/or lender credit. Other sources to help with a down payment with other mortgage programs may be gifted funds. Lenders allow gift funds by relatives for homebuyers to use as a down payment.

Many home buyers have 401k retirement accounts. Homebuyers are allowed to use 401k for home purchases. Borrowers can borrower up to 60% of their 401k value. The repayment of their 401k does not impact borrowers’ debt-to-income ratios. The reason it does not count against borrowers’ debt to income ratio is when you are borrowing against 401k retirement accounts, you are borrowing your own funds. Therefore, you are not incurring any additional debt but borrowing against yourself.

January 21, 2022 - 6 min read