VA Loans During and After Chapter 13 Bankruptcy Guidelines

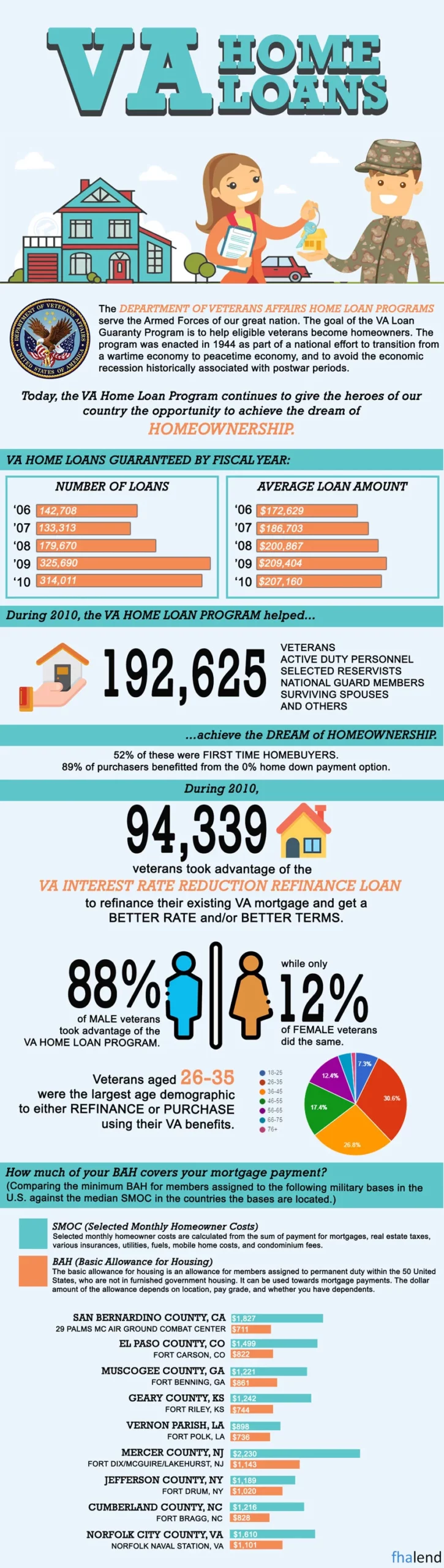

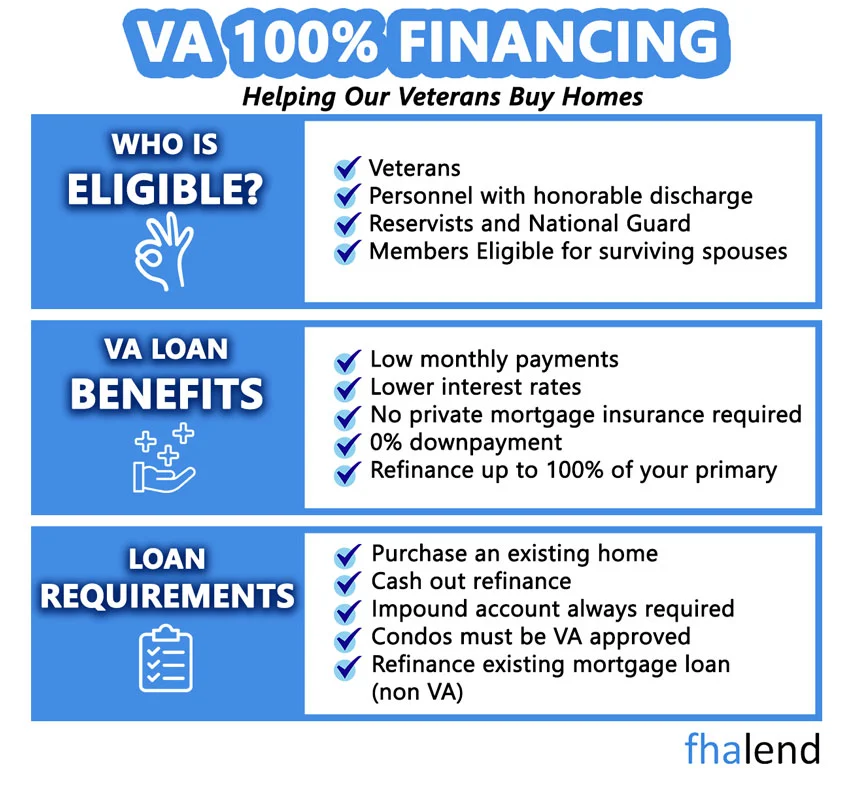

In this article, we will discuss and cover VA loans during and after Chapter 13 Bankruptcy Guidelines. VA and FHA loans are the only mortgage loan programs that allow borrowers to qualify for a home purchase and/or refinance mortgage during the Chapter 13 Bankruptcy repayment plan. No other loan program will allow borrowers in an active Chapter 13 Bankruptcy repayment plan to qualify for a home loan. Bankruptcy Trustee approval is required.

VA Loans During / After Chapter 13 Bankruptcy: Trustee Approval

Trustees will normally sign off on a home purchase and/or a refinance during the Chapter 13 Bankruptcy repayment plan. Many homeowners with substantial equity in their homes can do a VA and/or FHA cash-out refinance during the Chapter 13 Bankruptcy repayment plan and pay off the Chapter 13 early. With home values skyrocketing, homeowners are sitting with a lot of equity in their homes.

Does Chapter 13 Bankruptcy Need To Be Discharged?

Under VA chapter 13 mortgage guidelines, borrowers can qualify for VA loans during Chapter 13 Repayment Plan without needing to be discharged. There are no waiting period requirements after the Chapter 13 Bankruptcy discharge date. However, any Chapter 13 bankruptcy without a two-year seasoning after bankruptcy needs to be manually underwritten.

VA Manual Underwriting During Chapter 13 Bankruptcy

The automated underwriting system (AUS) will not render an approve/eligible per AUS on any Chapter 13 without a two-year seasoning after bankruptcy discharged date. Borrowers in an active Chapter 13 repayment plan and without a two-year discharged date seasoning will get a refer/eligible per AUS. Therefore, borrowers need to go through manual underwriting. In this article, we will cover and discuss VA Chapter 13 Mortgage Guidelines during and after the bankruptcy discharge. We will cover manual underwriting guidelines on VA Loans and the importance of compensating factors.

VA Manual Underwriting Versus Automated Underwriting System

Not all lenders do manual underwriting on VA Loans. FHA Lend is one of the very few national lenders that do a great deal of manual underwriting on VA and FHA Loans. VA and FHA Loans are the only two home loan programs that allow manual underwriting. There are very few differences between manual versus automated underwriting systems. VA does not have a minimum credit score requirement nor a maximum debt to income ratio cap. With manual underwriting, debt-to-income ratios are normally capped at 60% DTI with compensating factors. AUS on VA Loans can go up to 70% DTI depending on residual income and/or compensating factors.

VA Chapter 13 Mortgage Guidelines During Repayment Plan

Per VA Chapter 13 Mortgage Guidelines, borrowers can qualify for both purchase and refinance mortgage loans during the Chapter 13 Bankruptcy repayment plan.

Here are the basic VA Chapter 13 Mortgage Guidelines:

- 100% financing with no down payment required

- No minimum credit score requirement

- No maximum debt to income ratio requirements

- No maximum loan limit on VA Loans

- Borrowers need to make at least 12 monthly on-time payments to the Bankruptcy Courts to be eligible for VA financing during Chapter 13

- Debt to income ratios depends on compensating factors and residual income

- Chapter 13 Bankruptcy does not need to be discharged

- Bankruptcy trustee approval is necessary

- All manual underwriting requires verification of rent

- Low payment shock is considered a compensating factor

- Manual underwriting requires timely payments in the past 24 months

- One or two late payments in the past 24 months are not always deal killers as long as the borrower can document extenuation circumstances

We are one of the most aggressive lenders of helping borrowers qualify for VA Loans during Chapter 13 Bankruptcy.

Qualifying For VA Mortgages After Chapter 13 Discharged Date

There is no waiting period after the Chapter 13 Bankruptcy discharge date to qualify for VA loans. However, if the bankruptcy is not discharged for two years, it needs to be manually underwritten. Most lenders with lender overlays may require a waiting period requirement after the Chapter 13 discharge date. FHA Lend Mortgage is a mortgage company licensed in multiple states with no lender overlays on VA loans. We have no waiting period requirement after the Chapter 13 Bankruptcy discharge date.

Late Payments During Chapter 13 Bankruptcy

Late payments during Chapter 13 Bankruptcy repayment plan frowns upon by lenders. However, late payments during Chapter 13 repayment are not always a deal killer. FHA Lend Mortgage has helped countless borrowers with late payments during the Chapter 13 repayment plan. The borrower needs a good excuse and/or reason for the late payment during the Chapter 13 Bankruptcy Repayment Plan. The loan officer can help borrowers with detailing the late payments during the repayment plan.

Many homeowners were victims of the 2008 Real Estate and Mortgage Meltdown.

- Many were left with homes that were worth less than the value of their homes and could not sell or could not find an alternative to foreclosure

- Others had sub-prime mortgage loans that had initial teaser mortgage rates and/or negative amortization

- They had initial low monthly payments and when the teaser mortgage rate expired, their mortgage payment skyrocketed

- Some homeowners had mortgage payments that were double or sometimes even triple their original monthly mortgage payment

- With the combination of the Great Depression of 2008 and companies laying off millions of workers nationwide, many homeowners were forced to file for bankruptcy

- This was because they could no longer afford their home loan payments as well as their other monthly bills

- A large percentage of homeowners who filed for Chapter 7 Bankruptcy had their mortgage part of the bankruptcy

- They surrendered their homes to the original mortgage lender

Homebuyers can qualify for an FHA Loan after bankruptcy and foreclosure after they meet the minimum waiting period.

- There is a two-year waiting period after Chapter 7 Bankruptcy from the discharged date of the bankruptcy to qualify for an FHA Loan

- There is a three-year waiting period after foreclosure and deed in lieu of foreclosure from the recorded date of the foreclosure or deed in lieu of foreclosure to qualify for an FHA Loan

- There is a three-year waiting period to qualify for an FHA Loan after the short sale from the date of the short sale which is reflected on the HUD Settlement Statement

For homeowners who had a mortgage part of the bankruptcy and need to qualify for an FHA Loan, the waiting period starts from the recorded date of foreclosure and not the discharge date of their bankruptcy.

- There is a three-year waiting period after the recorded date of foreclosure to qualify for an FHA Loan

Here is a case scenario of the homeowner who had a mortgage part of the bankruptcy

- The bankruptcy was discharged on January 1, 2010

- But foreclosure was not recorded until January 1, 2015

- Homebuyer needs to wait three years from January 1, 2015, the recorded date of foreclosure which is January 1, 2018, for them to qualify for an FHA Loan

VA Mortgage After Bankruptcy And A Housing Event

Borrowers can qualify for a VA Loan 2 years after a Chapter 7 Bankruptcy discharged date:

- No late payments after the Bankruptcy discharge date

- Borrowers can qualify for a VA Loan one year into a Chapter 13 Bankruptcy repayment plan

- Borrowers can also qualify for a VA Loan right after a Chapter 13 Bankruptcy discharged date with no waiting period

- There is a two-year waiting period to qualify for a VA Loan after a recorded date of a foreclosure or deed in lieu of foreclosure

- There is a two-year waiting period to qualify for a VA Loan after the short sale date which is reflected in the settlement statement of the short sale

- Deferred student loans that have been deferred for more than 12 months are exempt from debt-to-income ratio calculations

- Outstanding collection accounts and charge-off accounts do not have to be paid to qualify for VA Loan

How Does Mortgage Part Of Bankruptcy Work?

If homeowners surrender the home in their Chapter 7 Bankruptcy, consumers can include the mortgage part of the bankruptcy.

- The loan balance will be discharged in bankruptcy discharge and the homeowner will no longer owe their mortgage loan balance

- Homeowners then surrender the home to their mortgage lender

- However, lenders are not in a major hurry to transfer the deed of the home to their names

- This can create an issue when it is time for homebuyers to qualify for a home loan in the near future

- There are mandatory waiting periods after bankruptcy and foreclosure that a home buyer needs to meet under federal mortgage lending guidelines

- Waiting periods after bankruptcy and foreclosure depend on the mortgage lending program

We will cover FHA, VA, and Conventional Loans in this article since they are three of the most popular mortgage lending program in the United States.

What is a Bankruptcy Waiting Period on VA Mortgage Loan

There are new regulations and mortgage lending guidelines on VA Guidelines On Mortgage Part Of Bankruptcy.

- If the homeowner had a mortgage part of the bankruptcy and is seeking to qualify for VA home loan, they need to wait four years from the discharge date of Bankruptcy to qualify for VA Home Loan

- The foreclosure can be recorded at a later date after the discharge date and they can still qualify for VA Loan with prior mortgage part of the bankruptcy

- This holds true as long as they have surrendered their home at the time of the bankruptcy

- They could not have reaffirmed their mortgage after the bankruptcy

Wait Period VA guidelines on the mortgage part of bankruptcy is the same as conventional loans. Fannie Mae and Freddie Mac require a four-year waiting period after the discharge date of bankruptcy to qualify for conforming loans with mortgages included in bankruptcy. The foreclosure, deed in lieu of foreclosure, and short sale need to be finalized. The recorded date of the housing event does not matter just like VA guidelines on the mortgage part of the bankruptcy.

Late Payments After Bankruptcy And Housing Event

Mortgage lenders frown upon borrowers who have a late payment after bankruptcy and/or foreclosure. Borrowers who have a late payment after bankruptcy discharge and/or foreclosure, short sale, or deed in lieu of foreclosure are classified as risky second offenders by mortgage lenders. Most lenders will not approve a mortgage to borrowers with late payments after bankruptcy and/or foreclosure no matter how high their credit scores are. However, one or two late payments after bankruptcy and/or foreclosure are not always a deal killer. The team at FHA Lend Mortgage has helped countless borrowers with late payments after bankruptcy and/or foreclosure.

To get qualified for a mortgage with a lender with no lender overlays on government and/or conventional loans, please contact us at FHA Lend Mortgage at [email protected] or call us at 888 900 1020. Text us for a faster response. The team at FHA Lend Mortgage is available 7 days a week, on evenings, weekends, and holidays.

January 31, 2022 - 7 min read