How Much Is The Mortgage Insurance On VA Loan

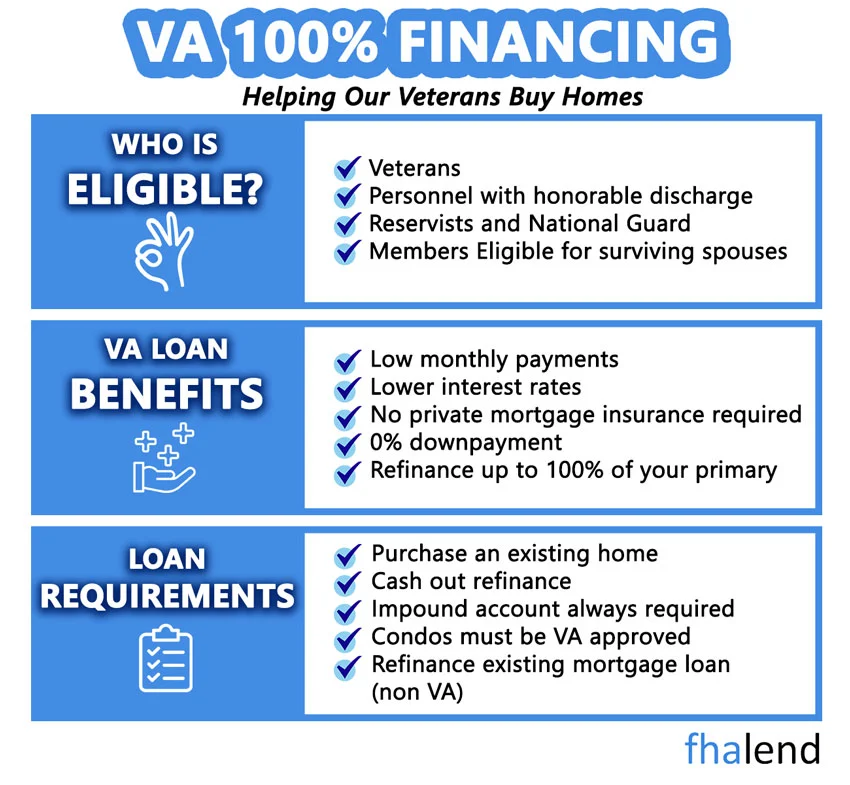

Do you have to pay mortgage insurance when applying for a VA loan or can be the insurance avoided so your monthly payment will be lower and you might afford a bigger house? In the below article we will answer all questions related to the VA home loan and how the MPI or PMI affects your future monthly mortgage payment.

- There is no mortgage insurance on a VA loan but you have to pay a funding fee which is around is quite low, at just 1.5% of the loan amount. This low rate helps to make VA loans more affordable for borrowers.

- For loans with less than 5% down, the annual funding fee is 2.15%.

- For loans with a down payment of less than 10% and more than 5%, the funding fee is 1.50% annually.

- If you are at 500, 580 or 550 credit score you can qualify for Va Loan

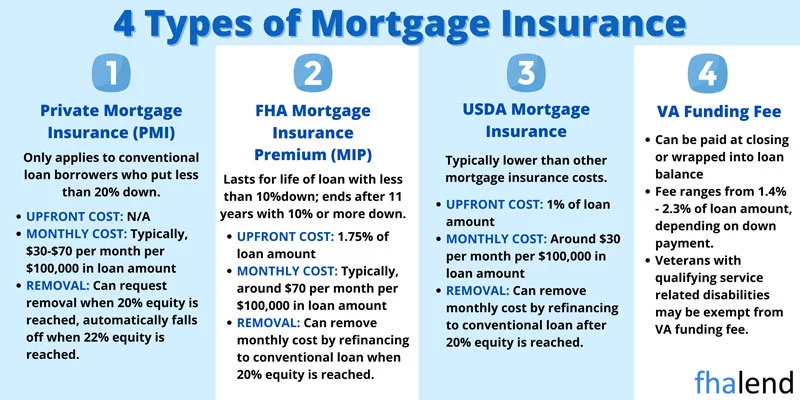

Mortgage insurance is a type of insurance that protects lenders from losses resulting from borrower default. For borrowers, mortgage insurance provides protection in the event of involuntary unemployment or death. Mortgage insurance for a VA home loan is provided by private insurers, not by the government. There are two types of mortgage insurance: private mortgage insurance (PMI) and lender-paid mortgage insurance (LPMI).

In this article (Skip to…)

Do I Need To Pay a Mortgage Insurance When Applying For a Va Loan?

Conventional or FHA borrowers who put down less than 20% when they bought their home typically have to pay for PMI or MPI. The premium is usually added to the borrower’s monthly payment. LPMI is an alternative to PMI that is sometimes offered by lenders. With LPMI, the lender pays the mortgage insurance premium, but the borrower pays a higher interest rate.

The amount that the government will guarantee to a lender is known as a veteran’s entitlement

Mortgage insurance is required for VA loans with down payments of less than 20%. The good news is that borrowers can cancel mortgage insurance once they have reached 20% equity in their home. To do this, the borrower must submit a request to the lender, and the lender must agree to cancel the insurance.

VA Loans also have a funding fee, which is a one-time charge paid at closing. The funding fee ranges from 0.5% to 3.3% of the loan amount and is based on the type of veteran and the size of the down payment.

If you’re thinking about getting a VA loan, it’s important to understand how mortgage insurance works. This will help you make an informed decision about whether or not to get a loan with mortgage insurance. The good news is that borrowers can finance the funding fee, so it doesn’t have to be paid out of pocket. And, most importantly, VA Loans do not require private mortgage insurance (PMI).

VA Funding Fee Percentage Table [Purchase]

| Type of Veteran | Down Payment | Fee % (First-Time Use) | Fee % (For Each Use) |

|---|---|---|---|

| Regular Military | 0% – 4.99% 5% – 9.99% 10% and up |

2.15% 1.50% 1.25% |

3.30% 1.50% 1.25% |

| Reserve/National Guard | 0% – 4.99% 5% – 9.99% 10% and up |

2.40% 1.75% 1.50% |

3.30% 1.75% 1.50% |

VA Funding Fee Percentage Table [Cash-Out Refinance]

| Type of Veteran | Fee % (First-Time Use) | Fee % (For Each Use) |

|---|---|---|

| Regular Military | 2.15% | 3.30% |

| Reserve/National Guard | 2.40% | 3.30% |

What Are The Pros of Mortgage Insurance for a VA Home Loan?

Mortgage insurance for a VA home loan has several benefits.

- First, it allows borrowers to obtain a loan with a smaller down payment.

- Second, it protects the lender in the event that the borrower defaults on the loan.

- Third, it helps to keep monthly mortgage payments low.

What Are The Cons of Mortgage Insurance for a VA Home Loan?

There are some drawbacks to mortgage insurance for a VA home loan.

- First, the borrower is responsible for paying the monthly premium for the insurance.

- Second, if the borrower defaults on the loan, the insurance will pay off the balance of the loan, leaving the borrower with nothing.

- Third, mortgage insurance can add to the overall cost of the loan.

Is Mortgage Insurance for a VA Home Loan right for me?

Mortgage insurance for a VA home loan may be right for you if you are looking to obtain a loan with a smaller down payment. However, it is important to weigh the pros and cons of mortgage insurance before deciding if it is the right option for you. The funding fee for a VA loan is a one-time fee that is charged in order to help defray the costs of the VA loan program. The fee is generally between 0.5% and 3.3% of the loan amount, depending on factors such as the type of loan, the veteran’s military service, and whether the veteran is making a down payment.

How Can I Avoid Paying Mortgage Insurance (Funding Fee) on VA Loan?

For many veterans, the funding fee is waived entirely. Veterans with service-connected disabilities are exempt from paying the funding fee, as are surviving spouses of veterans who died in service or as a result of their service-connected disabilities.

Veterans who are eligible for VA benefits can finance the funding fee as part of their loan. This means that they do not have to pay the fee upfront, but it will increase the total amount of their loan. The funding fee for a VA loan is a way for the VA to ensure that the program remains self-sustaining. By charging a fee for each loan, the VA can keep the program running without relying on taxpayer dollars. For more information on the funding fee for a VA loan, please contact your local VA office or visit the VA website at

The funding fee for a VA loan is a one-time fee that is charged in order to help defray the costs of the VA loan program. The fee is generally between 0.5% and 3.3% of the loan amount, depending on factors such as the type of loan, the veteran’s military service, and whether the veteran is making a down payment.

Refinancing Into Conventional Loans With 20% Down To Avoid Mortgage Insurance or Funding Fee

For many veterans, the funding fee is waived entirely. Veterans with service-connected disabilities are exempt from paying the funding fee, as are surviving spouses of veterans who died in service or as a result of their service-connected disabilities. Veterans who are eligible for VA benefits can finance the funding fee as part of their loan. This means that they do not have to pay the fee upfront, but it will increase the total amount of their loan. The funding fee for a VA loan is a way for the VA to ensure that the program remains self-sustaining.

By charging a fee for each loan, the VA can keep the program running without relying on taxpayer dollars. For more information on the funding fee for a VA loan, please contact your local VA office or visit the VA website at www.va.gov. Make sure to check our article about credit score requirements for VA loans and how to avoid paying higher mortgage rates on VA loan.

How Much is The Cost of Funding Fee on VA Loan?

A funding fee on a VA Loan is a one-time fee charged by the Department of Veterans Affairs to help cover the cost of the VA Loan program. The fee is calculated as a percentage of the loan amount and can be paid upfront or rolled into the loan. The funding fee for first-time use is 2.15% for loans with no down payment, and 3.3% for loans with a down payment. The funding fee for subsequent use is 3.3%. The funding fee is waived for certain service members, veterans, and surviving spouses. The funding fee on a VA Loan helps to ensure that the VA Loan program remains self-sustaining so that veterans can continue to receive the benefits of the VA Loan program. The fee also helps to cover the cost of defaults on VA Loans.

The funding fee on a VA Loan is generally lower than the fees charged by private lenders for similar loans. This makes VA Loans an attractive option for many veterans and military families. If you are considering a VA Loan, be sure to ask about the funding fee and whether it can be rolled into the loan. This will help you to make an informed decision about whether a VA Loan is right for you.

Qualifying For VA Loan With Recent Bankruptcy

You might be eligible for a VA home loan mortgage if you had bankruptcy previously and it was discharged in the last three years. To qualify, you must have a credit history and show that your bankruptcy was caused by events outside of your control.

Chapter 13 bankruptcy is known as “reorganization” bankruptcy and usually entails a payment plan that allows you to repay your debts while keeping your home. You can be eligible for a VA loan if you completed the payment plan properly.

If you’ve made at least 12 months of payments toward the plan and your trustee or judge approves your application, you may be approved if you fulfill residence mortgage debt eligibility requirements. You must fulfill financial and income standards to be accepted in the same way as Chapter 7 bankruptcy.

March 24, 2022 - 6 min read