Home Loan After a Loan Modification Guidelines

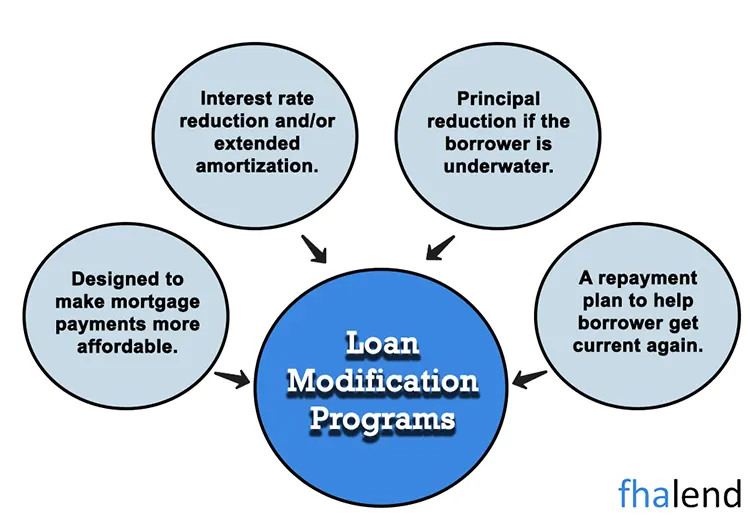

Back in the day, a right aftermarket crash in 2008 a loan modification gained popularity in late 2009 till 2014. People instead of refinancing loans started modifying terms and repayments. Here is a thing that makes a loan modified, a mortgage (loan) is modified if any of the following things have occurred:

- Changing interest rate (in most cases lowering it)

- increasing terms of the loan (extending it)

- converting an ARM to 15 or 30 years fixed-rate mortgage (lending rate has changed to a fixed rate or reduced amount)

- reducing the balance of the mortgage (principal balance

All the above loan modifications will result in lower payments and they will be treated as mortgage or loan modifications by credit bureaus, lenders, or brokers.

In this article (Skip to…)

What is a Mortgage Modification?

A loan modification is done usually by a company not always a mortgage bank that is servicing your loan. Nowadays in most cases, your servicer will be UWM, Chase or any other big bank nowadays. a change made to the terms of an existing loan. Loan modifications can be used to lower monthly payments, extend the repayment period, or both. Some common reasons for getting a loan modification include financial hardship, job loss, or illness.

If you’re considering a loan modification, there are a few things you should know. First, you’ll need to contact your lender and explain your situation. Be prepared to provide documentation of your income, debts, and assets. Your lender will then review your information and decide if you qualify for a modification.

If you do qualify, you’ll be given a new repayment plan that fits your current budget. It’s important to remember that a loan modification is not a cure-all. You’ll still need to make your monthly payments on time, and you may be required to pay additional fees. But a loan modification can help you keep your home and get back on track financially.

Waiting Period After Lowering Rate During Loan Modification

There is no waiting period after changing the mortgage interest rate or converting it into 30 years or 15 years fixed. You can qualify for a loan right away by applying here.

If you reduce your mortgage balance loan then you have to wait 1 year or more depending on the percentage of a reduction (how much you reduced the principal loan amount). However, in more than 90% of households, the was only adjusted rate done instead of changing the principal loan amount.

Why do People do Mortgage Modifications?

The main reason for the loan or mortgage modifications is to allow borrowers to keep their homes after thought times like the forbearance program in 2021.

People can stay in their homes after modifying their mortgage and they don’t need to go through a short sale or foreclosure process.

There are reasons why people got their loan modification:

- a person lost a job or income

- couldn’t afford a mortgage after the mortgage rate adjustment (ARM loan, sometimes as high as 7%) payment and increased amount of years or lower the mortgage rate

- people whose property value dropped so they modified the loan

Does Loan Modification Will Hurt My Credit Score?

Unfortunately, those in need of a loan modification are already experiencing financial difficulties, and many will have begun missing or late payments (disregarded for credit reporting purposes). As a result, their credit score has already been damaged. Some lenders may not consider a loan modification until a borrower falls behind on their mortgage, although this is not always the case with all lenders. So, it really boils down to how the loan modification is reported to the credit bureaus (negatively or positively)

How The Loan Modification Appears on a Credit Report

Lenders frequently report a loan modification to credit bureaus as a settlement or adjustment to the terms of the loan. If it shows up as not meeting the original conditions of your loan, this may have a detrimental influence on your credit score. However, the impact will be less and shorter-lived than if you missed several payments or had your home foreclosed upon. This is unfortunate since homeowners who were approved for a CARES Act forbearance must make a critical decision about what to do next when they emerge from it.

On the other side, not every lender will report a settlement as a change in your credit score. As a result, your credit score may improve because your monthly payment would be reported as decreased. Ask your lender how they plan to report the modification when negotiating one. They may even agree not to report it as a loan modification, especially if you’ve been a great customer for years.

How Long The Loan Modification Will Stay on My Credit Report?

The loan modification will stay on your credit report for 7 years.

Applying for FHA Loan After Loan Modification

The waiting period after loan modification when qualifying for an FHA mortgage loan is 3 years. The time counts from the day when your mortgage modification was completed. Exceptions for 3 years waiting period mark is that some mortgage lenders have mortgage loan modification guidelines that allow for 1-2 years witting period after a loan modification.

The FHA Lend has no minimum tie that has to have gone by since the loan modification was completed. If you just finished a loan modification then we can do your loan.

Check If I Qualify After The Loan Modification

Conventional Loan After Loan Modification

When applying for a conventional loan after mortgage modification you need o know that most lenders require from 1 year up to 3 years of waiting a period after the modification. FHA Lend has no minimum waiting period after the modification when applying for a conventional loan. With a Fannie Mae or Freddie Mac, some lenders require a 620 credit score. We don’t have overlays and we go down to 500 credit score with over 170 investors and licensing in 48 states. The main requirement is that the loan modification has to be completed and it cannot be in progress meaning it needs to be a new note and the loan modification cannot be in a trial phase.

Process Of Getting a Mortgage After Loan Modification

In order to be eligible for a mortgage loan modification, borrowers must first meet with their lender to discuss their financial situation. Borrowers will need to provide documentation of their income, expenses, and assets. They will also need to explain why they are struggling to make their payments and what has changed in their financial situation.

After reviewing the borrower’s information, the lender will decide if a loan modification is possible. If the borrower is approved for a modification, the terms of the loan will be changed and a new payment plan will be put in place. The borrower will then make their monthly payments according to the new terms.

Loan Modification Vs Loan Refinance

A loan modification is not the same as a refinance. You can modify the terms of your loan directly with your lender when you take a loan modification. Only if you are at imminent risk of foreclosure does most lending agree to modifications. Contact your lender if you believe you qualify for a loan modification. If your house loan is underwater, a loan modification may assist you to alter the terms of your loan. If you think you might be eligible for a change in terms, contact your lender.

A refinance, on the other hand, is when a new loan is used to replace your current mortgage. When you refinance, you have the option of changing your loan’s term, interest rate, and even loan type. A cash-out refinance allows you to take equity out of your house. To get a refinance, you’ll go through an application process that’s similar to the process you went through to buy your home.

Buying a Home With Late Payments On Loan Modification

When you missed payments on a loan modification you need 12 months waiting period from the last late. To be able to get a new loan a lot of lenders look for a good credit score after the modification. FHA lend doesn’t care if you have a low credit score or you had late payments after a loan modification.

If you had a mortgage loan modification a few years back and if you are not sure if you can qualify, please contact us at (312) 869-2731 and we will help you to refinance your home or help you to buy a new property. We are available 12 hours 7 days a week so please call us or apply so someone from our team will call you as soon as humanly possible.

Late Payment on Mortgage Modification

In most situations, you may get a mortgage to purchase another property after having had your loan modified provided that you haven’t missed any payments in the previous year, depending on your lender’s requirements. But you must understand how your original loan was changed. You may not be eligible for a conventional mortgage loan if you have any principal forgiveness or write-down on your mortgage. However, there are other options for obtaining a mortgage with a low credit score. It is partially determined by the type of modification plan you have.

Who To Contact When Doing a Loan Modification?

If you’re in a private modification, contact your servicer as soon as possible if you suspect that making payments will be difficult for you. The servicer’s job is to try to negotiate the best possible outcome for the homeowner, not to offer you new terms and conditions; therefore, negotiating a new modification may or may not be feasible.

However, they must consider your situation and provide clear information regarding your rights as well as any applicable timelines. Even if you’re in an old FHA-HAMP program that is still active, you may be able to get a new modification after completing a trial payment plan period. The previous HAMP program (ended 12/31/2016) has been replaced by a new Flex Modification initiative. Borrowers who have previously modified their loan under HAMP (or any of the previous programs) are eligible for a Flex Modification if the mortgage loan satisfies all of the requirements for the Flex Modification Program (including, but not limited to, the following):

| Home Loan Requirements After Loan Modification in 2022 |

|---|

| The mortgage loan must not have been modified with a Flex Modification and then become 60 days or more delinquent within 12 months of the modification date without being reactivated. |

| The mortgage loan must be in imminent default or delinquent |

| The mortgage loan must not have been modified 3 or more times under any of the loan modification programs. |

| The borrower must not have failed a Flex Modification Trial Period Plan within the last year and a half if they were previously eligible for another Flex Modification. |

How to Start Process Of Loan Modification

Is doing a loan modification a good idea? It depends on your situation. If you cannot afford the next mortgage payment this might be a way to keep your house and not foreclose on it. If you have already been late on your mortgage payment, the damage has been already done, and your credit score probably dropped by about 15-30 points. idea If you want to start the process of loan modification please contact the servicer of your loan. Look for contact phone numbers or website addresses on your mortgage statement. Some banks/servicers might have special numbers or sites dedicated to borrowers who are having difficulties with their loans.

If you have a loan that needs to be renegotiated, contact these people as soon as possible and inquire about what assistance they may give. You can apply for a mortgage after your loan has been modified. Loan modifications were particularly popular between 2009 and 2013. Since the start of 2014, you have not observed nearly as many. Depending on what you did to your loan when you modified it, and how long you had to wait if at all. A loan modification is when you alter your existing mortgage without refinancing it. The current servicer of the loan will usually perform a loan modification.

When Can Qualify For a Loan After You Modify Your Mortgage Loan Payment?

You can qualify for a new mortgage right away if you lowered the interest rate or converted it to a fixed rate, as long as you meet all of the qualifying conditions. You’ll have to wait at least a year if you reduced the amount of your loan. Increasing the term of your loan will also result in an additional year or more. The good news is that the majority of loan modifications only reduced the interest rate.

Loan modifications were done to assist consumers in keeping their existing homes. Perhaps they had a loss of work or a personal problem. Maybe they didn’t have enough money for their mortgage after it increased by up to 7% as a result of inflation. Then there were people who were furious because their worth had dropped. If you want to apply for an FHA or VA loan, most lenders will demand a minimum of three years following the conclusion of your loan modification. There are a few lenders that will let you wait up to two years after completing a loan modification.

March 20, 2022 - 8 min read