Non-QM Loans: What Are Non-QM Loans

Non-QM loans are helping fuel the already booming housing market. Borrowers who cannot qualify for a traditional qualifying mortgage (QM) may now qualify for non-QM lending programs. Non-QM loans can finance primary residences, second homes, and investment properties. Non-QM and specialty mortgages are not hard money loans. Interest rates for non-QM mortgages are higher than those of QM loans. Especially for those with less than 20% down because mortgage insurance is not available for these products. That makes them much riskier for lenders.

In this article (Skip to…)

Non-QM Lending Guidelines Depend on The Wholesale Lender

There are no set non-QM lending mortgage guidelines. Because non-QM mortgages are non-conforming loans, they don’t have to meet guidelines established by Fannie Mae, Freddie Mac, FHA, VA, or USDA. Each non-QM wholesale lender creates its own lending guidelines. Lenders can also make exceptions case-by-case. If a deal makes sense, lenders tend to be open-minded.

Non-QM Versus Qualified Mortgages

What is a non-QM loan? A non-QM mortgage is a “non-qualified” mortgage. So-called qualified mortgages meet rather conservative standards for qualifying and pricing and are the safest products for lenders and borrowers. There are specific rules defining QMs, but most are government-backed loans or conforming (Fannie Mae or Freddie Mac) home loans.

QM Qualified Mortgage: Ability To Repay

Lenders are protected from certain lawsuits or having to buy loans back if they fail, but only for QM loans. Non-QM loans are perfectly legal and can be better for many borrowers. However, lenders have less protection from the government and no protection from mortgage insurers, so they will charge more for these products. Is a home loan that is not required to meet agency-standard documentation requirements as outlined by the Consumer Financial Protection Bureau (CFPB)

Mortgage Terms of Non-QM Loans

According to CoreLogic, the most common types of non-QM loans have one or more of these features:

- Interest-only payments for an introductory period

- Alternative methods of income documentation

- Debt-to-income (DTI) ratios over 43%

CoreLogic also noted that non-QM loans in 2018 performed as well as or better than QM loans, largely because their borrowers tended to have better credit scores or larger down payments than traditional QM borrowers.

Non-QM Mortgages for Self-Employed Borrowers

Self-employed mortgage applicants face a challenge when proving their income. That’s because most programs use the applicant’s taxable income for qualifying. And self-employed people generally have a lot of write-offs that reduce that income. So the taxes don’t always reflect the amount of money that is available to pay a mortgage.

Non-QM Loans With No Income Documentation

Bank statements solve that problem. Applicants provide 12 or 24 months of their bank accounts to prove how much money they make. Lenders examine business account statements and assume that 50% to 60% of those deposits are income and the rest goes toward business expenses. Alternatively, they may look at applicants’ personal account statements and count 100% of transfers from the business account as income.

12-Month Bank Statement Mortgages for Self-Employed Borrowers

The 12-month bank statement mortgage program requires a 20% down payment. Borrowers who want to put less than 20% down can choose the 24-month bank statement mortgage program. FHA Lend Mortgage Group offers rate and term non-QM refinance sat 90% loan-to-value with a 720 credit score. Homeowners can do an 80% loan-to-value cash-out refinance with a 740 credit score with non-QM loans. There is no maximum loan limit or private mortgage insurance with non-QM loans.

Debt Service Coverage Non-QM Loans

Real estate investors have special needs. Most QM products limit the number of financed properties a borrower can have, and government-backed loans only allow owner-occupant borrowers. Non-QM investor loans offer some useful features:

- No limit on the number of financed properties

- Investor products do not require landlord/rental history

- Vested as LLC or corporation is acceptable.

- Rate-and-term refinance up to 80% LTV with 720 credit scores

- Cash-out refinance up to 75% LTV with 720 credit score

Lenders use the property income to qualify. Rental income must be at least 115% of the principal, interest taxes, insurance, and homeowners association dues (PITIA). Our non-QM wholesale investor will only finance a total of $5 million per borrower. Any aggregate loan size higher than $5 million will be evaluated case-by-case.

Non-QM Mortgages for Bad Credit

Traditional QM mortgages require waiting periods after serious derogatory events like bankruptcy or foreclosure, even if the event was not the borrower’s fault and even if the borrower has otherwise good credit. Non-QM mortgages don’t impose these waiting periods. In fact, you can be one day out of foreclosure and still qualify for a non-QM mortgage. There are also non-QM home loans for people with recent late payments or bad credit scores. And some non-QM loans allow co-signers for applicants with poor credit scores. The more recent the derogatory credit event, or the lower the credit score, the higher the interest rate. Down payments may also need to be larger.

Non-QM Loans With One Year Tax Returns

QM lenders almost always require at least two years of tax returns for self-employed applicants. This can be difficult for those who started their business a couple of years ago. Because they could be making very good money by Year Two but the lender will average that income over two years, including Year One when there were startup costs and no money yet. And the income is treated conservatively — if it’s increasing, the lender takes the average, which is lower. If it’s decreasing, the lender takes the lower year. Or even less if it believes that the business or industry is risky. But there are non-QM mortgages that require only the most recent year of tax returns for self-employed borrowers. That can be a real advantage for those with newer businesses or businesses with fluctuating income.

Doctor’s Specialty Mortgage Programs

Doctor mortgages are designed to solve specific problems that new doctors have when applying for mortgages:

- High student loan debt

- Little or no savings

- Minimal work history

One thing doctors in the US enjoy, however, is very high earning potential. Non-QM mortgages for doctors take this into account. There are loan programs available for doctors with a zero-dollar down payment, even in the jumbo mortgage market. What is a doctor’s mortgage program? It’s a unique mortgage with flexible guidelines for licensed graduates of these programs:

- MD – Doctor of Medicine

- DO – Doctor of Osteopathic Medicine

- OD – Doctor of Optometry

- DPM – Doctor of Podiatric Medicine

- DDS – Doctor of Dental Surgery

- DMD – Doctor of Medicine in Dentistry

- DC- Doctor of Chiropractic

These individuals may qualify for the doctor loan program. Doctor’s mortgage guidelines exclude student loan debt from the debt to income ratio. These programs require no down payment in most states. What really sets this program apart is the ability to qualify based on future income. Many doctors start with lower income thresholds and then maximize their earning potential a few years into their careers. These programs allow medical professionals to purchase a home based on future income, which can greatly increase buying power!

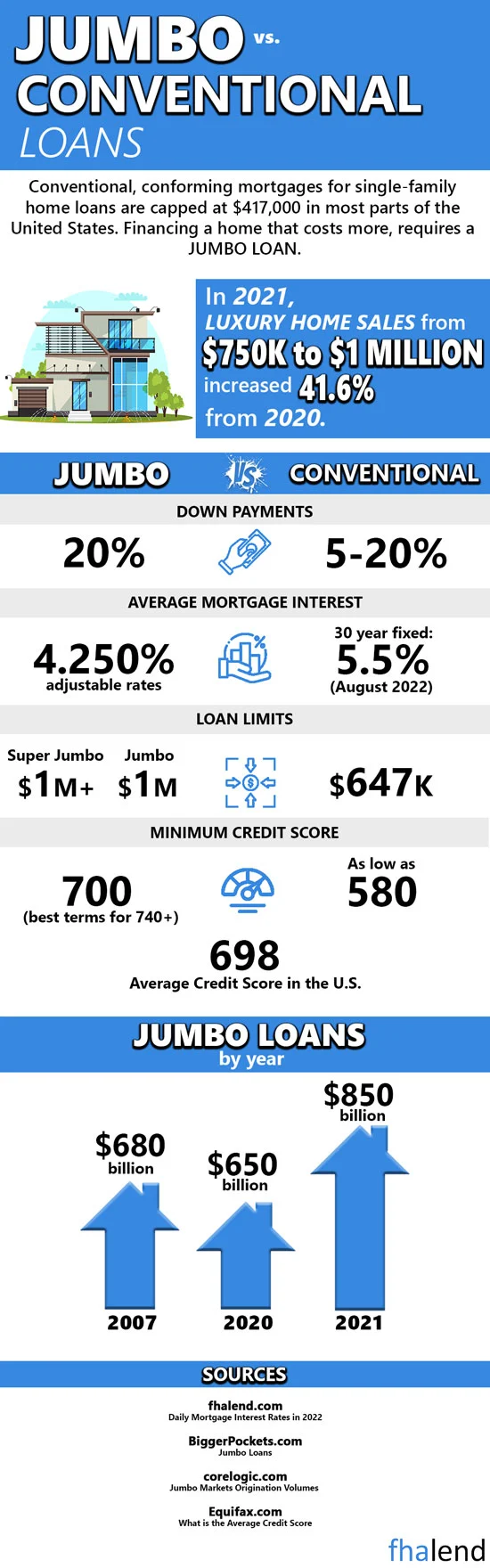

Jumbo Non-QM Lending Mortgages

Jumbo Non-QM programs are designed for borrowers who wish to finance more expensive homes. The loan amounts are too high for Freddie Mac, Fannie Mae, or government-backed programs. Applicants need at least 10% down for a loan with full, traditional income documentation and up to 30% down for large bank statement mortgages.

Non-QM Mortgages: Asset-Depletion Loans

Asset depletion is another way to qualify for a mortgage when the borrower has substantial wealth but a limited income. Lenders determine the income by taking a percentage of the value of the investments (depending on the type of account) and dividing it by the number of months in the loan term. Our product uses 100% of the account value and divides it by 60 months to come up with the borrower’s income. The loan can be used to purchase (up to 95% loan-to-value), refinance (up to 80% of the property value with a 680 credit score) or refinance with cash-out (up to 75% of the value with a 720 credit score).

Are Non-QM Loans Right for You?

In most cases, a traditional QM loan has a lower interest rate and minimum down payment than a non-QM home loan. But even highly-qualified applicants may not meet the guidelines of QM mortgages. When applying for a mortgage, try a lender with flexible underwriting and no overlays. If we can get you financed with a QM loan, we can save you money. And if not, we have more weapons in the form of non-QM mortgages. See if you qualify for QM or non-QM financing in minutes.

No-Doc Loans Are Back

Non-QM mortgages such as no-doc loans, bank statement mortgages for self-employed borrowers with no income tax returns required, asset-depletion loans, and stated-income mortgages were very popular prior to the 2008 Real Estate And Mortgage Collapse.

Comeback Of Non-QM Loans After The 2008 Financial Crisis

After the 2008 real estate and banking meltdown, alternative specialty mortgages and non-QM loans became extinct and not expected ever to resurrect. Non-QM and alternative specialty loan programs started making a comeback starting in 2015. The first non-QM loan program launched was the bank statement mortgages for self-employed borrowers where no tax returns are required. When it relaunched in mid-2015, it was an instant success. More and more non-QM loan products were launched and they all became a success. The mortgage industry has gone through a total restructure after the real estate, credit, and financial meltdown of 2008.

How Stated Income And Alternative Lending Were Affected After The 2008 Financial Crisis

Thousands of mortgage lenders went out of business. Mortgage products like no doc, bank statement mortgages, or stated income products have become extinct. Over half of this country’s mortgage loan originators have quit the business due to the new SAFE ACT. SAFE ACT was created by Congress where all mortgage loan originators need to go through federal and state testing, federal and state background investigations.

Creation of Regulations, SAFE ACT, Dodd-Frank, CFPB, NMLS

Every mortgage loan originators need to go through credit checks where they need to explain all derogatory items on their credit reports including bankruptcies, foreclosures, and collection accounts. State mortgage regulators can deny a mortgage loan originator their mortgage license just for having bad credit due to financial irresponsibility. Those employed by FDIC banks and credit unions are exempt from this rule.

NON-QM Loans After 2008 Real Estate Meltdown

Fortunately, all government and conventional loan programs have gotten more lenient after the 2008 mortgage meltdown. Home Buyers who became victims of the 2008 financial credit and mortgage collapse and who had to file bankruptcy or had gone through a foreclosure can now have a second chance in being homeowners. Lenders fully understand that the financial collapse of 2008 hurt millions of folks and that these folks’ credit got ruined due to extenuating circumstances. Bankruptcy and foreclosure rates hit a historical peak record.

Income, Credit, Assets In Mortgage Qualification

Today, as long as borrowers with documented income, can qualify for government and conventional loans. Self-employed borrowers and borrowers who did not meet waiting period requirements can qualify for non-QM loans:

- Bad credit, no credit, prior bankruptcy, foreclosure, deed in lieu of foreclosure, unsatisfied collection accounts, prior bad payment history will not be a hurdle in qualifying for home loans

- It is not whether borrowers will qualify for a mortgage, it is when they can qualify for a mortgage with bad credit

- One important thing is that most mortgage lenders want to see a 12-month timely payment history

- Old collections and charged-off accounts with open credit balances do not have to be paid off

- Medical collections are exempt from debt to income calculations

- Mortgage lenders treat medical collections differently than non-medical collections

- As long as borrowers have documented income and can be verified by the IRS, they will be a homeowner again

- Self Employed borrowers can qualify for bank statement loans for self-employed borrowers with no tax returns required

- Or if you are a first time home buyer, you will be a first-time homeowner

Waiting Period After Bankruptcy And Foreclosure

There are certain mandatory waiting periods on government and conventional loans with borrowers with prior bankruptcy or foreclosure. NON-QM Mortgages has no waiting period after bankruptcy and foreclosure:

- There is a two-year waiting period after Chapter 7 bankruptcy to qualify for VA, FHA, USDA Loans

- The three-year mandatory waiting period after foreclosure ( the time clock with foreclosure and deed in lieu of foreclosure starts from the date the deed of the home was transferred out of the homeowner’s name into the mortgage lender’s name or the date of the sheriff’s sale)

- There is a three-year waiting period after the date of the short sale to qualify for FHA and USDA Loans

- The waiting period after foreclosure, deed in lieu, a short sale is two years on VA Home Loans

- Mortgage lenders do want to see re-established credit after a bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale

Government and conventional loans have mandatory waiting periods after bankruptcy and/or foreclosure. Conventional loans require a seven-year waiting period after foreclosure. A lot can happen to home prices in seven years in this bullish housing market. Many folks recover sooner than others after bankruptcy and/or a housing event. Many homebuyers can benefit from using non-QM mortgages. This holds especially true for borrowers with recent bankruptcy and/or a foreclosure. The fact there is no waiting period after bankruptcy and/or a housing event with non-QM mortgages benefit homebuyers become homeowners in a booming housing market sooner than later.

Re-Establishing Credit After Bankruptcy And Housing Event

How can potential home buyers re-establish credit when they just went through a bankruptcy, foreclosure, deed in lieu of foreclosure, short sale with bad credit?

- The best and fastest way of re-establishing credit is by getting several secured credit cards

- having 3 to 5 secured credit cards

- No late payment on credit cards (if there is a deposit with the amount of the credit limit, these secured credit cards will report the late payments on the credit report)

- Do not get any credit if not intend on making timely monthly minimum payments because it will do more damage than good

To sum it up, as long as home buyers have the income they can qualify for a residential mortgage loan. However, one can have the highest credit scores possible but without the qualified income, they will not qualify. Working for cash money or writing everything off on income tax returns and do not show income, borrowers will have a problem getting any residential mortgage loan. Income is the Golden Ticket in getting a residential mortgage loan today on conventional loans. Again, self-employed borrowers can qualify for non-QM mortgages with the bank statement mortgage loan program.

Non-QM Mortgages One Day Out Of Bankruptcy And Foreclosure

Home Buyers can qualify for non-QM mortgages one day out of foreclosure or short sale with no waiting period. Non-QM loans are riskier loans versus traditional conforming loans. The down payment on a home purchase on non-QM mortgages depends on the type of property, credit scores, and other risk factors of the lender. Down payment requirements on non-QM loans are anywhere between 10% to 30%. Non-QM mortgage rates depend on the borrower’s credit scores, down payment, reserves, and the type of property.

Types Of Non-QM Loans

There are various types of non-QM mortgages. We will discuss and cover the various types of non-QM loan programs. There is no waiting period after bankruptcy and/or a housing event on non-QM mortgages one day out of bankruptcy and foreclosure. The non-QM loans one day out of bankruptcy and foreclosure is a specialty non-QM loan program where there is no waiting period after bankruptcy and/or a housing event with a 30% down payment.

Non-QM Mortgage Rates

Mortgage Rates are determined by borrowers’ credit scores and the amount of down payment. There is no private mortgage insurance required on non-QM mortgages. FHA Lend also offers bank statement mortgages for self-employed borrowers. Either 12 or 24 months of personal or business bank statements can be used. No income tax returns are required on bank statement mortgage loans for self-employed borrowers. There are no loan limits on non-QM mortgages. Borrowers with credit scores down to 500 can qualify for non-QM mortgages.

How To Apply Now

FHA Lend Mortgage has a national reputation of being able to do home mortgages other lenders cannot do. We have dozens of lending partnerships with wholesale non-QM and alternative specialty mortgage lenders. Some of our popular mortgage loan programs include non-doc mortgages, 12-month bank statements mortgage loans for self-employed borrowers, no-income-tax required no-doc loans, P and L stated income mortgage loan program, asset-depletion mortgages, 90% LTV jumbo mortgages, non-QM jumbo loans with credit scores down to 500 credit scores, FHA and VA loans during Chapter 13 Bankruptcy, no waiting period after bankruptcy and/or foreclosure, manual underwriting, borrowers with substantial outstanding collections and/or charged-off account, and FHA and VA loans with credit scores down to 500 FICO.

January 14, 2022 - 10 min read