How FHA Construction Loan Works?

The FHA construction loan is a great option for those looking to build their own home. It offers low-down payment and flexible credit score requirements, making it an attractive option for many. With an FHA construction loan, you can finance up to 95% of the cost of the home, making it an ideal choice for those who don’t have the cash to put down a large down payment. Additionally, the credit score requirements are much lower than with other loans, meaning that even those with lower credit scores can still qualify.

The FHA construction loan works by providing funds to the borrower for the construction of the home. These funds are typically provided in the form of a lump sum, and the borrower is then responsible for using the funds to build the home. Once the construction is complete, the loan is then converted into a traditional mortgage, and the borrower is responsible for making monthly payments on the loan. This makes the FHA construction loan a great option for those who want to build their own home, but don’t have the cash to put down a large down payment.

In this article (Skip to…)

What is an FHA Construction Loan?

An FHA construction loan is a loan provided by the Federal Housing Administration (FHA) to a borrower to construct a new home. It is a great option for borrowers who are looking to build their own homes, as the loan amount can be up to the full cost of construction.

- borrower – person who borrows the money

- loan amount – amount lent by a bank

- lender – institution/bank which lends you money

The loan is usually provided by a lender approved by the FHA, who will evaluate the borrower’s creditworthiness and determine the loan amount and terms. The borrower will then be responsible for repaying the loan in monthly installments. When the construction is completed, the borrower can then refinance the loan into a traditional mortgage. With an FHA construction loan, borrowers can benefit from low down payments, flexible credit requirements, and competitive interest rates.

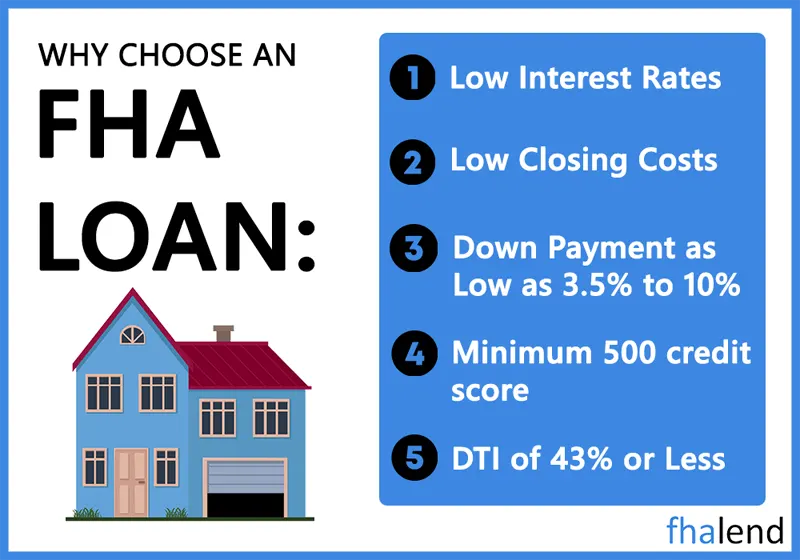

Understanding FHA Loan Requirements

- credit score

- down payment

FHA construction loans are a great option for those looking to build their dream home. With an FHA construction loan, you can finance the cost of your construction project, as well as the cost of the land itself. This type of loan is backed by the Federal Housing Administration (FHA) and is designed to help borrowers with less-than-perfect credit scores get approved for financing.

| State | Cost to build a house in 2024 |

|---|---|

| Alabama | $267,620 |

| Montana | $298,960 |

| Alaska | $421,080 |

| Nebraska | $210,900 |

| Arizona | $295,580 |

| Nevada | $334,140 |

| Arkansas | $251,800 |

| New Hampshire | $299,900 |

| California | $405,440 |

| New Jersey | $376,900 |

| Colorado | $299,300 |

| New Mexico | $290,940 |

| Connecticut | $345,440 |

| New York | $360,180 |

| Delaware | $327,060 |

| North Carolina | $301,500 |

| Florida | $263,640 |

| North Dakota | $212,500 |

| Georgia | $273,860 |

| Ohio | $222,480 |

| Hawaii | $412,840 |

| Oklahoma | $260,500 |

| Idaho | $315,520 |

| Oregon | $340,580 |

| Illinois | $265,440 |

| Pennsylvania | $302,200 |

| Indiana | $219,300 |

| Rhode Island | $338,180 |

| Iowa | $214,040 |

| South Carolina | $301,840 |

| Kansas | $207,120 |

| South Dakota | $204,420 |

| Kentucky | $280,580 |

| Tennessee | $261,940 |

| Louisiana | $269,920 |

| Texas | $264,100 |

| Maine | $282,140 |

| Utah | $288,560 |

| Maryland | $294,160 |

| Vermont | $307,840 |

| Massachusetts | $350,820 |

| Virginia | $310,100 |

| Michigan | $216,780 |

| Washington | $343,100 |

| Minnesota | $236,980 |

| West Virginia | $301,120 |

| Mississippi | $255,320 |

| Wisconsin | $239,140 |

| Missouri | $226,760 |

| Wyoming | $290,420 |

When applying for an FHA construction loan, you will need to have a good credit score and a down payment of at least 3.5%. You will also need to provide proof of income and assets to prove that you have the financial means to pay back the loan. The FHA also requires that the property you are building is your primary residence and that you will be living in it for at least one year after construction is complete. Once your loan is approved, you can begin building your dream home.

FHA construction loans are a great way to finance your dream home without having to worry about a high credit score or a large down payment. With an FHA construction loan, you can get the financing you need to build your dream home and start living the life you want.

FHA Construction Loan Terms and Conditions

- borrower

- lender

- HUD

The FHA construction loan is a loan offered by the Federal Housing Administration (FHA) to borrowers who want to finance the construction of a home. This type of loan is ideal for those who have limited funds for a down payment and who want to build a home instead of buying one.

The borrower is responsible for obtaining a loan from a lender approved by the US Department of Housing and Urban Development (HUD). In order to qualify for an FHA construction loan, the borrower must meet certain requirements, such as having a good credit score and a steady income. The lender will also need to review the plans for the construction project and make sure that all the necessary permits and inspections have been obtained.

Once approved, the lender will provide the borrower with the funds to complete the project. During the construction period, the borrower will be responsible for making monthly payments on the loan, which will include interest and principal. Once the project is complete, the loan will be paid off and the borrower will own the home.

FHA construction loans are a great option for those looking to build a home without having to put down a large down payment. With an FHA construction loan, borrowers can finance the construction of their dream home while still maintaining a comfortable budget.

FHA One-Time Close Construction Loan Project

We delved into the crucial aspect of choosing the right builder for your project. However, there are additional steps in the planning process that warrant consideration well in advance. Initiate the creation of a comprehensive budget on paper before commencing the project. Subsequently, discern which expenses can be incorporated into the loan and which ones necessitate out-of-pocket payments. Address the question of where you’ll reside during the construction phase and the anticipated duration.

Estimate the potential cost of renting and the duration of such expenses, ensuring these are factored into your budget. Anticipate potential delays in your construction project and allocate a buffer to cover expenses in case the project surpasses the expected timeline. These delays may stem from issues like contractors deviating from schedules, delays in material procurement, or weather-related setbacks. Before the project kickoff, finalize your personal touches.

While we previously acknowledged the role builders play in potential delays, homeowners also contribute to project timelines. Decisions on tile, countertops, wood flooring, carpeting, paint colors, light fixtures, appliances, and bath fixtures should be made before the builder initiates the project.

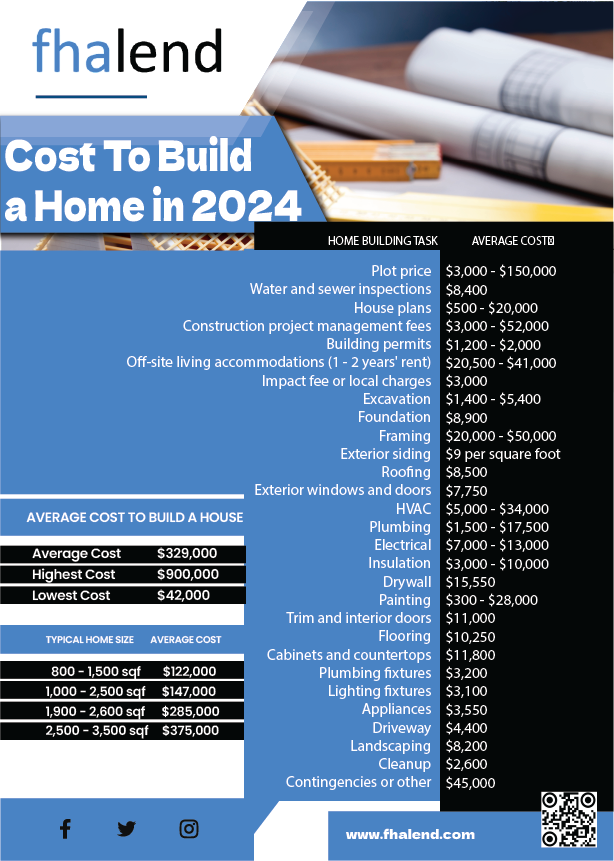

Cost to Build a Home

The average cost of constructing a home in the United States stands at $329,000 or $150 per square foot, excluding the land cost. That can range from as little as $42,000 to more than $900,000. However, this figure is a general average, and the expenses associated with your FHA construction loan project can vary based on several factors:

- Size of the home: Larger homes require more materials and time, leading to increased project costs.

- Geography: Labor costs vary by region.

- Materials: Opting for high-end, expensive materials will raise your overall cost.

- Timing: Builders may offer better deals during slower periods.

- Delays: Project delays can result in additional expenses.

While a new construction home might have a higher upfront cost compared to purchasing a pre-owned home, it ensures you get exactly what you desire, with fewer expected repairs in the initial years. In contrast, pre-owned homes may entail replacing costly items such as furnaces, roofs, and appliances shortly after purchase.

The Process of Obtaining an FHA Construction Loan

- credit score

- down payment

- loan amount

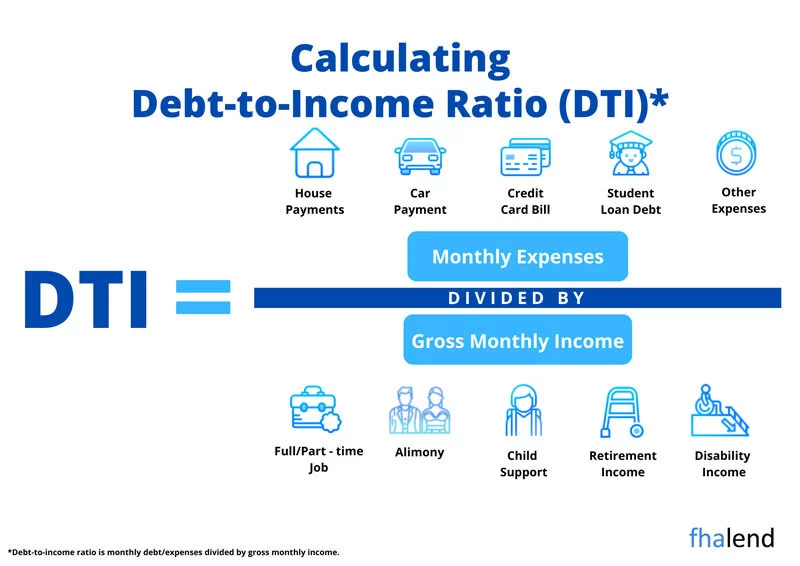

An FHA construction loan is a loan offered by the Federal Housing Administration (FHA) to help cover the costs of building a home. It is available for both new construction and existing homes, and can be used for either single-family homes or multi-family dwellings. The loan amount is based on the appraised value of the home, and the borrower must have a credit score of at least 580 to qualify. A down payment of at least 3.5% is required, and the loan can be used to finance up to 96.5% of the cost of the home.

The process of obtaining an FHA construction loan is relatively straightforward. The borrower must first apply to the lender, which includes a credit report, proof of income, and other financial documents. The lender will then review the application and determine whether the borrower meets the requirements for the loan. Once approved, the borrower must provide proof of ownership of the land where the home will be built, as well as plans and specifications for the home. Once the loan is approved, the borrower can begin construction and make payments on the loan.

The Benefits of Choosing an FHA Construction Loan

- Flexible terms

- Low down payment

An FHA construction loan is a great option for those looking to finance a home-building project. It offers flexible terms and a low down payment, making it an attractive option for those who may not have the funds for a large down payment. With an FHA construction loan, you can finance the construction of your home with a single loan, rather than having to take out multiple loans. This can make the process of building a home much simpler and more convenient. Additionally, the FHA construction loan is backed by the federal government, meaning you can have peace of mind knowing that your loan is secure.

In addition to the flexible terms and low down payment, an FHA construction loan offers a variety of other benefits. For example, you can choose the length of your loan, which can be anywhere from 15 to 30 years. You can also choose the interest rate, which can be fixed or adjustable, depending on your needs. FHA construction loans also typically come with lower closing costs, making them more affordable than other types of loans. With all these benefits, an FHA construction loan can be an excellent choice for those looking to finance their home-building project.

Tips for Getting the Most Out of an FHA Construction Loan

- down payment

- credit score

- loan-to-value ratio

An FHA construction loan can be a great option for those looking to build their dream home. With an FHA loan, you can make a smaller down payment and have a lower credit score than with a traditional loan. This can make it easier to qualify for an FHA loan. However, it is important to understand the loan-to-value ratio and the other requirements of the loan before you apply.

When applying for an FHA construction loan, it is important to understand the loan-to-value ratio. This ratio is the percentage of the loan that is secured by the property. Generally, the loan-to-value ratio should be no more than 96.5%. This means that the property should be worth at least 96.5% of the loan amount. It is also important to have a good credit score and to make a down payment of at least 3.5%.

By understanding the requirements and the loan-to-value ratio of an FHA construction loan, you can get the most out of your loan and build your dream home. With an FHA loan, you can make a smaller down payment and have a lower credit score than with a traditional loan. This can make it easier to qualify for an FHA loan.

- FHA loan requirements

- FHA construction loan terms

- Benefits of FHA construction loan

In conclusion, an FHA construction loan is a great option for those who are looking to build their dream home. The loan is backed by the Federal Housing Administration, which makes it easier to qualify than traditional construction loans. Furthermore, the loan offers several benefits, such as low down payments, flexible terms and conditions, and the ability to finance the cost of construction. With the right preparation and research, you can make the most of your FHA construction loan and create the home of your dreams. So, don’t wait any longer and start exploring your options today and after you moved in, get ready to read our top 27 steps to do after buying a home.

January 13, 2024 - 10 min read