FHA Home Appraisal Guidelines in 2024

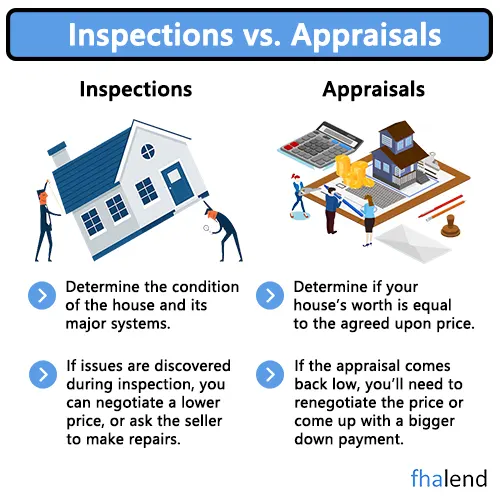

The Federal Housing Administration (FHA) appraisal guidelines are designed to protect the interests of lenders and borrowers. The guidelines establish minimum property standards that must be met before a property can be insured by the HUD. The appraisal is an estimated value of the property done by a third-party HUD-approved appraisal company and it’s a standard requirement for most refinances and mortgages. Banks and lenders use the appraised value to calculate your debt-to-income and loan-to-value ratio when applying for an FHA loan in opposite to a conventional loan. There are 2 steps when doing an appraisal.

- Physical site visit on the property – the appraiser visits the property and checks for structural, interior, and exterior conditions. He or She checks the condition of the lot, systems, and fixtures and takes photos.

- Market Analysis (market valuation) – here the HUD-approved appraiser research comps (comparable sales) within a 1-mile radius that were purchased in the past 3-6 months and estimates the value of the property. The comparables need to have the same amount of bedrooms, bathrooms, and similar square footage.

In this article (Skip to…)

There are two types of FHA appraisals: full and limited.

- A full appraisal is required when the property is being purchased with an FHA loan.

- A limited appraisal is used for refinancing, home equity loans, and other transactions where the property is not being purchased.

The purpose of an FHA appraisal is to determine whether the property meets the minimum standards set by the FHA. An appraiser will inspect the property and review documentation such as building permits, zoning regulations, and fha inspection reports. The appraiser will also compare the property to similar properties that have sold recently in the area.

If the property meets the minimum standards, the appraiser will issue an appraisal report indicating the property’s value and compliance with the FHA guidelines. The report will be used by the lender to determine whether the property is eligible for FHA insurance.

When Second Appraisal is Required?

A lender must obtain a 2nd appraisal by another HUD-approved appraiser when

- The resale date of a property is between 91 and 180 days after the seller acquires it, and

- the resale price is 100% or more over the price paid by the seller when the property was purchased.

- The 2nd appraisal cannot be charged to the borrower, a lender or loan officer needs to cover it.

FHA might revise the resale percentage at which this second appraisal is required by publishing it in the Federal Register. The FHA appraisal guidelines are updated periodically to reflect changes in the housing market. For example, in January 2013, the FHA announced a new policy that requires mortgage lenders to verify a borrower’s income and employment before issuing an FHA loan.

This policy was added to protect borrowers from being approved for a loan they cannot afford. The FHA appraisal guidelines are just one part of the mortgage process and real estate. It’s important to consult with a mortgage lender to find out which guidelines apply to your specific situation.

Changes to the FHA Appraisal Guidelines in 2024

The new guidelines are designed to increase the number of low and moderate-income borrowers who have a lower credit score and cannot qualify for a conventional mortgage. The appraisal guidelines for FHA loans are more strict than for other types of mortgages where a minimum 620 or 640 FICO score is required.

The most significant change is that the HUD will allow borrowers to use a property’s estimated market value, rather than the appraised value, to qualify for a loan. This change is intended to make it easier for borrowers to purchase homes in areas where prices have been rising rapidly.

The HUD will also increase the amount that it allows borrowers to borrow without requiring them to purchase mortgage insurance. And it will reduce the minimum down payment requirement from 3.5 percent to 3 percent.

These changes are welcome news for low- and moderate-income borrowers, who have been struggling to afford homes in today’s heated housing market. They should also help to boost the economy by encouraging more people to buy homes.

Can you Transfer The FHA Appraisal To Another Mortgage Lender?

The answer is YES. You can do it but only for the government (FHA and VA loans). Conventional appraisals do not transfer from lender to lender. This process typically takes a few days but can save you hundreds of dollars if you are changing lenders. If you have a conventional appraisal and now, we need to utilize a NON-QM mortgage product, most of the time, those appraisals can be transferred.

VA Appraisal Guidelines

A VA appraisal is a document that is required by the Department of Veterans Affairs in order to determine the value of a home being purchased by a veteran using a VA loan. The appraiser will visit the property and assess its condition and worth, taking into account any repairs or upgrades that may be necessary.

After the appraisal is complete, the results will be sent to the VA in order to determine whether or not the loan can be approved. The borrowing power of VA loan appraisal is shown in a Certificate of Reasonable Value (CRV) section.

Most Common Types Of Appraisal

When it comes to home appraisals, there are a few different types that you should be aware of. Here is a brief overview of the most common types of home appraisals:

- Home Value Estimate: A home value estimate is exactly what it sounds like – an estimate of your home’s value. This type of appraisal is typically used for insurance purposes or when selling your home.

- Refinance Appraisal: A refinance appraisal is conducted when you are looking to refinance your mortgage. The lender will need to know the current market value of your home in order to determine if refinancing is a good option for you.

- Tax Assessment: A tax assessment is conducted by your local municipality in order to determine your property taxes. The appraised value of your home will be used to calculate your property taxes.

- Estate Appraisal: An estate appraisal is conducted when a person dies and their estate is being settled. The appraised value of the home will be used to help determine how the estate should be distributed.

- Divorce Appraisal: A divorce appraisal is conducted when a couple is going through a divorce and they need to figure out how to split up their assets. The appraised value of the home will be used to help determine who gets the house in the divorce settlement.

- Insurance Appraisal: An insurance appraisal is conducted when you are looking to get insurance for your home. The insurance company will need to know the value of your home in order to properly insure it.

- PMI Removal Appraisal: A PMI removal appraisal is conducted when you are trying to remove private mortgage insurance from your mortgage. In order to do this, you will need to have the appraised value of your home be at least 80% of the original loan amount.

As you can see, there are a variety of different types of home appraisals that can be conducted. It is important to be aware of the different types so that you can be prepared for when an appraisal is needed.

Checklist of FHA Appraisal Requirements

The FHA has very strict guidelines for what homes are approved to be purchased with a mortgage. The requirements include that the property meet certain standards, or else it will need repairs made in order so they can still get their loans processed and go ahead as planned! The FHA is not going to approve the house if the seller can’t make major repairs and there are safety hazards. For example, The U.S Department of Housing and Urban Development has acceptability criteria and usually won’t insure a home with

- cracks in its foundation

- chipping lead paint

- infestation (termite & carpenter ants)

- unstable lateral stability

- naked cables sticking out from an outlet

- stairs without handrails because of the safety of the occupants and hazard issues.

The appraiser also checks for

- environmental contaminants

- noxious odors

- a septic system

- mechanical systems

- heating systems (water heater)

and offensive sights or excessive noises to the point of endangering the physical improvements or affecting the livability of the property. The FHA appraisal checks livability and usually includes a home inspection (checking a condition of a house) and comparable home prices, lot size, home features, school zones, and crime rates.

How Much Does The FHA Home Appraisal Cost?

Usually from $400 for a single-home family to even $1,000 for a multi-family unit it depends on the type of property, the property location, the number of units in the property, and other specifics. Usually, the homebuyer pays for the appraisal, however, sometimes there is a 2nd appraisal required for example for a flipped property when a person is trying to sell a property within 60-180 days. In this case, the lender or a buyer needs to cover the cost of having a 2nd appraisal.

If the homebuyer is using an FHA loan, the appraised value must be at least as high as the sale price of the property. If it is not, then the buyer may need to make up the difference in order to get the mortgage loan approved. There are several guidelines that homebuyers must follow when going through the FHA appraisal process. One of these guidelines is that the homebuyer must provide a copy of the signed purchase contract to the appraiser. This contract must include information on the sale price, down payment, and any closing costs that have been agreed upon.

The appraiser will also need access to all recent sales of similar properties in order to come up with an accurate estimate of the home’s value. This information is used to create an appraised value or the estimated market value of the property.

If you are considering buying a home, be sure to ask your lender about the FHA appraisal process. And if you are thinking of refinancing your current home, be sure to ask your lender if a full appraisal is required.

January 2, 2024 - 8 min read