Can Four People Purchase a Home? Mortgage With Multiple Owners

When it comes to mortgages, you would typically presume a married couple is involved. However, there are a variety of other individuals who combine to purchase a home – brothers, parents and their offspring, extended relatives, non-married couples, and even pals. A joint mortgage is what this is called in the business.

On the plus side, sharing the responsibility of a mortgage may make homeownership more accessible to individuals who could not otherwise afford it. However, entering into a major partnership as complicated as sharing a house and a mortgage necessitates careful preparation because you are committing to each other for an extended period of time. Together with Dale Elententy we prepared this article to explain the types of home ownership and will show you below how adding a co-borrower will help you for the loan you cannot afford because of your credit score, downpayment, or recent bankruptcies.

Adding another co-borrower or co-signer to the deal might raise your prospects of getting a mortgage and obtaining a good interest rate.

Can Four people Own a Home Together?

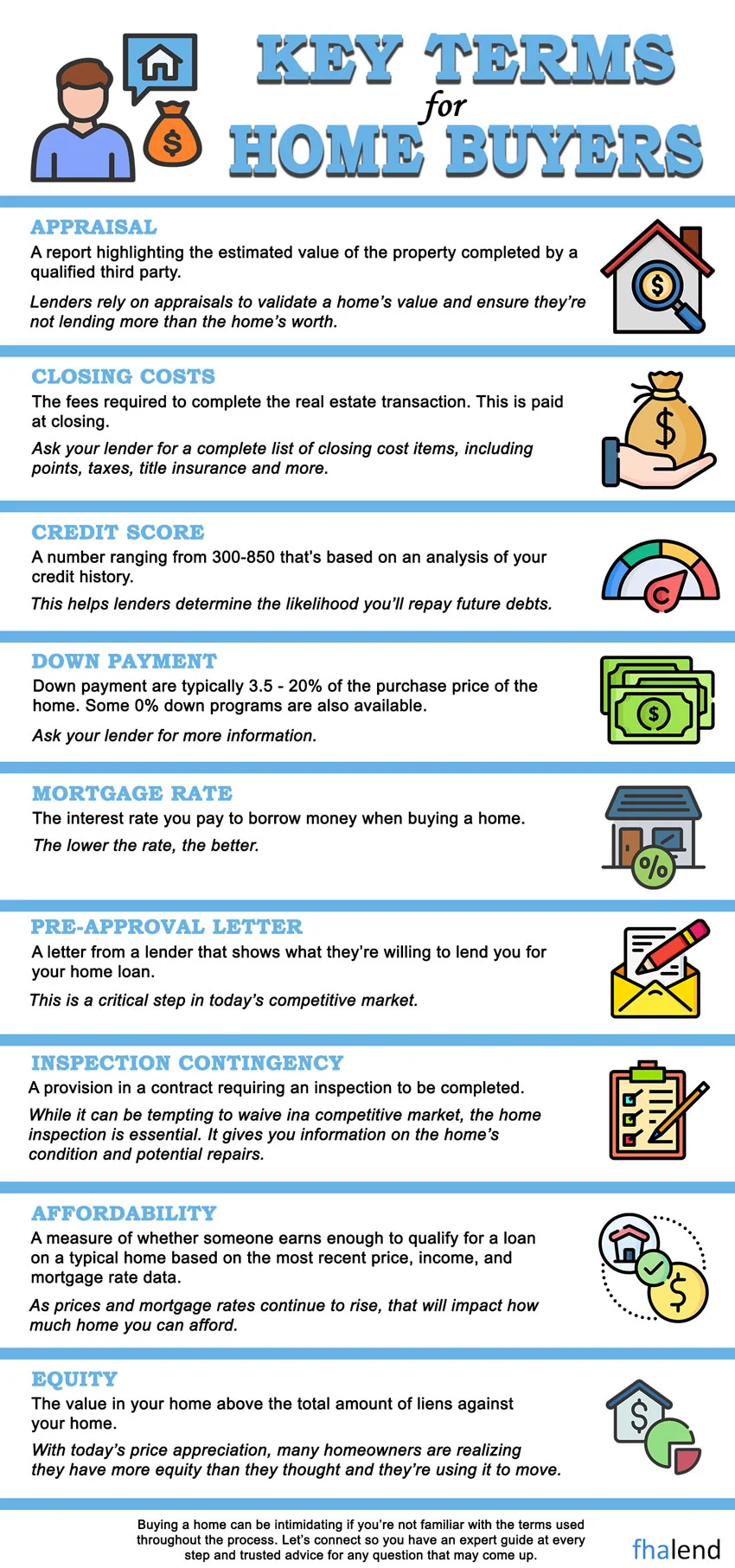

Co-borrowing occurs when two or more people co-own a property, and the most frequent situation is when only two parties are involved. However, many mortgage lenders allow for this practice, with 4 or even 10 individuals purchasing a home together. Based on Fanie Mae or Freddie Mac guidelines there is no maximum amount of people owning a home. However the credit score will not be averaged, it will be taken from the weakest borrower (with the lowest credit score) and the loan will be priced out (choosing rates) at that score Dale Dlenteny says.

Co-signers and co-borrowers

There are two options for four people to purchase a home together. They might either be co-borrowers or co-signers on loan.

A co-borrower will apply for the loan with you as the primary applicant, which means they will sign the deed and be recorded on the title alongside you. This person has the right to dwell in the house since they have a share of ownership; you can think of them as co-owners. Co-borrowers are also entitled to a portion of the property’s equity.

Co-borrowers are typically married couples, unmarried couples, or domestic partners, while other family members, such as the Yaars, might also be on loan.

On the other hand, a co-signer acts as a “guarantor,” agreeing to take responsibility for repaying the debt even if the principal borrowers are unable to do so. Borrowers frequently engage co-signers with excellent credit and low debts, believing that their solid financial circumstances can compensate for a low credit score or short credit history.

Co-signers are not named on the deed or title, and they are not allowed to dwell in the house. A parent, for example, who co-signs a loan for a credit-challenged adult kid for the latter to become a first-time homeowner. Although the parent is unlikely to dwell in the home, they will be responsible for the loan if their child defaults.

Why Should You Get a Joint Loan?

There are several reasons why borrowers should apply for a joint or shared loan, including pooling incomes, taking advantage of one borrower’s credit score, and having additional assets.

Joint Loans: Ownership and Responsibility

Examine your rights and duties before agreeing to use a joint loan. Find out the following information:

- Who is in charge of making payments?

- Who is the property’s owner?

- What are my options for getting out of the loan?

- What happens if I decide to sell my stock?

- What happens to the house if one of us passes away?

- Co-ownership is recognized differently depending on where you live and how you own the property. If you buy a house with a love partner, you may desire the property to pass to the other after you die, but local regulations may stipulate that the property goes to the deceased’s next of kin.

How To Get Approved For a Loan With Multiple Co-Applicants?

According to Venable, the procedure of qualifying for a home loan with another individual is similar to what it would be otherwise. “We examine each application in the same way, based on our product requirements, and consider the larger picture.” “We look at the debt-to-income ratio, credit score, and a two-year income history for both wage and self-employed borrowers,” he explains.

Keep in mind that over will consider both parties’ financial strengths and weaknesses. If one individual is qualified, but the other has financial difficulties, the first borrower’s chances of qualifying may be harmed.

Similarly, if one borrower has a lot of debt, it will affect the overall debt-to-income ratio of both borrowers. In that instance, qualifying may be more difficult.

While co-borrowing can make it easier to qualify for a mortgage, there are some disadvantages. Before applying, it’s critical to analyze both borrowers’ entire financial picture.

Is a Joint Loan Required?

If one borrower qualifies independently, you may not need to apply jointly. Even if only one person receives the loan, you can share payments if there are more than two of you. Even if only one of the owners files for a loan, you might be able to put everyone’s name on a deed of ownership.

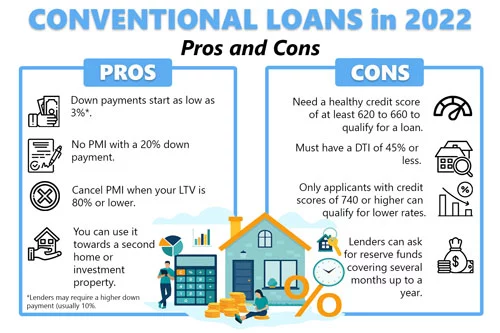

Non-borrowers contributing to the down payment are frowned upon by several lenders. A larger down payment, on the other hand, can help you save money in various ways:

- You borrow less and pay less interest because your loan balance is more minor.

- Because you have a lower loan-to-value ratio, you may be eligible for a lower interest rate.

- It’s possible that you can avoid paying private mortgage insurance.

Why Would Four People Want to Purchase a Home Jointly?

“People can cohabitate to buy a bigger home or a better investment than they could afford if they were buying on their own,” DiBugnara explained.

Co-borrower arrangements are helpful in various situations, according to Craig Luedtke, director of title operations at Chicago-based Landtrust Title Services.

“Often, two people who are friends or an unmarried couple would decide to buy a house, but a third borrower or co-signer must sign the promissory note,” he explained. “For example, a borrower’s two parents may need to be on the mortgage and title for the transaction to go through.”

Is There A Limit To How Many Persons Can Be On Loan?

According to Names, traditional Fannie Mae and Freddie Mac mortgage loans typically allow up to four or five co-borrowers.

“Fannie Mae allows up to four borrowers, whereas Freddie Mac allows five.” “However, there is no limit on the number of co-borrowers for manually underwritten loans,” he stated.

Manually underwritten loans are assessed by a human underwriter rather than going through an automated approval system.

According to Names, the number of co-borrowers allowed on FHA, VA, and USDA loans is technically unlimited. If you’re trying to buy a house rather than inherit one, you’ll probably want to keep the number of co-borrowers.

Consider Each Applicant’s Credit Score And Debt Level

Depending on the loan type and lender, four borrowers are usually authorized on loan.

However, before applying for the loan, you’ll want to improve your credit scores and boost your finances.

Be aware of each applicant’s debt load as well. Adding a borrower with high debts and a low income can lessen the amount you qualify for. You should talk to a lender as soon as possible to figure out how much you can all afford.

It’s also a good time to double-check your eligibility, depending on your home’s usage.

Purchasing a primary residence for all or part of you has different criteria than buying an investment property for which you all have a share. In the former situation, the down payment and credit score requirements will be lower. In contrast, an investment property will require superior credit scores, a much greater down payment, and cash reserves.

What To Think About When Buying A House For A Large Family

Buying a house with many co-borrowers can help you get a better deal, but it can also cause problems afterward.

The legal ownership structure developed for the investment will determine how and when the group can sell the property. When many co-borrowers are involved, experts recommend drafting and signing a legal contract with the help of an attorney.

There Are Several Common Ways To Hold Title When Buying A Home Together

When buying a house with another person or several individuals, one of the most important considerations you’ll make is how you’ll acquire ownership of the property:

- Sole ownership: One individual would be listed on the deed to the house and would have the authority to sell or not sell the house regardless of the views of the other borrowers.

- Joint tenancy: The house would be shared equally by all co-borrowers.

- All co-borrowers have ownership rights, which do not have to be divided evenly. If one individual puts less money down on the house or makes lesser monthly mortgage payments, this may be possible.

You should talk about your plans for your portion of the property – do you want to leave after a few years? Do you have any plans to transform the house into a rental property in the future? Even if your plans change, it’s critical to be clear about your objectives before purchasing a property with someone, especially if they aren’t your spouse or you don’t want to live together eternally.

Another issue is that if one borrower cannot contribute to the mortgage payments, for example, because they are unexpectedly unemployed, the other borrowers will be responsible for making up the shortfall.

You should talk about your plans for your portion of the property – do you want to leave after a few years? Do you have any plans to transform the house into a rental property in the future? Even if your plans change, it’s critical to be clear about your objectives before purchasing a property with someone, especially if they aren’t your spouse or you don’t want to live together eternally.

Another issue is that if one borrower cannot contribute to the mortgage payments, for example, because they are unexpectedly unemployed, the other borrowers will be responsible for making up the shortfall.

Choose Your Co-borrowers Carefully.

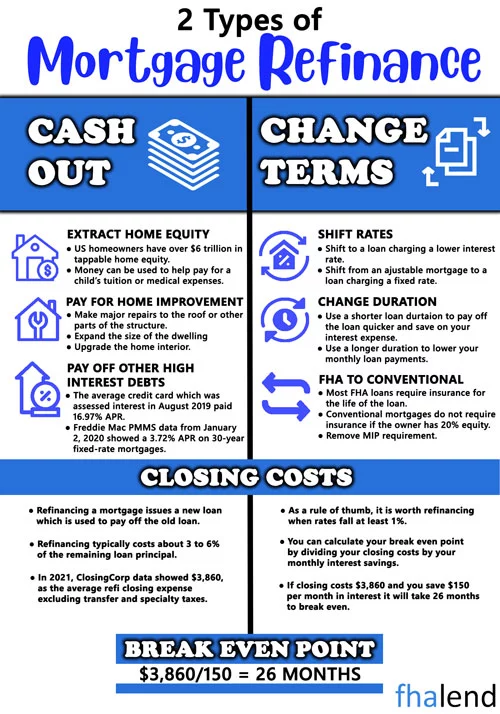

Can four people own a home together? Yes, but think twice about who you buy a house with because you won’t be able to remove them or yourself off the title unless you refinance later. Discuss each party’s responsibilities and how to resolve any potential problems or disputes.

Working closely with your real estate attorney can assist you in making informed decisions and ensuring that all co-borrower rights are secured when you purchase the home.

Why Is Co-ownership Becoming More Popular?

As budgets tighten across the country, co-ownership is becoming more common. Siblings, parents with children, unmarried partners, friends, and others can be co-buyers.

Due to growing housing costs, some would-be home buyers would have to get inventive to realize their ambitions of becoming homeowners. For many people, co-ownership is becoming a practical choice.

How do you go about buying a house with several owners?

When you co-own a home, each co-name owner will appear on the title. Furthermore, the mortgage will almost certainly be signed by all co-owners.

Mortgage Lending Programs For Co-ownership

Most borrowers in house-sharing scenarios, according to Venable, prefer fixed-rate conforming loans. “Most individuals choose long-term stability, particularly now that interest rates are so low,” he says. In rare cases, where the parties know they won’t be staying in the house for a long time, they may opt for a five-, seven-, or ten-year adjustable-rate mortgage.

Specialty loans, such as the VA Loan program, would be ineffective because they are intended for active military, veterans, and families. According to Venable, married couples are more likely to use FHA than single borrowers.

Is It Possible For Four People To Purchase A Home Together?

Yes, four people can purchase a home together. The friends may combine their resources to satisfy the lender’s conditions. Co-buying with friends might be a good alternative for those who can’t afford to pay cash for a house on their own.

Is It Possible For Two Families To Purchase A Home Together?

Yes. Many lenders allow two families to combine their incomes in order to purchase a home together. Both families will need to fulfill the minimal qualifying loan standards, which may differ from lender to lender. Lenders may also demand that both families have equal ownership rights of the property. Matters such as property usage, spending, and title should be discussed in detail

Parents are often the source of money for first-time home buyers. It is a private loan, or an intra-family mortgage, depending on how you look at it. Certain benefits may be derived by borrowing from your parents, including zero prequalifications, low-interest rates, the ability to pay whenever you want, and even tax deductions. Nonetheless, be prepared with specific amounts, tentative payment plans, and the specifics of your selected home before requesting a loan.

What Are The Challenges Of Purchasing A Property With Multiple Family Members?

A house can be purchased by several family members as co-borrowers.

The mortgage provider will ask you to list your whole family on the application. Each member of the family will be referenced in the mortgage application. You may use a co-ownership mortgage to borrow money with your siblings, adult children, or parents. As housing costs continue to rise, more families find it advantageous to form a co-ownership arrangement

Even if you are part of the family, it’s a good idea to figure out your financial responsibilities ahead of time. You don’t want your family ties to be harmed by the financial burden of co-ownership.

Is It Possible To Obtain A Mortgage With Four People?

Yes, you may take out a mortgage for four people. The co-borrowers can combine their resources to satisfy the lender’s requirements. As a result, it may be simpler to qualify for the financing.

For A Home, How Many Co-owners Can There Be?

Technically, there is no such thing as a maximum number of co-owners for a property. However, many lenders will restrict the number of borrowers to two families or four individuals.

If you want to co-own with more people, see whether lenders can offer a good fit.

Is It Possible To Register A Property In Four Different Names?

A home may be registered in more than one name. Although some lenders may have a limit on the number of names, many will allow four borrowers to co-borrow. And with that, there will be four names on the property deed.

Is it possible to purchase a home with multiple owners?

Yes, many lenders allow you to purchase a property with multiple people. However, the lender will assess whether the group of borrowers can fulfill its financial criteria.

Is It Legal To Have Four Homeowners Of A Property?

Yes, many lenders are willing to accept four people purchasing a home together. However, the applicants will need to fulfill the lender’s financial standards.

How Do You Divide Property Ownership?

In most situations, you’ll want to divide ownership through a tenancy in common understanding or a joint tenancy agreement.

The shares owned by each owner will vary based on their initial investment if the property is held in joint tenancy. Regardless of their initial investment, each owner will have an equal share with a joint tenancy agreement.

Is It Possible To Get A Mortgage For Both My Parents And Me?

Yes. Jointly purchased houses are one of the most frequent co-owned mortgage pairings around. Keep in mind that, depending on your preference, living together may necessitate changes in financial obligations and even lifestyle.

Is it legal for me and my mother to purchase a house together?

Yes, you can do it. You can co-finance a property with one or both parents. You may even buy a home together using the help of someone who isn’t a family member or spouse under current lending rules.

How Do You Buy A Home With Two Owners?

The procedure of acquiring a home with two owners begins with securing a joint mortgage. The application process is comparable to that of applying for an individual loan. One important distinction is that, when applying for a joint mortgage, both applicants’ incomes and assets are evaluated together. This may be useful when neither one of your incomes alone meets the requirements for the mortgage you are after. However, if your spouse has a bad credit history or debts, this might have an adverse influence on your personal credit.

March 1, 2022 - 11 min read