How To Calculate an Overtime Income On Mortgage

Over time, Bonus or Tip Income refers to income that you receive in addition to your normal salary. You can use the overtime, bonus, or tip Income as effective Income if you’ve received this income for the past two years and it is reasonably likely to continue.

Periods of overtime, bonus, or tip Income less than two years may be considered in DTI calculation if you can document that the overtime, bonus or tip income has been consistently earned over a period of not less than one year and is reasonably likely to continue.

You must calculate the Income by using the lesser of:

- the average Overtime, Bonus or Tip Income earned over the previous two years or, if less than two years, the length of time Overtime, Bonus, or Tip Income has been earned; or

- the average OBT Income earned over the previous year.

Buying a home can be one of life’s most exciting experiences! However, you must first qualify for a mortgage before starting looking for a home. To accomplish so, we’ll look at numerous other qualifying areas, including income. But what if you make a lot of money by working overtime? Let’s look at how you can use overtime money to help you get a mortgage.

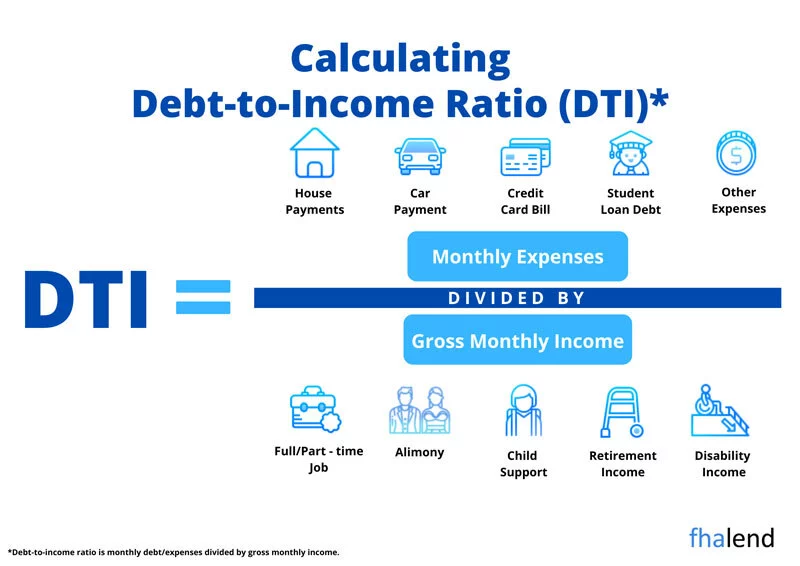

According to FHA lending guidelines, the loan officer must verify the borrower’s income before computing the debt-to-income ratio. Only verifiable income is acceptable, so the lender must establish that the revenue is consistent, predictable, and likely to continue. It is possible to consider income from a variety of sources.

Additional income from Overtime, Bonuses, Part-Time or Seasonal Employment that is not reflected in Effective Income can be used as a compensating factor subject to the following requirements:

- The Borrower must provide documentation that the Mortgagee verifies and documents that the Borrower has received this income for at least one year, and it will most likely continue. and

- the income, if it were included in gross Effective Income, is sufficient to reduce the qualifying ratios to not more than 37/47.

For some, overtime is a burden since it takes away from their spare time. Others see an opportunity to make money. This additional income may help secure approval for a house purchase and mortgage. So, let’s go over how lenders evaluate time and how you may use it to get the house you desire.

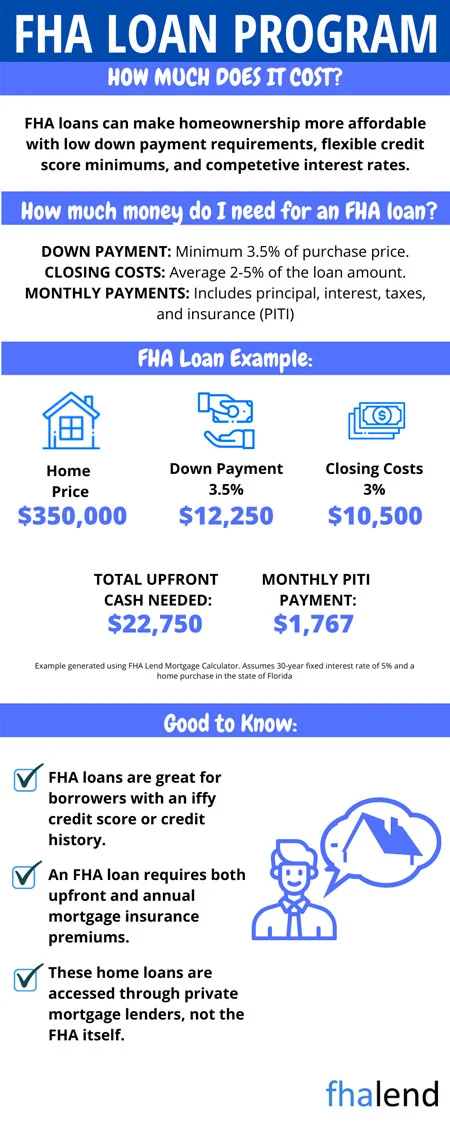

Some FHA loan candidates have seasonal work, part-time jobs, disability assistance, and other sources of income. These sources are acceptable as long as they meet FHA loan requirements on overtime income.

The same can be said for overtime pay. Borrowers may discover that, in certain instances, overtime can and is included in the debt-to-income ratio.

In this article (Skip to…)

How to Calculate Bonus Income for My Mortgage

There must be enough history to count overtime, and it is likely to continue in the foreseeable future. Before it can be considered income, lenders must first document the average overtime. The necessary time depends on the loan kind, overtime trend, and consistency. It is also determined by the file’s general composition and the pre-approval itself.

To compute effective Income for employees with overtime or bonus Income, the mortgagee must average the income earned over the past two years. However, if the current year’s overtime or bonus income falls by 20% or more from the prior year, the Mortgagee must use the current year’s revenue.

How The Overtime Income is Calculated When Qualifying For FHA Loan?

Because this form of income isn’t predictable, lenders must examine your earnings history and compute an average. There are other aspects to consider, which we’ll go over later. For now, simply know that if you plan to use your bonus, overtime, or commission income to pay for a mortgage, you’ll have to jump through a few extra hoops. To qualify for an FHA loan you loan officer needs to average out your last 2 years of income and you need at least two years of overtime income if you want the income to be one of the qualification factors (used to calculate your DTI)

How Mortgage Lenders Calculate Overtime Income

Paystubs can be used to figure out how much basic and extra pay you earned this year. As a result, lenders must request the complete employer verification of employment form. There are boxes to fill out that break down the revenue to calculate it accurately.

The lender must determine the base income. The lender might use the current hourly rate instead of averaging the base rate across time. As long as the employee has continuously worked 40 hours each week, the base computation is the current hourly rate multiplied by 40 hours.

How to Calculate Salary?

You will be required to present a few documents that will provide a more accurate picture of your earnings. We can calculate overtime income for qualification in a few different ways. First, if history is long and continuous, with no significant changes in recent years, it can be taken at face value. However, if the income amounts are not stable over the last two years, the average of the two years may be used to assess the qualification.

Paystubs and Overtime Income to Estimate Monthly Payment

To be eligible for overtime, you must submit pay stubs in addition to your W-2s. Your final yearly income will be shown on your W-2. Paystubs will show your pay stubs breakdown. This will provide your loan officer with a better picture of how much overtime money you make. Furthermore, if you change jobs, you may need to provide this information from them.

How Much Of a House I Can Afford With Overtime Income?

The first step is to figure out how long you will be receiving the overtime pay. Because overtime isn’t always guaranteed, and it isn’t included in your salary or hourly wage, a few weeks of extra work can’t be used as income. It will take at least a year or two of constant overtime labor to be considered part of your income qualification. If you want to take advantage of this money to secure a better mortgage, then having to establish this history may put off homeownership goals for a year or two. Consider if this is a realistic timetable for you; if your requirements push you to buy a home faster than that, do so. After calculating overtime income you have to add it to a salary and use our mortgage calculator to estimate your monthly payment and the maximum house price you can afford.

Employment Verification When Counting Overtime Income

You must submit a W-2, pay stubs, and an employment verification letter if your employer asks for them. Overtime is not a given. As a result, your employer will be required to provide proof that the overtime should be available during your career with them. Continuous verification involves performing the same automatic calculation for many years, at least until your mortgage is paid off. This may be seen as “endless verification.” The verification demonstrates that this income, while not part of your usual salary, will not go away and should not cause problems with your ability to pay your mortgage.

Calculating Overtime Earnings

Add the entire extra time over the last 24 months to get a two-year average of overtime. To calculate the monthly payment, divide the sum by 24. This portion of income must be the same or increase in the most recent year compared to the previous year to average it. To estimate adequate payment for an FHA loan, your lender must average your last two years of salary., and overtime income must be factored in for at least two years. Before applying, make sure you research each program and understand the eligibility requirements.

Some loan pre-approvals simply demand 12 months of proof of income for a one-year average of overtime. If that’s the case, a lender may use the last 12 months’ overtime to boost the base income.

Calculating Mortgage Qualification

What factors influence the number of houses I can afford? Five things affect how much home you can afford: your credit score, interest rate, loan length, cash reserves, expenses, and debt-to-income ratio. At this point, we can complete the mortgage qualification calculation. As a result, we employ our understanding of VA, USDA, FHA, Conventional, and Jumbo standards.

How Underwriters Calculate Overtime Income

As previously stated, you’ll need to create a few documents that will give a more accurate picture of your earnings. There are several methods for calculating overtime income for qualification. For example, if you have a long and consistent track record of financial success, in which no significant differences have occurred in the last few years, it may be taken at face value.

However, If the income amounts are not varied throughout the previous two years of history, we may use the average of the two years to determine qualification. Additionally, if you want to take out a mortgage through a government-insured program like FHA, USDA, or VA, there may be additional conditions for these programs to consider overtime earnings.

To be eligible for an FHA loan, your lender must average out your most recent two years of income to determine if you have the appropriate amount of earnings and you must have at least two years’ extra pay for it to be considered in this criteria. Before applying, it’s crucial that you familiarize yourself with each program and its requirements.

What to Include in your MortggaeApplication

Having the relevant papers on hand at the time of application will aid in a faster and more accurate prequalification. Your chances of closing rapidly improve if you provide thorough documentation upfront. Is it possible to use overtime as mortgage income? In a nutshell, sure. When it comes to using it as a source of income, however, there may be a few more hurdles to clear, including:

- Determine your earnings history – You’ll need to establish a continuous period during which you receive overtime pay. You cannot utilize a few weeks of overtime as revenue because overtime is not always guaranteed and is not included in your salary or hourly compensation

- Verification of employment – You may be asked to present an employment verification letter in addition to your W-2 and pay stubs. Overtime is not always possible. As a result, your employer will be required to produce proof that overtime will be accessible throughout your employment.

- Prepare your pay stubs – You will need to supply pay stubs in addition to your W-2s to have your overtime employment considered into your income for qualification. This will provide your loan officer with a more thorough picture of your overtime earnings.

Which Financial Institutions Can Assist You?

Most lenders will only consider overtime income if you can demonstrate that it is consistent and consistent. To compute Effective Income for employees with Overtime or Bonus Income, the Mortgagee must average the income earned over the past two years. However, if the current year’s overtime or bonus income is 20% or less than the prior year’s, the Mortgagee must use the current year’s revenue. Compared to other lending organizations, banks are better at understanding overtime income. When evaluating your loan, each bank will have its own set of criteria and regulations.

How Banks Compute Overtime Revenue in Different Ways But Here Are Some Examples of How they do it:

- Calculate your overtime pay by averaging your current financial year’s earnings.

- Using 80% of your prior year’s non-base or overtime income

- Finding the appropriate lender and having an extra income is critical to getting the best loan possible.

THE CONCLUSION

Using your overtime income to qualify for a larger mortgage can be an excellent method to get a better deal. You should be cautious about doing so. You should think about your situation before taking this path. Examine whether your overtime will be sustainable for the duration of your loan. It may be more helpful to consider your regular revenue solely.

If you’re still unsure how these guidelines apply to your situation when employing overtime as part of your verifiable income, speak with a loan officer.

January 14, 2024 - 8 min read