FHA Loan Limits in Louisiana by County For 2023

If you’re looking to buy a house with an FHA loan, you’ll need to know about the different FHA loan limits in Louisiana. The loan limit is the maximum amount in Louisiana that the FHA will insure for a particular loan. The limits vary by county and are based on the median home price in that county.

If you’re looking to buy a house with an FHA loan, you’ll need to know about the different FHA loan limits in Louisiana. The loan limit is the maximum amount in Louisiana that the FHA will insure for a particular loan. The limits vary by county and are based on the median home price in that county.

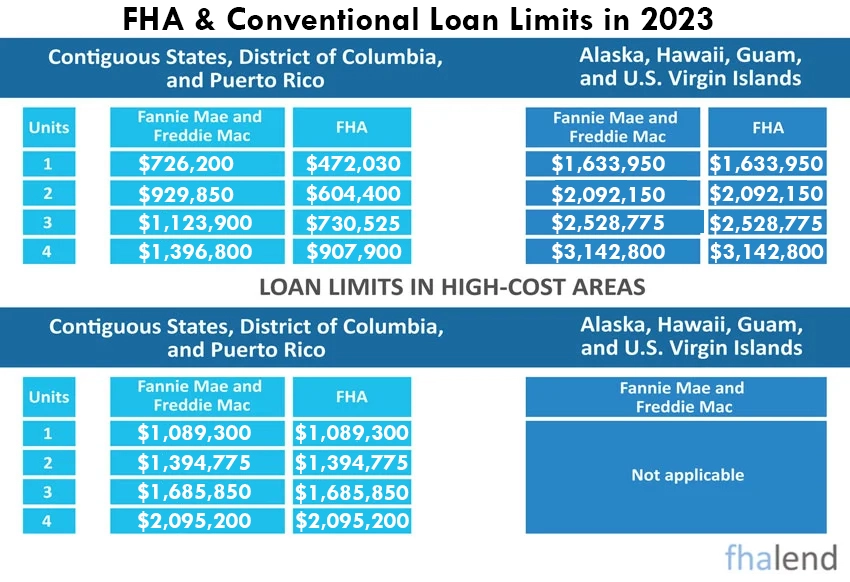

Here’s how FHA loan limits in Louisiana are calculated: The first step is to calculate the “national conforming loan limit.” This is the maximum loan amount that FHA will insure for a single-family home. The limit is calculated by taking 65% of the Freddie Mac conforming loan limit of $726,200. That gives us an FHA loan limit of $472,030 in all counties in Louisiana.

The next step is to calculate the “floor.” The floor is the lowest loan limit that FHA will insure for a particular county in Louisiana. The floor is calculated by taking the national conforming loan limit and subtracting 150% of the median home price for that county.

The final step is to calculate the “ceiling.” The ceiling is the highest loan limit that FHA will insure for a particular county. The ceiling is calculated by taking the national conforming loan limit and adding 150% of the median home price for that county.

MAX FHA FHA Loan Amount in Lousiana in High-Cost Areas

The maximum FHA loan amount in Louisiana is the same for all counties. There are no high-cost areas like in California or other states in th U.S. The FHA loan limits in Louisiana for a particular county will fall somewhere between the floor and the ceiling. If you’re looking for an FHA loan in a particular county, you’ll need to know the loan limits for that county. You can find the loan limits in the below table.

Here’s an example: let’s say that the national conforming loan limit is $647,200 and the median home price in a particular county is $205,000. The floor would be calculated by taking the national conforming loan limit of $726,200 and subtracting 150% of the median home price of $205,000, which gives us a floor of $472,030. The ceiling would be calculated by taking the national conforming loan limit of $726,200 and adding 150% of the median home price of $205,000, which gives us a ceiling of $1,089,300.

FHA Loan Limits in Lousiana by County Break Down

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ACADIA | $472,030 | $604,400 | $730,525 | $907,900 | $222,000 |

| ALLEN | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| ASCENSION | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| ASSUMPTION | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| AVOYELLES | $472,030 | $604,400 | $730,525 | $907,900 | $81,000 |

| BEAUREGARD | $472,030 | $604,400 | $730,525 | $907,900 | $143,000 |

| BIENVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| BOSSIER | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| CADDO | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| CALCASIEU | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| CALDWELL | $472,030 | $604,400 | $730,525 | $907,900 | $96,000 |

| CAMERON | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| CATAHOULA | $472,030 | $604,400 | $730,525 | $907,900 | $109,000 |

| CLAIBORNE | $472,030 | $604,400 | $730,525 | $907,900 | $71,000 |

| CONCORDIA | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| DE SOTO | $472,030 | $604,400 | $730,525 | $907,900 | $215,000 |

| EAST BATON ROUG | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| EAST CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $84,000 |

| EAST FELICIANA | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| EVANGELINE | $472,030 | $604,400 | $730,525 | $907,900 | $45,000 |

| FRANKLIN | $472,030 | $604,400 | $730,525 | $907,900 | $88,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| IBERIA | $472,030 | $604,400 | $730,525 | $907,900 | $222,000 |

| IBERVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| JACKSON | $472,030 | $604,400 | $730,525 | $907,900 | $69,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| JEFFERSON DAVIS | $472,030 | $604,400 | $730,525 | $907,900 | $101,000 |

| LAFAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $222,000 |

| LAFOURCHE | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| LASALLE | $472,030 | $604,400 | $730,525 | $907,900 | $304,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| LIVINGSTON | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $35,000 |

| MOREHOUSE | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| NATCHITOCHES | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| ORLEANS | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| OUACHITA | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| PLAQUEMINES | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| POINTE COUPEE | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| RAPIDES | $472,030 | $604,400 | $730,525 | $907,900 | $145,000 |

| RED RIVER | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| SABINE | $472,030 | $604,400 | $730,525 | $907,900 | $108,000 |

| ST. BERNARD | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| ST. CHARLES | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| ST. HELENA | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| ST. JAMES | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| ST. JOHN THE BA | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| ST. LANDRY | $472,030 | $604,400 | $730,525 | $907,900 | $106,000 |

| ST. MARTIN | $472,030 | $604,400 | $730,525 | $907,900 | $222,000 |

| ST. MARY | $472,030 | $604,400 | $730,525 | $907,900 | $110,000 |

| ST. TAMMANY | $472,030 | $604,400 | $730,525 | $907,900 | $283,000 |

| TANGIPAHOA | $472,030 | $604,400 | $730,525 | $907,900 | $199,000 |

| TENSAS | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| TERREBONNE | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $175,000 |

| VERMILION | $472,030 | $604,400 | $730,525 | $907,900 | $222,000 |

| VERNON | $472,030 | $604,400 | $730,525 | $907,900 | $160,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $75,000 |

| WEBSTER | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| WEST BATON ROUG | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| WEST CARROLL | $472,030 | $604,400 | $730,525 | $907,900 | $104,000 |

| WEST FELICIANA | $472,030 | $604,400 | $730,525 | $907,900 | $257,000 |

| WINN | $472,030 | $604,400 | $730,525 | $907,900 | $93,000 |

How FHA Loan Limits In Louisiana Are Calculated

The Federal Housing Administration (FHA) sets loan limits for mortgages that are insured by the agency. These limits are calculated each year and are based on median home prices in Louisiana and all counties separately. In many cases, the FHA loan limits in Louisiana are higher than the conforming loan limit set by Fannie Mae and Freddie Mac. This means that borrowers who qualify for an FHA loan may be able to get a mortgage with a lower interest rate and a smaller down payment requirement.

There are two types of FHA loan limits in Louisiana: One is for single-family homes and the other is for multi-family homes. The single-family home limit is based on 115% of the median home price in the area, while the multi-family home limit is based on 200% of the median home price.

The FHA loan limit can vary from one county to another in Louisiana. In some states, the limit is the same for both single-family and multi-family homes. In other states, the limit for multi-family homes is higher than the limit for single-family homes.

Maximum Multifamily Loan Limits in LA

When trying to buy an investment property or an SHF in one of the counties in Louisiana you need to make sure that the maximum loan amount is not higher than your loan amount. You can still qualify when you put down more (the minimum is required 3,5%) but when you put 20% you can qualify for over 1 million dollar home price. You cannot use an FHA loan to buy an investment property but you can do the same thing with a 2-unit, triplex, or 4-unit building. Live rent-free in of the units and rent others for an income like an investment property. The bottom line is that you can buy up to $809,150 multifamily property prices in Lousiana state. All continues in Louisiana are the same for FHA so all limits remain the same for 202.

How FHA Loan Limits in Louisiana are Determined

How FHA Loan Limits in Louisiana are Determined

In order to determine the FHA loan limits in Louisiana for a particular area, the FHA uses data from two sources: The first source is from sales of mortgages that have been insured by the FHA. The second source is from a survey of lenders. The FHA uses the median sale price of homes that have been insured by the agency to calculate the loan limit for single-family homes. The agency uses the median price of loans originated by lenders to calculate the loan limit for multi-family homes.

The FHA loan limit is calculated each year and announced in advance. The limit can change from one year to the next, depending on changes in median home prices across the country. Borrowers who are planning to apply for an FHA loan should check with their lender or local FHA office to find out what the FHA loan limits in Louisiana are for their area.

Benefits of FHA loans For Louisiana Borrowers

There are many benefits to getting an FHA loan in Louisiana. Here are the most important ones:

- FHA loans state are attractive to borrowers because they have lower down payment requirements in Louisiana than conventional loans.

- Borrowers can put as little as 3.5% down on an FHA loan in Louisiana, whereas a conventional loan requires a minimum of 5%.

- FHA loans have more flexible credit requirements than conventional loans in Louisiana, making them easier for borrowers with limited credit histories to qualify.

FHA Loan requirements and eligibility for borrowers:

- have a valid Social Security number and live in Louisiana

- have a steady employment history or have been employed for at least two years

- have a good credit history with no bankruptcies or foreclosures in the past three years

- be of legal age to sign a mortgage contract in Louisiana (their state of residence)

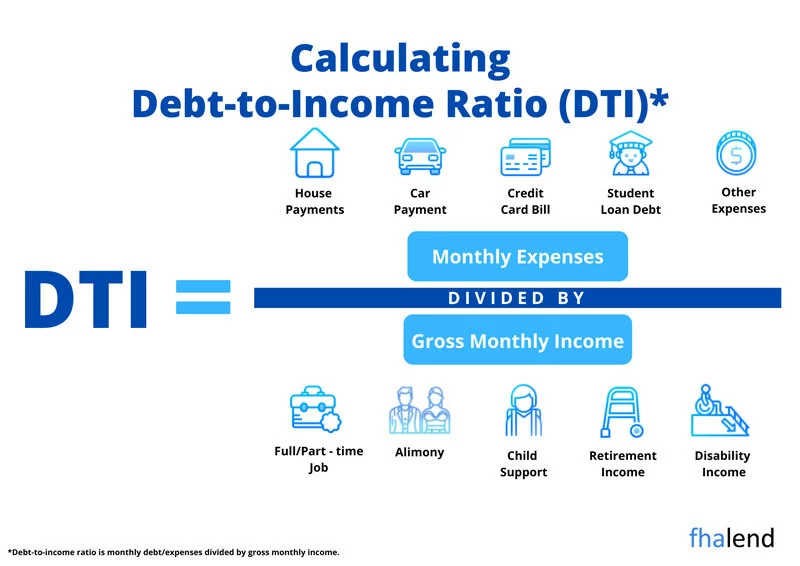

- have a maximum debt-to-income ratio of 43%

Borrowers who do not meet these requirements may still be eligible for an FHA loan if they can show that they have extenuating circumstances or compensating factors. Extenuating circumstances include things like losing a job due to no fault of your own, experiencing a divorce, or being the victim of identity theft.

FHA loans are available to both first-time and repeat home buyers. The FHA also offers the 203(k) loan, which is a renovation loan that allows borrowers to finance the cost of repairs and improvements to their mortgage.

If you’re interested in an FHA loan, be sure to speak with an approved lender to find out if you qualify.

Low down payment

You only need to put down 3.5% of the purchase price. This is much lower than the 20% you would need to put down with a conventional loan.

Easier credit requirements

FHA loans have looser credit requirements than other loans. This makes them accessible to more people.

Lower interest rates

FHA loans usually have lower interest rates than conventional loans. This can save you a lot of money over the life of your loan.

More forgiving if you go into foreclosure

If you do go into foreclosure, the FHA will forgive the loan rather than seizing your home.

There are many other benefits to FHA loans, including easier qualification, smaller down payments, and more lenient terms if you experience financial difficulty. If you’re thinking of buying a home, an FHA loan should be one of your top choices.

Are There FHA Loan Income Limitations in Louisiana?

The good news is that there are no FHA loan income restrictions in Louisiana. That is not to say income isn’t important. Lenders will want proof that you can afford your regular mortgage installments in order to approve you. Fortunately, there are several sorts of income that are valued:

- W2s

- Freelance or bonus work income

- Investment income

- SSN income

- Supplemental Security Income

- Social Security Disability Insurance

- Alimony

- Child Support

Effective alimony, child support, or maintenance income may be granted if payments are expected to be made regularly for the first three years of the mortgage and the borrower provides proof, such as a copy of the final divorce decree, legal separation agreement, court order, or voluntary payment agreement to qualify for FHA mortgage loan program in Lousiana. Some people who are self-employed might also be able to qualify for an FHA loan in Louisiana.

Before your loan can go through underwriting, a loan officer may request pay stubs, tax returns, and other proof of income. Mortgage lenders also take your earnings into account when computing your debt-to-income ratio (DTI), which we’ll discuss in greater detail shortly.

Calculating DTI For FHA Loan in Lousiana

FHA loans have less stringent credit score requirements than conventional loans in Lousiana state. The maximum DTI for FHA loans is 57%, however, it is determined on a case-by-case basis.

What Should I Do If My Debt-To-Income Ratio Is High?

Before you apply for a mortgage, there are certain methods you can use to reduce your Detached Value if it is high.

Pay Off Your Smallest Debts First

The easiest method to reduce your debt-to-income ratio is to stop making payments. If you have the cash, pay off your smallest outstanding bill in full. Your debt-to-income ratio will decrease dramatically.

Increase Your Income

Adding a side hustle, taking on a few more hours at your current job, or freelancing can provide you with a financial boost to reduce your DTI when buying a home in Lousiana. Just remember that you’ll need to show that the money you’re earning is consistent and will continue for the long term. Lenders like to see a two-year history of each income

Add a Co-borrower to The Loan

If you apply for a mortgage with your spouse or partner, the lender who needs to be licensed in Louisiana will combine both of your incomes and obligations to determine your DTI. If your spouse or partner has a low DTI, you may reduce the overall household DTI by including them on the loan as an FHA co-borrower.

If your partner’s debt-to-income ratio is comparable to or greater than yours, however, applying them to the loan may not help.

If your partner’s debt-to-income ratio is comparable to or greater than yours, however, applying them to the loan may not help.

If that’s the case, you can always ask a family member or close friend to co-sign your mortgage loan. When you utilize a co-signer, lenders will consider your DTI when evaluating your application, possibly allowing you to secure a larger mortgage or a lower interest rate.

Down Payment Assistance in Louisiana

The average person might think that buying a home is out of their price range. However, with the help of Louisiana FHA down payment assistance, more people than ever are able to purchase homes.

There are many different types of down payment assistance programs available in Louisiana, so potential homeowners can find the perfect fit for their needs. Some programs require recipients to live in the home they purchase for a certain number of years, while others do not.

Down payment assistance can be a great way to get into your dream home without having to save up for years. If you’re interested in finding out more about down payment assistance in Louisiana, be sure to contact your local housing authority. They’ll be able to help you find the right program for you. Contact us if you want to qualify for FHA or any other loan, we will guide you and help you to buy a house during bankruptcy chapter 7, collection account, or student loans.

Louisiana Down Payment Assistance Program

Louisiana offers one of the most generous down payment assistance programs. The Resilience Soft Second Loan provides the following incentives:

- A 20% “soft loan” of the home purchase price, up to $55,000

- Up to $5,000 in closing cost assistance for a maximum of $60,000

Better yet, the debt is absolved after ten years. As a result, you won’t have to pay anything unless you remain in your house for at least ten years.

The Louisiana Housing Corporation runs this program, and you must meet financial criteria. You may not make more than 80% of the median income in your area.

Only first-time buyers are eligible. Only first-time homebuyers can join in the program. Single parents who owned a house while married qualify as first-time purchasers in Louisiana.

Only homes in the following parishes qualify: Acadia, Allen, Ascension, Avoyelles, Beauregard, Bienville, Bossier, Caddo, Calcasieu, Caldwell, Catahoula, Claiborne, De Soto, East Carroll, East Baton Rouge, East Feliciana, Evangeline, Franklin, Grant, Iberia, Iberville, Jackson, Jefferson Davis, Lafayette, LaSalle, Lincoln, Livingston, Madison, Morehouse, Natchitoches, Ouachita, Pointe Coupee, Rapides, Red River, Richland, Sabine, St. Helena, St. James, St. Landry, St. Martin, St. Tammany, Tangipahoa, Union, Vermilion, Vernon, Washington, Webster, West Baton Rouge, West Carroll, West Feliciana, and Winn Parish.

Visit LHC’s website for further information on the program. Also, check out HUD’s list of alternative homeownership assistance programs in Louisiana.