FHA Gift Funds Requirements & Sample Gift Letters

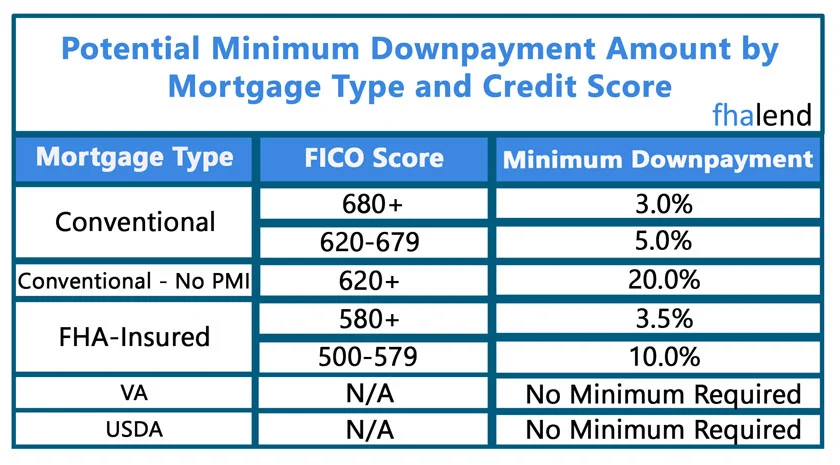

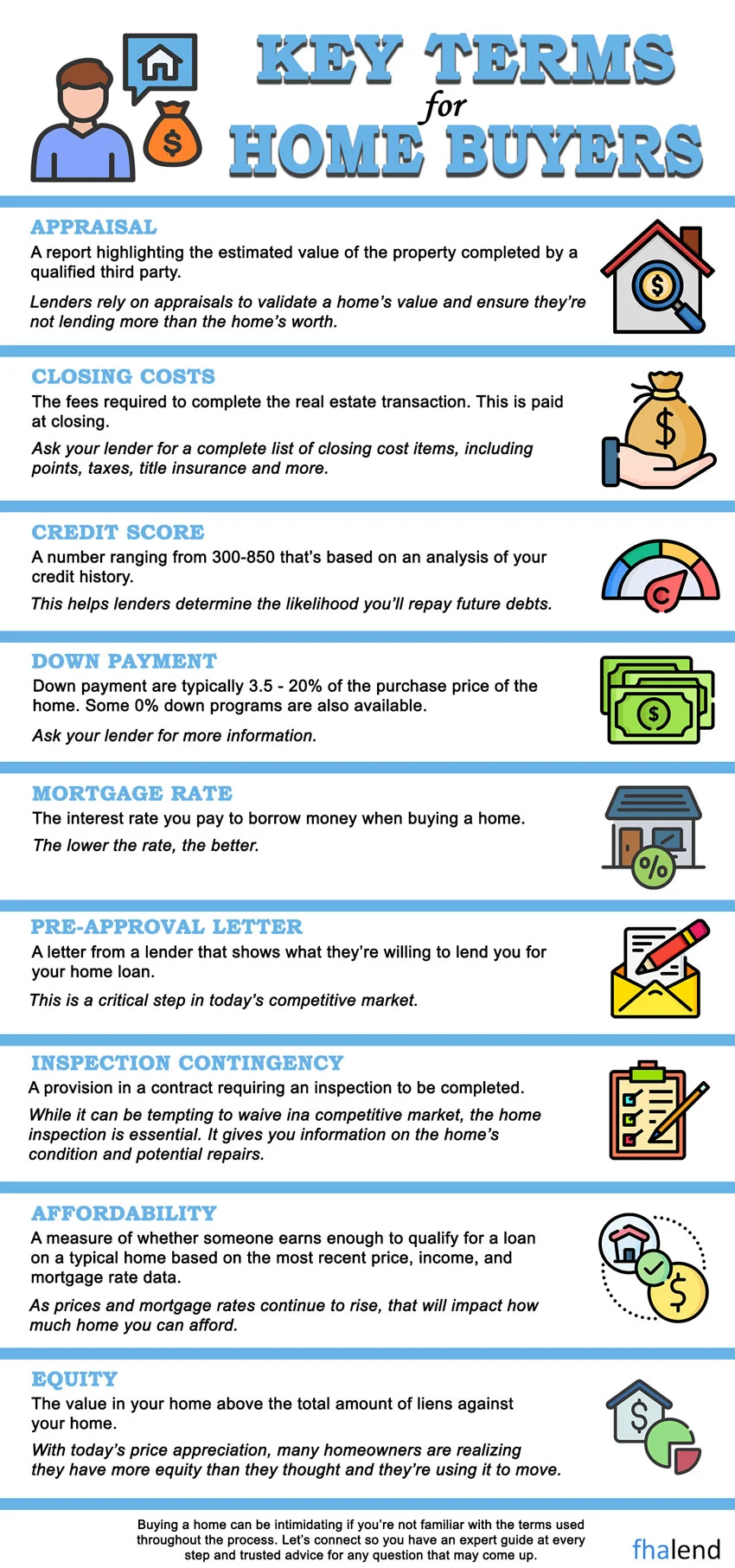

The FHA state that a minimum down payment of 3.5% is required for new and existing borrowers with an interest-free period of up to five years. They also allow funds from an authorized source such as a family member or close friend to be transferred to the borrower. The FHA Gift Fund can be used for both the down payment and closing costs on your home. The minimum amount you can receive as a gift is $500, and there is no maximum amount.

The down payment used in an FHA loan must come from a source where the down payment is not required to be paid back (for example, another loan or credit card advances).

The USDA requires strict documentation on the use of FHA loan proceeds, and this form is no exception. An intent letter should be used for each application (even if it’s a duplicate) to document that funds have been provided in accordance with the guidelines established by HUD in 4155.1 Chapter Five Section B, which states that no repayment of FHA gift money is required or implicit.

In this article (Skip to…)

FHA Gift Letter Template?

The FHA gift letter is a document that outlines the requirements of using an FHA loan. Your FHA lender can offer you a blank FHA gift letter. Simply fill out the short form, and we will connect you with an FHA lender who may give you both the example gift letter as well as a fantastic interest rate quote.

Below are 2 types of gift letters in PDF format you can download and fill up.

FHA Gift Funds Utilization

The funds may be utilized to cover the down payment, FHA closing costs, or even the reserves required for approval. If the gift is big enough, it might cover all of those items.

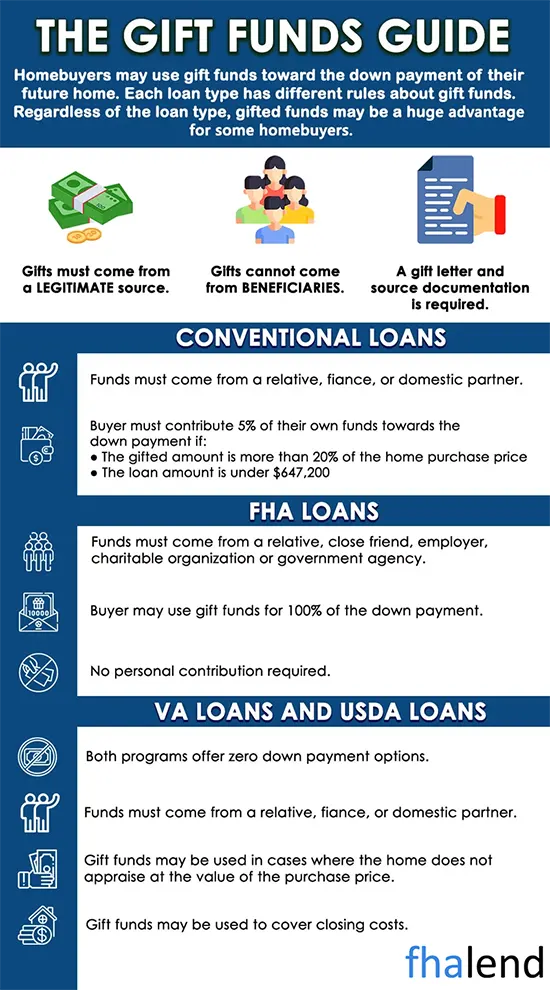

The FHA has limitations on how gift funds can be used & who can give funds and who can’t

From Who I Can Get Gift Funds To Get FHA Loan?

To use the FHA Gift Fund, you will need a letter from the donor stating that the money is a gift and not a loan. The donor cannot be an interested party in the sale of the home (for example, the seller or real estate agent).

HUD 4155.1, Section 5-Chapter 5, Gift Donors Who Are Approved Sources for FHA Gift Funds, says the following people are acceptable sources for FHA gift money:

- A relative

- A close friend

- Employer

- The borrower’s employer or labor union

- A charitable organization without tax-exempt status

- A government agency or public entity that runs a program to assist low- and moderate-income families in buying homes, or first-time buyers.

Unapproved FHA Gift Funds: Unapproved Sources

The FHA gift money may not be from a person or entity with an interest in the property, such as a real estate agent and all other parties below

- The lender

- The builder

- The seller of the property

- The real estate agent or mortgage broker or lender

- Any entity connected to the real estate transaction, such as a title company

If a gift is received from one of the above-mentioned sources, it is considered an “incentive to purchase” and must be deducted from the sales price.

Summary Of The FHA Gift Funds

Gift funds are a wonderful method for people who have little cash to put down on a house but wish to buy one. This is a typical scenario, and virtually all FHA lenders allow gift money according to the FHA rules.

It is critical to verify that the person offering you the gift has agreed to do so before beginning your house hunt. If you’re considering buying a home, examine your finances to see whether you have enough money for the FHA down payment of 3.5%. If not, start talking with your relatives about possible gifts immediately.

- Do not gift cash

- Document the funds

- Confirm that repayment is not required by speaking with your family member about the conditions of the gift.

- Down payment assistance tools are sometimes combined with gift funds.

- Most significantly, talk about alternatives, needs, and solutions with your loan officer.

Can FHA closing costs be gifted?

Gift funds may be used to pay closing costs as long as the donor and the money are FHA-approved. If the gift is large enough to cover the down payment and some or all of the closing costs, it can be spent on them.

How Do FHA Gift Funds Work?

Buying a home is a significant accomplishment for many, but it isn’t easy to do so for most people. Getting the down payment together is a major problem for first-time buyers attempting to get on the ladder.

For many people, saving for a down payment while still paying rent and other living expenses is a lengthy and difficult process. As a result, many individuals rely on the assistance of family to get them over the hump. Having relatives who can contribute to the down payment is really beneficial.

This, coupled with a mortgage backed by the Federal Housing Administration (FHA), makes homeownership much more feasible for individuals on lower incomes.

However, if you want to apply for an FHA loan, you should research the rules of FHA gift money. The FHA has strict criteria for what constitutes a gift fund and what does not.

Using Gift Funds For an FHA Down Payment

The down payment gift fund donor sends you a short note, in which he or she expresses his or her desire to “gift” an amount of money to be used towards the purchase of your property. The letter must make it clear that no repayment is expected.

The lender then sends you the actual gift amount, which must be deposited into your bank account before receiving approval to finish the loan. The lender may be required to ask for proof showing the withdrawal from the donor’s account, followed by a deposit into the borrower’s account.

What Is the FHA’s Definition of a Gift Fund?

A gift is defined by the FHA as a financial or ownership contribution without any expectation of repayment. To put it another way, if a friend or family member gives you cash for your down payment, it isn’t a loan.

You can’t disguise a loan by calling it a present because this may violate the FHA’s gift funds regulation.

FHA Gift Fund Uses

You can only spend FHA gift money on specific payments in the house purchase. They may be spent on the following items:

- As part of the down payment

- FHA closing costs

- Financial reserves needed for approval of the loan

The down payment for an FHA loan is often 3.5% or more of the purchase price (with a 500 credit score is 10%). As a result, if your gift fully covers your down payment, it must be at least 3.5% of the purchase price.

Who Can Receive Gift Money?

A gift fund isn’t something that you can just accept from anybody. The FHA and lenders have rules about who is allowed to offer gifts. Gift funds may be supplied by the following individuals:

- A relative

- Employer or labor union

- Charitable organization

- A close friend with a known and well-documented interest

- A government agency or public entity that offers housing assistance to low- or moderate-income families or first-timers.

If you give this gift, make sure everyone understands why they’re doing it. If no one has a logical reason for giving the gift, lenders or the FHA may think it’s a loan disguised as anything. It’s also vital that the person giving the present is not involved in the buying transaction. It can’t be a lender, seller, realtor, or builder.

What Is an FHA Equity Gift, and How Does It Work with an FHA Loan?

An FHA gift fund may also be provided through an FHA gift of equity. This is when a relative sells you their house but gives you a price reduction. on of the familly member sells the property for a current real estate market price, but they remove the gift of equity component, which is calculated as a down payment credit.

Here’s an example:

- Purchase price: $400,000

- 3.5% down payment Gift of equity: $14000

- Loan amount for FHA: $386,000

When a family member sells you their house but gives you a discount on the purchase or a gift of equity, it’s known as an equity gift. This is not the same as when a close relative gives you money to buy from a third party.

In a gift of equity sale, the family member who is selling the property sells at market value. This is then taken into account during the transaction and recorded as a down payment credit.

If a seller’s discount is used, the buyer may be able to acquire a home with no down payment. This might indicate that purchasers may essentially purchase a house with no money down by taking advantage of the seller’s discount. If the equity can cover the 3.5% min requirements, this can happen.

Who is Eligible to Give a Gift of Equity?

In terms of rules governing equity gifts, they are more demanding than simple gift funds. They must come from close relatives only. So, a family friend, employer, or charity organization can’t provide a gift of equity on an FHA loan.

The Next Steps

To purchase an FHA property with a gift of money or equity, you’ll need to create an official gift letter. The following information must be included in the gift letter:

- Donor’s name, phone number, address

- Donor(s) and Borrower(s) signatures with date

- A Relationship with the borrower

- Evidence that the funds have been received or a letter to the closing agent verifying this

- A statement that repayment is not necessary

- Gift Check Copy

- Bank statement for donor showing (a gift withdrawal transaction)

- Amount of the gift

We offer a formal FHA gift letter, but you may also write your own if that’s what you prefer. All you have to do is make sure the following criteria are met.

Whether you take equity or a cash route, make sure that all money and transactions are recorded and that all criteria are clearly explained to both parties. This is where speaking with us and one of our licensed senior loan officers can be beneficial: they’ll be able to tell you what to do next.

August 9, 2022 - 7 min read