Mortgage Without 2 Years Work History

If you’re like most people, you probably think that you need a long and illustrious work history in order to qualify for a mortgage. After all, lenders want to see that you have a steady income and are capable of making your payments on time. However, you may be surprised to learn that you can actually get a mortgage with only one year of work history. So how much work history is needed to buy a house, the answer is 2 years so 24 months of documented job history is always required by lenders and underwriters.

However below we will explain to you that there are some extenuating circumstances where people can get a mortgage without 2 years of work history and even with less than 1 year of documented job history and not get disqualified from obtaining financing for a house.

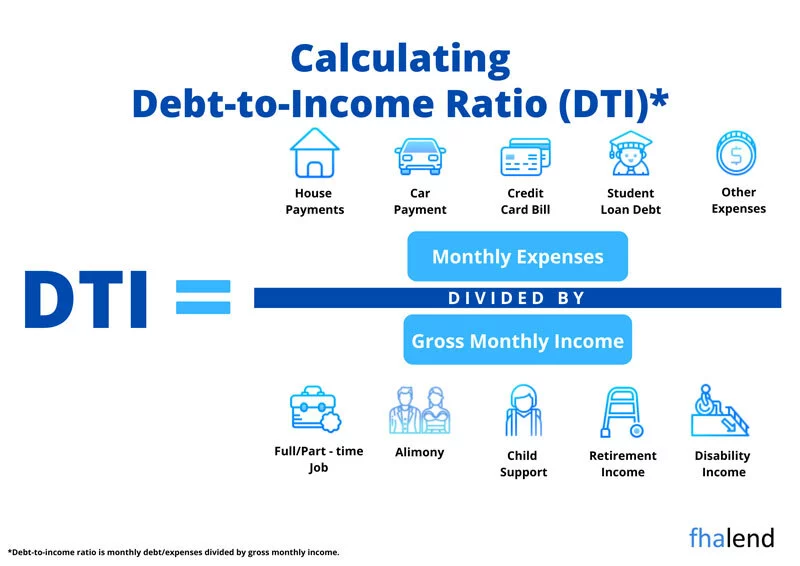

When it comes to getting a mortgage, there are two main things that lenders look at: your credit score and your debt-to-income ratio. Your credit score is a measure of your financial responsibility and helps lenders determine whether or not you’re likely to repay your loan. As for your debt-to-income ratio, this is a calculation that compares your monthly debt obligations to your monthly income. Lenders use this number to determine how much of their income is available to put towards your mortgage payments.

So, what do you need in order to get a mortgage with only one year of work history? First and foremost, you’ll need to have a strong credit score. If you don’t have a solid credit history, you may still be able to qualify for a mortgage by providing other forms of documentation, such as tax returns or bank statements. Additionally, it’s important to have a low debt-to-income ratio; ideally, you should aim for a ratio of 36% or less. Finally, most lenders will require that you have a down payment of at least 10% for a conventional loan and 3,5% for an FHA loan of the home’s purchase price.

In this article (Skip to…)

What Are Exceptions For 2 Years’ Job Requirements?

If you switch your job recently and haven’t been with the same employer in the last 2 years, FHA has an exception where you don’t need to have 2 years of pay stubs to qualify for the FHA loan. Below are FHA exceptions that we will ask you when qualifying you for the FHA loan without 2 job work history. The electronic verification is done by a TPV to verify your income, assets, and employment.

- W2s

- Verification of Employment (VOE)

- Electronic Verification is acceptable (TPV – Third Party Verification)

- 2 Full years of recent military or school evidence supporting documents

Can I Get a Mortgage With 1 Year of Work History?

If you’re self-employed, you may have an easier time getting a mortgage with only one year of work history. This is because lenders typically require two years of tax returns in order to verify your income. The bottom line is that it’s possible to get a mortgage with only one year of work history, but you’ll need to have strong credit and a low debt-to-income ratio.

Additionally, most lenders will require that you have a down payment of at least 10% of the home’s purchase price. If you’re self-employed, you may have an easier time getting a mortgage with only one year of work history. However, if you can provide other documentation, such as bank statements or a letter from your accountant, you may still be able to get a mortgage with only one year of work history.

Mortgage Without 2 Years Work History Requirements to Buy a House

When you’re ready to buy a house, your work history will be one of the first things that lenders look at. They want to see that you have a steady job and income so that you can afford to make your mortgage payments. Here are some tips on how to improve your work history to get approved for a home loan:

1. Get a full-time job

if you’re currently working part-time or freelance, try to get a full-time job with benefits before you apply for a mortgage. This will show lenders that you have a stable income and are more likely to be able to make your monthly payments.

2. Stay at your job for at least two years.

Lenders like to see stability in your employment history, so try to stay at your job for at least two years before you apply for a mortgage. This will show that you’re not a job-hopper and that you’re likely to stick around for the long haul.

3. Get a promotion or raise.

If you’ve been at your job for a while and are looking to buy a house, try to get a promotion or raise before you apply for a mortgage. This will show lenders that you’re doing well at your job and that your income is growing.

4. Keep your credit clean.

Lenders will also look at your credit history when considering you for a home loan. So, it’s important to keep your credit clean by paying your bills on time and not taking on too much debt.

5. Save for a down payment.

Lenders typically require a down payment of at least 20% of the purchase price of the home. So, it’s important to start saving early so that you have enough money for a down payment when you’re ready to buy a house.

Can I Get a Mortgage With Gaps in Employment

You can still qualify for a mortgage (FHA loan or conventional loan) if you had gaps in employment properly documented. they have to be valid reasons which lenders can take into account. Here are few examples:

- Maternity leave (can take up to six months off work, you need to provide a maternity leave request letter )

- Go back to school time off (you will need your transcript from each semester)

- Disability caused by accident (provide Statements or letters on a physician’s/medical professional’s letterhead stationery, the disability income can be counted as income to qualify for a mortgage)

- Layoffs from work (Request a ‘Laid-Off Letter’ from Human Resources)

- Take time off to take care of a family member (write a letter explaining the circumstances and how you will manage the situation while working)

Each reason and application is reviewed case by case scenario individually by underwriters and logical and specific gaps will be taken into consideration when applying for a mortgage. However, there are also people who change their job more frequently (3 or more times in the last 12 months) and large decrease in income These fellows might need to stick only with bank statement loans or loan types like non-QM loans, and asset depletion, or no-doc loan mortgage program.

With 6 months of work gaps, you can get a mortgage but you have to provide as following also:

- provided your last pay stubs covering 30 days of wages

- you need to work at least 6 months after your ‘gap’ to be able to qualify for a conventional or FHA loan

Can I Qualify for More House If My Income Incrased?

Yes, however, it depends if you are on a salary or paid hourly. If you’re getting paid hourly a lender will take the average hourly income from your last 2 years. However, If your salary increased last month, the underwriter will count a new salary and calculate the debt to income ratio based on new numbers. So always remember if have an option to choose to be on a salary or hourly, it’s better to choose a salary because it has more risk for lenders and will get you into a bigger house.

I Changed My Job and Can I Buy a House?

You can apply and qualify for a mortgage and buy a house if the gap in employment wasn’t longer than 6 months and the job was in the same profession (or similar). You will need to provide 2 last paystubs in a new job before getting CTC (clear to close) and completing all required items above.

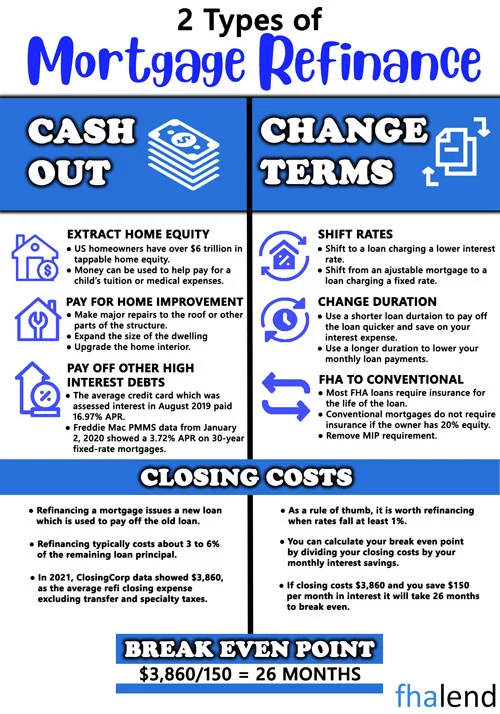

Can I refinance My Home If I Lost My Job?

Most people think that they have to have a job in order to refinance their homes. However, this is not always the case. There are many different programs available that can help you refinance your home even if you have lost your job.

One option is the Home Affordable Refinance Program (HARP). This program is designed for homeowners who are current on their mortgage payments, but who owe more than their home is worth. If you qualify for HARP, you may be able to get a new loan with a lower interest rate and monthly payment.

Another option is the Home Affordable Modification Program (HAMP). This program is designed for homeowners who are struggling to make their mortgage payments. If you qualify for HAMP, you may be able to get your interest rate reduced or your monthly payment lowered. If you are unemployed and facing foreclosure, there are also programs available to help you. The Making Home Affordable program offers a variety of options for homeowners who are struggling to make their mortgage payments. You may be eligible for a loan modification, which will lower your interest rate and monthly payment. You may also be eligible for a short sale or deed in lieu of foreclosure.

If you have lost your job and are struggling to make your mortgage payments, don’t give up hope. There are many different programs available that can help you keep your home. Click the above button to see if you qualify and one of our senior loan officers will contact you ASAP to go through your mortgage scenario.

Find A Co-Signer for the Mortgage When Having 1 Year Job History

If you’re looking to get approved for a mortgage but are having trouble doing so on your own, finding a co-signer may be the answer. A co-signer is someone who agrees to sign the loan with you and is equally responsible for making the payments. This can be a family member, friend, or even a business partner.

The benefit of having a co-signer is that it increases your chances of getting approved for the loan, as well as potentially getting a lower interest rate. However, there are also some risks involved. If you default on the loan, your co-signer will be held liable. This means that they could end up losing their home or having their credit destroyed. Because of this, it’s important to only choose a co-signer that you trust and who is financially stable.

If you’re considering finding a co-signer for your mortgage, there are a few things you should keep in mind. First, make sure that you exhaust all other options first. Applying for a loan with a co-signer should be a last resort. You’ll also want to make sure that you choose someone who is responsible and who you can trust. Finally, be aware of the risks involved before you enter into any agreement.

Make A Larger Down Payment When Having 1 Year Job History

When you’re ready to buy a home, one of the first things you’ll need to do is save for a down payment. Ideally, you should aim for a 20 percent down payment so that you can avoid paying private mortgage insurance (PMI). But if you can’t swing that much, don’t worry – there are still plenty of options available to you.

One way to make a larger down payment is to tap into your savings. If you have money saved up in an emergency fund or in a retirement account, you may be able to use some of it for your down payment. Just be sure to replenish your savings as soon as possible so that you’re not putting yourself at financial risk.

Another way to come up with a larger down payment is to get help from family and friends. If you have someone who’s willing to give you a gift or loan you the money for a down payment, that can be a great way to come up with the funds you need. Just be sure to draw up an agreement so that there’s no confusion about the terms of the loan or gift.

Years in The Line of Work Mortgage Meaning

If you’re like most people, the phrase “years in the line of work mortgage” probably doesn’t mean much to you. But if you’re in a specific field or have a particular job, it can be an important part of your career.

The phrase generally refers to the number of years you have been working in a certain field or occupation. For example, if you’ve been working as a loan officer for five years, you could say that you have five years in the line of work.

This phrase is often used to describe someone’s experience level. If someone has been working in a particular field for a long time, they might be described as having “many years in the line of work.” This usually means that they are considered to be experienced and knowledgeable about their field.

If you’re just starting out in a particular field, you might be described as having a “few years in the line of work mortgage.” This means that you don’t have a lot of experience yet, but you’re still learning.

What Type Of Mortgage I Can Get Without 2 Years of Work History?

VA Loan Without 24 Months Work History

VA loans are available to active-duty service members, qualified National Guard and reservists, veterans, and eligible surviving spouses.

The VA loan offers a lot of advantages. One of the most significant is that no down payment is necessary. Additionally, VA mortgage rates are frequently lower than those available on other alternatives. A VA loan is the only mortgage financing option from FHA Lend that allows you to convert all of your existing home equity into cash down the road if you have a 580 credit score or higher. Some lenders will require you to leave at least 10% in equity or more.

The VA does not impose a minimum credit score requirement, but lenders may do so. Most banks or mortgage brokers have lender overlays in place and a minimum of 620 FICO to qualify for a loan. At FHA Lend we can go down as low as a 500 credit score.

The funding fee is the only significant disadvantage to a VA loan. This charge may be paid at closing or added into the loan. The funding fee can range from 0.5 percent to 3.6 percent, depending on your VA transaction’s variables, the amount of any down payment or existing equity, and whether it’s a first or subsequent use.

The VA funding fee is not applied to those who are exempt

- Those receiving a VA disability pension are eligible.

- Purple Heart recipients who have resumed their service are eligible for the Purple Heart.

- Surviving spouses who receive Dependency Indemnity Compensation (DIC)

FHA Loan With Less Than 2 Years of Employment

With an FHA loan, you may borrow up to 85% of the property value with as little as 3.5 percent down for a 1-4 unit primary home. The fact that FHA loans are forgiving even if you have a few dents on your credit is what makes them so appealing.

With a FICO® score of 500 or higher, you may qualify for an FHA loan through us as long as your debt-to-income ratio (DTI) is 45 percent or less and you put down at least 10%. If you are at a 580 credit score you can put 3,5$ down as qualify. You’ll also need a housing expense ratio – your mortgage payment divided by your gross income – no greater than 45%. If you have a median credit score of 620 or higher, you might be able to qualify for a lower DTI than with other loan alternatives.

Conventional Loan When I Changed My Job After 1 Year

When considering mortgage lending, a standard loan might be appealing because you may make a down payment on a single-unit property for as little as 3% at a low-interest rate. If you put down less than 20 percent, you’ll have to pay for private mortgage insurance (PMI). Once you reach 20% equity, the mortgage insurance can be terminated.

You’ll need a FICO® Score of 620 or higher in order to be considered for the loan. The other major benefit of traditional conventional loans is that they are the only loan available from major investors for purchasing a second home or an investment property.

Applying For a Mortgage With 2 Years Line of Work

The phrase “years in the line of work” can also be used to describe how long someone has been working in a certain job. For example, if you’ve been working as a web developer for 10 years, you could say that you have 10 years in the line of work.

This phrase is often used to describe someone’s level of experience. If someone has been working in a particular job for a long time, they might be described as having “many years in the line of work.” This usually means that they are considered to be experienced and knowledgeable about their job.

If you’re just starting out in a particular job, you might be described as having “few years in the line of work for a mortgage.” This means that you don’t have a lot of experience yet, but you’re still learning.

No matter what your level of experience is, if you’ve been working in a particular field or occupation for a while, you can say that you have “years in the line of work.” This phrase is a way to describe your experience and show that you’re knowledgeable about your field or job.

Review Your Compensating Factors

Another aspect to consider is that if you have other parts of your application that demonstrate strength and balance out a weakness or risk to the lender or a mortgage broker. In this case, the worry or concern would be applying for a mortgage without two years of employment experience. A large down payment, excellent credit ratings, and a large bank balance are examples of compensating factors. When reviewing your application, lenders will take these favorable compensating factors into account and qualify or not for the loan.

Can I Get a Mortgage Without 2 Years Work History Using My Assets?

If you have liquid assets equal to or greater than the purchase price, then we can get you an asset-based mortgage.

An asset-based mortgage is a type of mortgage that uses the borrower’s assets as collateral. The loan amount is based on the value of the assets, and the borrower makes payments using the income generated from the assets. This type of mortgage can be used to finance the purchase of a home, investment property, or other types of real estate.

Check If You Are Eligible

Asset-based mortgages can provide borrowers with a number of advantages. First, they can help borrowers qualify for a loan when they might not otherwise qualify based on their income or credit history. Second, asset-based mortgages can provide borrowers with access to funds that can be used for any purpose, including home improvements or other investments. Finally, asset-based mortgages can provide flexibility in terms of repayment, as the borrower can make payments based on the cash flow generated by the assets.

Despite these advantages, asset-based mortgages also have some drawbacks. First, they can be difficult to obtain due to the lack of lenders who offer this type of mortgage. Second, if the value of the assets declines, the borrower may be required to provide additional collateral or even face foreclosure. Finally, if the borrower does not make timely payments, the lender may sell the assets to repay the loan. Please contact us so we can answer for free all of your questions today.

July 2, 2022 - 12 min read