Mortgage Refinance Calculator

FHA Lend mortgage calculator is for homeowners who want to make a purely economical decision about which loan will be better based on the interest rate and home equity versus closing costs when refinancing their property. There are several advantages to refinance your mortgage, including modifying terms, lowering monthly payments, pulling equity from your home, and reducing your interest rate. We provide a number of alternative home refinancing programs to choose from so that you can get the best fit for your requirements.

What is a Mortgage Refinancing and How It Works?

Refinancing a mortgage is all about the math. It may be a money-saver for people who can get a lower rate, minimize their monthly payments, extend the term of their loan, or drop mortgage insurance premiums.

Before you shop for lenders, crunch the numbers to see if refinancing your present house loan will save you money. The FHA Lend Mortgage Refinance Calculator can provide an estimate of how much money you may save by refinancing your mortgage. There are 2 types of refinancing, a cashout out refinance mortgage and a rate and term refinance mortgage program.

What is The Mortage Refinance and When to Do It?

When you refinance your home loan, you replace it with a new one. Just like any other lending application, you fill out an application and provide documentation about your credit score, income, job history, and finances. A home appraisal is also done to figure out the market value of your property and how much equity you have in it.

When Is The Best Time To Refinance My Mortgage

How To Decide If You Should Refinance Your Loan

Your Mortgage Refinance Application Got Denied?

How Mortgage Refinance Calculator Works

After you’ve figured out how much it will cost to refinance, figure out how many years it will take to recoup your costs – or pay off the refinancing fees – with the new monthly payment. The break-even point is the date on which you can truly profit from your new lower payment rather than covering refinancing expenses. Follow these steps to get your mortgage’s break-even point: To figure out how long it will take you to repay a mortgage, add up all of the interest and principal payments over the life of the loan.

- To find out how much money you’ll save each month, subtract your new, refinanced monthly mortgage payment from your existing monthly payment.

- Determine your tax rate, which is the percentage of income you pay in taxes. Then subtract one from that to get your after-tax rate.

- To find your after-tax savings, multiply your monthly savings rate by your after-tax return.

- Calculate the total fees and closing charges for your new mortgage, divide it by your monthly after-tax savings and figure out how many months it will take you to recoup the financial costs of refinancing your mortgage the break-even point.

Mortgage Refinance Calculation Math

As an example, if you’re refinancing a 400,000, 25-year, fixed-rate mortgage at 6.5% with a new 5% interest rate, refinancing will reduce your original monthly mortgage payment from $2,701 to $1,524 yielding a monthly savings of $1,177. This will result in cash savings of $62,000, a $59,000 difference in principal payment, and total savings of $121,000.

When you refinance, the new loan’s borrowed funds are used to pay off your previous one. Most people refinance in order to secure a lower interest rate and decrease their monthly payments or reduce the term of their mortgage. You may also refinance your mortgage by taking out a cash-out refinance, which allows you to borrow against the equity in your house and get a portion of the gap between what you still owe and its current value. On most loan types, many lenders limit cash-out refinancing to 80% of the property’s entire value. So on a $200,000 you are able to pull out a maximum of $160,000 if your house is fully paid off based on mortgage loan program LTV values. In addition, money that you withdraw from the equity in your house may be applied to reduce higher-interest debt or improve your home.

Is it Free To Refinance My Mortgage?

Refinancing may save you money in the long run, but it comes with upfront costs. Refinancing generally entails the same costs like those incurred when you initially purchased your house, such as:

-

- Mortgage lender costs, including a mortgage application cost, loan origination fees, and points

- Third-party costs, such as the appraisal charge, document recording, and a credit check

- Mortgage title insurance and check for any encumbrances, issues with title, etc

- Costs associated with escrow for property taxes and homeowners insurance.

- Your closing costs will vary based on the new loan sum, your credit score and debt-to-income ratio, loan program, and interest rate.

Shopping around for a lender who not only offers a competitive interest rate but also the lowest costs is time well spent. Because refinancing may cost several thousand dollars, be sure that it will provide you with a noticeable financial advantage and that you will stay in your house long enough to earn back the costs.

What are the Cons of Mortgage Refinance?

When deciding whether to refinance a mortgage, one of the most important things to consider is when you’ll break even on your costs. The break-even point is calculated by adding up all refinancing closing expenses and determining how long it will take you to recoup those costs with the savings from your new mortgage payment versus your old one. Refinancing makes more sense if you intend to stay in your house longer than the break-even point, otherwise, you may lose money. Losing money is one of the cons of mortgage refinancing, another one is to pulling out your equity and getting back to the old terms of the loan which in most cases is 30 years. That means you need to get back to the beginning and start paying your interest and a small chunk of the principal loan.

You should also think about how long you expect to live on your property when refinancing. Even if you obtain a lower interest rate, refinancing if you intend to move in a few years isn’t always beneficial because you may not have enough time to break even on closing costs. According to most experts, you’ll want to be in your house for at least two to five years after refinancing, but you should do your own break-even calculation to see what works best for you.

What Are the Benefits of Refinancing my Mortgage?

For a variety of reasons, homeowners may opt to refinance their mortgage. Regardless of why you’re refinancing your mortgage, the end result should make you financially better off. Here are just a few examples of popular reasons why homeowners might choose to refinance their mortgage:

Lower Your Mortgage Interest Rate

Increase Your Loan Terms

Switching to Fixed-Rate Loan

Take Advantage of Your Higher Credit Score

Pull Out Equity

Remove Co-Borrower

Remove the MIP

Consolidate Your Debt

How To Find a Mortgage Broker Who Can Refinance My Mortgage

If you’ve studied the numbers and determined that refinancing is a smart idea, it’s time to start shopping around for a refinance mortgage broker. Check with your current mortgage servicer and national banks, credit unions, internet mortgage lenders, and perhaps a mortgage broker to see if any offer better rates or conditions than yours. If you don’t have anybody please contact us and we can help you to lower your monthly mortgage payment, pull out cash, get rid of the PMI, or remove a co-borrower from your loan.

Make sure you write everything down in writing, such as the fees and interest rates. Lenders will provide you with a loan estimate that breaks down your new loan conditions and all expenses. Loan estimates are useful tools for comparing lenders to help you figure out which one can help you meet your refinance objectives.

Home Equity And Maximum Cash-Out Amount?

Your home equity is the percentage of your home’s appraised value that you own is known. In other words, it’s the amount you’ve already paid off – as example, when your house is appraised at $400,000 and your loan was paid off in 20% ( $80,000), you have twenty percent of equity. A refinance requires at least 20% equity in your house.

A cash-out refinance takes advantage of the equity in your house during the time and you receive money for taking on a bigger mortgage over years. The amount of money a person wants to receive when a person borrows more than owns on a mortgage is known as your desired cash-out amount.

5 Steps To Do Before Refinancing Your Mortgage

5 Steps To Do Before Refinancing Your Mortgage

The costs of refinancing a mortgage can be expensive, so it’s critical to shop around for the best rates and fees available. Start by examining your existing mortgage broker or lender to see what kind of refinancing terms are available. If you have a current relationship with another bank, things will most likely go more quickly through the application procedure and provide better conditions. If you’re getting a regular mortgage, go with a nationally chartered or community bank. National banks, as well as large and local banks, are typically the greatest alternatives for people depending on their credit history and needs. If you want to refinance quickly, there are alternative lenders like online non-bank firms that specialize in mortgages, but they generally charge a higher interest rate.

FICO score is an important element in determining loan eligibility and, as a result, interest rates. Borrowers with a credit score between 760 and 850 could expect around a 4,5 percent APR on a 30-year $400,000 mortgage; in contrast, a score between 660 and 679 might have earned an interest rate.

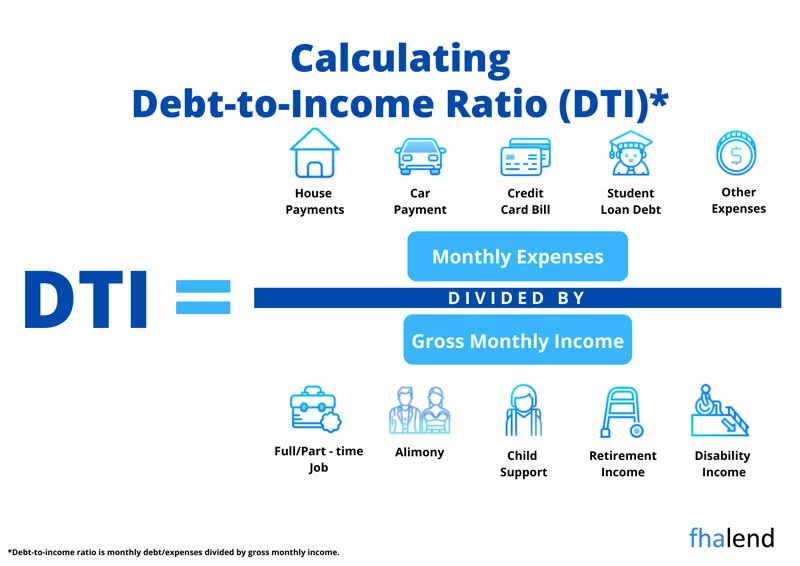

Your DTI Ideally, your new mortgage payment should be less than 30% of your monthly income; total debt should not exceed 40% of your monthly income.

Steady Job/Employment Lenders or mortgage brokers will ask to see your pay stubs before refinancing a mortgage. Before applying for a new loan, gather employment paperwork like recent W-2s and tax returns. If you’re self-employed or just recently changed jobs, collect your employment documents such as recent W-2s and tax returns.

You Can Pay Points Depending on the lender/mortgage broker, you may earn a lower interest rate by paying points a lump-sum payment to the lender at closing—which allows you to save money. Plus, your lender might be prepared to negotiate an interest rate reduction of more than 0.25% per point.

Home Equity of Your House – During the refinancing process, a borrower’s loan-to-value ratio – the present amount owed on their mortgage obligation divided by the current market value of their house—is also a significant consideration. Before refinancing, you should have at least 5% equity in your home, but this number varies depending on the sort of mortgage. Expect to pay mortgage insurance if you have less than 20% equity in your house.