FHA Jumbo Loan Limits and Requirements for 2022

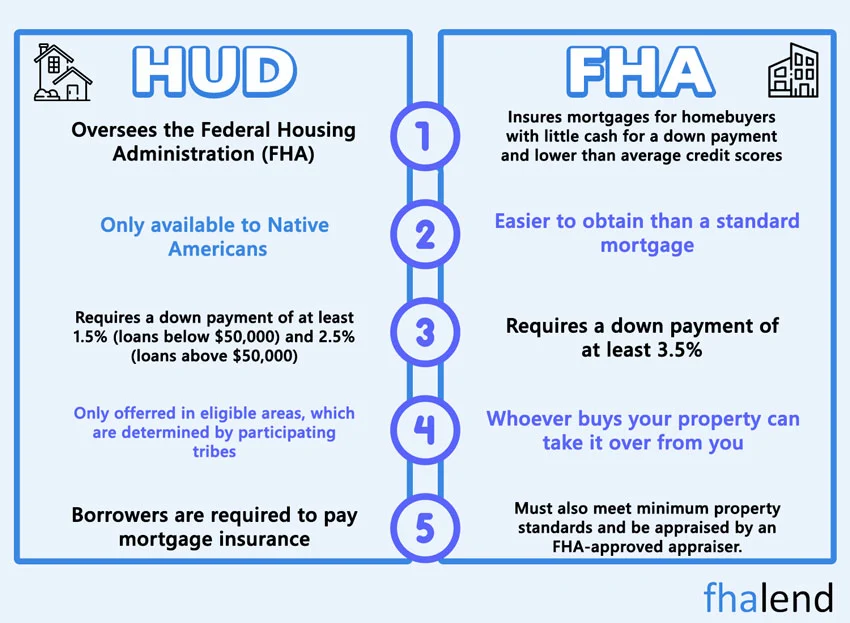

In this blog, we will cover and discuss FHA jumbo loan mortgage guidelines. We will detail what FHA jumbo loans are and the eligibility requirements.FHA loans are the most popular mortgage loan programs for borrowers with low credit scores and bad credit. HUD, The U.S. Department of Housing and Urban Development is the parent of the Federal Housing Administration (FHA). HUD is not a lender and does not fund FHA loans.

In this article (Skip to…)

The Role of HUD Versus FHA Mortgage Lenders

The role of HUD is to insure lenders who originate and fund FHA loans the event borrowers default on their loans. FHA mortgages are home loans for owner-occupant borrowers originated and funded by banks and private lenders. FHA’s role is to insure FHA loans. If borrowers default on FHA loans, HUD will insure banks and private lenders for the loss due to foreclosure. Because of the government guarantee from HUD, lenders can offer low-interest rates with low down payment requirements. In this article, we will discuss and cover FHA jumbo loan mortgage guidelines in high-cost areas.

FHA Loan Limits In Median-Priced Areas Versus High-Cost Areas

Government loan programs such as FHA as well as Conventional loans (FANNIE MAE/FREDDIE MAC) have maximum mortgage loan limits. Every year, the Federal Housing Finance Agency sets the maximum conforming loan limits for home loans which are backed by Fannie Mae and Freddie Mac. Maximum conforming loan limits are currently set at $647,200 for single-family homes. Maximum FHA loan limits for 2022 on single-family homes are capped at $420,680 in median-priced areas.

What Are FHA Jumbo Loans

High-balance FHA loans also called FHA jumbo loans, non-conforming loans or super jumbo loans is a mortgage loan that exceeds the conforming loan limit set by the Federal Housing Finance Agency (FHFA). Jumbo loans are designed for high-income borrowers who want to finance expensive properties, such as luxury homes or investment properties. Conforming loans in high-cost areas are also referred to as High-balance jumbo loans.

High-balance conforming loans and high-balance FHA loans in high-cost areas are set at $970,800 for single-family homes FHA and Conforming loan limits are higher on 2 to 4-unit multi-family homes. Alaska, Puerto Rico, Guam, and Hawaii have higher home prices and are high-cost areas with limits set at $947,800 on FHA and conforming loan limits.

Types Of Jumbo Loans

A conventional jumbo loan is a mortgage that is not backed by the federal government. These loans are not subject to the same strict underwriting guidelines as government-backed loans, so they may be easier to qualify for. However, because they’re not guaranteed by the government, they usually come with higher interest rates and stricter terms.

A government-backed jumbo loan is a mortgage that is backed by the federal government. These loans are subject to the same underwriting guidelines as other government-backed loans, so they may be more difficult to qualify for. However, because they’re guaranteed by the government, they usually come with lower interest rates and more favorable terms.

If you’re considering a jumbo loan, it’s important to understand the different types of loans available and how they work. Jumbo loans can be a great way to finance expensive properties, but they also come with some risks. Make sure you understand all the pros and cons before you apply for a jumbo loan.

FHA High-Balance Loans in High-Cost Areas

In many counties in California, conforming and FHA loan limits are higher than the standard $420,680 loan limit on single-family homes. Conventional loans are often referred to as conforming loans because they need to conform to Fannie Mae and/or Freddie Mac Mortgage Guidelines. FHA Loan Limits in most U.S. counties are capped at $420,680. FHA loan limits are higher in high-cost areas. For example, many counties in California have FHA loan limits capped higher than the FHA loan limit of $420,680 which is called FHA jumbo loans.

What Are Non-Conforming And FHA Jumbo Loans

Mortgage loans that exceed conforming loan limits are often referred to as non-conforming loans and/or jumbo loans. Homebuyers now have options with larger-sized loans which include conventional and FHA jumbo loans. FHA jumbo loans are higher loan-sized residential mortgages backed by the Federal Housing Administration.

Advantages of FHA Jumbo Loans

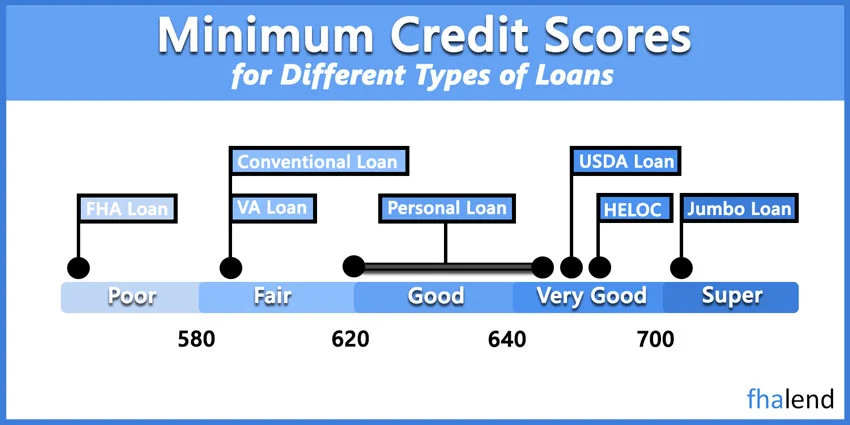

There are many advantages of FHA jumbo loans. Many lenders have lender overlays on FHA jumbo loans. Lenders normally require higher lending standards above and beyond the minimum FHA minimum mortgage requirements of HUD. For example, HUD requires a 580 credit score for a 3.5% down payment home purchase FHA loan. However, lenders may require a 640 credit score versus a 580 FICO on FHA jumbo loans. Homebuyers with credit scores down to 500 FICO can qualify for FHA jumbo loans. HUD requires borrowers with under 580 credit scores to put a 10% down payment versus a 3.5% down payment for borrowers with at least a 580 credit score.

Benefits And Negatives Of FHA Jumbo Loans

One of the biggest benefits of FHA jumbo loans is the smaller down payment required on a higher-priced home purchase. HUD requires a 3.5% down payment on home purchases, whether it is a traditional or FHA jumbo loan. Homebuyers with credit scores down to 500 FICO can qualify for an FHA loan. Homebuyers with credit scores between 500 to 570 FICO require a 10% down payment. To qualify for a 3.5% down payment FHA jumbo loan, you need a 580 credit score.

Homebuyers who do not meet the minimum 580 credit score can try to have the loan officer do a rapid rescore to get their credit to the 580 FICO mark. Since FHA jumbo loans are guaranteed by the government, mortgage interest rates are lower than Conventional loan programs or jumbo mortgages. The downside of FHA Jumbo Loans is that borrowers are required to pay a Mortgage Insurance Premium of 0.85% annually for the term of a 30-year fixed-rate loan.

FHA Mortgage Insurance Premium

There is also a one-time 1.75% upfront FHA mortgage insurance premium that needs to be paid. But that amount can be rolled into the balance of the FHA loan. FHA guidelines on debt-to-income ratios are much less strict than conventional and jumbo mortgage programs. FHA allows up to 46.9% front-end and 56.9% back-end debt to income ratios. Fannie Mae’s maximum debt to income ratio is 50% DTI to get an approve/eligible per AUS. Freddie Mac can go up to 50% DTI to get an AUS Automated Approval. Most jumbo mortgage lenders will cap DTI at 43% or less.

FHA Guidelines On Credit Scores

FHA is much more lenient on minimum credit score requirements than Conventional and/or Jumbo mortgage loans. The minimum credit score required on FHA loans is 580 credit scores for a 3.5% down payment home purchase loan. Borrowers with credit scores between 500 and 579 FICO can qualify for FHA loans. However, for borrowers under 580 FICO, a 10% down payment is required. Conventional loans require a minimum of 620 credit scores. Jumbo mortgage lenders normally require a 700 FICO.

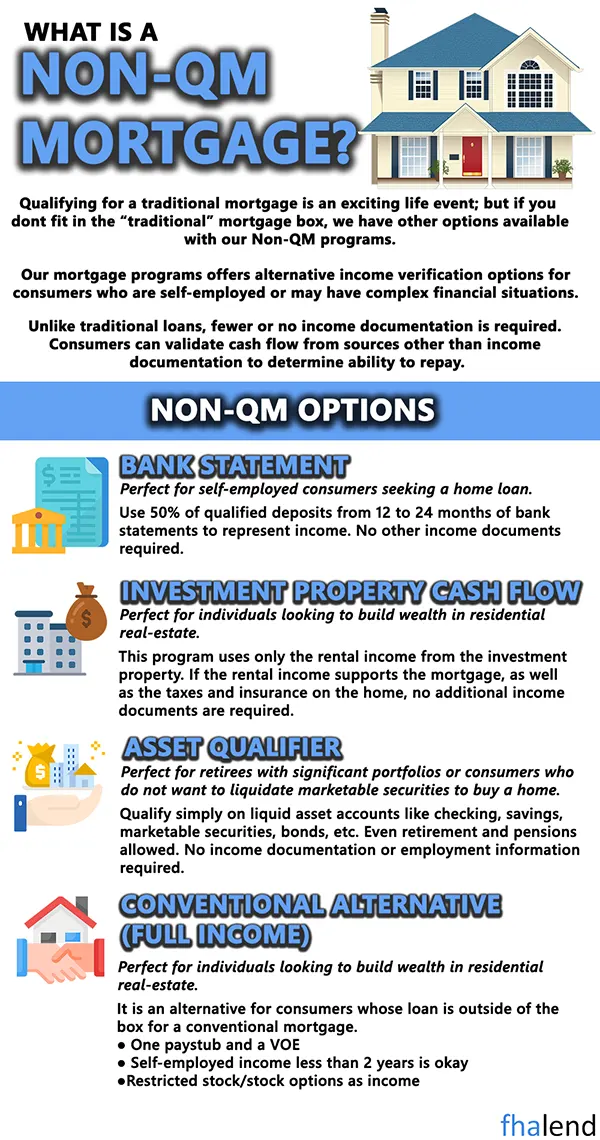

Waiting Period After Bankruptcy And Foreclosure To Qualify For Mortgage

Government, Conventional, and Jumbo loans have waiting period requirements to qualify after bankruptcy and foreclosure. NON-QM loans and Bank Statement Mortgage Loan Programs do not have any waiting period requirements after bankruptcy and foreclosure. HUD and VA require a 2-year waiting period after Chapter 7 Bankruptcy to qualify for VA and FHA loans.

USDA requires a three-year waiting period after Chapter 7 Bankruptcy to qualify for a USDA loan. HUD and VA allow borrowers who are in the Chapter 13 Bankruptcy repayment plan to qualify for VA and FHA loans with chapter 13 bankruptcy trustee approval. However, borrowers need to be in a Chapter 13 Bankruptcy repayment plan for at least 12 months.

Mortgage Guidelines After Chapter 13 Bankruptcy Discharged Date

There is no waiting period to qualify for VA and FHA Mortgages after the Chapter 13 Bankruptcy discharge date. There is a four-year waiting period to qualify for conventional loans after bankruptcy, deed in lieu of foreclosure, and short sales. There is a seven-year waiting period to qualify for conventional loans after the recorded date of a standard foreclosure. There is no waiting period to qualify for NON-QM Loans after bankruptcy and foreclosure.

NON-QM Loans and Bank Statement Mortgage Loans For Self Employed Borrowers require a 20% down payment. Jumbo bank statement mortgage loans for self-employed borrowers require 24 months of bank statements and the deposits of 24 months are averaged and used as monthly income.

March 7, 2022 - 6 min read