What Is a Rapid Rescore and How It Works?

Many of our clients have issues reporting on their credit reports. Our team is made up of mortgage professionals who know and understand the insides and outs of credit reporting. We are a lender that does not have mortgage lender overlays. In this blog, we will detail what a rapid rescore means. We will explain how a rapid rescore may benefit you when qualifying for a mortgage. A rapid rescore is a mortgage term used to describe a faster process to update information on your credit report.

In this article (Skip to…)

Rapid Rescore For Quicker Updates on Credit Reports

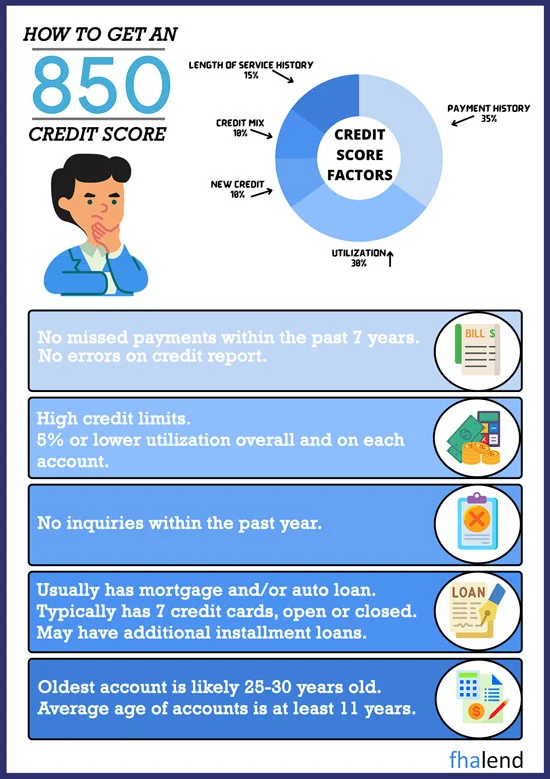

If you track your credit, you probably know that each tradeline on your credit report refreshes only once per month. This means you may be waiting almost two months for an account to update. When paying off an account such as a credit card, you can see a significant increase in your credit score.

Updating Paid Collection and Charged-Off Accounts With Rapid Rescoring

Items such as collections and charge-offs may take more time to show positively on your credit report. If you are shopping for a loan, it is important to have the highest credit score possible. Many loans are time-sensitive so achieving a higher credit score may require a rapid rescoring process. A rapid rescore can also correct errors on your credit report in a period of three to five days. This holds true if you have documentation proving the errors are valid.

What Is A Rapid Recore During The Mortgage Process

What is the process to complete a rapid rescore? A rapid rescore is going to require effort and a little bit of time on your part. However, this is worth expediting the process many times over. Waiting for your credit score to update can feel worse than watching paint dry. Being able to have your tradelines updated in just a few short days is highly beneficial.

Steps Of The Rapid Rescore Process

First, we must identify which tradeline needs to be updated and with which credit bureau(s). This process will be done with each credit bureau individually. Let’s say we are updating your XYZ credit card tradeline. Currently, your XYZ card has a $500 limit, and you have your car virtually maxed out at $478. Our goal is to get this card below 10% utilization or $50. You will need to log into your XYZ credit card account and pay your card down below $50. In this example, you are going to make a $430 payment paying your car down to $48 (slightly under 10% utilization). We will then need a bank statement (or transaction history) from the account in which you made the payment to your XYZ card.

Documentation Required To Validate Rapid Rescore

We will need to see that transaction from your bank statement showing money left your account to pay your XYZ card. At that point, since we have online proof that your XYZ card was paid down to $48 and your bank statement showing you made the payment, our team can then get to work starting the rapid rescoring process. It is important to understand the correct documentation is key. During a rapid rescore, the credit bureaus like to reject information if it is not done correctly. When printing proof that your XYZ card is at $48, your documentation will need to include your name, at least the last four numbers of your account number, and a URL/web address at the bottom.

Rapid Rescoring Process

If any of this documentation is missing, the rapid rescoring process may be rejected. Please call Mike Gracz on 630-659-7644 in order to discuss proper documentation for rapid rescoring. Over the years, Mike has completed many rapid rescore requests assisting many borrowers in updating their credit reports.

Rapid Rescore Are Used For Borrowers In A Hurry To Qualify For A Mortgage

We know this sounds difficult but updating your credit report to reflect current and accurate information requires attention to detail. If you discover an error on your credit report, you may also use a rapid rescore to remove that tradeline. A word to the wise. If you plan on paying off a credit card, we recommend you pay it as close to zero dollars as possible. Showing just a few dollars on the trade line will reflect you utilizing your credit card responsibly.

Rapid Rescoring Used To Update Credit Tradelines In Three to Five Days

After you pay your card down, you are nowhere near the limit and you have made on-time payments. We do not recommend you close a credit card during the mortgage process. Closing a credit card can actually lower your credit score. If you no longer want the credit card, will you recommend you close on your purchase or refinance transaction before officially closing the account? We want our clients to understand that a rapid rescore is not the same thing as credit repair.

Companies Tha Does Rapid Rescore

There are many companies that do a rapid rescore. Usually, a lender or a mortgage broker will request it from a 3rd party company that will do a tri-merge credit pull. Some of the companies are listed below:

Advantage – Advantage Credit, Inc. has been providing superior credit reporting services to mortgage lenders and others in the industry since 1993 with their “Customer First” approach that focuses on delivering only top-notch information for your customers’ needs.

Credit Plus – Credit Plus, Inc. is a company that provides credit reporting services and also sells information about your past loans to mortgage lenders for use when lending out money or deciding whether you’re worthy of being approved in the first place! They operate out there at 31550 Winterplace Pkwy Salisbury Maryland which may appear on my report as an inquiry – this usually happens if I’m applying with regards to getting approval from them.

Avantus – Same as Credit Plus, Inc. which was acquired. Avantus has been at the forefront of this change with its specialized services for mortgage lenders. They do a soft credit pull that can help weed out potential risks before you apply for your dream house or loan so it’s easier than ever to get approval from one lender when applying across multiple banks.

All above pull and combine data from your TransUnion, Experian, and Equifax reports to give lenders a comprehensive overview of your past credit use.

- Soft credit checks

- Employment verification

- Two-factor authentication

- Tenant screening

- Social Security Number verification

What Can A Rapid Rescore Do or Not Do?

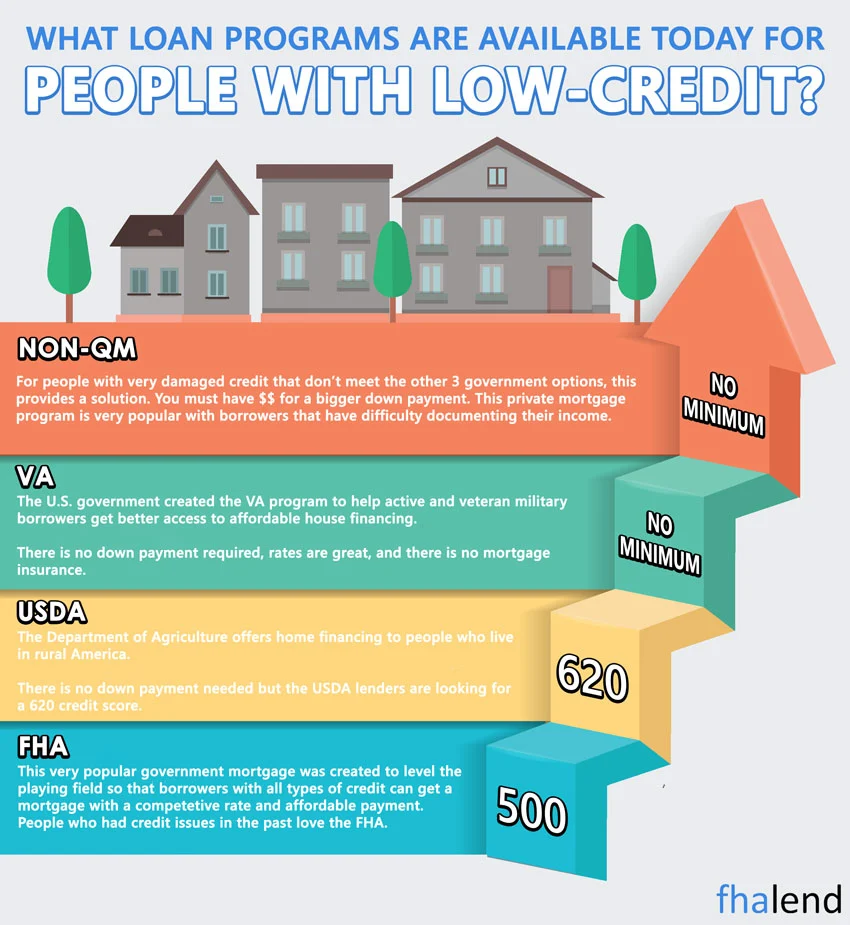

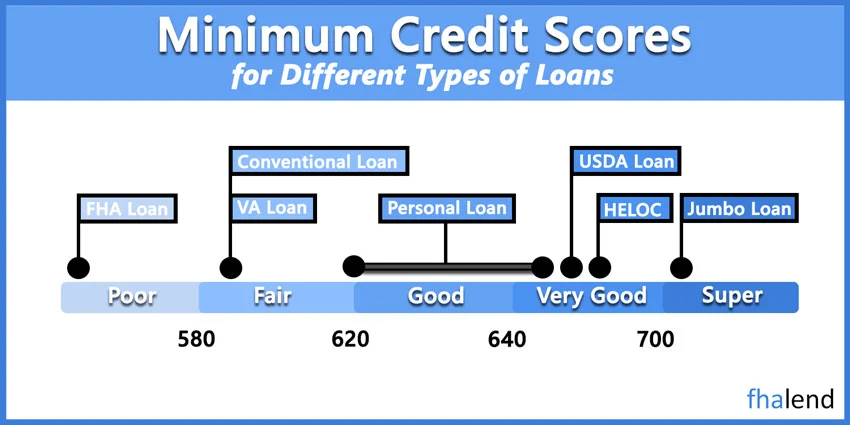

A rapid rescore is not going to remove major delinquencies such as bankruptcy, late payments, charge-offs, or foreclosures. Major derogatory information such as the accounts listed usually report for 10 years with an immediate impact affecting your credit score. You may have heard of the miracles of credit repair agencies, we do not have a referral for credit repair. Homebuyers who need to boost their credit scores to qualify for FHA jumbo loans to get the best pricing on rates often does a rapid rescore. We have heard too many promises from credit repair agencies that are not fulfilled. You are welcome to explore this option on your own, but there are no guarantees in the world of credit repair.

Who Pays For A Rapid Rescore?

To complete a rapid rescore, there is a large fee passed on to the lender for the service. Since this is a service a borrower may not pay for, your lender will only complete this process if they know it will make an immediate impact. Typically, they will run a credit simulator to make sure the trade line will positively impact your credit score enough to help your qualifications. The Fair Credit Reporting Act is very specific on what fees a lender may and may not charge a borrower. This is why most lenders do not participate in the rapid rescoring process.

For Example, if you applied for a mortgage of $300,000. You’re short with funds to close on your home within the next week, but the interest rate is higher than you like. Your score dropped because your credit utilization is high but you made a large payment the previous week. In this case, your loan officer can use a FICO simulator to see how many points your credit score will improve and if the improvement will change your current rate. To speed up and force updating your score from 3 credit bureaus (Transunion, Equifax, Experian) your mortgage loan officer should do a rapid rescore, and based on your score improvement hopefully you will qualify for a lower interest rate before getting CTC and closing on your loan.

How To Expedite Your Credit Profile In Three To Five Days

If you have troubled credit, we encourage you to reach out to our mortgage team. We will give you a free credit review based on the information we see. If you are not comfortable having us run your credit, and you have a copy of your current credit report, our team will also discuss that report with you in detail. We are experts in lower credit score mortgage lending and have seen quite a few unique scenarios over the years. We want you to qualify for the mortgage that is best for you and your family. And your credit score will have a major impact on what you qualify for. For any credit-related mortgage questions please contact us through email at [email protected]. You may also reach Mike directly via phone call or text Mike for a faster response at 888-900=1020. Reach out to the experts today!

March 6, 2022 - 6 min read