What Is An Overlay In Mortgage Lending?

In this blog, we will discuss and cover what lender overlays are on government and conventional loans. There are two different types of HUD mortgage guidelines on FHA loans:

- FHA Mortgage Loan Guidelines by HUD

- Mortgage Lender Overlays by each individual lender

Just because borrowers meet minimum HUD agency mortgage guidelines on FHA loans by HUD does not mean every lender honors it. Each lender can have higher standards than those of FHA which are called Lender Overlays. Lenders can have overlays on credit scores, debt to income ratios, and outstanding collections/charged-off accounts. Just because one FHA Lender says no does not mean that borrowers cannot qualify at other lenders with no overlays.

In this article (Skip to…)

HUD Agency Guidelines Versus Lender Overlays

As long as HUD approves it via Automated Underwriting System and borrowers can meet conditions stipulated on AUS, FHA loan will close with us. Non-traditional credit lines are accepted. 46.9% front-end debt-to-income ratios/ 56.9% debt to income ratios to get AUS Approval on 620 credit scores. Under 620, max DTI is capped at 43% to get AUS FINDINGS Approval. Outstanding collections and charged-off accounts do not have to pay. Most lenders will have overlays on the debt-to-income ratios. We do not. We go the maximum debt to income ratios allowed by HUD.

HUD Ability To Repay: Quality Mortgage

There are many factors that go into determining whether or not you will be able to pay for your home loan. There is one thing lenders look at the closely-the probability of default. To decrease this likelihood even further some banks implement lender overlays which means: additional rules apply with regards to credit score requirements and other documentation needed before they approve a loan submitted by an applicant seeking financing through them!

Understanding The Mortgage Process

We all want to get the best mortgage for our money and live in a home that suits us well. But there are some risks associated with buying property, like FHA loans or conventional mortgages through government-backed agencies (Fannie Mae), private companies who buy cheap mortgages from banks. If you’re worried about these things then maybe it’s time to consider one of these overlays!

What Are Debt To Income Ratio

- The maximum debt to income ratio allowed on FHA loans to get an approve/eligible per AUS is 46.9% front-end and 56.9% back-end.

- The maximum back-end DTI for conventional loans is typically 45% to 50%.

- For borrowers to get an approve/eligible per automated underwriting system (AUS) up to 50% DTI, they need higher credit scores.

- Private mortgage insurance companies will not insure conventional loans with under 680 FICO with higher than 45% DTI.

- Some lenders require a lower DTI than that.

Importance of Credit History of Borrowers

- To qualify for a mortgage, you must demonstrate that your financial situation is stable and sustainable.

- Lenders want the reassurance of responsible management from all parties involved in the process; this includes having sometimes at least 3 credit accounts and a year of experience to qualify for a mortgage

Employment History Guidelines Versus Lender Overlays

- Borrowers with minimal or unsteady employment history might not qualify for a mortgage even if they meet HUD guidelines.

Lender Overlays on Credit Scores

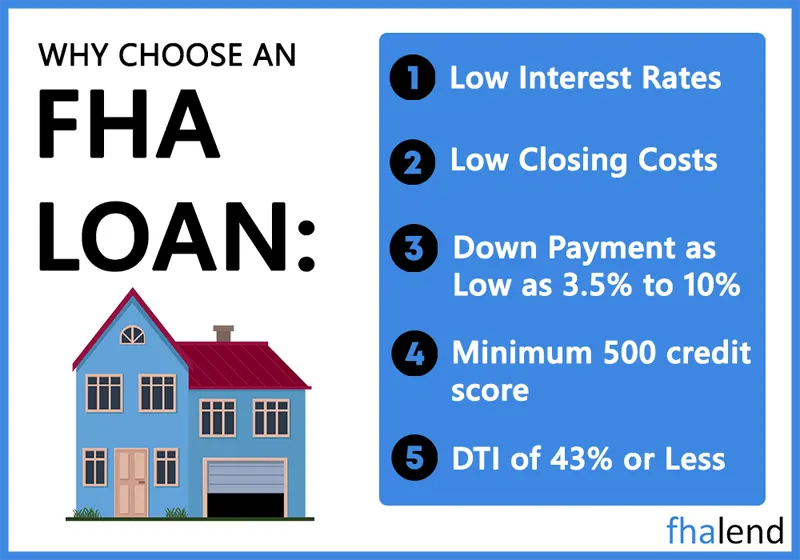

- The good news is that you can get an FHA loan with a 580 credit score and a 3.5% down payment (or as low as 500 FICO and 10% down).

- However, most lenders will only consider applicants who have 620 or higher qualifying scores; unfortunately, there’s not much we’ve been able to find on the minimum required conventional loan standards just yet but I’ll keep looking!

- Conventional loans require credit scores of 620, but some banks set the asking for FICO 640 or higher.

What Types of Property Can I Purchase?

- Some banks restrict the type of property eligible for a mortgage like manufactured homes.

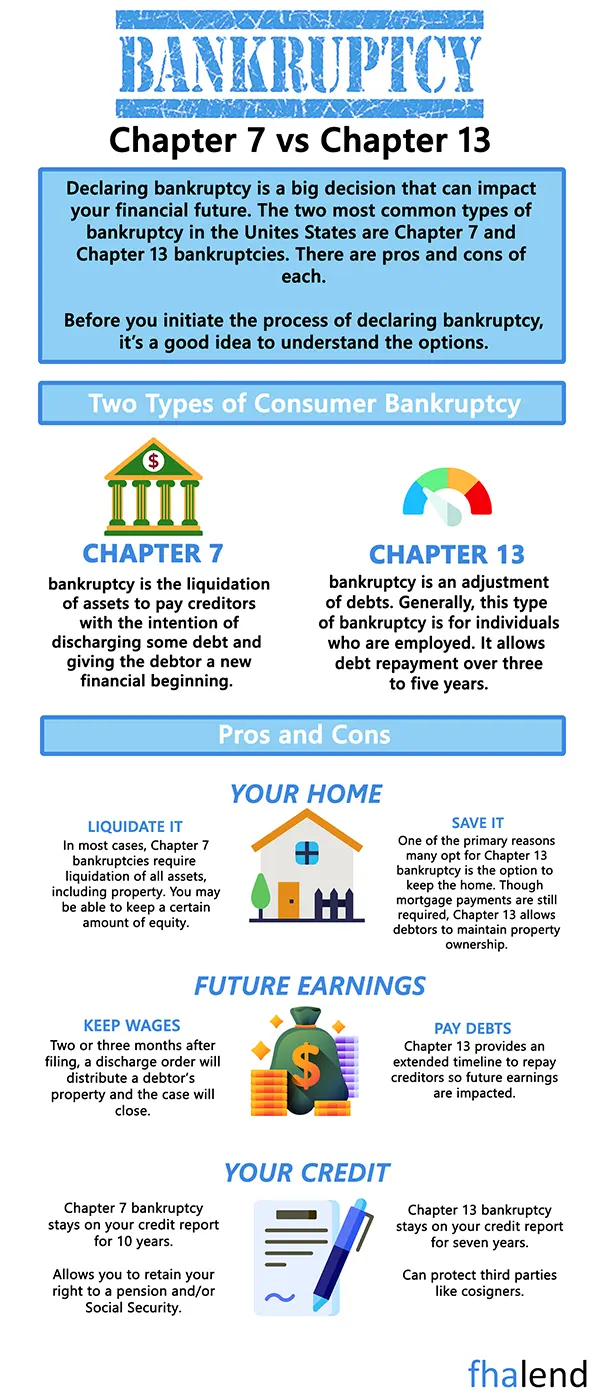

Qualifying For A Mortgage After Bankruptcy

Bankruptcy: Consumers with discharged bankruptcies can still qualify for home loans per federal guidelines. However, most lenders have overlays that require a waiting period of one or two years and the consumer will be subject to an additional surcharge fee on their interest rate.

How Much Down Payment Is Required on Home Purchase

Down payment on home purchase:

- Conventional mortgages require a down payment of 3%, but lenders don’t always follow the rule.

- In fact, some will only approve the loan if you bring 5% or even 10%.

Using Gift Funds

- Gift funds are money given as a gift and can be used towards your down payments.

- Be careful when applying for these types of loans since they may have restrictions on how much is allowed!

Are Reserve Funds Required When Buying a Home?

Reserves:

- When you’re looking to buy a home, it’s important that you have enough money set aside in case anything goes wrong.

- This is why most lenders recommend having at least six months’ worth of payments saved before they’ll approve your loan application!

- They will ask for bank statements to prove that and the money needs to be seasoned for at least 60 days.

FHA Guidelines Versus The Lending Overlays Of Individual Mortgage Lenders

FHA Lend has no mortgage overlays on FHA Loans. As long as borrowers meet FHA Mortgage Loan Guidelines set by HUD and can get an automated approval either by Fannie Mae’s Automated Underwriting System and/or Freddie Mac’s Automated Underwriting System, we close our FHA loans. Closing costs can be paid by the lender through lender credit and/or a seller’s concession towards closing costs. All home buyers need to worry about is the down payment because closing costs can be paid with seller’s concessions or lender credit or a combination of both. FHA has implemented new rules and regulations which may or may not affect home buyers.

2022 FHA Loan Limits For Standard And High-Cost Counties In The United States

First of all, HUD/FHA increases the 2022 FHA Loan Limits to $422,680. The increase was the sixth year in a row with consistent annual loan limits. HUD normally follows the Federal Housing Finance Agency’s (FHFA) conforming loan limit increase. The FHFA increased the 2022 conforming loan limit on single-family homes in standard traditional areas with the national average median prices to $647,200. The 2022 conventional loan limit increase was a substantial increase from the 2021’s $548,250. The increase was FHFA’s highest increase in one year in FHFA’s history. HUD follows in FHFA’s lead on annual loan limit increases.

FHA Loans On Collections Accounts

Collections and charge-offs – FHA guidelines do not require collections and charge-offs to be paid in full to qualify for a home loan, but some lenders have overlays that prevent applicants with unsettled or unpaid collection accounts from qualifying and getting approved. HUD also toughens standards on collection accounts. Now, all collection accounts with balances of $2,000 have new FHA Mortgage Loan Guidelines. Collections do not have to be paid off. However, 5% of the unpaid collection balance will be used towards the calculation of debt to income ratios on non-medical collections with balances of $2,000 or greater. This rule only applies to non-medical collection accounts. Medical collection accounts are exempt from this FHA collection guidelines and the 5% rule does not apply.

Guidelines On Credit Disputes During Mortgage Process

Borrowers cannot have a credit dispute on a derogatory item with outstanding collection balances of $1,000 greater. This only applies to non-medical derogatory items with a total unpaid credit balance of $1,000 or more. Borrowers need to retract the credit dispute in order for the mortgage approval process to proceed. Medical credit disputes do not apply. Medical collection account credit disputes are exempt and do not have to be retracted. Non-medical collection account credit disputes are exempt and do not have to be retracted. Any non-medical collection accounts with an aggregate total of $1,000 or less are exempt from retraction of credit disputes.

FHA Credit Requirements Versus Lender Overlays

500 is the minimum credit score required to obtain an FHA-insured loan. However, home buyers with credit scores between 500 and 579 will need to put a 10% down payment on a home purchase. For those who only want to put a 3.5% down payment on a home purchase minimum of 580 credit score is required.

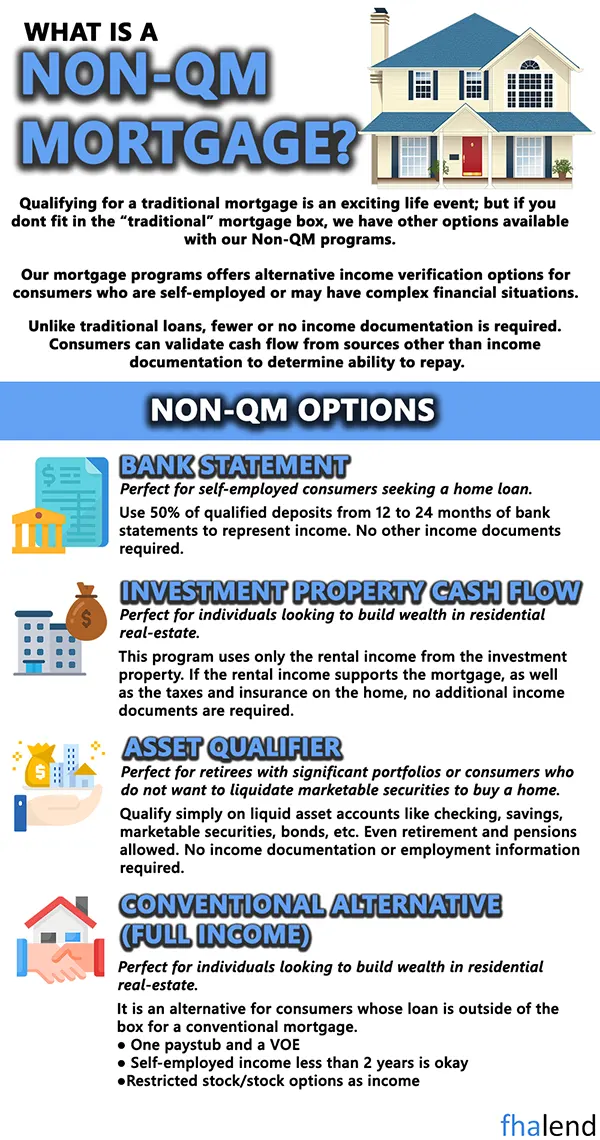

Qualifying For An FHA Loan Without A Credit Score With Lender With No Lender Overlays

Sometimes home buyers have no traditional credit, therefore no credit scores. We can help those with no credit scores and no credit tradelines. Non-traditional credit lines are allowed in lieu of traditional credit tradelines. Non-traditional credit is credit that does not report to three credit bureaus.

Non-Traditional Versus Traditional Credit Tradelines Explained

Examples of non-traditional credit tradelines are the following:

- utilities

- cell phone

- insurance payments

- rental verification

- Other credit where the creditors do not report it to the three credit reporting agencies

A Pre-Approval With Mortgage Company With No Lender Overlays

All pre-approvals are full loan commitments fully underwritten and signed off by our underwriters. No overlays and all guidelines are based on Automated Underwriting System FINDING. Since we have no mortgage lender overlays, all mortgage approvals close because they already have been fully underwritten and signed off by our mortgage underwriters. Again, our approvals are based on Automated Underwriting System FINDING. So once borrowers get AUS approve/eligible and our pre-approval signed off by our underwriters, they can rest assured mortgage loan will close.

Using Seller Concessions For Closing Costs

Sellers can pay for buyers’ closing costs with seller concessions. A maximum of 6% of sellers concession towards buyers closed is allowed for FHA loan. 30 year and 15 year fixed rate mortgage loans are available with no pre-payment penalty. Can flip homes into FHA loans without the 91 day waiting period. If main borrowers do not qualify based on income, a non-occupant co-borrower is allowed to qualify. No income is required from the borrower if they can get a family member to be a non-occupant co-borrower.

Using Gift Funds For The Down Payment and Closing Costs on Home Purchase

Home Buyers with no down payment, gift funds are allowed by:

- family member

- Or a very close friend who you have known for at least five years

One Day Out Of Bankruptcy and/or A Housing Event

FHA Lend now offers non-QM loans one day out of bankruptcy and/or foreclosure. There is no waiting period after bankruptcy and/or foreclosure, deed in lieu of foreclosure, short sale. The down payment required on non-QM is normally 10% to 30% down payment on a home purchase. The down payment depends on the borrower’s credit scores, payment history, type of property, and how long has the economic event has been seasoned.

Bankruptcy and/or a Housing Event With No Waiting Period

For example, if the homebuyer was discharged from bankruptcy within the past 12 months, there is a 30% down payment. As the bankruptcy and/or housing event seasons, the down payment requirements on non-QM loans reduce. Many people recover from bankruptcy and/or a housing event sooner than others. In today’s bullish housing market and low mortgage rates, homebuyers do not have to wait out the waiting period after bankruptcy and/or foreclosure and be priced out of the housing market.

No Waiting Period Requirements on Non-QM Mortgages

Non-QM Loans has no waiting period after the following:

- Bankruptcy

- Foreclosure

- Deed In Lieu Of Foreclosure

- Short Sale

- Late housing payments in the past six months

Non-QM Loans require a 10% to 30% down payment is required. There are certain credit score requirements on certain non-QM and alternative financing loan programs. No-doc mortgages for primary homes require a 20% down payment with a 660 credit score.

VA Lender Without Overlays

The Department of Veterans Affairs does not have minimum credit score requirements. The VA also does not have a maximum debt to income ratio cap. Then why are these lenders require certain credit scores and debt to income ratio requirements? The reason is because of VA Overlays All borrowers need to meet minimum VA mortgage guidelines to qualify for VA Home Loans:

- VA does not require a minimum credit score requirement

- VA, also does not have a maximum debt-to-income ratio cap

- As long as borrowers can get an approve/eligible per automated underwriting system, they meet all VA Agency Guidelines

- However, most lenders have VA Overlays on VA Home Loans

- Let’s take the example where The VA has no minimum credit score requirements

- However, most lenders will require a 620 to 640 credit score on VA Loans

- This credit score requirement is not by the VA but by the individual lender

- Other common VA overlays are a debt to income ratios

- The VA does not mandate a maximum debt to income ratio if the borrower can get an approve/eligible per automated findings

- However, most lenders will cap debt to income ratios on VA loans to 41% to 50%

- As long as borrowers get an approve/eligible per AUS Findings, we will approve, process, underwrite, and close the VA Loans

Typical Overlays Imposed By Lenders On VA Home Loans

Most lenders impose lender overlays on VA Home Loans. If you’re looking for a lender with no overlays please fill up this form and we will find you a lender or a mortgage broker in your state who doesn’t have any mortgage lender overlays.

Here are typical overlays most lenders impose on VA Loans:

- VA does not require a minimum credit score requirements but many lenders have overlays requiring certain credit score minimums

- VA does not have a debt-to-income ratio requirements

- Many lenders will cap DTI on VA Loans at 41% to 50%

- VA does not require borrowers to pay outstanding collections and/or charged-off accounts

- Most lenders will require derogatory credit tradelines and collections/charged-off accounts to be paid

- VA allows manual underwriting: Many lenders will not accept files that need to be manually underwritten

- VA allows homebuyers to qualify for VA Loans during Chapter 13 Bankruptcy repayment plan: Most lenders will not require this unless the Chapter 13 Bankruptcy has been discharged two years

- There is no waiting period after the Chapter 13 Bankruptcy discharged date

Most lenders have overlays requiring 2 years of seasoning after the Chapter 13 bankruptcy discharge date.

HUD Mortgage Guidelines With No Lender Overlays: Non-QM Loans Versus FHA Back To Work

HUD launched the FHA Back to Work Extenuating Circumstances due to an economic event mortgage loan program back in August 2013. This loan program launched by HUD, the parent of FHA, turned out to be a major flop and distaste. This loan program shortened the waiting period for those who have had a prior bankruptcy or foreclosure to a one-year waiting period. The FHA Back to Work Extenuating Circumstances due to the economic event mortgage program was all manual underwrites. Mortgage borrowers needed to have been out of work for at least six months.

Reduction of Income Is Considered Extenuating Circumstances

Had to have a reduction of at least 20% in their household income. The fact that borrowers have been unemployed or underemployed needs to be the cause of the mortgage loan applicant being out of work. The applicant’s credit history needed to have been good and the credit would have suffered during the period of the mortgage applicant’s economic event period. After gaining full employment, the credit needed to have been re-established. There should not be any late payments after the recovery of the bankruptcy, foreclosure, deed in lieu of foreclosure, or short sale.

Likelihood For Future Stable Employment: Qualified Mortgage

Lenders wanted proof and feel comfortable that borrowers will be employed for the next three years. A one-hour HUD-approved counseling course is required and a certificate of completion with the housing course counselor, signed and dated, needs to be provided. This counseling certificate is only good for six months. An FHA Back to Work Mortgage loan applicant cannot apply for a formal FHA Back to Work Mortgage loan until 30 days after the housing counseling course date of completion.

One-Stop Mortgage Shop Licensed in 18 States with No Lender Overlays

When FHA Back To Work Mortgage was launched, the program was hot. Unfortunately, this loan program turned out to be a major disaster. Most of the pre-approved borrowers never closed their loans. Stress was an understatement during the mortgage process. The program ended in 2014 but not until countless of home buyers went through the stress and nightmare of their lifetime. Fortunately, non-QM loans launched in 2017 turned out to be a major success. No waiting period after foreclosure, deed in lieu of foreclosure, and short sale with our new NON-QM Loan Program. Please check your FHA eligibility here or contact FHA Lend Mortgage at [email protected] or call us at 800-900-8569. Text us for a faster response.

February 14, 2022 - 10 min read