FHA Loans For Mixed-Use Property

When it comes to financing a mixed-use property, there are a few options available. One of the most popular choices is an FHA loan. This type of loan can be used to purchase a property that has both residential and commercial uses. Does HUD, the parent of FHA, allow mixed-use properties when applying for a loan? Is it true that FHA will take commercial, mixed-use, or other non-residential use properties? In the below article, we will explain all of that and you will know if you can qualify for the mixed-use use property.

There are a few things you should know about FHA loans for a mixed-use property if you’re thinking about using them to finance your property. The Federal Housing Administration (FHA) guarantees mortgages for a variety of commercial projects that aim to encourage the development of low-income, elderly, and disabled housing. Some loans are available to both for-profit and non-profit organizations, while others are only available to non-profits.

Mixed-use properties are dwellings that are used for a range of purposes, such as commercial, residential, retail, office, or parking lots. In other words, the FHA has approved loans on commercially zoned buildings that have been determined to be “essentially residential.” For example, an FHA commercial loan would be appropriate for a multi-story building with first-floor commercial space and an apartment on the second floor.

In this article (Skip to…)

How To Tell If The Property is Mixed-Use?

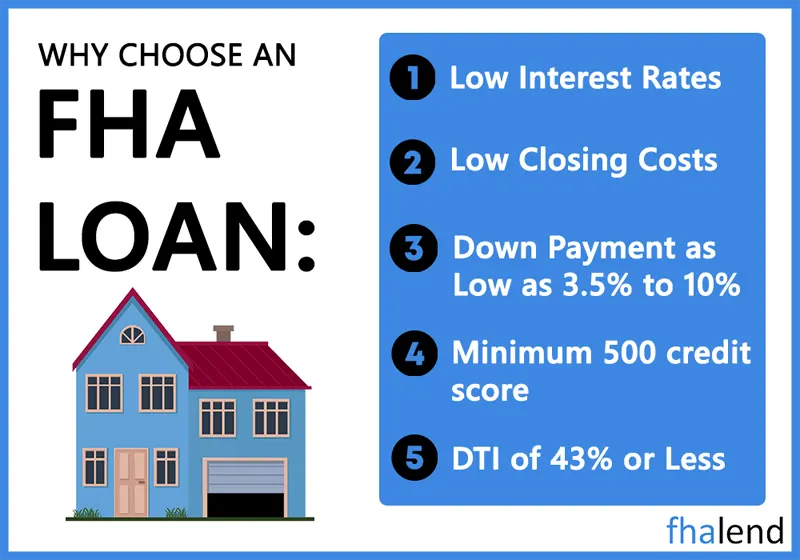

Not many individuals are aware that the Federal Housing Administration (FHA) is the most common insurer for mixed-use houses. We are one of the largest mortgage brokers in the country, servicing FHA mixed-use loans. The percentage of residential use for mixed Use Properties is based on the location, with some restrictions. The FHA requires a minimum of 51% of the building’s square footage to be used for residential purposes.

| FHA Checklist For Mixed-Use Property | |

|---|---|

| 1 | Minimum Score is 580 |

| 2 | Manual Underwriting |

| 3 | Manufactured Homes OK! |

| 4 | W2 Transcript Only program to 500 score |

| 5 | NO Verification of Rent is needed. |

| 6 | NO Minimum Credit Tradelines |

| 7 | MAX DTI is up to 56.99% per HUD. |

What Types Of Mixed-Use Properties FHA Can Finance?

| FHA Insures Real Property Types: | |

|---|---|

| 1 | Detached or semi-detached dwellings |

| 2 | Manufactured Housing |

| 3 | Row Houses |

| 4 | Townhouses |

| 5 | FHA-Approved Condominium Projects Individual Units |

FHA Mixed-Use Property Examination

To assure that the Property provides enough collateral for the Mortgage, the Mortgagor must inspect it.

- The FHA requires that the property complies with all applicable zoning rules. The appraiser must rule on whether the current use is in accordance with the zoning laws.

- If the property does not meet all of the present zoning restrictions but is recognized by the local zoning authority, it must be labeled as “legal non-conforming” and given a brief explanation.

- The Appraiser must determine whether the Property may be rebuilt if it is destroyed.

Benefits of FHA Loans For Mixed-Use Property

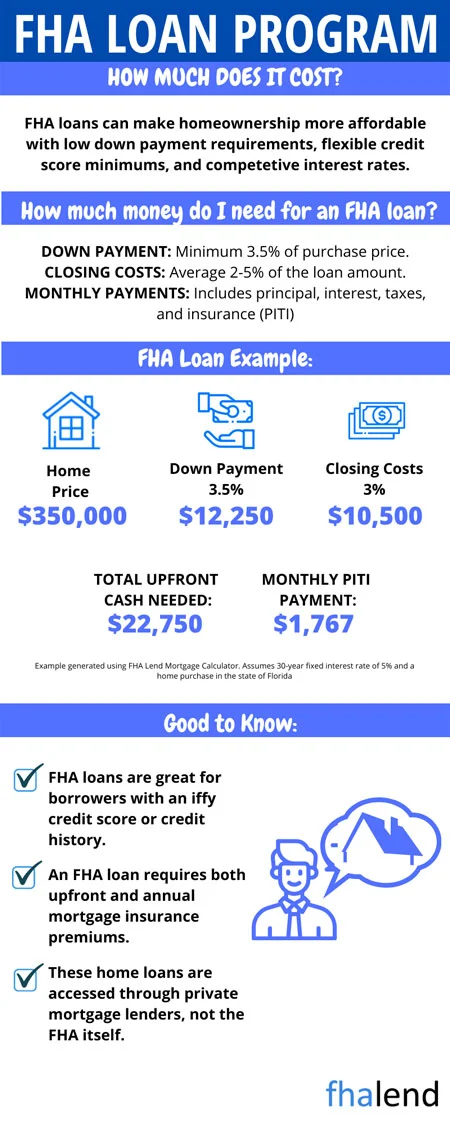

One of the biggest benefits of using an FHA loan to finance a mixed-use property is that the down payment requirement is lower than for other types of loans. You only need to put down 3.5% of the purchase price. This can be a big help if you’re not able to come up with a large down payment.

Renovation Loans For FHA Loans For Mixed-Use Property

Another advantage of an FHA loan is that you can include the cost of renovations in your loan amount. This can be helpful if you need to make some repairs or upgrades to the property before move-in. There are also a few things to keep in mind when using an FHA loan for a mixed-use property.

FHA Loans For Mixed-Use Property is Only For Owner-Occupant Homes

One is that you’ll need to occupy the property as your primary residence. This means that you can’t use it as an investment property or rental unit. You’ll also need to get approval from the FHA before making any changes to the property’s use. If you’re thinking about financing a mixed-use property, an FHA loan can be a good option. Keep in mind the benefits and restrictions of this type of loan before making your decision.

How Can I Get FHA Loans for Mixed-Use Property?

When it comes to buying a home, most people think of just the residential options. However, there are other types of properties that can be purchased with a home loan – including those that are zoned for commercial or mixed-use. So, does FHA accept properties zoned for commercial or mixed-use? The answer is yes.

HUD FHA Loans For Mixed-Use Property for Owner-Occupant Residential 51%/Commercial 49% Ratio

HUD will allow you to purchase a property that’s zoned for commercial or mixed-use as long as you meet their requirements. One of the biggest things you’ll need to consider is how the zoning will affect your ability to use the property as your home. For example, if the property is zoned for commercial use, you may not be able to live in it full-time.

Here are a few things to keep in mind if you’re considering purchasing a property that’s zoned for commercial or mixed-use:

- You’ll need to meet the minimum requirements for the loan.

- The zoning of the property will affect how you can use it.

- You may need to get approval from the city or county before you can purchase the property.

- The loan process may take longer if you’re buying a property that’s zoned for commercial or mixed-use.

Can FHA 203k Work for a Mixed-Use Property?

The FHA 203k loan is a great way to finance a mixed-use property. With this type of loan, you can borrow the money you need to purchase the property and make any necessary repairs or renovations. This makes it a great option for those who are looking to buy a fixer-upper or for those who want to finance a property that needs some work. Here are some things you should know about FHA 203k loans and how they can work for a mixed-use property.

What are FHA 203k loans and FHA Loans For Mixed-Use Properties?

An FHA 203k loan is a government-backed mortgage that can be used to purchase a property and make repairs or renovations. This type of loan is ideal for those who are looking to buy a fixer-upper or for those who want to finance a property that needs some work.

How does an FHA 203k loan work?

With an FHA 203k loan, you can borrow the money you need to purchase a property and make any necessary repairs or renovations. This makes it a great option for those who are looking to buy a fixer-upper or for those who want to finance a property that needs some work.

What are the benefits of FHA Loans For Mixed-Use Property: FHA 203k Loans

There are many benefits to using an FHA 203k loan to finance a mixed-use property. Some of these benefits include:

- You can borrow the money you need to purchase a property and make repairs or renovations.

- FHA 203k loans are ideal for those who are looking to buy a fixer-upper or for those who want to finance a property that needs some work.

- The interest rates on FHA 203k loans are typically higher than the interest rates on other types of mortgages.

Qualify and Get Pre-Approved For FHA Loans For Mixed-Used Property

If you’re thinking about purchasing a property that’s not strictly residential, make sure you do your research and understand all of the requirements before you apply for a loan. FHA loans for mixed-use property can be a great option for those looking to buy a non-traditional property, but it’s important to understand all of the details before you get started.

April 1, 2022 - 5 min read