Gift Funds Mortgage Guidelines On Home Purchases

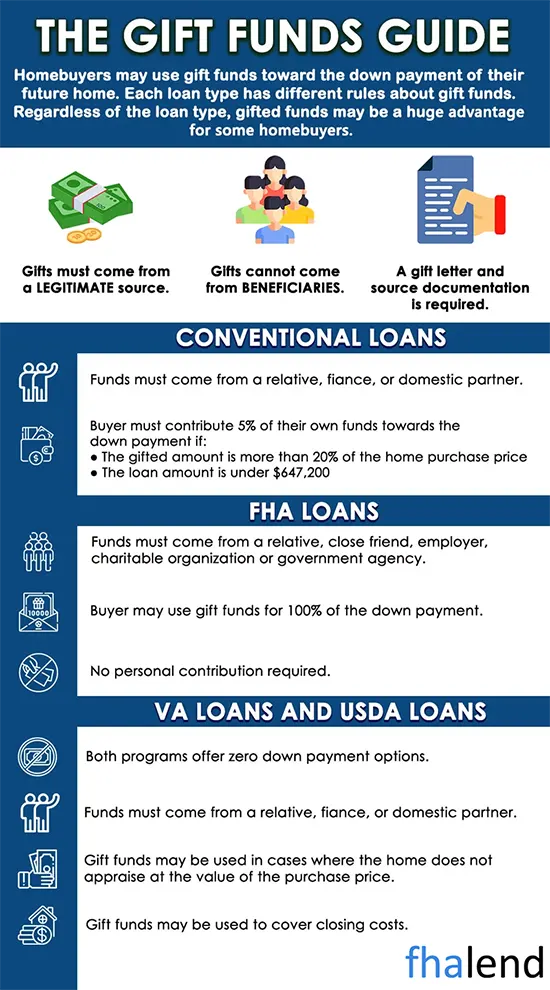

Gift Funds Mortgage Guidelines are similar for all loan programs. Per Gift Funds Mortgage Guidelines, homebuyers can get a gift from a family member for the down payment and/or closing costs on a home purchase. However, the gift can only be a gift and not a loan. The donor needs to sign a gift letter stating the gift is not a loan and will not be repaid back. This gift letter is provided by the lender/ Both the donor of the gift funds and the recipient needs to sign the gift letter

Gift Funds Mortgage Guidelines: Costs Associated With Home Purchase

Most homebuyers can easily afford the proposed monthly housing payment on a home purchase. However, coming up with a down payment often becomes an issue. There are two costs required on home purchase:

- Down Payment

- Closing Costs

Sellers Concessions And Lender Credit To Cover Closing Costs

Most homebuyers do not have to worry about closing costs. The best way of covering closing costs on a home purchase is by seller concessions and/or lender credit. The down payment is required on all home purchase transactions with the exception of VA and USDA loans. Using Gift Funds is one way where many home buyers come up with a down payment on home purchase transactions. Per Using Gift Funds Mortgage Guidelines, all gift funds need to be verified and sourced. It is not a matter of handing a check and/or cash by a donor to a recipient.

Verified Assets Required By Mortgage Underwriters

All lenders will ask for 60 days of bank statements by mortgage borrowers. The main reason mortgage underwriters want to see 2 months’ bank statements is because they need to see assets for the down payment and/or closing costs. A recent deposit that has not been sourced is not a verified asset and cannot be used for the down payment asset calculations by underwriters.

All down payment and/or closing costs funds need to be sourced and verified by mortgage underwriters. Any irregular deposits and/or cash deposits that are older than 60 days do not have to be sourced and/or verified. Borrowers who have irregular non-verified deposits in their bank account that are seasoned less than 60 days need to get gifted funds for their down payment and/or closing costs.

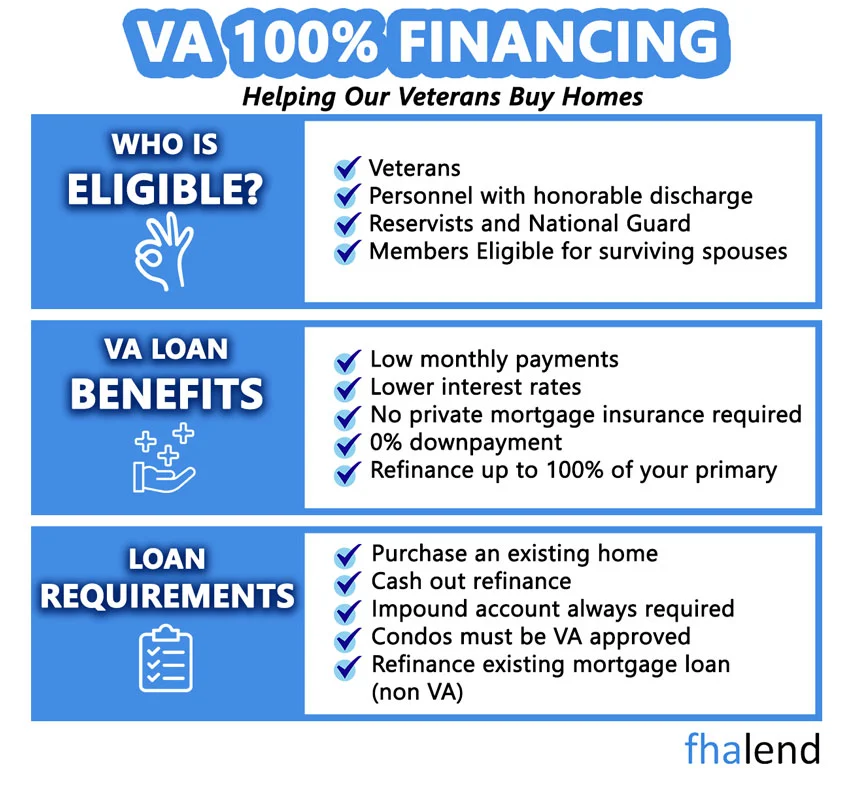

Gift Funds Mortgage Guidelines On Government And Conventional Loans

Every loan program has its own Using Gift Funds Mortgage Guidelines:

HUD Guidelines On Gift Funds For FHA loans:

- FHA Loans allows gift funds for down payments gifted by family members

- The employer and/or labor union of the home buyer can gift the borrower the down payment

- A private and/or government-sponsored non-for-profit organization and/or charitable non-profit local, county, state, a federal agency can gift down payments to home buyers

- Down Payment Assistance Mortgage Program by a city, county, state, and/or federal agency

- Grants to first-time home buyers

The Department Of Veterans Affairs Gift Guidelines On VA Home Loans

The Department of Veterans Affairs, VA, does not require any down payment on home purchase transactions. VA allows 100% financing for eligible borrowers with a Certificate of Eligibility (COE). However, VA, as well as other loan programs, have closing costs. Closing costs can be covered with seller concessions and/or lender credit.

Gift Funds Mortgage Guidelines On Home Purchases On VA Loans

In the event a borrower needs additional funds for closing costs, the following are VA Guidelines on Gift Funds.

Gift funds may be used by the borrower from an individual with whom they have an established relationship, but unacceptable by any person with a financial interest in the transaction such as the seller, realtor, builder, or Loan Originator.

Gift Funds Mortgage Guidelines On USDA Loans

There is no down payment requirement on USDA loans. However, there are closing costs on USDA loans. Most homebuyers do not have to worry about closing costs on USDA loans. Closing costs are normally covered with seller concessions and/or lender credit. However, if a home buyer is short on closing costs, USDA does allow gift funds.

Gift Funds Mortgage Guidelines On Home Purchases on USDA Loans

Here are the USDA Gift Mortgage Guidelines:

For USDA loans, gifts funds can be provided by a mortgage applicant’s relative, employer or labor union, charitable organization, or government agency or public entity with a program similar to FHA Loans.

Gift Funds Mortgage Guidelines On Conventional Loans

Fannie Mae and Freddie Mac allow gift funds for homebuyers to use for the down payment on conventional loans. Gift funds can be accepted by the following:

- Spouse of the borrower

- Domestic partner

- The fiancee of the borrower

- Children and/or stepchildren of the borrower

- Any individual who is related to the main borrower by law, marriage, blood

- Or any donor who is a close friend of the borrower

How Do Gift Funds Get Processed

The proper process and steps need to be taken when using gift funds for a home buyer’s down payment. The lender will prepare a gift letter for the borrower and the donor to complete, attest to, sign, and date. The gift letter will contain the following information:

- Donor’s Name and Recipient’s name and relationship to the borrower

- Date

- Location of the subject property

- Verbiage that the gift is solely a gift for the down payment and not a loan

- The gift will not be paid back

- Information of donor’s account: type of account, account number, name of depository, the signature of the donor(s), printed name of the donor, address of the donor, and telephone number.

- Certification that the gift funds are a gift and not a loan and the gift will not be paid back

- Needs to be dated and signed

- Need 30 days of bank statement by the donor

- Need to provide documentation showing the gift funds have been withdrawn by the donor’s bank account and transferred to the borrowers’ bank account

- Provide canceled check if applicable

Gift Funds Mortgage Guidelines From Family Members

As we approach the holiday season of 2022, some of you may be getting the GIFT of down payment/closing cost funds from a family member. As home prices continue to rise, so do down payment requirements. Closing costs are not getting any cheaper in the foreseeable future, increasing the use of gift funds in the mortgage industry.

In this blog, we will detail gift fund requirements for each agency, who can be a donor and important requirements for gift funds. The Federal Housing Administration defines give funds as contributions of cash or Equity with no expectation of repayment. In order to use gift funds, it must be an actual gift and not a loan. We will go into more specific to low. In the following paragraphs, we will cover and discuss Gift Funds By Family Members Mortgage Guidelines.

HUD Gift Funds By Family Members Mortgage Guidelines

HUD Gift Funds By Family Members:

Gift Funds Mortgage Guidelines on FHA loans:

- Gift funds are an acceptable source of down payment and or funds for closing costs with an FHA mortgage

- Gift funds may only be provided by a borrower’s family member, employer or labor union, a close friend with clearly defined and documented interest in the borrower, a charitable organization, or a government agency

- The gray area of a close friend comes into play quite often

- We have seen situations where a family friend can be used, and we have seen situations where they are not considered an acceptable donor source

- You must have a highly documented relationship to use a close friend as a gift donor

It is the underwriter’s discretion if they aren’t acceptable donors or not.

Fannie Mae Gift Funds Mortgage Guidelines

- Per Fannie Mae guidelines, a borrower may utilize gift funds for a primary residence or a second home

- Gift funds may fund all or part of a down payment and closing costs

- Fannie Mae has very specific guideline requirements for gift funds

- If the Loan to Value is 80% or less any amount of funds is acceptable

- If the Loan to Value is Greater than 80% for a one-unit home, you may also use 100% gift funds

- If it is a two to four-unit principal residence or second home, the borrower was making a minimum contribution of 5%

- Meaning any required assets above 5% can be in the form of a gift

- Fannie Mae defines a gift donor as a relative, defined as the borrower’s spouse, child, or other dependent or by an individual who is related to the bar or by blood, marriage, or adoption or legal guardianship

A donor may also be a fiancée or domestic partner.

Freddie Mac Gift Funds Mortgage Guidelines

- Freddie Mac also allows the use of gift funds

- Their guidelines are very similar to Fannie Mae

- Gift funds are not allowed for investment properties

- They are allowed for primary residences and second homes

- For a second home with a loan to value above 80%, the borrower must once again provide at least 5% of their own funds

- After 5%, get funds are allowed

Freddie Mac will also require a signed gift letter showing no repayment needed. Below is a snip-it from Freddie Mac’s website.

Non-QM Gift Funds Mortgage Guidelines

NON-QM:

- NON-QM mortgages have more leeway compared to your standard mortgage product

- NON-QM programs do allow the use of gift funds on most NON-QM programs

- Depending on your qualifications, a minimum investment requirement may be required

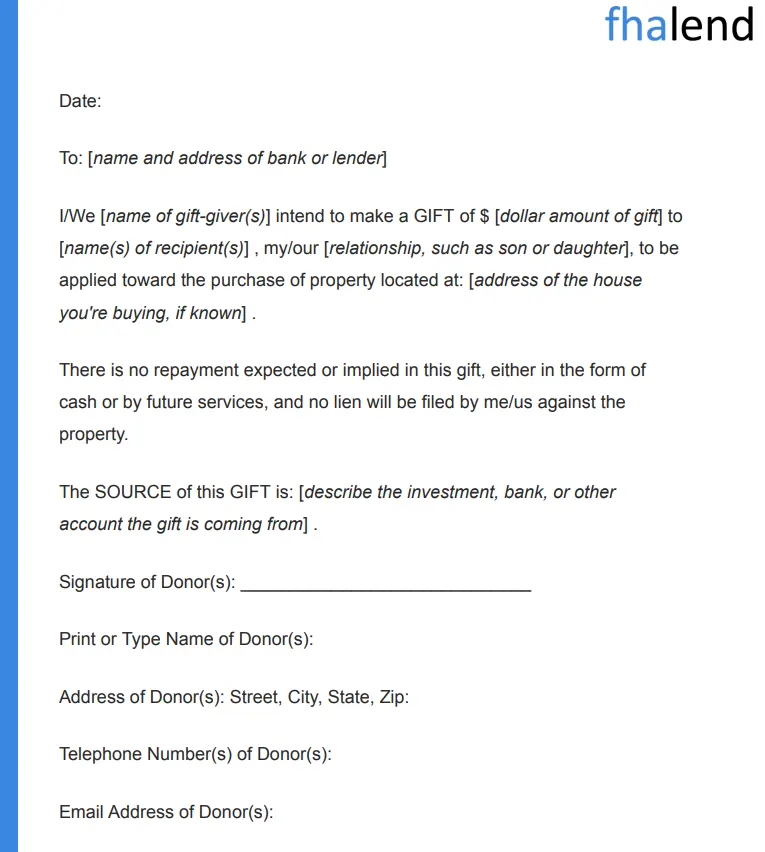

What Is A Gift Letter?

GIFT LETTER – A gift letter is a required piece of documentation when you are utilizing gift funds. The gift letter is provided by the lender. This letter must be signed by all parties. The donor MUST provide:

- Banking information

- Account number

- Amount of the gift

- Explain their relationship to the borrower

- Personal information

- Address

- Phone number

Without this executed gift letter, gift funds may not be used. Below is a sample gift letter. Add gift letter here:

How To Deposit Gift Funds

How to deposit gift funds:

When utilizing gift funds, it is imperative to keep a paper trail. This paper trail can be confusing to all parties, but it is a requirement due to the PATRIOT ACT of 2001. You will need to document where the gift funds came from. They must be ACCEPTABLE SEASONED FUNDS. You will need to obtain a 30-day bank statement from the donor verifying they have the funds to gift you.

You will need a copy of the canceled check made out to you or paperwork showing the wire transfer. If the donor is getting the gift funds from selling stocks or cashing out other investments, you will need a paper trail of that as well. This can be incredibly frustrating for the donor. Many donors do not want to release their financial information, but they can send it directly to us for privacy purposes.

Gift Funds By Family Members Mortgage Process

Once the gift funds are sent to you, we then need a paper trail to show me the money to enter your account. This is typically done with a transaction history (for the account where gift funds are deposited) from the date of your last statement through the present date. This will give the lender evidence you have received the funds. For more information on this topic and/or other mortgage questions, please contact us at 888-900-1020 or text us for a faster response. Or email us at [email protected]. We are available 7 days a week, on evenings, weekends, and holidays.

January 24, 2022 - 7 min read