Due-on-Sale Clause For Inherited House With Mortgage

If you’re inheriting a house that has a mortgage, you may be wondering if the due-on-sale clause will affect you. The due-on-sale clause is a provision in a mortgage that gives the lender the right to demand full payment of the loan if the property is sold. In most cases, the clause is triggered by the death of the borrower.

In this article (Skip to…)

For Lenders

The due on sale clause is important for lenders because it allows them to control the disposition of the collateral for the loan. If the borrower sells the property, the lender can demand repayment of the loan in full. This ensures that the lender will not be left holding a loan that is secured by property that is no longer owned by the borrower.

Almost all mortgages have a due-on-sale provision, which allows the lender to demand payment in full if the owner sells the property without having paid off his or her loan.

The lender has the right to call in the loan at any time if it believes that doing so is in its best interests unless prohibited by federal law.

For Borrowers

The due on sale clause is also important for borrowers because it gives them an incentive to keep up with their payments. If the borrower defaults on the loan, the lender can demand full payment of the loan, which could put the borrower in a difficult financial position.

If you’re considering taking a cash-out refinance, be sure to understand all of the terms and conditions, including the due on sale clause. This will help you to make the best decision for your financial situation and protect your interests.

Checking If The Inherited Property Has a Mortgage

When you purchase a property that has an existing mortgage, you will assume responsibility for that mortgage. In order to determine if the inherited property has a mortgage, you will need to review the deed and any other relevant documentation. If you find that there is a mortgage on the property, you will need to work with the lender to determine what options are available to you. It is important to remember that assuming an existing mortgage is a big responsibility and should not be taken lightly.

If you’re considering buying a property that has been inherited, you’ll want to know if there is a mortgage on the property. If so, this will affect your ability to get financing and may impact your decision to purchase the home. There are a few ways to determine if there is a mortgage on an inherited property.

Check Documents Related to The Property

Contact a County Recorder

Contact a Title Company

Contact a Lender/Servicer

Keep in mind that if there is a mortgage on the property, you’ll need to factor this into your decision to purchase the home. You’ll also need to make sure that you have the financial resources to cover the mortgage payments if you decide to go ahead with the purchase.

Inheriting Property Process Timeline

If you’re like most people, you probably own some property – a home, a vehicle, or maybe some land. And, if you’re planning ahead, you’re probably thinking about what will happen to that property when you die. Will it go to your spouse? Your children? A charity?

In some cases, lenders are prohibited from repaying a full amount because of the court settlement or a borrower’s death.

Inheriting property can be a complicated process, especially if there are multiple heirs involved. In this blog post, we’ll outline some of the basics of inheritance law and give you some things to consider when inheriting property.

Intestate Succession VS Testamentary Disposition

First, it’s important to understand the difference between intestate succession and testamentary disposition.

Intestate succession is the process by which property is distributed if the owner dies without a will. The property will be distributed according to the laws of your state if you have no relatives. This is referred to as “intestate succession” or “intestacy.” Who gets what is determined by your nearest blood relatives?

Testamentary disposition is the process by which property is distributed if the owner dies with a will. If you die without a will, your property will be distributed according to the laws of intestate succession in your state. These laws vary from state to state, but generally, the property is distributed to a surviving spouse and/or children first, and then to other relatives if there are no surviving spouse or children.

If you die with a will, your property will be distributed according to the terms of your will. You can leave your property to whomever you want, and you can stipulate how and when it is to be distributed.

For example, you could leave your home to your spouse with the provision that it is to be sold and the proceeds divided equally among your children. When you inherit property, you also inherit any debts associated with that property. For example, if you inherit a house from a relative, you will also inherit any mortgage or other debts on the house.

You are not responsible for any debts incurred by the deceased prior to their death, but you are responsible for any debts incurred after their death. If you’re inheriting property, there are a few things to keep in mind.

- Consult with an attorney to understand your rights and responsibilities.

- Be aware of any deadlines for taking possession of or selling the property.

- Make sure you’re prepared to take on any debts associated with the property.

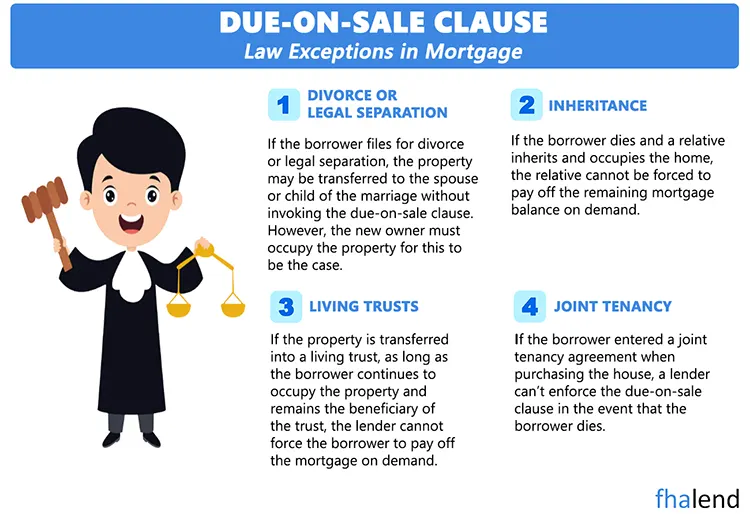

Alienation (Due-on-Sale) Clause Exceptions

A due-on-sale clause is not always enforceable. People should be aware of the exceptions to this rule so that you can determine whether or not the property sale will trigger the clause. Here are a few exceptions where it may be used:

Assumable mortgages – Mortgages that are dated in 1970s have no alienation clause and they don’t need to be paid off after transferring it to another person.

Second mortgage – If a borrower has a second mortgage, such as a HELOC, the lender cannot force a due-on-sale clause.

Living Trust – For occupants and trust beneficiaries there are some options that allow borrowers to transfer the property into a living trust.

Death – If the title is inherited by a spouse, child, or close family member who already owns or plans to live on the property, the alienation clause is unenforceable.

Joint tenancy – The due-on-sale clause does not apply to a joint tenant (such as a surviving spouse) who takes over the mortgage.

Divorce – When a home sale is triggered by a divorce, the due-on-sale clause cannot be enforced by lenders.

Debt Restructuring – In some cases, a sale may be exempt from a due-on-sale clause if it is part of a debt restructuring agreement. This allows the borrower to sell the property and use the proceeds from the sale to pay off the loan without having to pay off the loan in full.

Foreclosure – A sale may be exempt from a due-on-sale clause if it is part of a foreclosure proceeding. This allows the borrower to sell the property and use the proceeds from the sale to pay off the loan without having to pay off the loan in full.

June 28, 2022 - 6 min read