How To Check If Your Mortgage is Insured By FHA?

If you’re not sure whether or your mortgage loan is an FHA, there are a few things you can check to figure it out if you got FHA-insured financing or not.

First, look at the loan’s paperwork – it should say somewhere on there if the mortgage is FHA-insured. You can also check with your lender or mortgage servicer. Lastly, you can look up the property’s address on the HUD website to see if it’s listed as an FHA property. If it is, then your mortgage is likely FHA-insured. If you’re thinking of getting an FHA loan, or are currently shopping for a home, it’s a good idea to check and see if the property you’re interested in is listed as an FHA property. That way, you’ll know for sure whether or not your mortgage will be FHA-insured. Check the mortgage statement or paperwork to see if the loan is insured by the Federal Housing Administration.

Secondly, if you don’t know what loan mortgage option you choose when buying a house – contact your lender and ask them directly if your mortgage is FHA-insured. If you’re not sure if your mortgage is FHA-insured, call your lender and ask. They should be able to tell you for sure one way or the other.

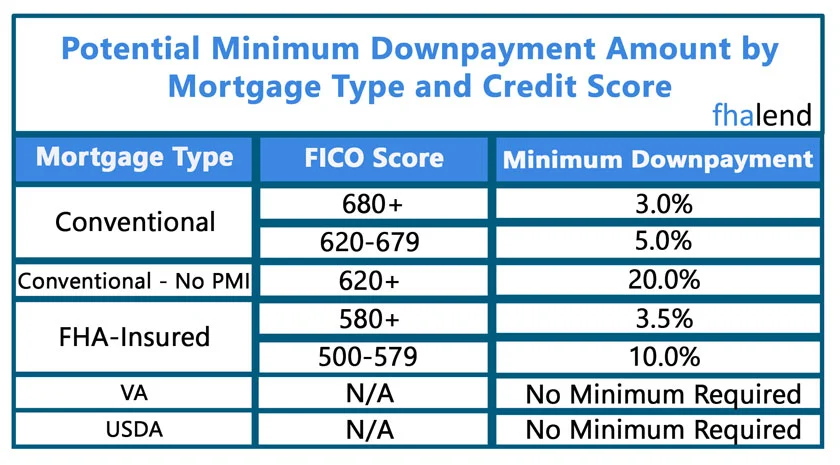

Third, check what downpayment you put down. If you put down exactly 3,5% then you can be almost sure that you went with FHA financing. If you put down 0% you probably obtained a VA loan or USDA loan. If you put 5% or 10% down you probably went with a conventional loan which requires also a higher credit score (min 620 and up).

Fourth, Call any title company and inquire about a copy of the Deed of Trust. The deed of trust is published in the public records. On the document, you’ll see “FHA.”

In this article (Skip to…)

How To Contact a Title Company to Get FHA Loan Number

A title company is a business that specializes in conducting research on a property’s title history and issuing title insurance. Title companies are usually involved in real estate transactions, acting as an intermediary between buyers and sellers.

The main function of a title company is to search for and clear any titles that may have liens or other encumbrances against them. This process protects the buyer from purchasing a property that has outstanding debt attached to it. Once the title is clear, the company will issue a policy to the buyer that guarantees the ownership of the property.

Title companies also handle other aspects of real estate transactions, such as escrow services, deed preparation, and loan closings. In some cases, they may also provide home warranties and other types of insurance. Choosing a title company is an important task in any real estate transaction.

Your title company was probably selected by the seller or your mortgage company. Contact them first to find out the name and address of your title company your loan was closed. Sometimes at the closings, there are only lawyers present that’s why you might not remember the exact location where your closings took place.

There are a few things to keep in mind if you think your mortgage might be FHA-insured. First of all, it’s important to remember that the FHA only insures mortgages for primary residences. So if you have an investment property or a second home, it’s unlikely that your mortgage is FHA-insured. Secondly, the FHA has certain requirements for properties that they will insure. So if your home doesn’t meet those requirements, your mortgage is also unlikely to be FHA-insured.

If you’re not sure whether or not your mortgage is FHA-insured, the best thing to do is to contact the FHA directly. They can help you determine whether or not your mortgage is insured by them. You can reach the FHA at 1-800- CALL FHA.

When you contact the FHA, be sure to have the following information ready:

- Your name, address, and phone number

- The name of your mortgage lender

- Your loan number

- A brief description of your complaint

- Any supporting documentation or correspondence that you have with your mortgage lender

The FHA will investigate your complaint and take appropriate action. They may contact your mortgage lender on your behalf and try to resolve the issue. If they are unable to resolve the issue, they will take further action as necessary.

Where to Find an FHA Loan Number?

If you’re not sure what your loan number is, don’t worry – there are a few ways to find it. Your loan number is important because it’s how your lender keeps track of your account and all the information associated with it. Your loan number is typically made up of both numbers and letters. If you have your mortgage statement handy, you can usually find it near the top. It will likely be listed as your “account number” or something similar. To find your loan number, start by looking at your monthly statement.

Your loan number will be listed on the statement, usually near the top. If you can’t find it there, try looking on your mortgage note or in your closing documents. If you don’t have your mortgage statement on hand, you can also find your loan number by logging into your online account with your lender. Once you’re logged in, click on the tab that says “Account Details” or something similar. Your loan number should be listed there.

If you still can’t find your loan number, contact your lender directly. They should be able to give you the information you need. Knowing your loan number is important, so make sure you take the time to find it if you’re not sure where it is. Keep it in a safe place so you can reference it in the future if needed.

Main Characteristics of FHA Loan

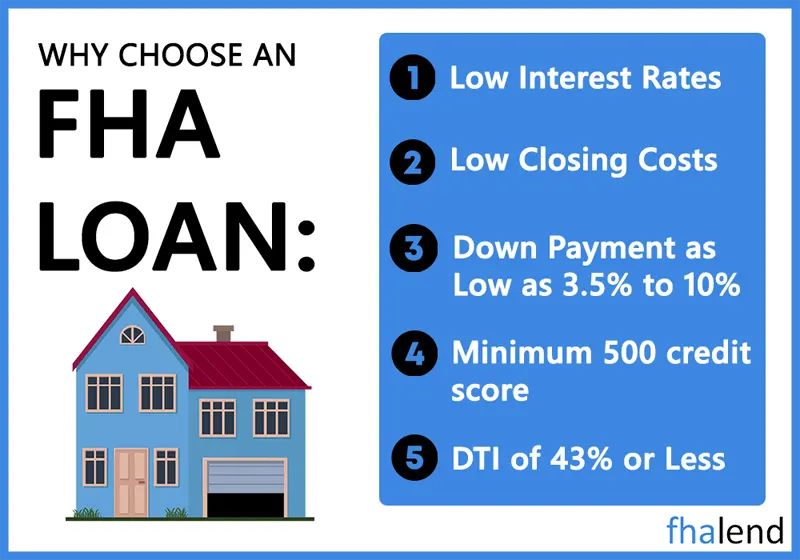

If you have an FHA loan, there are a few things that will jump out at you:

FHA Assigned Case Number

FHA Down Payment

FHA Mortgage Letter

FHA UMIP

FHA Escrow

An FHA escrow is when a borrower has an account with the lender that the lender uses to pay the property taxes and insurance on the borrower’s behalf. This is done to protect the lender’s investment in the property, as well as to make sure that the borrower is not delinquent on these important payments.

If you are considering an FHA loan should be aware of the requirements for an FHA escrow, as well as the benefits and drawbacks of having one.

- An FHA escrow is required if you have an FHA loan.

- An FHA escrow protects the lender’s investment in your property by ensuring that the property taxes and insurance are paid on time.

- The borrower is responsible for making monthly escrow payments to the lender, which the lender then uses to pay the property taxes and insurance on the borrower’s behalf.

- If the borrower falls behind on their monthly escrow payments, the lender may require the borrower to make a lump sum payment to catch up, or may even foreclose on the property.

- On the other hand, if the borrower makes their monthly escrow payments on time, they will accrue interest on the money in their escrow account. This interest is paid to the borrower when they sell or refinance the property.

- Having an FHA escrow can be beneficial for borrowers who are not good at budgeting or keeping track of their property taxes and insurance payments. However, it is important to remember that you are still responsible for making your monthly escrow payments on time, even if you forget to pay your property taxes or insurance bill.

- You can typically avoid having an FHA escrow if you get a conventional loan instead. However, some lenders may require an escrow account even for a conventional loan, so be sure to ask about this before you apply.

- If you already have an FHA loan and want to get rid of your escrow account, you may be able to do so by refinancing into a conventional loan. However, this is not always possible, so be sure to ask your lender about their specific guidelines.

Overall, having an FHA escrow can be beneficial or detrimental depending on your individual circumstances. Be sure to speak with your lender to see if an FHA escrow is right for you.

What is an FHA Case Number?

An FHA case number is a unique 10-digit identifier given to a borrower’s loan file. This number is assigned by the Federal Housing Administration (FHA) and used by participating lenders throughout the mortgage process. The case number allows lenders to access the financial and credit history of the borrower, as well as any prior FHA-insured loans. It also provides important information about the property being purchased, such as the appraised value and loan limits.

The FHA case number must be included on all documents related to the loan application, including the Loan Estimate and Closing Disclosure forms. Borrowers can ask their lender for their FHA case number, or they can find it on their credit report. When applying for an FHA loan, it’s important to have all the required documentation ready, including the FHA case number. This number helps lenders verify your identity and pull your credit history.

When transferring your appraisal to a different lender when you got denied or you are not happy with your current lender you will need the FHA case number as well.

April 13, 2022 - 7 min read