FHA Mortgage Calculator

Mortgage Payment Calculator / How To

Downpayment – The amount of your down payment or equity can be entered in this section. A dollar figure will represent cash paid at closing while a percentage represents the percent you are putting towards purchasing price per se; however, either way it must add up to 100%.

Length Of The Loan – The length of time you’ll be making payments on your loan is determined by the term option. You can choose between 30 years or 20, 15 or 10; our calculator will adjust accordingly so that it works out to suit both short-term needs as well long-distance journeys in between!

Interest Rate – Entering the expected interest rate is fairly easy. Our calculator defaults to current average rates, but you can adjust this percentage if needed!

HOA – You can also ignore these amounts, as they might be rolled into your escrow payment. But if you want to make sure that the loan costs don’t affect how much money is left over at closing – for anything from property taxes and homeowners insurance through HOA fees- edit them accordingly!

Our Mortgage calculator doesn’t take into account your specific needs, but it will tell you if the numbers work out or not so that’s something! If I was looking at getting a house right now with my current situation – rate-shopping definitely sounds like a good idea to me

A mortgage calculator is an easy tool for anyone who wants help crunching some numbers when deciding on their loan term; how much down payment do i need?, what type of interest rates are available in order find one suited specifically to our requirements (I’m thinking about going longer than usual)?

How to Get The Lowest Possible Mortgage Rate in 2022

The best way to get the lowest mortgage rates is to have a good credit score, a down payment of at least 20 percent, and to shop around for the best rate.

- If you have a good credit score, you will be able to get a lower interest rate on your mortgage.

- The higher your credit score, the lower your interest rate will be.

- A down payment of at least 20 percent will help you get a lower interest rate.

- The more money you put down, the lower your interest rate will be.

- Shopping around for the best mortgage rate is the best way to ensure that you are getting the lowest mortgage rate possible.

- You can compare mortgage rates from a variety of lenders to find the best rate for you.

When you are shopping for a mortgage, be sure to compare apples to apples. Some lenders will offer a low-interest rate but then charge high fees. Others may have no fees but a higher interest rate. Be sure to compare all of the terms and conditions before you choose a lender.

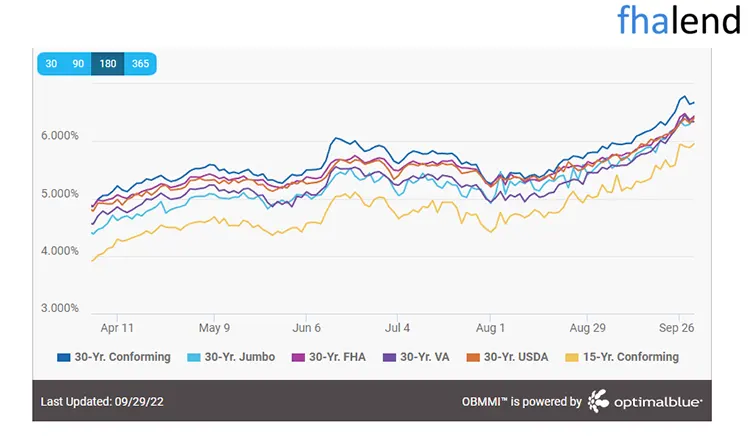

Disclaimer: Above chart with mortgage rates for September 2022 is from google.com and OptimalBlue

Disclaimer: Above chart with mortgage rates for September 2022 is from google.com and OptimalBlue

The best way to get the lowest mortgage rates is to have a good credit score, a down payment of at least 20 percent, and to shop around for the best rate. By following these tips, you can be sure that you are getting the best deal on your mortgage.

Calculating Your Monthly Mortgage Payment

When you’re ready to buy a home, one of the first things you need to do is figure out how much house you can afford. Part of that equation is your monthly mortgage payment. To calculate your monthly mortgage payment, you’ll need to know four things:

- The size of the loan you’re taking out

- The interest rate on your loan

- The term of your loan (the number of years you have to pay it back)

- Your down payment

With all of that information in hand, you can use our mortgage calculator above to figure out your monthly payment. Keep in mind that your monthly mortgage payment is just one part of your overall housing costs. You also need to factor in things like insurance, taxes, and repairs.

And don’t forget about utilities! When you’re budgeting for your new home, make sure you have a realistic idea of all the costs involved. If you’re not sure how much house you can afford, start by talking to a loan officer. They can help you understand what kind of loan options are available to you and give you an estimate of your monthly payments.

Once you know what you’re looking at, you can start shopping for your dream home!

The Equation For Mortgage Payments

M = P[r(1+r)^n/((1+r)^n)-1)]

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Banks provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 (0.05/12=0.004167).

- n = number of payments over the loan’s lifetime. You have to multiply the number of years in your loan term by 12 if you want to get the number of total monthly payments for your mortgage. For example, a 30-year fixed mortgage would have 360 payments (30×12=360).

P / Principal – This is the amount you owe to a lender.

MIR / Mortgage Interest Rate – The interest rates are what make or break your loan. The higher the amount of this fee,the worse off you will be in terms on finances!

PT / Property Taxes – The local authorities assess an annual tax on your property. If you have a escrow account, pay about one-twelfth of the total tax bill with each monthly mortgage payment. A great way to save money in Malibu is by having an accountable cash flow system set up through which I collect my taxes and send them directly over for assessment every year – it’s so easy!

HI / Home Owners Insurance – Your home is your most valuable asset. It’s important to protect it with the right coverage, and that includes insurance! When you buy a policy from us at123Coverages®, we’ll take care of everything – all new policies are guaranteed until they reach their expiration date so there won’t be any gaps in protection while waiting weeks or months between payments as some other companies might require; if this sounds good but isn’t quite working out exactly how I had envisioned then please feel free contact our customer service team who will go over options available including making adjustments on an ongoing basis

MI / Mortgage Insurance – Mortgage insurance is an additional cost that you’ll need to consider when buying a home. If your down payment isn’t at least 20% on the purchase price, then make sure this percentage includes mortgage ensure and add it into each monthly payment stream along with any other payments such as interest or escrow accounts for real estate taxes/inauthenticy fees; these additions may not show up immediately but they’re still relevant because eventually, everything adds up!

How to Lower Your Monthly Mortgage Payment

If you’re looking for ways to lower your monthly mortgage payment, you’re in luck. There are several things you can do to reduce the amount you pay each month. In this blog post, we’ll explore three of the most effective methods for lowering your monthly mortgage payment.

Refinance your mortgage

Refinancing your mortgage is one of the most effective ways to lower your monthly payments. When you refinance, you take out a new loan with a lower interest rate and use the proceeds to pay off your existing mortgage. This effectively lowers your monthly payments by reducing the amount of interest you’re paying on your loan.

Get rid of private mortgage insurance

Private mortgage insurance (PMI) is insurance that protects the lender in the event that you default on your loan. If you have a conventional loan and put down less than 20% of the purchase price, you’re likely paying PMI. Getting rid of PMI can lower your monthly payments by hundreds of dollars each month.

Make biweekly payments

Making biweekly payments instead of monthly payments can also help you save money on your mortgage. When you make a biweekly payment, you’re effectively making one extra payment each year. This extra payment goes towards the principal, which reduces the amount of interest you’ll pay over the life of the loan. Biweekly payments can save you thousands of dollars in interest and help you pay off your mortgage sooner.

If you’re looking to lower your monthly mortgage payment, any of these three methods can help. Talk to your lender about refinancing, getting rid of PMI, or making biweekly payments to see how you can save money each month.