FHA Loan Limits in North Carolina For 2023

Applying for an FHA loan in North Carolina can be quick as soon you have all paperwork ready. You just need to check FHA loan limits in North Carolina before. You have to know what your credit score is and how much you can afford as well. With the second option, we will help you to navigate through costs related to obtaining an FHA loan, pros, and cons.

Applying for an FHA loan in North Carolina can be quick as soon you have all paperwork ready. You just need to check FHA loan limits in North Carolina before. You have to know what your credit score is and how much you can afford as well. With the second option, we will help you to navigate through costs related to obtaining an FHA loan, pros, and cons.

We will guide you through all steps in the process so you are ready to make a move and buy or refinance your home with an FHA loan. the Federal Housing Administration (FHA) is a government agency that provides mortgage insurance on loans made by FHA-approved lenders. The FHA allows borrowers to finance homes with down payments as low as 3.5% without having to pay Private Mortgage Insurance (PMI).

If you’re looking to purchase a home in NC this year, understanding your loan options is essential. The Federal Housing Administration has set loan limits for 2023 at $472,030for a single-family home. With an FHA loan, you can qualify for more lenient credit scores and lower down payments.

Be sure to meet the requirements set forth by FHA in order to qualify, including having a valid Social Security number, providing proof of income and employment, and demonstrating financial responsibility. With this information in mind, you should now be well-equipped to make informed decisions regarding your mortgage needs.

- Job History – stable employment and income. You need to be employed for 2 years or more in the same company or same niche.

- Financial Statements – You should expect to be required to provide your 2 most recent bank statements, pay stubs, and tax returns. In some cases, you can amend your tax returns to be able to qualify for the mortgage and be able to get a prequalification letter.

- Credit Score – To qualify for the FHA loan you must have a 500 credit score or higher.

- Down Payment – HUD requires a 3,5% down payment for the FHA Loan depending on your credit score. On a $300,000 house, you will need $10,500. If your credit score is between 500–579, you are eligible for up to 90% financing. So the minimum down payment would be 10% of your home’s purchasing price. So if you buy a house worth $300.000 you need to come up with $30,000.

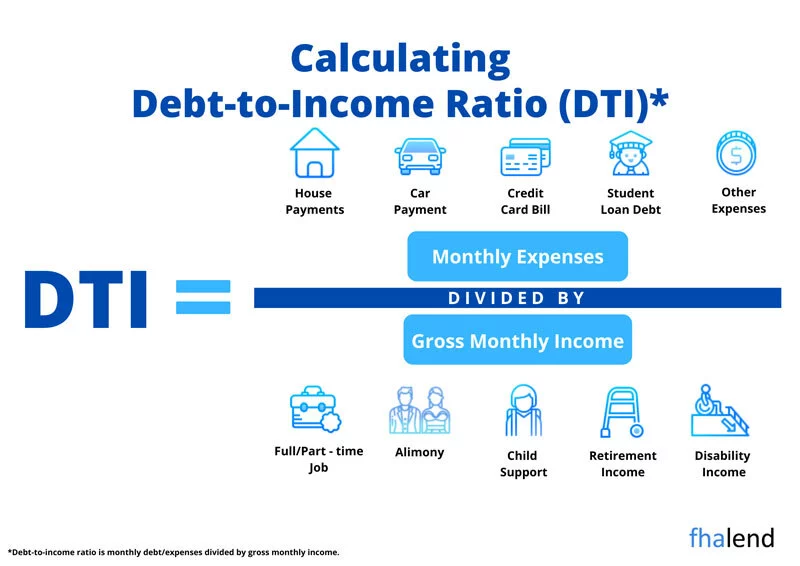

- Debt-to-Income (DTI) – You can not have a debt-to-income ratio higher than 43%. However, if you have “compensating factors” you might be able to get approved with higher debt levels (a compensating factor could be more money in savings, long job history, or great credit).

- Primary Residence – You must occupy the home that you intend to purchase and have it be your primary residence. FHA loans are not available to purchase an investment property, second home, or vacation home.

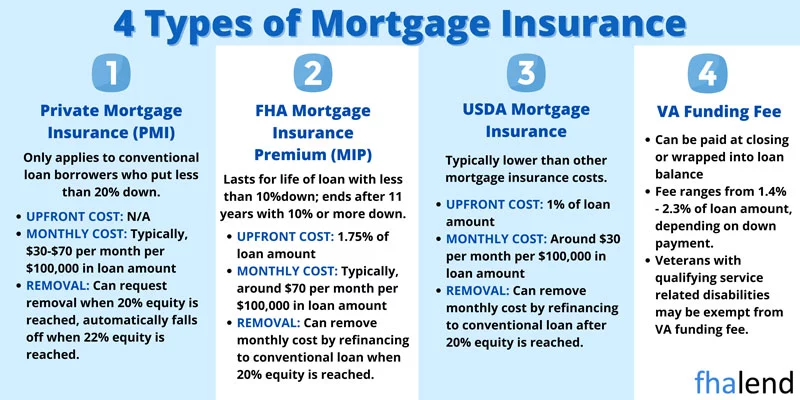

- Mortgage Insurance – FHAs require two types of mortgage insurance. UPMIP (Upfront Mortgage Insurance Premium) and the MIP (Mortgage Insurance Premium). FHA MIP acts similarly to how PMI (Private Mortgage Insurance) on a conventional loan acts. You can use our loan calculator to estimate your monthly payment and mortgage insurance costs.

- FHA Loan Limits – FHA loans have maximum lending limits, which are set at the county level. You can view the 2023 FHA loan limits in North Carolina for all counties below.

FHA Loan Limits in North Carolina in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ABBEVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| AIKEN | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| ALLENDALE | $472,030 | $604,400 | $730,525 | $907,900 | $38,000 |

| ANDERSON | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| BAMBERG | $472,030 | $604,400 | $730,525 | $907,900 | $44,000 |

| BARNWELL | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| BEAUFORT | $485,300 | $621,250 | $750,950 | $933,300 | $422,000 |

| BERKELEY | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| CALHOUN | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| CHARLESTON | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| CHEROKEE | $472,030 | $604,400 | $730,525 | $907,900 | $117,000 |

| CHESTER | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| CHESTERFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $120,000 |

| CLARENDON | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| COLLETON | $472,030 | $604,400 | $730,525 | $907,900 | $181,000 |

| DARLINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| DILLON | $472,030 | $604,400 | $730,525 | $907,900 | $58,000 |

| DORCHESTER | $538,200 | $689,000 | $832,850 | $1,035,000 | $468,000 |

| EDGEFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| FAIRFIELD | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| FLORENCE | $472,030 | $604,400 | $730,525 | $907,900 | $180,000 |

| GEORGETOWN | $472,030 | $604,400 | $730,525 | $907,900 | $325,000 |

| GREENVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| GREENWOOD | $472,030 | $604,400 | $730,525 | $907,900 | $141,000 |

| HAMPTON | $472,030 | $604,400 | $730,525 | $907,900 | $80,000 |

| HORRY | $472,030 | $604,400 | $730,525 | $907,900 | $311,000 |

| JASPER | $485,300 | $621,250 | $750,950 | $933,300 | $422,000 |

| KERSHAW | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| LANCASTER | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| LAURENS | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| LEE | $472,030 | $604,400 | $730,525 | $907,900 | $44,000 |

| LEXINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| MCCORMICK | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| MARION | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| MARLBORO | $472,030 | $604,400 | $730,525 | $907,900 | $103,000 |

| NEWBERRY | $472,030 | $604,400 | $730,525 | $907,900 | $138,000 |

| OCONEE | $472,030 | $604,400 | $730,525 | $907,900 | $197,000 |

| ORANGEBURG | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| PICKENS | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| SALUDA | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| SPARTANBURG | $472,030 | $604,400 | $730,525 | $907,900 | $232,000 |

| SUMTER | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| UNION | $472,030 | $604,400 | $730,525 | $907,900 | $50,000 |

| WILLIAMSBURG | $472,030 | $604,400 | $730,525 | $907,900 | $38,000 |

| YORK | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

*for 500 credit score clients 10% downpayment is required to qualify for FHA loan in North Carolina, for 580+ only 3,5% is required to qualify for a loan

Difference Between FHA Loans and Conventional Mortgages

One of the main differences between an FHA loan and a conventional mortgage is that an FHA loan requires a lower down payment (as low as 3.5%). This makes it easier for borrowers who may not have the funds to put down a larger sum of money upfront. Additionally, with an FHA loan, you can qualify for more lenient credit scores than you would with a conventional mortgage.

What is DTI (Debt-to-Income Ratio) and How To Calculate it When Applying for a Mortgage Loan In North Carolina?

The debt-to-income ratio (DTI) is the percentage of gross monthly income spent to pay off debts such as a mortgage, student loans, automobile loans, credit cards, and other obligations. Because it’s typically a good predictor of how difficult you’ll be able to pay your bills, lenders consider your DTI.

The FHA also looks at a borrower’s debt-to-income ratio (DTI) in order to approve a loan. This ratio is calculated by dividing the total monthly debt obligations by the monthly gross income. Borrowers with a DTI of more than 41% may not be approved for an FHA loan, even if they have a credit score above 580. This is because the FHA views borrowers with high DTIs as being at a higher risk of defaulting on their mortgage.

To obtain an FHA loan, you must not spend more than half of your gross income on debt, which is usually defined as a DTI of 50% or more. With such a ratio, in certain circumstances, someone may qualify. In general, lenders will want to see that your debt-to-income ratio is no greater than 43%.

What Type Of Mortgage Insurance Do I Need to Pay For FHA Loan?

What Type Of Mortgage Insurance Do I Need to Pay For FHA Loan?

The upfront mortgage insurance premium (UFMIP) is a significant disadvantage of the FHA loan. This is paid at closing, although it may also be financed into the loan amount. Monthly mortgage insurance premiums (MIP) are required by the FHA to protect the lender in case of default.

Unless you put down 10% and have at least 11 years left, MIP is a minimum of 11 years. If you refinance your FHA to a conventional loan, you may get rid of your monthly mortgage insurance. With an FHA mortgage, you will pay the same insurance premium regardless of your credit score.

Mortgage insurance is payable monthly if you put down less than 20% on a conventional loan, but this might be lower than with an FHA loan if your credit score is over 720. The borrower pays more over the life of the loan with an FHA loan.

Unpaid Bills or Collections

The FHA also looks at a borrower’s credit history in order to approve a loan. This includes any bills that are unpaid or have gone into collections.

If a borrower has any bills that are unpaid or in collections, they may not be approved for an FHA loan. Borrowers should make sure to pay any outstanding bills and get their credit score as high as possible before applying for an FHA loan.

Insufficient Funds for Closing Costs

Borrowers are typically required to pay for closing costs in order to obtain an FHA loan in North Carolina. These costs can include the down payment, appraisal fee, title search, and other related fees.

Borrowers are required to have at least 3.5% of the home’s purchase price available for the down payment. However, if the borrower is using the FHA’s “cash-out” program to refinance their existing mortgage, they may be able to finance up to 97.5% of the home’s value.

Insufficient Credit History

The FHA requires borrowers to have a minimum credit score of 500 in order to be eligible for a loan. However, borrowers with a score of 580 or higher will be able to take advantage of the FHA’s lower down payment requirements of 3.5%.

North Carolina Down Payment Assistance Program

With the NC Home Advantage Mortgage, first-time and repeat home buyers may receive a down payment loan of up to 3% of their mortgage amount.

- This mortgage assistance loan begins to be forgiven in year 11 of your loan and is fully erased by year 15. You’ll have to repay the whole amount if you sell, transfer, or refinance before year 11.

- Veteran and first-time homebuyer programs are also available through the VA. The Veterans United Home Purchase Assistance Program, for example, provides $8,000 in down payment help to veterans and first-timers seeking to buy a house.

Visit the North Carolina Housing Finance Agency’s website for more information. Also, check out HUD’s list of additional homeownership assistance programs in the state.