How To Qualify for FHA Loan After Short Sale

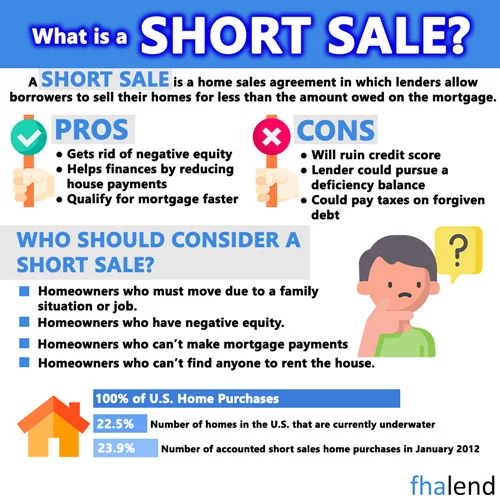

Do you want to know how long it will take to get a new mortgage after losing your house in a short sale? Your credit score will be damaged following a short sale, although the damage may not be as significant as if you had lost your home through foreclosure. Nonetheless, owing to the fact that you sold your house for less than its value you can still get an FHA Loan after short sale if your credit score is over 500 and your short sale was 3 years ago or less depending on circumstances.

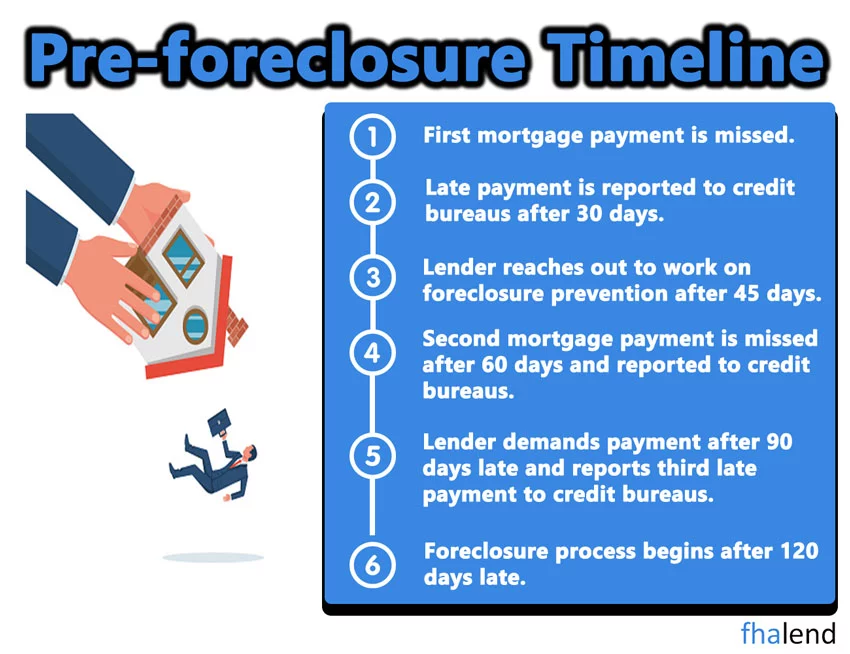

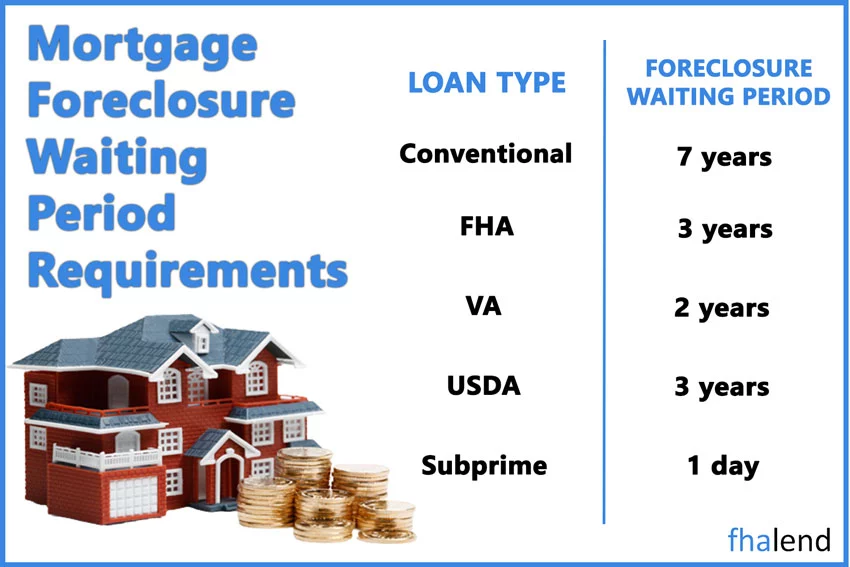

The term you need to wait before submitting your 1003 and applying for a new mortgage loan is determined by the sort of mortgage and your credit score history. The waiting period following a short sale for various sorts of loans is shown in the chart below, with more information available below.

You should know that a short sale will have a big impact on your credit scores, making future loans more difficult to obtain. The quality of your credit before you lost your house influences how much your scores fall. If your previous credit score was in great standing, then it will suffer more than if you had a collection account, charge-off account, missed or late payments, or any negative items on your credit.

In this article (Skip to…)

FHA Extenuating Circumstances After Short Sale

The Fannie Mae and Freddie Mac standards define “extenuating circumstances” as “exceptional situations,” which include:

- The divorce process (in certain situations)

- If a family member dies as the result of an death or illness, it is usually the primary borrower who suffers.

- Typically, this entails the primary borrower (wage earner) losing their job, which is often a problem in and of itself.

When Is a Waiting Period Required?

If you have a short sale, your credit will be ruined if the lender forecloses. If a lender forecloses after filing for bankruptcy and selling your home as part of it, you might not need to wait long before applying for an FHA-insured mortgage loan.

- Mortgage payments on the prior mortgage must be made within the month owing for the preceding 12-month period.

- You meet the criteria if you made both your installment debt repayment and refinancing payments in the same month.

Short Sale Exceptions To Waiting Period For FHA Loan

The period between the date of default and when you can acquire a mortgage is usually three years, although this varies by lender. If you can show that extraordinary events such as a major sickness or the death of a breadwinner caused the mortgage default, you may be able to qualify sooner than three years. Divorce is not considered an extenuating circumstance.

If your ex-spouse is receiving possession of the home and there was a short sale as a result of relocation or changing jobs, you mthe ay be eligible for exception. The inability to sell your house due to a job relocation or transfer to another area does not get approved with the above circumstances.

What Is the Average Credit Score Used for Mortgage Approval?

The FICO credit score, also known as the FICO credit rating, is the most popular credit score used by mortgage lenders. The average credit score in the USA range from 300 to 850 points. There are a variety of scoring models accessible, such as FICO and FICOn8.

A score is determined by which model is used to generate it and getting the underlying credit report by a reporting agency. In most situations, mortgage lenders must utilize the “Classic FICO” credit score when determining a borrower’s creditworthiness with Fannie Mae and Freddie Mac. These names are used to identify the “Classic,” or Traditional, version of this score at major credit reporting agencies.

After a Short Sale, Getting an FHA-Insured Loan

You may have to wait days, weeks, or months to get a new FHA-insured mortgage depending on your credit history and the reasons for the short sale.

You Can Get a Fannie Mae or Freddie Mac Loan After a Short Sale

The Mortgage Bankers Association is a trade association for mortgage lenders, which include banks and independent mortgage bankers. Fannie Mae and Freddie Mac are both government-sponsored enterprises that regulate mortgage lending standards. These “conventional, conforming” loans are suitable for Fannie Mae or Freddie Mac to purchase.

Depending on the circumstances, the waiting period for this sort of mortgage loan after a short sale varies.

You will have to wait:

- four years or

- You are eligible for this program if you suffered a nonrecurring, uncontrollable, and a significant reduction in income or an overwhelming increase in financial commitments due to extenuating circumstances (for example, a situation that was nonrepetitive, beyond your control, and resulted in a sudden, significant, and long-term decrease in income or an overwhelming increase in financial responsibilities).

FNME requires borrowers a credit score of 620 or 640 as of August 2022, however, this may vary based on the circumstances. A single-family primary residence with Freddie Mac needs a credit score of 620 or 660, depending on the scenario. Lenders may utilize more stringent criteria than those specified above.

For an FHA-insured loan with a score of 580, a low down payment (as little as 3.5%) is necessary. If your FICO score is 500 to 579 you will need 10% instead of a 3.5% down payment, allowing you to qualify for an FHA-insured loan.

You can also prepare for a house purchase by checking your credit report, writing down all of the information on your credit cards and bank accounts that appear to be in good standing (whether or not you have an outstanding balance), and using a free service like Equifax Credit Report Express.

However, a foreclosure might drop your FICO score by hundreds of points or more, perhaps below 500, it’s best not to take any chances and get preapproved for mortgage rates currently available from lenders in our network who are ready to approve borrowers immediately this month. There is a still way of financing a house after foreclosure but there are certain waiting period requirements. Even if the waiting period has passed, you may not qualify for a mortgage loan if your FICO rating is 500 or less.

Although the VA does not have a min FICO score requirement, lenders must evaluate your entire loan profile when considering you for a mortgage.

After A Short Sale, You Must Rebuild Your Credit

Short sales harm credit ratings. The credit score drop from a short sale is greater the higher your credit score is. To improve excellent credit and raise your FICO score, you must perform the actions detailed below:

- To avoid debt, maintain a minimal amount of credit cards

- Regardless of the circumstances, pay your bills on time

- Make sure your credit report is correct and up to date with a credit monitoring service

- You’ll be more likely to pay off your debt if you keep your credit card utilization low. Your debt-to-credit ratio, commonly known as the “credit utilization rate,” your FICO score will rise if you don’t maintain them low.

How to Change Your Credit Reports and Improve Your Credit Score

Check your credit reports as soon as possible if you intend to take out a mortgage following a short sale. As a result of the fact that short sales are sometimes recorded as “foreclosures” on credit histories, this is conceivable. You may be turned down for a new mortgage loan due to the reasons listed below if your short sale is labeled as a foreclosure on your credit report:

- The lender compelled you to make a greater down payment than you would have had to make if the short sale were properly reported, so

- It’s possible that your foreclosure was finalized without your knowledge if a lender applied a greater post-foreclosure waiting period to you when you would have qualified.

- Your credit score is lower than it should be (foreclosures are generally more damaging to credit scores than short sales).

The Department of Housing and Urban Development (HUD) published an article on October 1 announcing new short-sale restrictions.

After A Short Sale, There Is Usually A Waiting Period

If you defaulted on your previous mortgage and were in foreclosure during the short sale, you must wait at least three years before reapplying for an FHA-insured loan.

What Is the Average Credit Score Needed to Purchase a Home?

Mortgage lenders frequently use the FICO credit score, often known as the FICO score. Credit scores range from 300 to 850. There are a variety of scoring models accessible, such as FICO and FICO 8. A person’s score varies based on which model is used to compute it and which credit reporting agency supplied the underlying credit report.

For example, most mortgage lenders must utilize the “Classic FICO” credit score when assessing a borrower’s creditworthiness with Fannie Mae and Freddie Mac. The “Classic,” or Traditional, version of this score is also known as these names at major credit reporting agencies:

- Equifax Beacon® 5.0

- Experian/Fair Isaac Risk Model V2SM, and

- TransUnion FICO® Risk Score, The current FICO score may be the same as all previously existing models. We’ll show you how to generate a brand new credit report and discover what credit reporting agency supplied the underlying credit report. In most situations, mortgage lenders must use the “Classic FICO” credit score when assessing a person’s creditworthiness with Fannie Mae and Freddie Mac. These names are also known by the “Classic,” or Traditional, version of this score at major debt reporting agencies

FHA Short Sale HUD’s Guidelines and Requirements

On October 1, 2013, HUD announced the following adjustments to the Federal Housing Administration’s short sale criteria.

Borrowers must meet the following requirements in order to be eligible for the FHA short sale program:

- Your mortgage must be in default on the date your short sale is completed.

- A violation of federal law may be found if there is any indication or actual breach of the arm’s-length requirement.

- They are not allowed to market or sell the property to anybody with whom they have a personal or business relationship. It must be a “arm’s-length” transaction in legal terms.

The mortgagee, or trustor in this case, will not release the mortgage until after all outstanding liens on the property have been satisfied. If a lien holder asks for money to remove its claim, it must provide a signed statement and an agreement to let go of the lien if the sum is paid.

Servicers must apply the Deficit Income Test (DIT) to determine whether a homeowner is in financial difficulty for a typical preforeclosure sale. The IRS Collection Financial Standards is utilized to check for errors in homeowners’ costs that aren’t reflected on their credit reports. Only owner-occupied houses are eligible for the normal preforeclosure sale.

If you are planning to sell your property quickly, there is no need to provide financial information or demonstrate financial hardship. Primary residences, second homes, investment properties, and service members who have received a Permanent Change of Station (PCS) order are among the eligible properties.

After the appraisal is finished, it should take no more than ten business days to complete the property evaluation. Once the assessment is completed, the short sale file will be updated and ready for inspection. In some circumstances, approval from the investor or FHA may be required, which can extend the process.

When you finance a house, you will certainly have to complete numerous forms. However, if everything goes according to plan and the buyer makes all of the payments on time, the closing may be quick. At this point, any outstanding charges (such as mortgage-burning fees or points) would most likely have been paid and perhaps waived. Any last amounts (also known as cash contributions) that are required before closing must still be paid.

If you are a homeowner who is acting in good faith and successfully selling your house, you could be eligible for a reward of up to $3,000. The revised FHA short sale addendum must be signed and dated by all parties. All parties under this agreement agree that the property should be sold through an arms-length transaction.

A short sale occurs when one party sells something for less than it is worth but intends to buy it back at a later date when the price has risen. It’s typically between two unrelated people, and it involves a selling price as well as other terms that would exist in an open market scenario. There may be no secret agreements or unusual understandings among any of the participants (e.g., buyer, seller, appraiser, sales agent, closing agent, and mortgagee) involved in the transaction.

August 12, 2022 - 8 min read