FHA Loan With 620 Credit Score [NEW 2023 Guidelines]

Homebuyers and borrowers thinking of qualifying for a mortgage should plan ahead on fixing their credit to qualify for a mortgage. So can you qualify for the FHA loan with 620 credit score which is insured by the federal housing administration (HUD)? Yes, you can, you can find all about your FICO and how it’s affected by reading below.

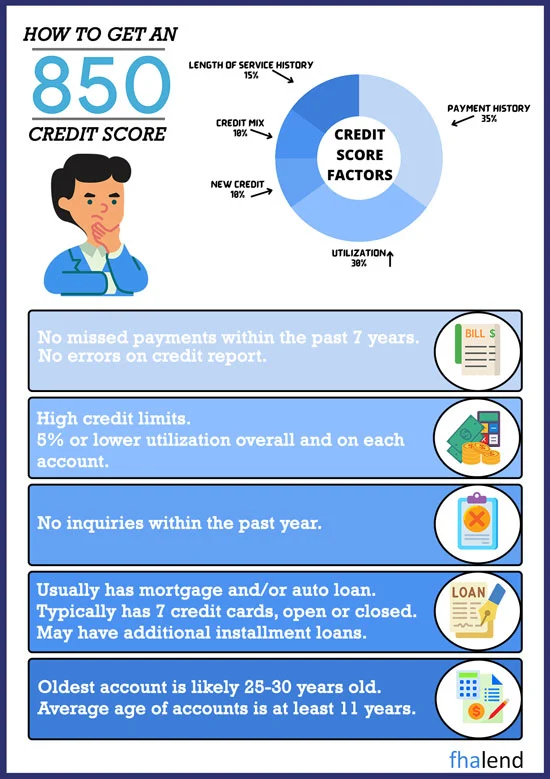

A low credit score can mean higher interest rates and a greater chance of being denied a loan. It can also mean that you won’t be able to get a mortgage at all. So, what can you do to improve your credit score? Start by checking your credit report and making sure there aren’t any errors. You can then work on paying down your debt and increasing your credit limit.

Homeowners have a variety of loan options and types of mortgages available now. By increasing their credit score they can decrease their monthly payments and mortgage payments significantly for the life of the loan. They can shop for a bigger house, increase their loan amount or spend more on closing costs.

As soon as they didn’t have a foreclosure or bankruptcy in the past 2-to 4 years they can buy their favorite real estate and obtain an FHA home loan and get their dream of homeownership a reality.

If you’re concerned about your credit score, it’s best to start working on it as soon as possible. By improving your score, you’ll make it easier to buy a home in the future or qualify for a better option like a conventional loan in this case.

In this article (Skip to…)

Should I Qualify for a Conventional or FHA Loan With a 620 Credit Score?

When you have a credit score of 620 or below, it may be difficult to get approved for conventional loans. This is where the FHA loan can be a helpful option for borrowers. An FHA loan is backed by the federal government and can be obtained with a credit score as low as 580. There are some other requirements that must be met in order to qualify for an FHA loan, such as a down payment of 3.5% and proof of income.

The main advantage of an FHA mortgage is that it is much easier to get a higher credit score and approval than conventional loans. The interest rates are also typically lower than with a conventional loan. Another benefit is that the down payment can be financed, which means you don’t have to come up with the entire amount upfront.

Benefits of FHA Loan With 620 Credit Score

If you are considering an FHA loan, it is important to compare the different FHA lenders with no overlays and rates to make sure you are getting the best deal. It is also important to be aware of the other requirements, such as the minimum credit score, so that you can be prepared to meet them.

Going with the FHA loan with a 620 credit Score may be a good option for you if you have a low credit score, are unable to put down a large down payment, or need help getting loan approval for a mortgage. Once a buyer has decided in buying a new home, the next step is getting qualified for a home loan and seeing how much you qualify. The two most important factors in qualifying for a mortgage are credit and income.

There are specific minimum credit score requirements to qualify for a home loan, depending on the mortgage loan program. FHA requires a 580 credit score for a 3.5% down payment home purchase FHA Loan. Fannie Mae and Freddie Mac require a minimum credit score to qualify for FHA loan with 620 credit score and a downpayment of 3,5% to 10% of a home purchase.

USDA Loans normally require credit scores of 640 or higher and credit score requirements on VA Loans normally require 620. Jumbo mortgage FHA lenders require credit scores of 700 from Jumbo Mortgage Loan Applicant. If your credit score is under 580 you might need to go through a manual underwriting process to be able to qualify for a loan. A lender might request from your provide compensating factors and a letter of explanation.

If borrowers have sufficient documented income but lower credit scores, fixing their credit to qualify for a mortgage is recommended. Fixing your credit to qualify for a mortgage can take as little as 30 days or may take months. Many loan originators, like myself, will help and advise in fixing your credit to qualify for a mortgage.

Should You Pay Down Your Credit Card Balances When Applying For FHA Loan With 620 Credit Score?

One quick fix to boost credit scores for borrowers instantly is by paying down your credit card balances. Consumers with high credit card balances or credit card balances that are to the credit limit, will hurt credit scores. Getting credit card balances to 10% of the available credit limit can really boost credit scores.

Whether the credit card limit is $300 or $10,000, credit bureaus will use the percentage of the credit balance to the credit card limit, called the credit utilization ratio, in determining consumer credit scores.

Consumers should not have a zero credit card balance either. Having a zero credit card balance will also hurt consumer credit scores. The way credit bureaus determine credit scores is by dividing credit card balance by credit card limit and the lower the figure, the better the credit scores. Dividing a zero credit card balance by the credit limit will yield zero which is not good. There has to be a number and the lower that number is, the better credit scores will be.

Borrowers With No No Credit or Zero Credit

Many borrowers have low credit scores because they have no credit tradelines, their credit score shows 0 when checking a credit report. Consumers may not have any late payments for years and many who had prior bad credit do not want to open up new credit tradelines and pay cash so they do not want to get into debt. Unfortunately, not having active credit tradelines will not help consumers with their credit scores. Those with no active credit tradelines can easily boost their credit scores by getting secured credit cards.

Check Credit Score Requirements

Secured credit cards are like traditional unsecured credit cards. However, borrowers need to place a deposit with the secured credit card company, and the secured credit card company will grant a credit limit equivalent to the deposit.

Fixing Your Credit To Qualify For FHA Loan With 620 Credit Score

Borrowers can use the secured credit card as a regular unsecured credit card and they do not have to pay off the credit balance every month minimum payment due is required and the payment history of the cardholder is reported to all three credit reporting agencies (Experian, Transunion, and Equifax). Each secured credit card should easily boost the consumer’s credit scores by more than 20 points if the consumer has no active credit tradelines.

A total of 3 to 5 secured credit cards is recommended. As the credit card payment history ages and if the borrower pays their monthly bills on time, the consumer’s credit scores will improve. Most secured credit card companies will increase the credit limit without asking for additional deposits.

Adding Yourself As an Authorized User To Another Credit Card

Another way for borrowers to increase their credit scores is by adding themselves as an authorized user to a family member and/or friend’s credit card account. There is a risk associated with this. They need to make sure that the main cardholder has perfect payment history with no late payments on a credit report and has a low credit card balance.

Adding yourself on as an authorized credit card user to another credit card can hurt you if the main cardholder will eventually maximize their credit card balance to the available credit limit or in the event that the main cardholder is ever late. Adding yourself as an authorized user to another credit card can be a quick fix to temporarily boost your FICO score but it is recommended that you take your name off sooner than later. After adding yourself you should see all new credit tradelines under your name on your credit report.

Fixing Your Credit To Qualify FHA Loan With 620 Credit Score

Mortgage Rates are determined by the borrower’s credit scores. To get the best available mortgage rates, you need credit scores higher than 740 FICO. With that credit, you can qualify for any type of loan (conventional loans, non-QM loans). To qualify for the FHA loan with a 620 credit score you cannot have late payments and bankruptcies in the past 2-4 years. The lower your credit scores are, the higher your mortgage rates will be.

Mortgage lenders and creditors view lower credit score borrowers as higher risk borrowers so they charge higher interest rates to consumers who have lower credit scores.

There are a lot of reasons to consider an FHA Loan With a 620 Credit Score. Here are some of the benefits:

You can get a mortgage with as little as 3.5% down

- There are no prepayment penalties, so you can pay off your loan faster if you want to

- You can qualify for an FHA loan with a 620 credit score than you would need for a conventional loan

- The interest rates on FHA loans are typically lower than on conventional loans

- FHA loans are available in all 50 states

- There are loan limits on how much you can borrow with an FHA loan

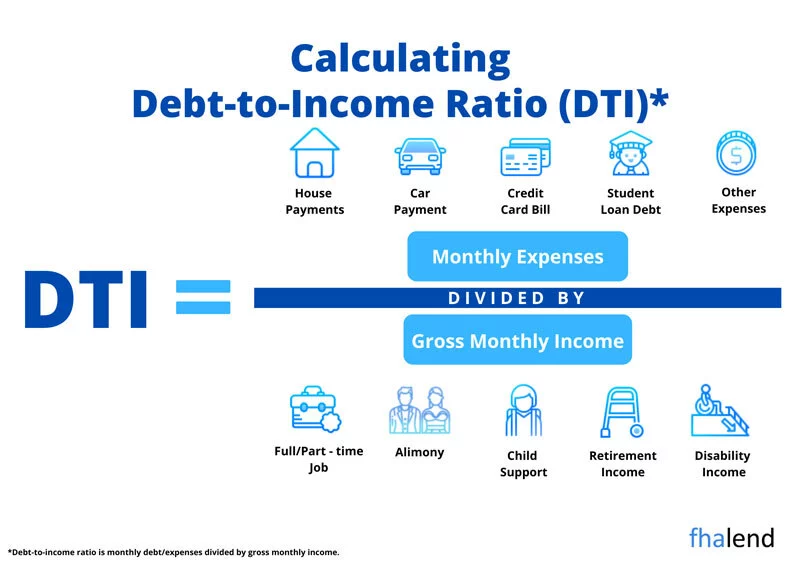

First, you’ll need to meet the FHA loan requirements (your debt-to-income ratio, loan-to-value) will be calculated, and also include having a steady job and a good credit score. You’ll also need to be able to afford mortgage insurance.

If you can meet these requirements, an FHA loan is a great option for borrowers with bad credit. It’s easy to qualify for, and it comes with a number of benefits that other mortgages don’t offer. So if you’re looking for a way to buy a home despite your low credit score, an FHA loan is definitely worth considering.

If you’re looking to buy or refinance your home, but your credit score is keeping you from qualifying for a conventional loan, don’t worry – you may still be able to qualify for an FHA loan. An FHA loan is a government-insured mortgage that requires less stringent credit qualifications than a conventional loan.

But before you can apply for an FHA loan, you need to make sure your credit score is in good shape. Here are 13 simple steps to take to fix your credit and qualify for an FHA loan with 620 credit score:

1. Check your credit report for errors.

Mistakes on your credit report can cause your credit score to drop, so make sure you check your report for errors and dispute any that you find.

2. Pay your bills on time.

One of the biggest factors in your credit score is your payment history, so make sure you always pay your bills on time.

3. Keep your credit utilization low.

Your credit utilization ratio is a measure of how much of your available credit you’re using, so try to keep it below 30%.

4. Don’t apply for too many loans or credit cards.

Applying for too many loans or credit cards can hurt your credit score, so only apply for what you need so you can qualify for FHA loan with 620 credit score.

5. Don’t max out your credit cards.

Maxing out your credit cards can also hurt your credit score, so try to keep your balances below 30% of your limit.

6. Don’t close old accounts.

Closing old accounts can actually hurt your credit score, so try to keep them open unless you have a good reason to close them.

7. Don’t open too many new accounts at once.

Opening too many new accounts at once can also hurt your credit score, so space out any new applications.

8. Make sure your information is up-to-date on your credit report.

any inaccurate information on your credit report can lower your credit score, so make sure all of your information is up-to-date.

9. Don’t co-sign a loan for someone else.

Co-signing a loan for someone else can hurt your credit score, so only do it if you’re absolutely sure you can afford it.

10. Keep an eye on your credit score.

Monitoring your credit score is one of the best ways to make sure your credit is in good shape. You can get a free credit report from Credit.com.

11. Try to build a good credit history.

Long credit history can help boost your credit score, so try to keep your accounts open and always pay on time so you can qualify for a FHA loan with 620 credit score.

12. Get a copy of your credit score regularly.

Knowing what your credit score is and how it changes over time can help you track your progress and identify any areas where you need to improve.

13. Be patient.

Improving your credit score takes time, so be patient and keep working on building good credit habits.

If you follow these steps, you’ll be on your way to a better credit score and a mortgage you can actually afford.

If you are looking for the best mortgage rates, fixing your credit and maximizing your credit scores will definitely get you the best mortgage rates.

FHA Loan With 620 Credit Score For First-Time Home Buyers

First-time homebuyers who are interested in an FHA loan may be wondering what the requirements are. An FHA loan is a mortgage that is insured by the Federal Housing Administration and is available to those who meet specific eligibility requirements. In order to qualify for an FHA loan, you must be a first-time homebuyer, which means that you have not owned a home in the past three years.

You must also have a credit score of at least 580, and your debt-to-income ratio must be less than 43%. If you want to qualify for FHA Loan With 620 credit score it will be fairly easy for you when you go with a mortgage broker without overlays. You might still have an issue at Chase or other banks however when you apply with us the min FICO we can go is 500.

An FHA loan may be a good option for first-time homebuyers who don’t have a lot of money saved up for a down payment. The down payment on an FHA loan is only 3.5%, and you may be able to get a mortgage with a down payment as low as $100. You also don’t have to pay mortgage insurance premiums if you have an FHA loan, which can save you a lot of money over the life of your mortgage.

There are a few other things that you should know about FHA loans. First, the maximum amount that you can borrow is $424,100. Second, FHA loans are available in all 50 states. Third, there are some restrictions on what types of properties you can buy with an FHA loan. Finally, FHA loans are not available to everyone; you must meet specific eligibility requirements in order to qualify.

March 2, 2022 - 9 min read