How Much House Can I Afford Versus Qualify From My Lender

In this article, we will discuss and cover how much house can I afford versus qualify from my lender. There is a right way and a wrong way to buy a home. People who do it the wrong way head out to open houses on the weekend or jump on real estate websites after work, see a place they like and go straight to making an offer. Without knowing what it would cost them every month or how it would affect their budget. See how much home you can afford in 5 minutes!

In this article (Skip to…)

The Right Way to Buy a Home

Here’s the right way to buy a home:

- Figure out what you can afford to spend each month.

- Determine the size of your down payment and where you’ll get it.

- Save your down payment if needed.

- Improve your finances and/or credit score if necessary.

- If buying will raise your monthly housing costs, get used to living on less money.

- Prequalify for a mortgage.

- Apply for mortgage preapproval.

- Find a home and make your offer.

There should be no ugly surprises when you buy your house. You should be very clear on the costs and how it will affect your budget.

How Much of a Home Can You Afford?

How do you determine what’s affordable for you when you buy a home? You could use a general rule, work with a mortgage calculator, ask a loan officer, or submit an application to a mortgage underwriter. However, the highest authority may be your own gut. Here’s why.

The common rule of thumb

Everyone likes a rule of thumb because it’s easy. You don’t have to be a math genius or (gasp) create a budget. One popular rule says you can borrow three times your annual gross income to buy a home. So, if you earn $75,000 per year, you can safely borrow three times that — $225,000. There are two HUGE flaws in this logic. First, it doesn’t account for mortgage rates. A $225,000 loan with a 4% interest rate has a principal and interest (P and I) payment of $1,074.

Mortgage Rates and Property Taxes Have Impact On Housing Payments

But for the same loan amount at a 6% interest rate, the P and I payments are $1,350. You can’t compute an affordable loan amount without considering the interest rate, mortgage insurance, and loan term. Second, the rule ignores your other expenses. If you’re financing a boat, RV, and college tuition, you may have less income available to pay a mortgage. And what’s affordable also depends on insurance costs and property tax rates in your area.

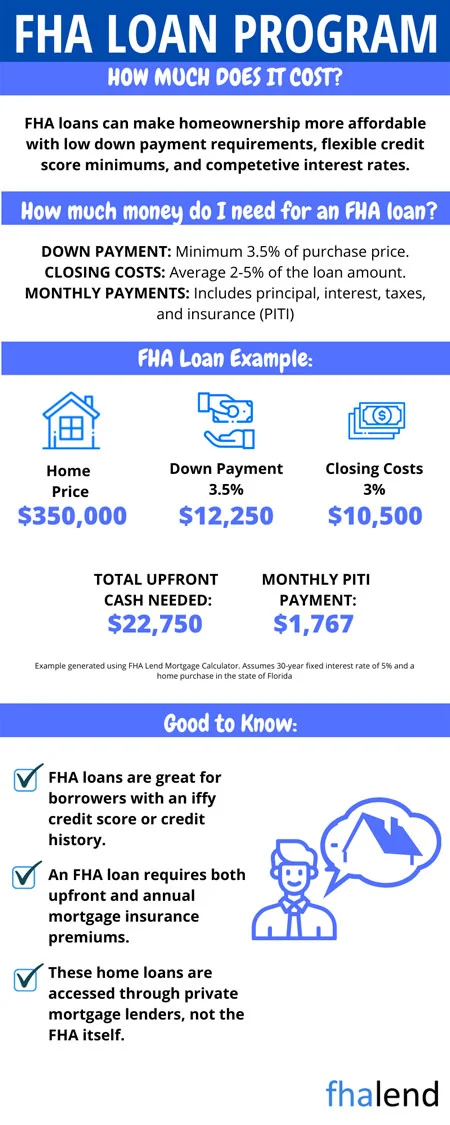

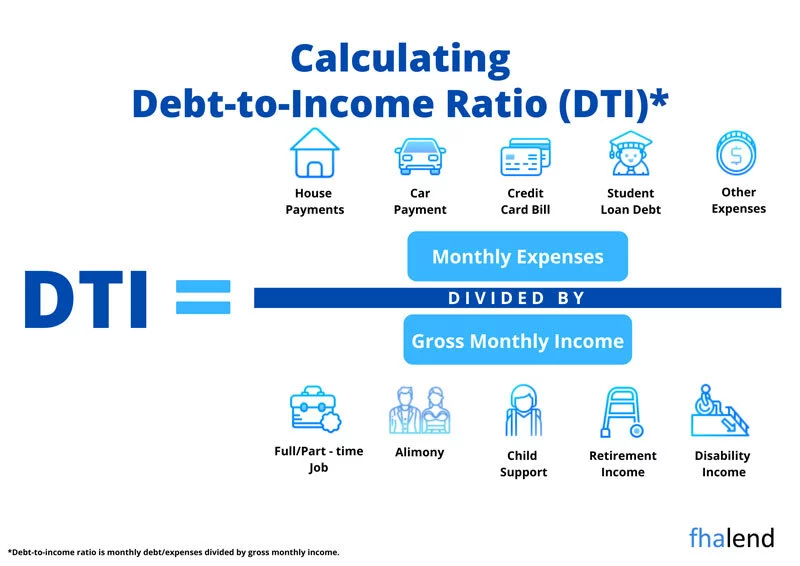

Mortgage calculators

Mortgage calculators use debt-to-income (DTI) ratios to come up with your maximum loan amount. Your DTI equals your proposed mortgage payment plus monthly payments for your student loans, credit cards, and other accounts (but not utilities or living expenses) divided by your gross (before-tax) monthly income. The lender also calls the DTI your “back-end” or “bottom” ratio. Most lenders also consider an additional ratio — the “front-end” or “top” ratio. This number is just your proposed housing payment divided by your gross monthly income.

Debt to Income Ratio Biggest Factor On How Much Home You Can Afford

Mortgage calculators frequently set this number at a maximum of 36 to 43 percent. If a lender says you have an ugly back-end, it means your expenses are too high and not that the underwriter is criticizing the fit of your pants! This calculation has limits as well. First, it does not consider your credit rating. Applicants with better credit get approved with higher DTIs than those with poorer credit. It doesn’t consider payment shock. “Payment shock” is the extent that your new house payment exceeds your current one. If your rent right now is $1,000 per month, but your new mortgage, property taxes, and insurance costs are $2,000 per month, you’re looking at a 200% payment shock. It’s not uncommon for lenders to allow a payment shock of no more than 150%, especially with a low down payment.

Automated Underwriting System Approval

Automated underwriting systems (AUS) underwrite most mortgage applications in the US. They look at your income, assets, and credit report and apply formulas. Then they spit out an underwriting decision. Once you have approval through AUS, all you need to do is submit documents proving that the information on your loan application is correct.

AUS Approval Versus How Much You Can Afford

Assuming that the property you choose meets the lender’s guidelines, you should be able to close your loan and purchase your property. This is a much more accurate way to see how much you can afford to spend on a house. However, you’ll have to provide your information and proof of income and assets to get it. In addition, AUS does not process information like your job stability or the strength of your industry. It can’t handle incorrect information on your credit report and it can’t tell if bad credit was caused by you or something that was not your fault.

Human underwriters

Human underwriters can deal with things that software cannot. They can adjust your maximum loan amount up or down according to guidelines. Here are some factors only humans can see that may get you a bigger loan:

- Your future income will increase a lot (maybe you just graduated from medical school).

- You have a part-time job or your spouse plans to get a new job but that income doesn’t officially count.

- You’re buying an energy-efficient house.

These factors could lower your loan amount:

- You’re renting from your Mom and can’t prove that you paid her.

- You change jobs frequently and your earnings don’t increase.

- Your bank statements show bounced checks.

Human underwriters can consider intangibles that software cannot. That may work for you or against you.

Housing Payment On Your First Home Purchase

Only you know how well a new house payment might fit into your life. On paper, you may qualify for a lot more or a lot less than you could safely spend on a house. And there are some factors even human underwriters don’t consider. Only you know if you’re planning to start a business, send a child off to college, or kick grown children out of your house. Or that you skydive, donate large amounts to charity, are planning a trip around the world, or that you have a gambling or shopping habit that’s not exactly under control.

Determining How Much You Can Afford On Your First Home Purchase

So when determining what you can afford, envision your life in one, five, or ten years. Plan for your goals and the money you’ll need to meet them. Decide what payment amount works for you and then use a mortgage calculator to determine the loan amount you get for that payment. And remember — rules of thumb are great, but only if you’re buying thumbs. Get a custom mortgage quote in 5 minutes.

What’s Next:

Your Mortgage Payment: PITI Home Affordability Worksheet (Calculator) Practicing for Homeownership Saving a Down Payment Improving Your Credit Financial Health

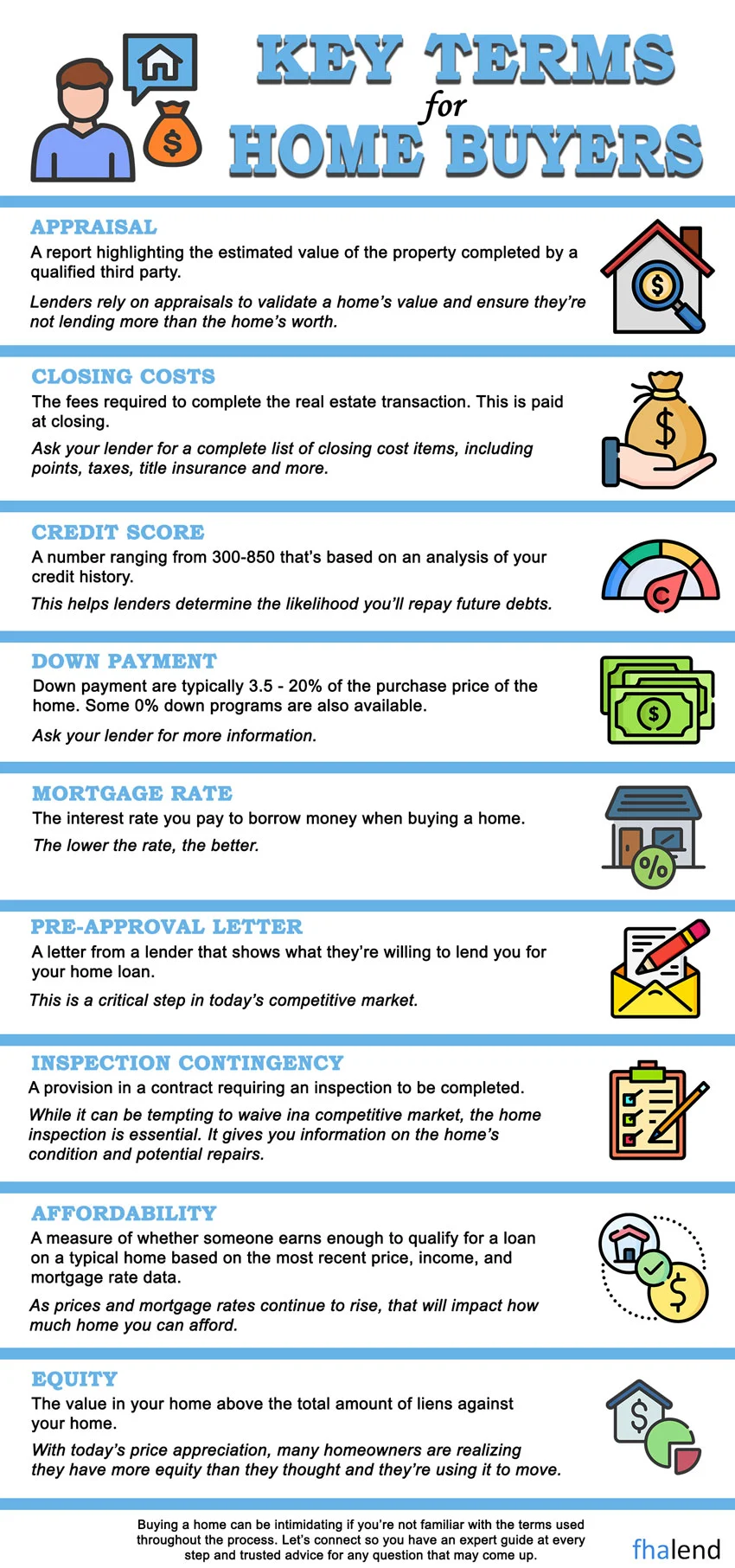

We Will Cover and Discuss How Much House You Afford As A New Homeowner

Once you have decided to purchase a home, the first step you need to do is to see how much of a mortgage loan you qualify for. To determine how much you can qualify for, you need to contact a lender. Whether it is a bank, credit union, mortgage broker, or mortgage banker, you need to choose who you will go to.

Qualifying For A Mortgage With Bad Credit

If your credit scores are perfect and you have solid income and assets, you can go to any lender. If you have had prior bad credit and have lower scores, you may need to go to a specialty lender like us at FHA lend mortgage who specializes in helping borrowers with not-so-perfect credit and who specializes in home loans with bad credit. If you decide to purchase a higher-end home, you may need to seek a lender who specializes in Jumbo Mortgages. Depending on your financial status and situation, the key question is not how much can you get qualified for but how much house can I afford

Mortgage Lender Will Give You Maximum Loan Limit You Qualify For

When you contact a mortgage loan originator, the loan originator will ask you to complete a 4-page mortgage loan application which is also known as 1003. Once you complete 1003, your mortgage loan officer will then run credit. If you are self-employed, your loan officer will request to see your tax returns, two years tax returns with all schedules. Income qualification is the most important factor in determining how much you qualify for.

What You Qualify For Versus What You Can Afford

Once your mortgage loan originator has a solid monthly gross income figure. The loan officer will look at your monthly liabilities such as minimum credit card payments, auto loans, student loans, installment loans, child support payments if any, alimony payments if any, and any other monthly obligations. After careful review and analysis of your mortgage application, credit, credit history, monthly obligations, and reviewing your automated approval per DU FINDINGS and/or LP FINDINGS, your mortgage loan officer will give you the maximum amount of mortgage you qualify for. The loan officer will give borrowers the maximum price range of the homes they should be shopping for.

Pre-Approval Versus How Much House Can I Afford

When you get pre-approval from your mortgage loan originator, the loan originator will give you the maximum amount of mortgage you qualify for. The loan officer will give you the maximum home you can purchase with property taxes, homeowners insurance, and other added expenses such as homeowners association dues and flood insurance. The lender will not take into consideration the key question you should always keep in mind: ” How much house can I afford”.

Factors Lenders Not Taking Into Consideration When Calculating Debt To Income Ratio

Lenders do not take into account each family’s monthly expenses except those related to income, and minimum monthly debt obligations that are being reported on your credit report. They do not consider personal expenses. Just because under the lender’s eyes you may qualify for a mortgage loan, you may be taking on a larger financial burden where you may be buying too much house where you will struggle every month just to barely meet your minimum housing payment.

Things You Should Take Into Account On How Much House Can I Afford

When thinking about how much house can I afford, keep in mind that your mortgage lender does not consider utilities and maintenance costs associated with homeownership. Expenses that come along with homeownership include water expenses and scavenger expenses. As a renter, water bills and garbage bills were taken care from the landlord. Now you will be responsible for. Lenders do not calculate utilities when figuring out expenses.

Maintenance Costs For New Homeowners

Another major factor you need to consider when thinking about how much house can I afford is maintenance.. Homeowners are responsible for general maintenance such as landscaping, snow plowing, and general repairs. Some repairs can be quite costly. For example, if you have a well and the well needs major repairs, you may be talking over $5,000 plus.

High-Cost Maintenance Items For Homeowners

Same with heating and air conditioning systems where a replacement of a furnace or central air conditioning system can run into the thousands. Many homeowners have children who they send to private schools instead of public schools. Private school tuition can get quite costly especially if you have multiple children.

Other Expenses Besides Housing Expenses

Many homeowners also have other expenses such as graduate school, medical expenses, hobbies, travel, and other expenses that the mortgage underwriter did not calculate in qualifying for a mortgage. It is the responsibility of the home buyer to make sure they do not buy too many houses and consider other expenses they have besides just going by the mortgage amount the mortgage lender gave them. Remember that How Much House Can I Afford should be an extremely important factor when offering on a home and going through the mortgage loan application and mortgage approval process.

March 15, 2022 - 8 min read