NO DOC Mortgage Loans Requirements in 2022

A no doc residential loan is a mortgage where the borrower doesn’t have to provide documentation of their income or assets. So are no doc mortgage still available? The answer is Yes however you need to find a proper mortgage broker who is experienced with this type of loan and is signed up with banks or a wholesale lender doing those loans.

This type of loan can be helpful for borrowers who are self-employed or have income that’s difficult to verify. No-doc mortgage loans typically have higher interest rates and require a larger down payment than other types of loans. If you’re thinking about applying for a no-doc mortgage loan, here are some things you should know:

- You’ll need to have strong credit to qualify. Lenders will be looking at your credit score and history to determine whether or not you’re a good candidate for a no doc loan. If you’ve missed any payments or have a high balance on your credit cards, it may be difficult to get approved.

- You’ll need to have a large down payment saved up. Because no-doc loans are considered to be higher risk, lenders will typically require a larger down payment than they would for other types of loans.

- You may have to pay a higher interest rate. Again, because no doc loans are considered to be higher risk, you may have to pay a higher interest rate than you would with another type of loan.

- You’ll need to be prepared to provide alternative documentation. While you won’t have to provide traditional documentation like W-2s or tax returns, lenders will still want to see some proof of your income and assets. Be prepared to provide bank statements, asset documents, and other documentation to prove that you can afford the loan.

If you’re considering a no-doc loan, make sure you understand the pros and cons before applying. This type of loan isn’t right for everyone, but it can be a good option if you’re self-employed or have income that’s difficult to verify. FHA Lend does no doc mortgage loans and we are available for you here please feel free to fill up the form and one of our senior loan officers will contact you and will go through your loan scenario to see if you qualify or not.

In this article (Skip to…)

Mortgage Loan Without Income Proof

The first thing to understand is that when you’re not providing proof of income, the lender is taking on more risk. As such, you can expect to pay a higher interest rate for this type of loan. Additionally, you’ll likely need to make a larger down payment than you would with a traditional mortgage loan.

One of the biggest advantages of getting a mortgage loan without income documentation is that it can be easier to qualify for. If you have a good credit score and a steady job, you may be able to get approved even if you don’t have extensive income documentation. This can be a great option for people who are self-employed or have other sources of income that are difficult to document.

Another advantage is that these types of loans can be faster and easier to close than traditional mortgages. This is because there’s less paperwork involved and the underwriting process is typically simpler.

However, there are also some significant drawbacks to getting a mortgage loan without income documentation. One of the biggest is that you may not be able to get as much money as you would with a traditional loan. This is because the lender is taking on more risk by lending to you without proof of income.

Additionally, if you’re not able to make your payments, the foreclosure process can be much quicker with these types of loans. This is because the lender doesn’t have to go through the same lengthy process as they would with a traditional loan.

No Income Verification Mortgage Refinance

A no-income verification mortgage refinance is a type of loan that allows borrowers to refinance their homes without having to provide documentation of their income. This can be beneficial for borrowers who are self-employed or who have other sources of income that are difficult to document. However, it is important to note that this type of loan typically comes with a higher interest rate than a traditional mortgage. These loans will have similar mortgage rates compared to regular purchase mortgage loans and qualifications based on LTV will go up to 80 LTV leaving 20% equity in your residence.

Lenders With No Doc Verification

So where do you get a no income verification mortgage? There is a limited amount of wholesale lenders like Quantic bank for example who specialize in this type of loan. FHA Lend works with many more like the bank to provide our customers with the best options available right now on the market. We will look into your credit score, down payment, and if the property will be cash flowing or not. If you’re ready please apply here. We will get back to you with answers at no charge.

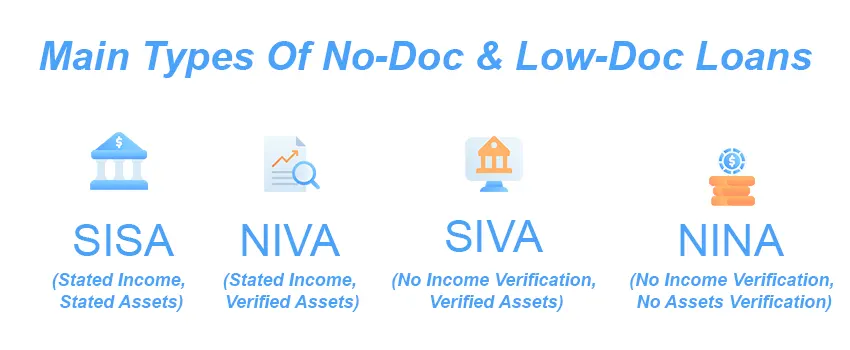

No Doc Mortgage Loans Type

There is a variety of no-doc mortgage loans available nowadays. To start with just loans without tax returns where the borrower needs to provide other required documents to (NINA) No asset and no income mortgage loans. The loans which don’t require any job history are called NINJA loans which stand for no income, no job, and no assets loans. This type of loan is almost instinct nowadays.

Light Doc Mortgage Loans

The process for applying for a light doc mortgage loan is similar to the process for applying for a traditional mortgage loan. Borrowers will need to complete a loan application and provide documentation of their income and assets. However, Light Doc Mortgage Loans typically require less documentation than traditional mortgage loans. This can make the process quicker and easier for borrowers who may not have all of the required documentation on hand.

Light Doc Mortgage Loans can be a good option for borrowers who:

- Have less than perfect credit

- Do not have all of the required documentation to qualify for a traditional mortgage loan

- Are self-employed or have income that is difficult to document

- Need to close on their loan quickly

Light Doc Mortgage Loans can be a good option for borrowers who need to close on their loan quickly or who may not have perfect credit. However, it is important to remember that light doc mortgage loans typically come with higher interest rates and fees than traditional mortgage loans.

No Income No Asset Loans (NINA)

No Income No Asset Loans (NINA) are a type of loan that does not require borrowers to have any income or assets in order to qualify. This makes them ideal for people who are self-employed, freelancers, or otherwise may not have a steady source of income. NINA loans can be used for both home purchases and refinances.

The main advantage of a NINA loan is that it allows people to qualify for a loan who would not normally qualify. This can be helpful if you are trying to purchase a home or refinance your current home but do not have the income or assets required by most lenders. Another advantage is that NINA loans often come with lower interest rates than other types of loans, making them more affordable in the long run.

Downside Of No-Doc Mortgage Loan Programs

The downside of NINA loans is that they are often harder to qualify for and may require a higher down payment than other types of loans. Additionally, NINA loans may have stricter eligibility requirements, such as a minimum credit score.

If you are considering a NINA loan, it is important to compare offers from multiple lenders to ensure you are getting the best deal possible. It is also important to understand the terms and conditions of the loan before signing any paperwork.

No Income No Asset Loans (NINA) can be a helpful tool for people who do not have a steady source of income or assets.

No Documentation Residential Mortgage Loan Requirements

If you’re interested in taking out a no-doc loan, there are a few requirements you’ll need to meet in order to qualify. The lender will underwrite the property and is more concerned with the investment property’s potential cash flow

Credit Score

First, you’ll need to have a good credit score (please apply with details so we can review your case). This is because no-doc loans are considered higher risk by lenders due to the lack of documentation. As such, they’ll want to see that you’re a responsible borrower who is likely to repay the loan on time.

Income

You’ll also need to have a steady income in order to qualify for a no-doc loan. This is because lenders will want to see that you have the ability to repay the loan. Income can come from a variety of sources, such as employment, self-employment, investment income, or even retirement income. The borrower needs to meet the 45% debt to income ratio based on Fannie Mae guidelines

Minimum 10% Down Payment

You’ll typically need to make a larger down payment on a no-doc loan than you would for a traditional loan. This is because lenders view no-doc loans as higher risk and want to offset that risk with a larger down payment.

Type Of Property

The financing can be for a primary residence, second home, or investment property

No Tax Return

We don’t require tax returns from your past 2 years however in some cases we do require your bank statements from the past 2 months.

Stated Income 2nd Mortgage (SISA)

The area called also stated income-stated asset loans. With this type of mortgage, you don’t have to provide documentation of your income or assets in order to qualify. This can make the process of getting a loan much easier and faster.

The true state income mortgage was only available for non-occupying borrowers who wanted to buy an investment property however nowadays some brokers like we do have an option for residential borrowers to help them to acquire a property with programs like that or other programs like asset depletion or DSR mortgage program. Please call us or apply so we can help you to find loan products to fit best your needs.

April 5, 2022 - 7 min read