FHA Loan Limits in Wyoming

If you’re looking to buy a home in Wyoming, an FHA loan can be a great option. Check below FHA loan limits in Wyoming to see what is the maximum loan amount available in your county. With relatively lenient eligibility requirements and low down payment, FHA loans make buying a home more accessible for many people. Be sure to compare offers from multiple lenders to get the best deal on your loan.

If you’re looking to buy a home in Wyoming, an FHA loan can be a great option. Check below FHA loan limits in Wyoming to see what is the maximum loan amount available in your county. With relatively lenient eligibility requirements and low down payment, FHA loans make buying a home more accessible for many people. Be sure to compare offers from multiple lenders to get the best deal on your loan.

FHA Loan Limits in Wyoming are calculated using a formula specified by the Housing and Economic Recovery Act of 2008 (HERA). The loan limit is equal to 115% of the median home price in the county, with a maximum limit of $625,500.

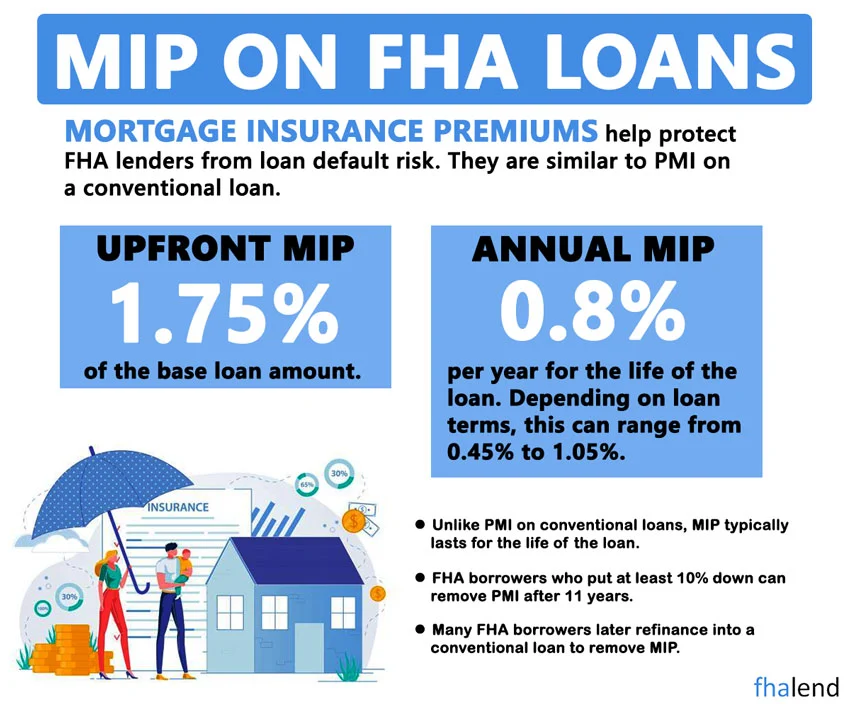

In order to get an FHA loan in Wyoming, you’ll need to meet the standard eligibility requirements set forth by the Federal Housing Administration. These include having a steady income, good credit history, and sufficient savings for a down payment and closing costs. You’ll also need to purchase homeowners insurance and pay an upfront mortgage insurance premium.

FHA Loan Limits in Wyoming by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| WYOMING | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| WYOMING | $472,030 | $604,400 | $730,525 | $907,900 | $170,000 |

| WYOMING | $472,030 | $604,400 | $730,525 | $907,900 | $35,000 |

| ALBANY | $472,030 | $604,400 | $730,525 | $907,900 | $332,000 |

| BIG HORN | $472,030 | $604,400 | $730,525 | $907,900 | $209,000 |

| CAMPBELL | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| CARBON | $472,030 | $604,400 | $730,525 | $907,900 | $209,000 |

| CONVERSE | $472,030 | $604,400 | $730,525 | $907,900 | $253,000 |

| CROOK | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

| FREMONT | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| GOSHEN | $472,030 | $604,400 | $730,525 | $907,900 | $201,000 |

| HOT SPRINGS | $472,030 | $604,400 | $730,525 | $907,900 | $223,000 |

| JOHNSON | $472,030 | $604,400 | $730,525 | $907,900 | $281,000 |

| LARAMIE | $472,030 | $604,400 | $730,525 | $907,900 | $341,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $316,000 |

| NATRONA | $472,030 | $604,400 | $730,525 | $907,900 | $266,000 |

| NIOBRARA | $472,030 | $604,400 | $730,525 | $907,900 | $167,000 |

| PARK | $472,030 | $604,400 | $730,525 | $907,900 | $345,000 |

| PLATTE | $472,030 | $604,400 | $730,525 | $907,900 | $207,000 |

| SHERIDAN | $489,900 | $627,150 | $758,100 | $942,100 | $340,000 |

| SUBLETTE | $472,030 | $604,400 | $730,525 | $907,900 | $304,000 |

| SWEETWATER | $472,030 | $604,400 | $730,525 | $907,900 | $267,000 |

| TETON | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $688,000 |

| UINTA | $472,030 | $604,400 | $730,525 | $907,900 | $282,000 |

| WASHAKIE | $472,030 | $604,400 | $730,525 | $907,900 | $177,000 |

| WESTON | $472,030 | $604,400 | $730,525 | $907,900 | $295,000 |

Max Loan Amount in Sheridan County in Wyoming

If you live in Sheridan, Big Horn, Ranchester, Story, Arvada, Parkman. Clearmont, Ucross or Dayton you can borrow up to $489,900 for a single-home family. For duplex, a maximum FHA loan amount is set at $627,150. When purchasing a triplex in Wyoming and in Sheridan county you are able to get $758,100 to finance the property. When you are a first-time investor and you want to do a house hacking (renting 3 units and living rent-free in one of them as a primary residence) a lender can lend you up to $942,100. You need to have a 3,5% down payment so you can buy a 4-unit property for almost $942,133.

What is a Maximum Loan Amount Available in Teton County in Wyoming?

In Tenton county there are the highest FHA loan limits in Wyoming. They are set at $970,800 for a 1-unit house. When purchasing two flats, a bank can lend you as much as $1,243,050. To buy a triplex you can borrow $1,502,475. If you want to purchase a fourplex you can get financing for $1,867,275, which means the house price can be as high as $1,932,629.625 with 3,5% down payment ($65,354.625).

Above FHA loan limits in Wyoming are available for the below cities in Tenton county :

- Jackson, WY

- Alta, WY

- Teton Village, WY

- Wilson, WY

- South Park, WY

- Rafter J Ranch, WY

- Kelly, WY

- Moose Wilson Road, WY

How FHA Loan Limits in Wyoming Are Calculated?

FHA loan limits in Wyoming in 2023 are calculated based on the median home price in each county. The median home price in counties in Wyoming is the point at which half of the homes sell for more and half for less. In order to find the median home price, all transaction prices for homes that sold in a particular county during a specified time period are collected and ranked from highest to lowest. The home price at the exact middle of this list is the median home price.

FHA loans are available for both purchase and refinance transactions. Borrowers can choose a fixed-rate or an adjustable-rate mortgage (ARM) product.

The maximum FHA loan limits in Wyoming vary depending on the median home price in each county in Wyoming where the property is located. The table above shows the maximum FHA loan limits in Wyoming for 2023:

9 Steps To Apply For FHA Loan in Wyoming

The process of applying for an FHA loan is nine steps long, but it doesn’t have to be difficult. In fact, with a little time and effort, you can get through the entire process quickly and easily. Here are those nine steps:

1. Get pre-approved by a lender.

This is the first step in the process and one that you absolutely must do before moving forward. Without pre-approval, you won’t know how much money you have to work with and will have a harder time finding a home that fits your budget.

2. Find a real estate agent.

Once you have pre-approval in hand, it’s time to find a real estate agent who can help you find the right home. Be sure to interview several agents before making a decision.

3. Find the right home.

This is the fun part! Once you have a real estate agent, they will help you find homes that fit your budget and meet your needs. Make sure you first check also FHA loan limits in Wyoming if you going to apply for an FHA-insured mortgage.

4. Make an offer on a home.

Once you’ve found the perfect home, it’s time to make an offer. Your real estate agent will help you with this process.

5. Get a loan estimate from your lender.

After your offer has been accepted, it’s time to get a loan estimate from your lender. This document will outline the estimated costs of your loan and give you an idea of what your monthly payments will be.

6. Get an appraisal.

In order to get your loan, the lender will require an appraisal of the home you’re buying. This is to ensure that the home is worth the amount you’re borrowing.

7. Get a home inspection.

Once your appraisal is complete, it’s time to get a home inspection. This is to ensure that there are no major problems with the home you’re buying.

8. Complete your loan application.

Now it’s time to fill out your loan application and provide all of the required documentation to your lender.

9. Close on your loan and move into your new home!

Congratulations, you’ve made it through the entire process! Now it’s time to close on your loan and move into your new home.

With a little time and effort, you can easily complete the process of applying for an FHA loan. Just be sure to work with a reputable lender and real estate agent, and you’ll be well on your way to homeownership.

Top Common 6 Issues When Applying for FHA Loan in Wyoming

If you’re thinking of applying for an FHA loan, be sure to research the pros and cons carefully before making your decision. And if you have any questions, our team at FHA Lend is here to help! Give us a call or fill out our online form to get started.

When it comes to buying a home, there are many financing options available. But for first-time homebuyers or those with low incomes, the Federal Housing Administration (FHA) loan program can be a good choice.

The FHA insures loans that are available to first-time homebuyers and others who might not qualify for a traditional mortgage. But there are some potential pitfalls with FHA loans to be aware of before you apply.

Your Credit Score May Be Too Low For FHA Loan

The minimum credit score required for an FHA loan is 500. However, keep in mind that your lender may require a higher credit score depending on their policies. If you have a low credit score and are worried about qualifying for an FHA loan in Wyoming, there are a few things you can do to improve your chances. First, try to improve your credit score by paying off any outstanding debts and making all of your payments on time. You can also dispute any errors on your credit report that may be dragging down your score. Another option is to apply for an FHA loan with a cosigner who has good credit. This can help you qualify for a lower interest rate and may make it easier to get approved.

You May Not Have Enough Income To Qualify For FHA Loan

If you don’t have enough income to qualify for an FHA loan in Wyoming, there are a few things you can do. You can try to get a co-signer on the loan or look into other financing options. You may also be able to get financial assistance from a family member or friend. Whatever you do, make sure you explore all of your options before you decide on a loan.

You Could Have Trouble Qualifying If You’re Self-employed

As a self-employed individual, you may be wondering if you’re eligible for an FHA loan. The answer is yes, you can apply for an FHA loan as a self-employed individual. However, there are a few things that you’ll need to keep in mind when doing so.

For starters, it’s important to know that the FHA requires borrowers to have a steady income in order to qualify for a loan. This means that if your income fluctuates from month to month or year to year, it could make it more difficult to qualify for an FHA loan in Wyoming. Additionally, the FHA usually requires borrowers to have a minimum of two years of consistent income in order to qualify. So if you’ve only been self-employed for a year or less, you may have a more difficult time qualifying for an FHA loan.

Another thing to keep in mind is that, as a self-employed borrower, you’ll likely need to provide additional documentation in order to prove your income. This could include tax returns, bank statements, and other financial documents. So if you’re self-employed and considering an FHA loan, make sure you’re prepared to provide additional documentation to prove your income.

You May Need A Higher Down Payment

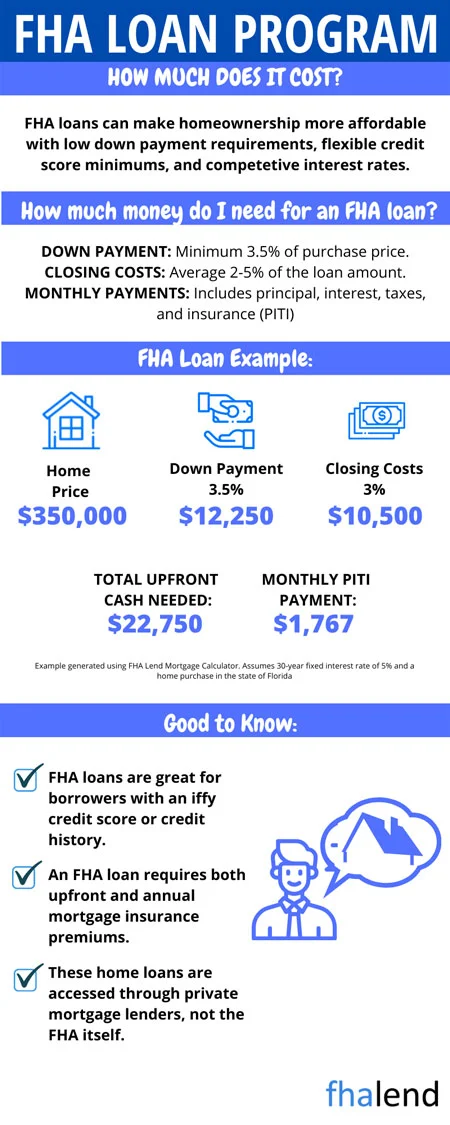

When you’re ready to buy a home, one of the first things you’ll need to do is apply for a mortgage in Wyoming. If you’re looking for a loan from the Federal Housing Administration (FHA), you’ll need to have a down payment of at least 3.5% of the purchase price.

While this may seem like a lot of money, it’s important to remember that your down payment is just the beginning of your home-buying journey. You’ll also need to factor in closing costs, moving expenses, and other associated costs when budgeting for your new home.

If you’re not sure how much you can afford to spend on your new home, be sure to talk to a lender or financial advisor. They can help you understand your options and find a mortgage that’s right for you.

You Could Be Stuck With A Higher Interest Rate

If you’re looking to apply for an FHA loan, you might be surprised to find out that you could end up paying a higher interest rate than you expected. Here’s what you need to know about this potential cost, and how to avoid it.

When you apply for an FHA loan in Wyoming, your interest rate is determined by a number of factors. One of these is your credit score. If your credit score is on the lower end, you may end up paying a higher interest rate than someone with a higher credit score.

Another factor that can affect your interest rate is the type of property you’re buying. If you’re buying a fixer-upper, for example, your interest rate may be higher than if you were buying a turnkey home. Finally, the size of your down payment can also affect your interest rate. If you’re putting down less than 20%, you may have to pay a higher interest rate.

- If you’re concerned about paying a higher interest rate, there are a few things you can do to try to reduce it. First, make sure you have a good credit score. You can check your credit score for free on sites like Credit Karma.

- Second, consider making a larger down payment. This will show lenders that you’re serious about the loan and will help you get a lower interest rate.

- third, try shopping around for lenders. Not all lenders offer the same interest rates, so it’s important to compare rates from a few different lenders before you choose one.

If you’re stuck with a higher interest rate than you expected, there are still ways to save on your mortgage. By shopping around and comparing rates, you can make sure you’re getting the best deal possible.

House Price is Higher Than FHA Loan Limits in Wyoming

Your FHA mortgage loan can fall through if the house price subtracted for a 3,5% downpayment will be higher than the FHA loan limits in Wyoming for a particular city. To be able to buy the more expensive house you need to come up with the difference at the closing. This way you will be able to qualify for an FHA loan and the FHA-approved lender will lend you money.

Gift Fund Requirements For FHA Loan Qualification in Wyoming

For many homebuyers, an FHA loan is the perfect choice. These loans are backed by the Federal Housing Administration, making them easier to qualify for than a traditional mortgage. One of the biggest benefits of an FHA loan is that you can use a gift fund to help with your down payment. But there are strict rules around these gifts, so it’s important to understand the requirements before you apply for a loan.

Here are the basics of the FHA gift fund requirements:

- The donor must be a close relative, such as a parent, child, or sibling.

- The donor cannot be the borrower’s employer or labor union.

- The donor cannot be someone with an interest in the property, such as the seller.

- The gift must be given with no expectation of repayment.

- The gift cannot be used to cover any of the borrower’s closing costs.

- The donor must provide a written statement that says the money is a gift and does not need to be repaid.

The donor must provide proof of the funds, such as a bank statement or canceled check.

Wyoming Down Payment Assistance Program

Wyoming Down Payment Assistance Program

The Wyoming Community Development Authority (WCDA) administers two down payment assistance (DPA) programs. Both loans are up to $10,000 in size.

You’ll need a FICO score of 620 or better, and must contribute at least $1,500 toward your purchase, though that may be a gift.

The programs are:

- Home$tretch DPA: “Gift money” that has a 0.080% interest rate (0.080% APR) with no monthly payments, only “upon sale of the home, refinance or 30-year maturity”

- Amortizing DPA: Paid down in full with low monthly payments over 10 years

The WCDA’s website has additional information. And, on HUD’s list of other homeownership assistance programs in Wyoming, see more..