FHA Loan Limits in Vermont

FHA loan limits in Vermont are estimated according to an equation specified in the National Housing Act. This formula results in a “base loan limit” for each county. The base loan limit is the lower of:

FHA loan limits in Vermont are estimated according to an equation specified in the National Housing Act. This formula results in a “base loan limit” for each county. The base loan limit is the lower of:

- The greater of 107 percent of the median house price in the county, or

- The floor amount of $472,030.

- In high-cost areas, the limit can be as high as $492,200.

If you’re looking to get an FHA loan in 2023, here’s what you need to know about how the loan limits in Vermont are calculated. The first step is to find the median home price in your county. The best way to do this is to look at local real estate listings or check with a real estate agent in your area.

Once you have the median home price, you can use the below table to accurately estimate you FHA loan limits in Vermont for the county you purchasing a house in to figure out how much you’re eligible for. This will take into account things like your income and existing debt obligations so that you can get an accurate estimate.

Once you know how much you’re eligible for, you can start shopping for a home within your budget. Keep in mind that you’ll need to factor in things like closing costs and down payment when coming up with your budget.

If you have any questions about the loan limit in your area, or how to calculate it, be sure to talk to a loan officer. They’ll be able to give you more information and help you through the process.

FHA Loan Limits in Vermont By County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADDISON | $472,030 | $604,400 | $730,525 | $907,900 | $285,000 |

| BENNINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $261,000 |

| CALEDONIA | $472,030 | $604,400 | $730,525 | $907,900 | $171,000 |

| CHITTENDEN | $492,200 | $630,100 | $761,650 | $946,550 | $428,000 |

| ESSEX | $472,030 | $604,400 | $730,525 | $907,900 | $100,000 |

| FRANKLIN | $492,200 | $630,100 | $761,650 | $946,550 | $428,000 |

| GRAND ISLE | $492,200 | $630,100 | $761,650 | $946,550 | $428,000 |

| LAMOILLE | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| ORANGE | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| ORLEANS | $472,030 | $604,400 | $730,525 | $907,900 | $179,000 |

| RUTLAND | $472,030 | $604,400 | $730,525 | $907,900 | $200,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| WINDHAM | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| WINDSOR | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

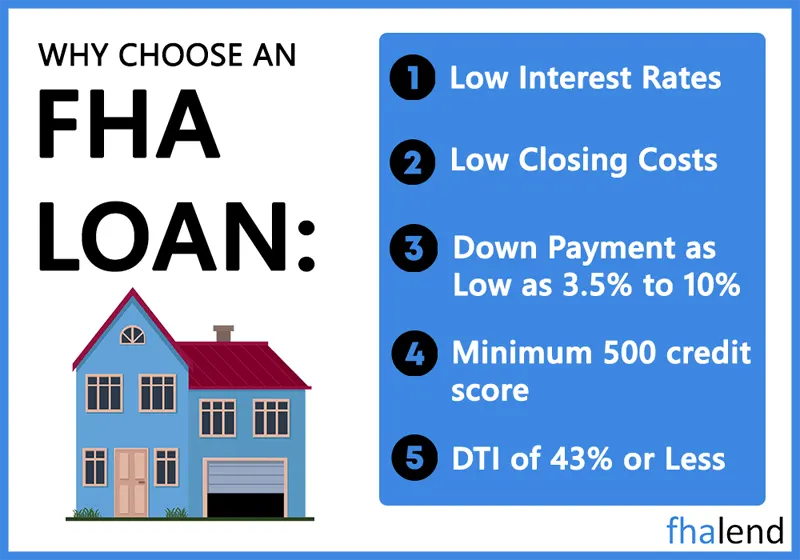

The FHA (Federal Housing Administration) offers a number of great benefits to homeowners who choose an FHA loan. These benefits may include lower interest rates, lower down payment requirements, and more flexible qualifying criteria than traditional mortgage loans. Some of the top benefits of getting an FHA loan include:

Benefits of FHA Loan in Vermont

1. Lower interest rates

Because the FHA is helping to guarantee your loan, lenders are often willing to offer lower interest rates than they would with other types of loans. This can help you save money on monthly payments and reduce the overall cost of your mortgage over time.

2. Lower down payment requirements

With an FHA loan, you may be able to get approved for a mortgage even if you don’t have a large down payment saved up. Many lenders will allow you to make a down payment of as little as 3-5%, with some programs even requiring no down payment at all.

3. Easier qualifying criteria

In general, it can be much easier to qualify for an FHA loan than a conventional mortgage loan, especially if you have less-than-perfect credit or other issues that might make it difficult to get approved. This can help open up home ownership to more people who may not otherwise have been able to buy a house.

Overall, getting an FHA loan can offer many great benefits for homeowners looking for affordable and flexible financing options. Whether you’re buying your first home or refinancing an existing mortgage, be sure to explore all the benefits of an FHA loan and see if it’s the right choice for you.

Overall, getting an FHA loan can offer many great benefits for homeowners looking for affordable and flexible financing options. Whether you’re buying your first home or refinancing an existing mortgage, be sure to explore all the benefits of an FHA loan and see if it’s the right choice for you.

TOP 5 FHA High-Cost Areas in Vermont

1. Burlington

As one of the largest cities in Vermont, Burlington offers all of the conveniences of a big city along with a laid-back vibe that you can only find in New England. With plenty of shopping and dining options as well as easy access to outdoor recreation areas like Lake Champlain and Camel’s Hump State Park, it is no surprise that homes here are among the priciest in the state.

2. South Burlington

This hip, up-and-coming city has a lot to offer, including an abundance of tech companies and startups that have helped spur economic growth in the area. Along with this, South Burlington also boasts plenty of entertainment options like museums, theaters, and festivals that draw people from all across the state. And with its close proximity to the mountains, it’s no wonder why homes in South Burlington are some of the most expensive in Vermont.

3. Barre

As one of the largest cities in central Vermont, Barre offers residents plenty of job opportunities as well as cultural attractions like local art galleries and performance venues that appeal to a wide range of interests. And with its affordable housing, beautiful parks, and easy access to nature preserves and recreational areas, it’s no wonder why Barre is one of the most desirable cities in Vermont.

4. Middlebury

This quaint college town offers a unique combination of historic charm and modern amenities, making it an ideal choice for anyone looking for a balance between urban living and small-town vibes. In addition to its bustling downtown area, Middlebury also boasts plenty of outdoor recreation opportunities like hiking trails and ski resorts that appeal to both locals and tourists alike.

5. Colchester

As one of the fastest-growing cities in Vermont, Colchester has managed to maintain its small-town feel in the midst of rapid development. With easy access to quality schools, beautiful parks, and plenty of local shops and restaurants, it’s no wonder why homes here are some of the most sought-after in Vermont.

If you are looking for an upscale place to live or just exploring the state, these top 5 most expensive cities in Vermont have something to offer everyone. So why not check them out today? And be sure to let us know what your favorite city is in the comments section below!

With its bustling downtown areas, high quality of living, and endless opportunities for fun and recreation, there is something for everyone in these great cities. So why not start your search today? And be sure to let us know what your favorite city is in the comments section below

Steps to Qualify For FHA Loan In Vermont

The FHA qualification process is relatively simple and easy to understand. In order to qualify, you will need to have a steady income, a good credit score, and a down payment of at least 3.5%. Here are the steps you need to take in order to qualify:

- Get a copy of your credit report from all three major credit reporting agencies.

- Review your credit report for any errors or negative items that could hurt your chances of qualifying.

- If you have any errors on your credit report, dispute them with the appropriate agency.

- Make sure you have a down payment of at least 3.5% of the purchase price of the home

- Find a lender who is willing to work with you on an FHA loan.

- Apply for the loan and provide all of the required documentation.

- Once you have been approved for the loan, you will need to make sure that you have homeowners insurance in place before you close on the loan.

- Close on the loan and move into your new home!

FHA loans are a great option for those who may not have the best credit or who may not have a large down payment saved up. If you think an FHA loan may be right for you, follow the steps above to get started on the qualification process.

FHA Loan Types Available For People In Vermont

The first type of FHA loan is the traditional 30-year fixed-rate mortgage. This is the most common type of home loan and offers a number of benefits, including a fixed interest rate and monthly payments that stay the same for the life of the loan. This makes budgeting easy and predictable and can help you lock in a low-interest rate if rates are rising.

FHA adjustable-rate mortgage (ARM)

If you’re looking for a shorter-term loan, you may be interested in an FHA adjustable-rate mortgage (ARM). These loans start with a lower interest rate than fixed-rate mortgages, but the rate can change over time – usually annually, but sometimes more often. This can make budgeting more difficult, as your payments may go up or down depending on market conditions. However, an ARM can be a good option if you plan to sell your home before the interest rate increases.

FHA interest-only loan

For borrowers who want to minimize their monthly payments, an FHA interest-only loan may be a good option. With this type of loan, you only pay the interest on the loan for a certain period of time – typically five to seven years. After that, you begin paying both principal and interest. This can help make your monthly payments more manageable in the short term, but it’s important to make sure you have a plan in place to pay off the loan before the interest-only period ends.

FHA Rehab 203(k) loan

Finally, if you are a first-time homebuyer or have a low income, an FHA 203(k) loan may be the right option for you. This type of loan allows you to purchase a home and make repairs or improvements at the same time, which can help get your new home up and running more quickly.

When choosing a type of FHA loan, it’s important to consider your individual needs and goals. Do some research, talk to a lender or financial advisor, and carefully weigh your options before making a decision. With the right knowledge and planning, an FHA loan can be a great choice for many home buyers. If you are looking for a lender with no overlays on government loans please check the above table for FHA loan limits in Vermont and contact us so we can pre-approve you for a loan and you can start talking to your realtor.

Vermont Down Payment Assistance Program

Assisted second mortgages are only available to first-time buyers through the Vermont Housing Finance Agency (VHFA) ASSIST Second Mortgage. This may give you a loan of $10,000 or $15,000, depending on your income, with zero percent interest and no monthly payments. When you sell the property, the loan expires. This down payment assistance can only be used with one of VHFA’s home financing alternatives.

This program is available to both first-time homebuyers and repeats buyers who are purchasing a primary residence in Vermont. Eligible applicants must have a household income at or below 80% of the Area Median Income (AMI), as well as meet other program requirements.

In order to be eligible for the Vermont Down Payment Assistance Program, applicants must meet the following requirements:

- Household income at or below 80% of AMI – Must be a first-time homebuyer or repeat buyer purchasing a primary residence

- Must be able to obtain a mortgage from a participating lender

- Must meet other program requirements

If you think you might be eligible for the Vermont Down Payment Assistance Program, we encourage you to contact a participating lender to learn more and start the application process.

The Virginia HousingFA’s website has more information. Check out the list of other housing assistance programs in the state offered by HUD.