FHA Loan Limits in North Dakota For 2023

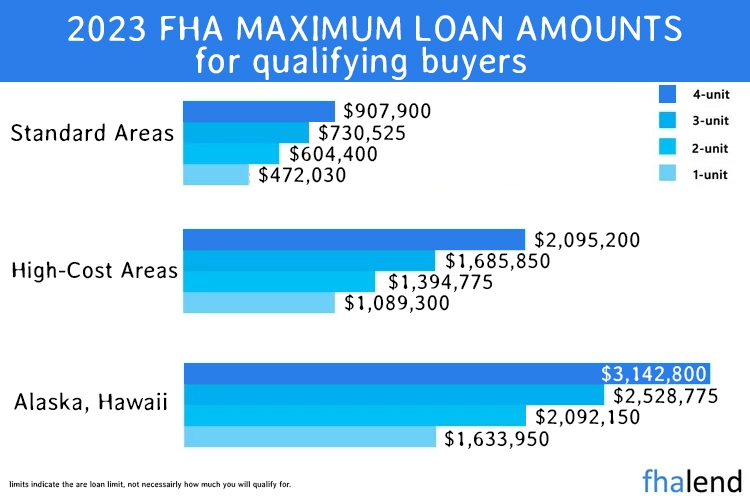

FHA loan limits in North Dakota increased from $420,680 in 2022 to 472,030 for a single-family home in 2023. The maximum loan limit for a duplex is $604,400. For a 3-unit building, you can go up to $730,525. For a fourplex (which is the maximum, you can go with a number of units with an FHA loan) is $907,900. This means that you can finance up to 96.5% of the purchase price of your home with an FHA loan.

FHA loan limits in North Dakota increased from $420,680 in 2022 to 472,030 for a single-family home in 2023. The maximum loan limit for a duplex is $604,400. For a 3-unit building, you can go up to $730,525. For a fourplex (which is the maximum, you can go with a number of units with an FHA loan) is $907,900. This means that you can finance up to 96.5% of the purchase price of your home with an FHA loan.

If you’re looking to buy a home in North Dakota, an FHA loan may be a good option for you. The Federal Housing Administration (FHA) offers loans with low down payment requirements and flexible credit guidelines. If you have a minimum credit score of 580, you could qualify for a loan with a down payment as low as 3.5%.

If you’re interested in an FHA loan, be sure to shop around with different lenders to compare rates and terms. You can also visit the HUD website for more information on FHA loan limits in North Dakota.

FHA Loan Limits in North Dakota by County in 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $114,000 |

| BARNES | $472,030 | $604,400 | $730,525 | $907,900 | $135,000 |

| BENSON | $472,030 | $604,400 | $730,525 | $907,900 | $107,000 |

| BILLINGS | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

| BOTTINEAU | $472,030 | $604,400 | $730,525 | $907,900 | $150,000 |

| BOWMAN | $472,030 | $604,400 | $730,525 | $907,900 | $118,000 |

| BURKE | $472,030 | $604,400 | $730,525 | $907,900 | $51,000 |

| BURLEIGH | $472,030 | $604,400 | $730,525 | $907,900 | $296,000 |

| CASS | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| CAVALIER | $472,030 | $604,400 | $730,525 | $907,900 | $105,000 |

| DICKEY | $472,030 | $604,400 | $730,525 | $907,900 | $128,000 |

| DIVIDE | $472,030 | $604,400 | $730,525 | $907,900 | $68,000 |

| DUNN | $472,030 | $604,400 | $730,525 | $907,900 | $223,000 |

| EDDY | $472,030 | $604,400 | $730,525 | $907,900 | $42,000 |

| EMMONS | $472,030 | $604,400 | $730,525 | $907,900 | $95,000 |

| FOSTER | $472,030 | $604,400 | $730,525 | $907,900 | $132,000 |

| GOLDEN VALLEY | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| GRAND FORKS | $472,030 | $604,400 | $730,525 | $907,900 | $248,000 |

| GRANT | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| GRIGGS | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| HETTINGER | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| KIDDER | $472,030 | $604,400 | $730,525 | $907,900 | $113,000 |

| LAMOURE | $472,030 | $604,400 | $730,525 | $907,900 | $65,000 |

| LOGAN | $472,030 | $604,400 | $730,525 | $907,900 | $60,000 |

| MCHENRY | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| MCINTOSH | $472,030 | $604,400 | $730,525 | $907,900 | $129,000 |

| MCKENZIE | $472,030 | $604,400 | $730,525 | $907,900 | $275,000 |

| MCLEAN | $472,030 | $604,400 | $730,525 | $907,900 | $147,000 |

| MERCER | $472,030 | $604,400 | $730,525 | $907,900 | $143,000 |

| MORTON | $472,030 | $604,400 | $730,525 | $907,900 | $296,000 |

| MOUNTRAIL | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| NELSON | $472,030 | $604,400 | $730,525 | $907,900 | $78,000 |

| OLIVER | $472,030 | $604,400 | $730,525 | $907,900 | $296,000 |

| PEMBINA | $472,030 | $604,400 | $730,525 | $907,900 | $97,000 |

| PIERCE | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| RAMSEY | $472,030 | $604,400 | $730,525 | $907,900 | $165,000 |

| RANSOM | $472,030 | $604,400 | $730,525 | $907,900 | $139,000 |

| RENVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| RICHLAND | $472,030 | $604,400 | $730,525 | $907,900 | $168,000 |

| ROLETTE | $472,030 | $604,400 | $730,525 | $907,900 | $90,000 |

| SARGENT | $472,030 | $604,400 | $730,525 | $907,900 | $115,000 |

| SHERIDAN | $472,030 | $604,400 | $730,525 | $907,900 | $25,000 |

| SIOUX | $472,030 | $604,400 | $730,525 | $907,900 | $99,000 |

| SLOPE | $472,030 | $604,400 | $730,525 | $907,900 | $129,000 |

| STARK | $472,030 | $604,400 | $730,525 | $907,900 | $329,000 |

| STEELE | $472,030 | $604,400 | $730,525 | $907,900 | $125,000 |

| STUTSMAN | $472,030 | $604,400 | $730,525 | $907,900 | $178,000 |

| TOWNER | $472,030 | $604,400 | $730,525 | $907,900 | $62,000 |

| TRAILL | $472,030 | $604,400 | $730,525 | $907,900 | $154,000 |

| WALSH | $472,030 | $604,400 | $730,525 | $907,900 | $130,000 |

| WARD | $472,030 | $604,400 | $730,525 | $907,900 | $240,000 |

| WELLS | $472,030 | $604,400 | $730,525 | $907,900 | $68,000 |

| WILLIAMS | $472,030 | $604,400 | $730,525 | $907,900 | $285,000 |

How HUD Calculate The FHA Loan Limits in North Dakota?

FHA loan limits in North Dakota are set each year and typically released in late December. The loan limit is the maximum amount that a borrower can finance through the Federal Housing Administration (FHA). The 2021 FHA loan limits in North Dakota for most counties across the U.S. is $472,030, which is a slight increase from last year’s $420,680 loan limit.

How FHA loan limits in North Dakota are calculated? FHA loans are backed by the federal government, so when Congress appropriates money for the program each year, they also set a maximum loan limit. The Department of Housing and Urban Development (HUD) establishes single-family floor and ceiling loan limits annually based on median home prices estimates provided by the Federal Housing Finance Agency (FHFA).

For example, the FHA loan limit for a single-family home in California in Contra Costa county is $970,800, which is significantly higher than the national loan limit of $433,550. This is because the cost of living and median home prices in California are much higher than in the rest of the country.

What if you need a loan amount that exceeds the FHA loan limit? In some cases, you may be able to get a jumbo loan through a private lender. A jumbo loan is a non-conforming loan that exceeds the FHA loan limit. Jumbo loans typically have higher interest rates and down payment requirements than conventional loans.

If you’re thinking about buying a home in 2023, it’s important to start planning now. Keep an eye on FHA loan limits in your area and start saving for a down payment so you can get the best mortgage rate possible.

Benefits of FHA Loan in North Dakota State

The Federal Housing Administration (FHA) offers a number of benefits for borrowers in North Dakota.

- For one, FHA loans are available to borrowers with less-than-perfect credit. So if you have some blemishes on your credit report, or don’t have a lengthy credit history, you may still qualify for an FHA loan.

- Another benefit of FHA loans is that they require a smaller down payment than conventional mortgages. You can put as little as 3.5% down when you get an FHA loan, whereas you’ll need to put at least 5% down (and sometimes 20%) when you get a conventional mortgage.

- FHA loans also have lower credit score requirements than conventional loans. So if your credit score is on the low side, an FHA loan could be a good option for you.

- Additionally, FHA loans come with several built-in protections for borrowers. For example, if you’re struggling to make your mortgage payments, you may be able to take advantage of the FHA’s mortgage forbearance program. This program allows you to temporarily stop making payments, without incurring any late fees or penalties.

If you’re thinking of buying a home in North Dakota, an FHA loan could be a good option for you. Be sure to compare the terms of different loans before you decide which one is right for you.

FHA Eligibility Requirements in North Dakota

Before you apply for an FHA loan, it’s important to understand the eligibility requirements. Generally speaking, borrowers must meet certain income and debt-to-income ratio requirements to qualify for this type of loan.

Borrowers must also be a U.S. citizen or permanent resident with a valid Social Security number, have full legal capacity to enter into a contract, and not be delinquent on any federal debts or child support payments. Additionally, the property that is being purchased must be used as the borrower’s primary residence and meet certain HUD requirements.

Write About Closing Costs and Fees in North Dakota

Closing costs and fees associated with an FHA loan can vary depending on the lender. Generally speaking, buyers should expect to pay anywhere from 2% to 5% of the home’s purchase price in closing costs and fees. This includes things like origination fees, appraisal fees, title search fees, and other closing costs associated with the loan.

Mortgage Insurance Premiums (MIP) in North Dakota

When it comes to FHA loans, borrowers are required to pay for mortgage insurance premiums (MIP). This is an upfront fee that can range from 0.5% to 1.5% of the loan amount. Additionally, borrowers may also be required to pay an annual premium of 0.55% or more over the life of the loan. The exact amount will depend on factors such as your credit score and loan amount.

Rate Lock Options in North Dakota

Once you’ve been approved for an FHA loan, you may have a few different rate lock options. Generally speaking, the lender may allow you to choose a fixed-rate loan, an adjustable-rate loan, or a hybrid loan that combines features of both. It’s important to understand the details of each option before deciding which one is right for you.

Mortgage Terms in North Dakota

FHA loans generally come with terms ranging from 15 years up to 30 years. The exact term will depend on factors such as your credit score, income level, and other qualifications. Additionally, borrowers should keep in mind that shorter terms often mean lower interest rates while longer terms typically have higher interest rates.

Real Estate Market in North Dakota in 2023

The North Dakota real estate market is predicted to be incredibly robust in the year 2023. This is due to a number of factors, including the state’s strong economy and low unemployment rate. As a result, now is a great time to invest in North Dakota real estate.

Now let’s take a closer look at each of these three reasons in turn.

1. The state’s strong economy and the low unemployment rate

The North Dakota economy is currently very strong, thanks in large part to the state’s thriving oil industry. In fact, norNorth h Dakota has the lowest unemployment rate in the country, at just 2.5%. This is good news for those considering investing in North Dakota real estate, as a strong economy usually leads to increased demand – and prices – for the property.

2. The state’s population is growing

Thanks to the strong economy, North Dakota’s population is currently growing at a rapid rate. In fact, the state’s population grew by 2.2% in 2017, which was the second-highest rate of growth in the country. This population growth is likely to continue in the coming years, which will put even more upward pressure on North Dakota real estate prices.

3. North Dakota is a great place to live

Not only is North Dakota’s economy strong and its population growing, but it’s also a great place to live. The state offers a high quality of life, with plenty of things to do and see. In addition, North Dakota has a very low cost of living, which is another plus for those considering investing in North Dakota real estate.

Top Cities in North Dakota to Live In

When it comes to finding the best places to live in North Dakota, there are a few key factors you should keep in mind. First, consider the cost of living in the area. You’ll also want to think about the climate and whether you prefer a rural or urban setting. Finally, take into account the job market in the area and what kind of commute you’re willing to make.

With all of that in mind, here are some of the best places to live in North Dakota:

Bismarck: Bismarck is the capital city of North Dakota and is one of the best places to live in the state thanks to its low cost of living, diverse economy, and variety of recreational activities. The city has a population of just over 61,000 and is located in the central part of North Dakota.

Fargo: Fargo is the largest city in North Dakota with a population of over 118,000. It’s located in the eastern part of the state and is a great place to live if you’re looking for an urban setting. The city has a strong economy and is home to a variety of cultural attractions.

Grand Forks: Grand Forks is another great option for those looking for an urban setting. The city has a population of over 52,000 and is located in the northeastern part of North Dakota. Grand Forks offers a variety of dining and shopping options, as well as a lively nightlife scene.

Minot: Minot is a city of just over 40,000 people and is located in the north-central part of North Dakota. It’s a great place to live if you’re looking for a smaller city with a low cost of living. Minot also has a variety of parks and recreation areas.

Williston: Williston is a small city located in northwestern North Dakota with a population of just over 28,000. It’s a great place to live if you’re looking for a rural setting. The city is home to a number of parks and recreation areas, as well as a variety of shops and restaurants.

No matter what you’re looking for, there’s sure to be a great place to live in North Dakota that meets your needs. So, don’t wait any longer, get pre-approved for your dream home with us and start shopping.

North Dakota Down Payment Assistance Program

North Dakota Down Payment Assistance Program

The North Dakota Housing Finance Agency (NDHFA) has two programs called “Start” and “DCA,” which are intended to assist with upfront house purchase closing costs. Up to 3% of the mortgage amount may be reimbursed through each program, depending on the situation.

To be eligible, you must have a household income below particular caps. Additionally, the value of the home you’re interested in buying may be restricted.

You’ll find more information here. Take a look at HUD’s list of additional North Dakota homeownership assistance programs.