NON QM Mortgage Lenders

Introduction: Buying a home can be an intimidating process, especially when it comes to understanding your mortgage options. With a wide array of lenders on the market offering different kinds of loans it can be hard to know what’s right for you and your financial situation. One type of lender you should consider is a Non-QM (Non-Qualified Mortgage) Lender. While often overlooked, non-QM lenders offer unique loan products that can give borrowers more flexibility and options for their home purchase.

In this article (Skip to…)

Benefits of Using a Non-QM Lender What are Non-QM Loans?

A non-qualified mortgage (Non-QM) is any home loan that does not comply with the Consumer Financial Protection Bureau’s (CFPB) existing rules on qualified mortgages. Generally, these mortgages are designed for borrowers who don’t fit into the traditional lending boxes due to their income, credit score or other factors. Non-QM loans generally feature more flexibility in terms of loan amount, interest rate and debt-to-income ratio than traditional qualified mortgages.

Who Qualifies for a Non-QM Loan?

Since non-QM loans often have looser requirements, they can be perfect for those with irregular incomes or unusually high expenses. They also may be suitable for self-employed individuals, investors and homeowners looking to consolidate debt using their home equity. However, it’s important to note that not all lenders offer non-QM loans; some may specialize in them while others do not. It’s a good idea to shop around and compare different lenders before settling on one.

Best Non-Qm Mortgage Lender List

Angel Oak Mortgage Solutions

Mortgage Programs: 12 Month Bank Statement Loans – 1099 Income Loans – Non-Warrantable Condos – DSCR Business Purpose Loans – Asset Depletion – Jumbo Loans – Conventional Loans.

States: AL, AR, AZ, CA, CO, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MT, NC, NE, NH, NJ, NV, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, & WY

Change Mortgage

Carrington Mortgage Services

Max LTV: 90% – Max DTI: 50% – Min Credit: 550 – Loan Limit: $2.5 MillionPrograms Offered:

Bank Statement Loans – Asset Depletion – DSCR Mortgage Loans – Recent Housing Event Program – Conventional Loans – FHA Loans – VA Loans – USDA Loans.

States: AL, AK, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MS, MT, NC, NE, NH, NJ, NV, NY, OH, OK, OR, PA, RI, SD, SC, TN, TX, UT, VA, VT, WA, WI, WV, & WY

First National Bank of America

Mortgage Programs Offered: Bank Statement Loans – P&L Statement Mortgage – Recent Housing Event – ITIN Loans – Asset Depletion

States: Nationwide

Citadel Servicing/Acra Lending

Northstar Funding

Max LTV: 90% – Max DTI: 50% – Min Credit: 500 – Loan Limit: $3 Million

Mortgage Programs Offered: Bank Statement Loans – P&L Statement Mortgage – Recent Housing Event – ITIN Loans – Asset Depletion – Conventional Loans – FHA Loans – Jumbo Loans

States: Nationwide (except for CA, IL, NJ, NV, NY, OH, and WA).

Acra Lending

Max LTV: 90% * Max DTI: 50% * Min Credit: 575 * Loan Amounts: $150,000-$3,000,000

Mortgage Programs: 12 Month Bank Statement Loans – 3 Month Bank Statement Loans – Jumbo Loans – Asset Depletion Loans – DSCR Business Purpose Loans – Foreign National Mortgages – ITIN Loans – Interest Only Mortgages

States: AL, AR, AZ, CA, CO, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MT, NC, NE, NH, NJ, NV, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, & WY

Impact Mortgage

Mortgage Programs Offered: Bank Statement Loans – Asset Depletion – Jumbo Loans – Investor Mortgages – Conventional Loans – VA Loans

States: AL, AK, AR, AZ, CA, CO, CT, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, and WI.

Benefits of Using a Non-QM Lender

Non-QM loans can be beneficial for borrowers who don’t necessarily fit into traditional lending boxes. These loans also provide an opportunity to access more flexible financing options, such as interest only payments or balloon payments, which may suit certain borrowers better than traditional qualified mortgages. Additionally, non-QM lenders often have more lenient debt-to-income ratio requirements than those set by the CFPB, meaning self-employed individuals and investors may have an easier time qualifying for these types of mortgages.

Non-QM mortgage lenders offer unique loan products that can provide more flexibility and options for homebuyers. These loans are ideal for those who don’t fit into traditional lending boxes due to their income, credit score or other factors. Additionally, non-QM loan products can offer different terms and repayment plans which may suit a borrower better than a qualified mortgage.

If you think a non-QM loan might be right for you, it’s important to shop around and compare lenders before settling on one. By understanding the types of mortgages available through Non-QM Lenders, borrowers can find the best option for their financial situation and purchase the home of their dreams!

What is a Non-QM Lender?

A non-QM lender is a financial institution that offers mortgages outside of the traditional guidelines set by government-backed loans. These lenders do not adhere to the same strict criteria, such as high credit scores and large down payments. Instead, they focus more on an individual’s ability to repay the loan rather than their credit history or other factors.

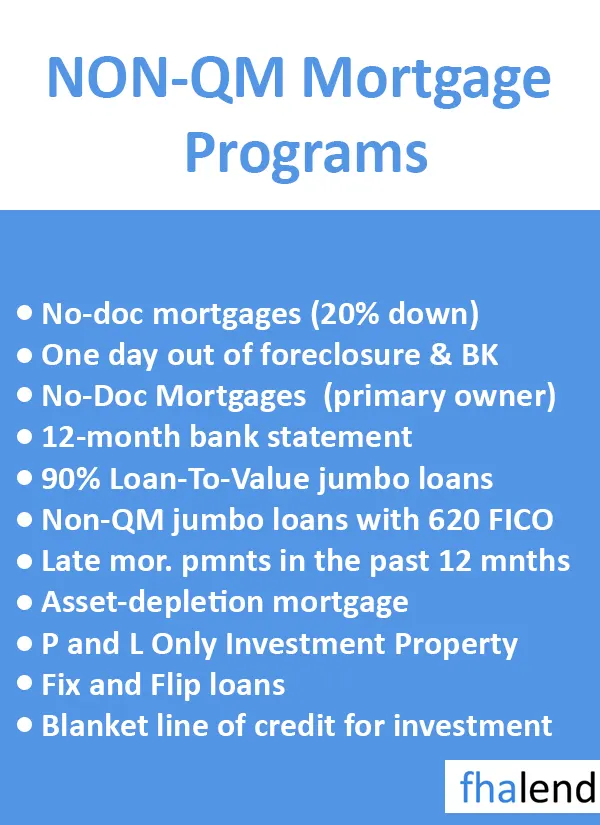

Types of Non-QM Loans

Non-QM lenders offer a variety of loan options for people who don’t meet the qualifications of traditional financing options. These include low doc loans which require fewer documents during the application process; asset utilization loans which allow borrowers to use assets in place of income; and stated income/asset loans which base approval on the borrower’s stated income and assets, instead of verified earnings.

Benefits of Working with a Non-QM Lender

The biggest advantage of working with a non-QM lender is that they may be more flexible when it comes to approving loans for borrowers who don’t meet the criteria for traditional financing options. Non-QM lenders also tend to offer competitive interest rates, making them an attractive option for homebuyers looking to stretch their budget. Finally, many non-QM lenders require less paperwork than their traditional counterparts, making the application process simpler and faster.

Non-QM lenders provide homebuyers with access to financing even if they don’t meet the qualifications of traditional loans. These lenders offer a variety of loan options with competitive interest rates and less paperwork. By understanding the types of non-QM mortgages available and the benefits they provide, homebuyers can find a lender that works for them.

Working with a non-QM lender can help you secure financing when other options are not available. Knowing what to expect from this type of lender makes it easier to make an informed decision about your mortgage needs. With the right information, you can find the perfect solution to get the home of your dreams. In summary, non-QM lenders offer a variety of loan options and benefits that may be more suitable for borrowers who don’t qualify for traditional financing. By researching the types of non-QM loans available, homebuyers can find a lender that meets their needs and obtain the loan they need to purchase their dream home.

January 1, 2023 - 6 min read