California FHA Loan Limits in Median Priced and High-Cost Areas

It is important to know the FHA loan limits in California because they impact a variety of down payment assistance programs offered in California. There are many programs in California with maximum loan amounts that are higher than the FHA loan limits set by HUD. The limits are capped by the Federal Home Administration. If that is the case, you will not be able to use an FHA loan to be qualified for the maximum loan amount available for the down payment assistance program you have chosen.

In this article (Skip to…)

California FHA Jumbo Loans in High-Cost Areas

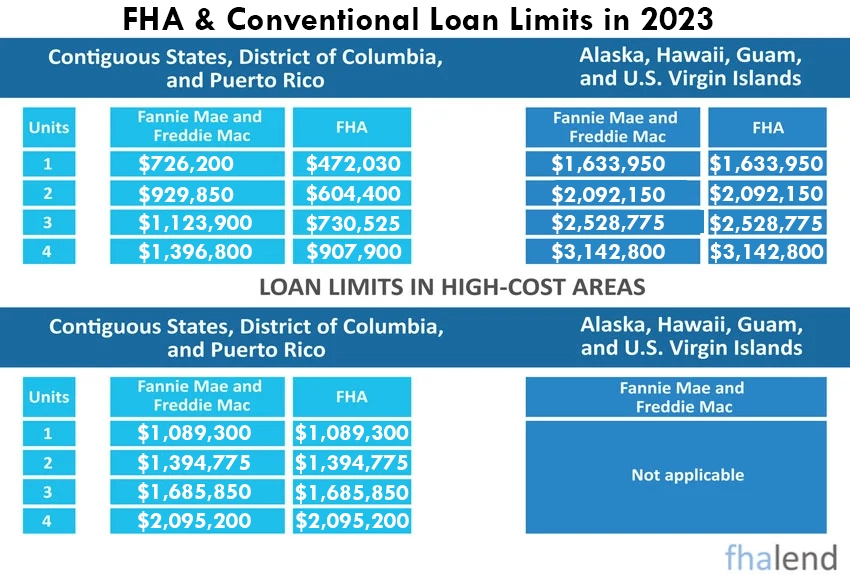

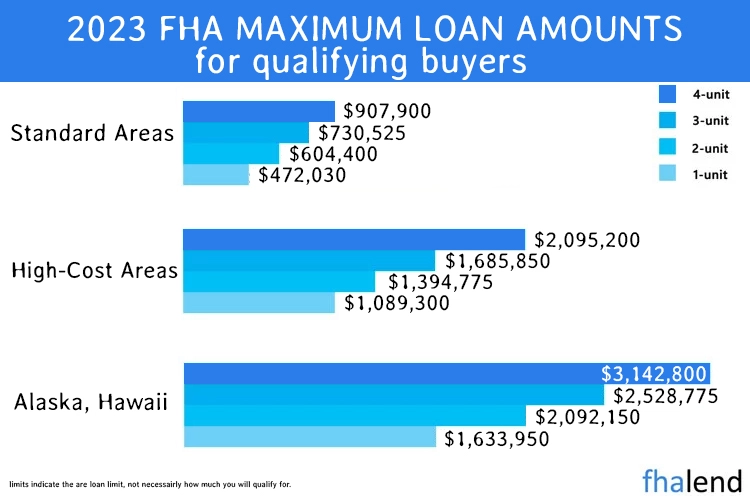

The current FHA loan limit in most of the high-cost counties in California is set to $1,089,300 for a single-family residence. This is the FHA’s maximum loan limit, which is 65% of the conforming loan limit. The FHA limits in Almeda County are higher because it is considered a high-cost-of-living area.

California FHA Loan Limits on Single and Multi-Family

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ALAMEDA | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $735,000 |

| ALPINE | $497,950 | $637,450 | $770,550 | $957,600 | $433,000 |

| AMADOR | $472,030 | $604,400 | $730,525 | $907,900 | $395,000 |

| BUTTE | $472,030 | $604,400 | $730,525 | $907,900 | $310,000 |

| CALAVERAS | $472,030 | $604,400 | $730,525 | $907,900 | $399,000 |

| COLUSA | $472,030 | $604,400 | $730,525 | $907,900 | $357,000 |

| CONTRA COSTA | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $735,000 |

| DEL NORTE | $472,030 | $604,400 | $730,525 | $907,900 | $271,000 |

| EL DORADO | $763,600 | $977,550 | $1,181,650 | $1,468,500 | $664,000 |

| FRESNO | $472,030 | $604,400 | $730,525 | $907,900 | $392,000 |

| GLENN | $472,030 | $604,400 | $730,525 | $907,900 | $309,000 |

| HUMBOLDT | $472,030 | $604,400 | $730,525 | $907,900 | $400,000 |

| IMPERIAL | $472,030 | $604,400 | $730,525 | $907,900 | $288,000 |

| INYO | $508,300 | $650,700 | $786,550 | $977,500 | $442,000 |

| KERN | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| KINGS | $472,030 | $604,400 | $730,525 | $907,900 | $321,000 |

| LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $259,000 |

| LASSEN | $472,030 | $604,400 | $730,525 | $907,900 | $189,000 |

| LOS ANGELES | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $120,000 |

| MADERA | $472,030 | $604,400 | $730,525 | $907,900 | $400,000 |

| MARIN | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $735,000 |

| MARIPOSA | $472,030 | $604,400 | $730,525 | $907,900 | $320,000 |

| MENDOCINO | $546,250 | $699,300 | $845,300 | $1,050,500 | $475,000 |

| MERCED | $472,030 | $604,400 | $730,525 | $907,900 | $405,000 |

| MODOC | $472,030 | $604,400 | $730,525 | $907,900 | $140,000 |

| MONO | $693,450 | $887,750 | $1,073,100 | $1,333,600 | $603,000 |

| MONTEREY | $915,400 | $1,171,900 | $1,416,550 | $1,760,400 | $796,000 |

| NAPA | $1,017,750 | $1,302,900 | $1,574,900 | $1,957,250 | $885,000 |

| NEVADA | $644,000 | $824,450 | $996,550 | $1,238,500 | $560,000 |

| ORANGE | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $120,000 |

| PLACER | $763,600 | $977,550 | $1,181,650 | $1,468,500 | $664,000 |

| PLUMAS | $472,030 | $604,400 | $730,525 | $907,900 | $300,000 |

| RIVERSIDE | $644,000 | $824,450 | $996,550 | $1,238,500 | $560,000 |

| SACRAMENTO | $763,600 | $977,550 | $1,181,650 | $1,468,500 | $664,000 |

| SAN BENITO | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $623,000 |

| SAN BERNARDINO | $644,000 | $824,450 | $996,550 | $1,238,500 | $560,000 |

| SAN DIEGO | $977,500 | $1,251,400 | $1,512,650 | $1,879,850 | $850,000 |

| SAN FRANCISCO | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $735,000 |

| SAN JOAQUIN | $656,650 | $840,650 | $1,016,150 | $1,262,800 | $571,000 |

| SAN LUIS OBISPO | $911,950 | $1,167,450 | $1,411,200 | $1,753,800 | $793,000 |

| SAN MATEO | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $735,000 |

| SANTA BARBARA | $805,000 | $1,030,550 | $1,245,700 | $1,548,100 | $700,000 |

| SANTA CLARA | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $623,000 |

| SANTA CRUZ | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $50,000 |

| SHASTA | $472,030 | $604,400 | $730,525 | $907,900 | $345,000 |

| SIERRA | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| SISKIYOU | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| SOLANO | $685,400 | $877,450 | $1,060,600 | $1,318,100 | $596,000 |

| SONOMA | $861,350 | $1,102,700 | $1,332,900 | $1,656,450 | $749,000 |

| STANISLAUS | $517,500 | $662,500 | $800,800 | $995,200 | $450,000 |

| SUTTER | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

| TEHAMA | $472,030 | $604,400 | $730,525 | $907,900 | $285,000 |

| TRINITY | $472,030 | $604,400 | $730,525 | $907,900 | $225,000 |

| TULARE | $472,030 | $604,400 | $730,525 | $907,900 | $328,000 |

| TUOLUMNE | $472,030 | $604,400 | $730,525 | $907,900 | $369,000 |

| VENTURA | $948,750 | $1,214,600 | $1,468,150 | $1,824,550 | $825,000 |

| YOLO | $763,600 | $977,550 | $1,181,650 | $1,468,500 | $664,000 |

| YUBA | $488,750 | $625,700 | $756,300 | $939,900 | $425,000 |

How To Qualify For FHA Loan in California

Down Payment / Credit Score – In order to get an FHA loan, the minimum down payment is 3.5% and you should have at least a 580 credit score. Friends, family members, and even your boss can help you with all or part of the down payment. It is possible to get approved for FHA loans with a score as low as 500 when you have put 10% down.

Debt-To-Income Ratio – The percentage of a person’s annual income that is spent on debt. FHA lenders are watching your debt compared to your income to find out how much of your income is going towards debt. The FHA guideline’s maximum DTI ratio is 43%, but exceptions are available with strong credit scores or extra cash reserves.

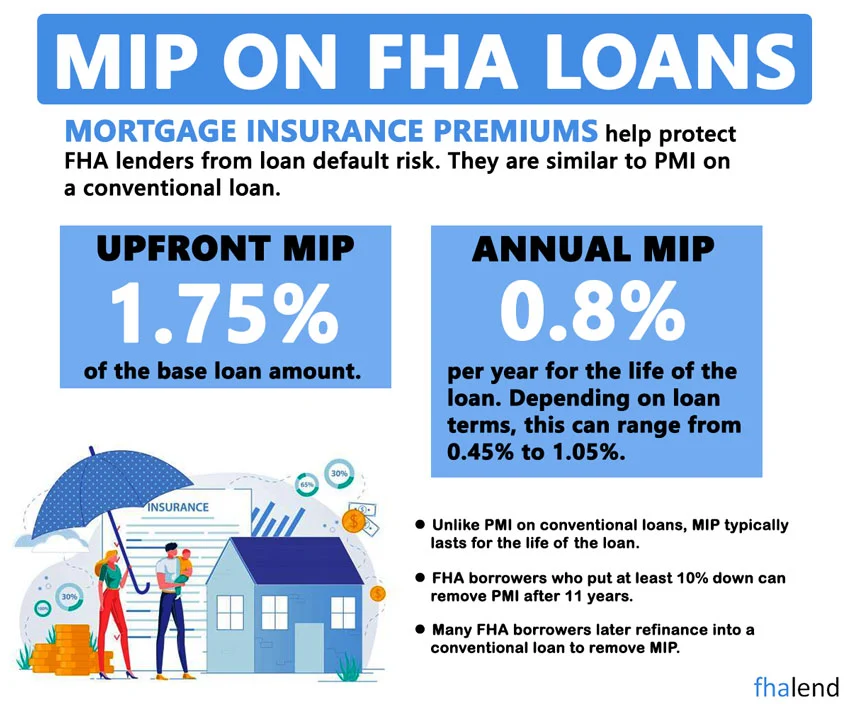

Mortgage Insurance – You pay a certain type of mortgage insurance to protect lenders if you stop making your payments on your mortgage. it’s 1.75% of your loan amount, which is usually added to your mortgage. There is a type of insurance called mortgage insurance premium or MIP and it’s 0.45% to 1.05% of the loan amount, divided by 12 and added to your monthly payment. e thing: You’ll have to pay it whether you make a down payment or not.

Occupancy – The property needs to be a primary residence meaning you have to live in it for at least one year. The program doesn’t allow financing on second homes, investment properties, or vacation homes.

FHA Home Appraisals

FHA appraisals – You’ll need an FHA appraisal for an FHA loan. The lender will order it for you and have to be done by a HUD-approved appraiser. FHA appraisal guidelines are more stringent than conventional loans. The appraisal for the FHA loan stays with the property for 4 months and HUD is very strict about having safety hazards like cables sticking out of outlets or cracks in the foundation. FHA will not insure a home that needs major repairs to be liveable.

Scope of Work By FHA Appraiser

Scope of Work By FHA Appraiser

The HUD/FHA-approved Appraiser will do the following during the inspection:

- estimate the market value of the property

- check the physical condition of the property and provide a valuation form with details for important repairs.

- assess if the property is free of physical defects, noise, odors, mold, termites, ants, and any defects

- estimate the expected life of the property so it can have 15 or 30 years mortgage(lien)

- analyze easements, encroachments, and the topography of the location.

- analyze the livability of the home (above-ground & basement living areas).

- The structure and functionality of the estate.

How California FHA Loan Limits are Determined?

The 2022 high-cost limits are higher than the low-cost limits. The high-cost limits are set to 150% of the conforming loan limits. The “ceiling” is set for $1,089,300. Below are high-cost limits for the top 9 counties in California for single-home families:

- Santa Clara County

- San Mateo County

- Alameda County

- Contra Costa County

- Los Angeles County

- Marin County

- Orange County

- San Benito County

- Santa Cruz County

California Loan Limits In Median Housing-Priced Counties

California Loan Limits In Median Housing-Priced Counties

If you’re buying a home in a cheaper part of California, The 2022 low-cost limit or “floor” is $472,030 for a single-family home and is 65% of the conforming loan limit of $647,200. If you’re buying a multifamily home, the low-cost limits increase with each unit:

- $604,400 for a two-unit home in Amador

- $730,525 for a three-unit home in Butte

- $907,900 for a four-unit home in Merced

Is it True That All FHA lenders are The Same?

Not all FHA/HUD-approved lenders or mortgage brokers are the same. Some of them don’t offer all the FHA programs, and their rates and fees may also vary. The individuals who process and underwrite your loan will make a huge impact on your loan experience. Some lenders have overlays as well in addition to FHA guidelines. Let us help you to find the right lender who can help you with your purchase or refinance. By completing this FHA Eligibility Form with your information we will connect you with the best lender in your state. No credit will be pulled after completing it.

California Down Payment Assistance Program

The California Housing Finance Agency’s (CalHFA) MyHome Assistance Program provides down payment assistance to qualified purchasers. This comes in the form of a second mortgage for 3-3.5% of the property’s purchase price, or $11,000 less than whatever is greater.

- 3% (up to $11,000) of the cost of a home financed with a standard or USDA loan is credited.

- It provides 3.5% (up to $11,000) for homes financed with FHA loans

This is a loan that helps first-time home buyers purchase homes. As a result, it won’t benefit you if you already own property.

However, CalHFA considers a first-time home buyer to be “someone who has not owned and occupied their own house in the previous three years.” Many individuals who have previously owned homes will qualify.

For further information, go to the MyHome Assistance Program webpage. There, you’ll discover income restrictions. If you work as a teacher or are a member of the fire department, some program limits may not apply.

Take a look at HUD’s list of alternative programs for California, which includes both permanent and transitional housing.