FHA Loan Limits in Idaho By County

What’s the largest mortgage I can get? As someone who is looking to buy a home in Idaho, you may be wondering what the largest FHA loan you can get is. The answer to that question depends on the county you are looking to purchase a home. Each county in Idaho has its own maximum FHA loan limit.

What’s the largest mortgage I can get? As someone who is looking to buy a home in Idaho, you may be wondering what the largest FHA loan you can get is. The answer to that question depends on the county you are looking to purchase a home. Each county in Idaho has its own maximum FHA loan limit.

While these are the maximum fha loan limits for some of the more populated counties in Idaho, there may be other counties with higher or lower limits. It’s important to check with your lender or broker to see what the limit is for the county you are looking to purchase a home in. You can also check the below table for FHA loan limits in Idaho for the specific county for 2023 year.

FHA Loan Limits in Idaho For 2023

| County | Single-Family | 2 Family | 3 Family | 4 Family | Median House Price |

|---|---|---|---|---|---|

| ADA | $586,500 | $750,800 | $907,550 | $1,127,900 | $510,000 |

| ADAMS | $472,030 | $604,400 | $730,525 | $907,900 | $260,000 |

| BANNOCK | $472,030 | $604,400 | $730,525 | $907,900 | $315,000 |

| BEAR LAKE | $472,030 | $604,400 | $730,525 | $907,900 | $308,000 |

| BENEWAH | $472,030 | $604,400 | $730,525 | $907,900 | $236,000 |

| BINGHAM | $472,030 | $604,400 | $730,525 | $907,900 | $316,000 |

| BLAINE | $740,600 | $948,100 | $1,146,050 | $1,424,250 | $644,000 |

| BOISE | $586,500 | $750,800 | $907,550 | $1,127,900 | $510,000 |

| BONNER | $523,250 | $669,850 | $809,700 | $1,006,250 | $455,000 |

| BONNEVILLE | $472,030 | $604,400 | $730,525 | $907,900 | $396,000 |

| BOUNDARY | $472,030 | $604,400 | $730,525 | $907,900 | $365,000 |

| BUTTE | $472,030 | $604,400 | $730,525 | $907,900 | $396,000 |

| CAMAS | $740,600 | $948,100 | $1,146,050 | $1,424,250 | $644,000 |

| CANYON | $586,500 | $750,800 | $907,550 | $1,127,900 | $510,000 |

| CARIBOU | $472,030 | $604,400 | $730,525 | $907,900 | $255,000 |

| CASSIA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| CLARK | $472,030 | $604,400 | $730,525 | $907,900 | $250,000 |

| CLEARWATER | $472,030 | $604,400 | $730,525 | $907,900 | $224,000 |

| CUSTER | $472,030 | $604,400 | $730,525 | $907,900 | $235,000 |

| ELMORE | $472,030 | $604,400 | $730,525 | $907,900 | $326,000 |

| FRANKLIN | $492,200 | $630,100 | $761,650 | $946,550 | $428,000 |

| FREMONT | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| GEM | $586,500 | $750,800 | $907,550 | $1,127,900 | $510,000 |

| GOODING | $472,030 | $604,400 | $730,525 | $907,900 | $265,000 |

| IDAHO | $472,030 | $604,400 | $730,525 | $907,900 | $224,000 |

| JEFFERSON | $472,030 | $604,400 | $730,525 | $907,900 | $396,000 |

| JEROME | $472,030 | $604,400 | $730,525 | $907,900 | $332,000 |

| KOOTENAI | $572,700 | $733,150 | $886,200 | $1,101,350 | $498,000 |

| LATAH | $472,030 | $604,400 | $730,525 | $907,900 | $380,000 |

| LEMHI | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| LEWIS | $472,030 | $604,400 | $730,525 | $907,900 | $231,000 |

| LINCOLN | $472,030 | $604,400 | $730,525 | $907,900 | $254,000 |

| MADISON | $472,030 | $604,400 | $730,525 | $907,900 | $375,000 |

| MINIDOKA | $472,030 | $604,400 | $730,525 | $907,900 | $280,000 |

| NEZ PERCE | $472,030 | $604,400 | $730,525 | $907,900 | $310,000 |

| ONEIDA | $472,030 | $604,400 | $730,525 | $907,900 | $286,000 |

| OWYHEE | $586,500 | $750,800 | $907,550 | $1,127,900 | $510,000 |

| PAYETTE | $472,030 | $604,400 | $730,525 | $907,900 | $350,000 |

| POWER | $472,030 | $604,400 | $730,525 | $907,900 | $315,000 |

| SHOSHONE | $472,030 | $604,400 | $730,525 | $907,900 | $265,000 |

| TETON | $1,089,300 | $1,394,775 | $1,685,850 | $2,095,200 | $688,000 |

| TWIN FALLS | $472,030 | $604,400 | $730,525 | $907,900 | $332,000 |

| VALLEY | $573,850 | $734,650 | $888,000 | $1,103,550 | $499,000 |

| WASHINGTON | $472,030 | $604,400 | $730,525 | $907,900 | $264,000 |

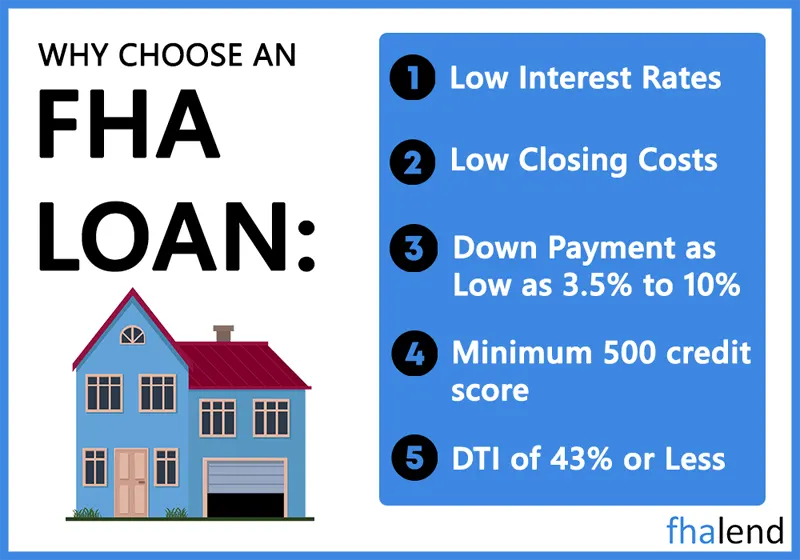

What’s the max DTI for FHA in Idaho?

That depends on the type of loan you’re seeking. For most standard FHA loans, the maximum DTI is 43 percent. But there are exceptions: If you’re applying for an FHA Energy Efficient Mortgage, the maximum DTI is 50 percent. And if you’re seeking an FHA Section 251 Adjustable Rate Mortgage, the maximum DTI is 55 percent. Whatever your DTI ratio, it’s important to remember that it’s just one factor the FHA considers when approving a loan. Other factors include your credit score, down payment amount, and employment history. So even if you don’t meet the max DTI limit, don’t give up on your dream of homeownership – the FHA may still be able to help you get into the home of your dreams.

What’s the max LTV for FHA in Idaho?

Your loan-to-value ratio (LTV) is one of the most important factors lenders consider when approving your FHA loan. This ratio is calculated by dividing your loan amount by the appraised value of the home. The higher your LTV, the more risk the lender is taking on, and this could lead to a higher interest rate or even loan denial.

When it comes to approving a loan application, the FHA looks at more than just your credit score. Here are some of the other factors they take into consideration:

What the FHA Considers When Approving a Loan in Idaho?

Your employment history

Your employment history is one of the factors that the FHA looks at when considering your loan application. They want to make sure that you have a steady job history and that you’ve been employed for at least two years. This is because they want to be sure that you’re able to afford your loan payments. They also want to see that you’re not likely to lose your job and default on your loan. If you don’t have a strong employment history, you may still be able to get an FHA loan. However, you’ll likely need to make a larger down payment than someone with a stronger employment history. This is because the FHA wants to protect itself from borrowers who may default on their loans.

Your current income and debt

When applying for an FHA loan in Idaho, both income and debt are important considerations. Lenders will want to see that you have a steady source of income and that your debts are manageable. They may also require that you have a certain amount of equity in your home before they will approve your loan. The following tips can help you make sure that you are prepared when applying for an FHA loan in Idaho.

The value of the home you’re looking to purchase

When it comes to the value of your home, the sales price, appraised value and LTV are three important factors to keep in mind. Work with a qualified lender or broker to ensure a smooth process and the best possible outcome.

Your down payment amount

The downpayment is an important aspect of getting an FHA loan in Idaho. For most FHA loans in Idaho, you will need to make a minimum down payment of 3.5%. However if your credit score is 580 or lower (500–579) you may still qualify for an FHA loan. But you’d need to put at least 10% down, and some lenders have overlays that don’t allow people to obtain the loan under 580 of something even under 640 like Chase bank of

Required Documents To Get the FHA loan in Idaho

When you apply for an FHA loan, the lender or broker will require certain documents as the loan process moves forward. This will most likely include:

- Social security number (SSN)

- Driver’s license or government ID

- Proof of income

- Employment status/history

- Current and future home address

- Property value

- Down payment amount

TOP 3 Things For FHA Streamline Refinance in Idaho

TOP 3 Things For FHA Streamline Refinance in Idaho

- When applying for an FHA loan, lenders will want to know how much income you bring in each month. Be sure to have your most recent pay stubs on hand so that you can provide accurate information.

2. Know Your Debt

- In addition to considering your income, lenders will also look at your debt-to-income ratio. This is a calculation that compares your monthly debt payments to your monthly income. Be sure to have a list of your current debts on hand so that you can accurately calculate this ratio.

3. Have Equity in Your Home

- Lenders often require that borrowers have a certain amount of equity in their home before they will approve an FHA loan. Typically, lenders want to see at least 20% equity in the home. If you do not have enough equity, you may be able to take out a loan called a Home Equity Conversion Mortgage (HECM), which allows you to borrow against the value of your home.

Idaho Down Payment Assistance Program

The Idaho Housing and Finance Association (IHFA) has a down payment assistance program that offers buyers up to 10% of the property’s price towards their down payment and/or closing costs.

To be eligible, purchasers must put at least 0.5% of the purchase price from their own money into the deal. Someone purchasing a $200,000 property would need to come up with at least $1,000 in cash.

The IHFA offers down payment assistance of up to $35,000 for first-time homebuyers with a monthly household income of less than $150,000. Buyers must take a homebuyer education course to qualify for down payment aid.

If you live in a low-income area in Idaho, visit the IHFA website for complete information, including income restrictions in certain circumstances. Check out HUD’s list of alternative programs for Idaho as well.